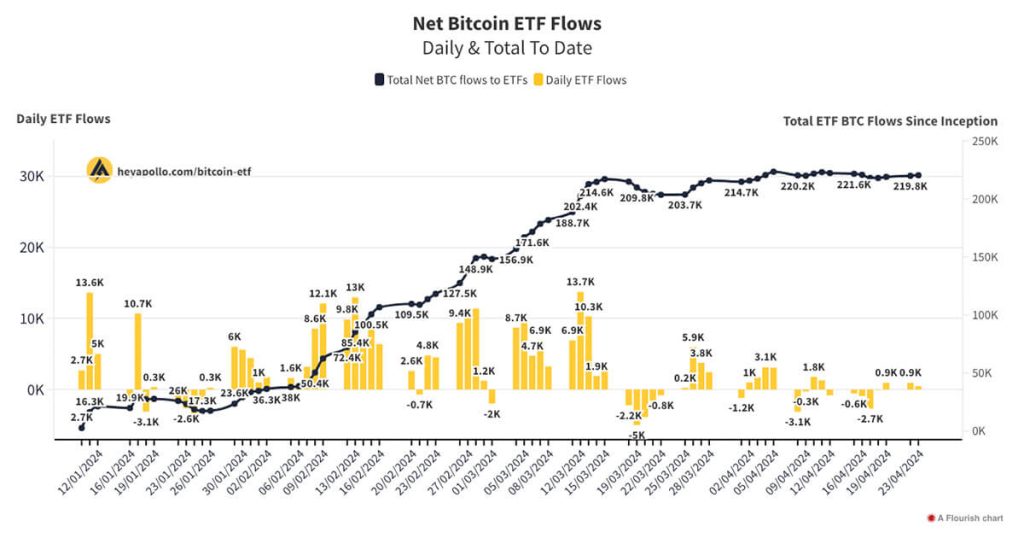

Bitcoin ETF inflows have kicked off a fresh cycle in the crypto market, showcasing a net creation of $561.8 million just as the previous trend saw almost $1.5 billion in outflows. This uptick signals institutional demand for Bitcoin, hinting at potential shifts in traditional ETF market dynamics. However, behind these figures lies a deeper story of volatility effects on Bitcoin, revealing that such inflows may not stem directly from bullish sentiment. Instead, they could reflect market maneuvers rather than a genuine appetite for Bitcoin, as seen in recent Bitcoin trading analysis. Understanding the intricacies of these inflows is crucial for anticipating future trends in the complex world of cryptocurrency investment.

The recent surge in Bitcoin exchange-traded funds (ETFs) has caught the attention of investors and analysts alike, pointing to notable movements in the digital asset arena. With substantial capital flowing back into these financial instruments, the conversation around Bitcoin equity is becoming increasingly relevant. This topic extends beyond mere numbers, delving into the broader implications of institutional purchasing behaviors and their responses to market volatility. Furthermore, as trends develop within the ETF landscape, observers are left to ponder the sustainability of these crypto capital inflows amid changing market conditions. Hence, the dynamics of investor behavior and market sentiment remain pivotal as the saga of Bitcoin continues to unfold.

| Key Point | Detail |

|---|---|

| Ending of Outflows | Bitcoin saw net inflows of $561.8 million on February 2, ending a four-day streak of $1.5 billion outflows. |

| Market Reaction | Investors may view this inflow positively, but experts like Jamie Coutts warn against assuming it’s a sustainable recovery. |

| Nature of Outflows | ETF inflows are primarily from a reduced pool of buyers with limited capacity, not necessarily from new conviction-based demand. |

| Delta-Neutral Trading | Trading strategies involving Bitcoin ETFs may not reflect positive directional demand, as many trades are for hedging purposes. |

| Volatility Impact | Increasing volatility and margin costs may make current ETF inflows unsustainable in the future. |

| Conclusion on Sustained Demand | A truly sustainable bottom for Bitcoin will require broader participation beyond current institutional strategies, indicating higher risk factors. |

Summary

Bitcoin ETF inflows have shown a significant but cautious recovery, with a notable inflow of $561.8 million occurring after a prolonged period of outflows. This trend, however, should be interpreted with caution, as analysts suggest that the underlying demand may not be as robust as it appears. The current inflows predominantly stem from a dwindling group of institutional investors that rely on delta-neutral strategies rather than new market confidence. To achieve a truly sustainable recovery in Bitcoin ETF inflows, a more diversified and robust demand structure is necessary—one that extends beyond current market participants who are feeling the pressure of volatility and limited capital.

Understanding Bitcoin ETF Inflows

Bitcoin exchange-traded funds (ETFs) have become a pivotal aspect of the cryptocurrency market, particularly regarding institutional participation. Recent inflows into Bitcoin ETFs, such as the noteworthy $561.8 million on February 2, had previously followed a steep decline of around $1.5 billion in outflows. This change in trajectory has sparked conversations about the nature of these inflows—is this a sign of enduring demand for Bitcoin or merely a market response to the fluctuating landscape of cryptocurrency trading? Investors are eager to decipher these trends, especially as they impact Bitcoin’s overall market stability.

However, one must consider that ETF inflows alone do not equate to long-term bullish sentiment or true market participation in Bitcoin trading. Jamie Coutts’ remarks underscore the caution needed: the inflows predominantly arise from a limited group of institutional players with specific treasury-like strategies. As this dynamic evolves, understanding Bitcoin ETF inflows becomes crucial for grasping broader crypto market trends and the potential impacts of volatility on future price movements.

The Role of Institutional Demand in the ETF Market

Institutional demand plays a critical role in shaping ETF market dynamics, particularly as these entities transform their strategies in response to prevailing market conditions. The recent analysis from the Commodity Futures Trading Commission highlights significant positions taken by non-commercial participants, which suggests that a large portion of current institutional demand is hedged rather than directional. When institutional players engage in this manner, it adds a layer of complexity to understanding market sentiment as these trades might not reflect a considerable commitment to holding or buying Bitcoin.

As the market evolves, the challenge remains to attract more unhedged, conviction-driven investors into Bitcoin ETFs. The sustainability of the recent inflows hinges on whether new capital enters the market with the intent to hold Bitcoin, spurred by positive fundamentals rather than mere arbitrage or basis trading. Until such investments manifest, the reliance on a decreasing group of participants could render ETF flows susceptible to sudden changes in market sentiment and risk-off conditions.

The Impact of Volatility on Bitcoin Trading

Volatility has always been a defining characteristic of Bitcoin and can significantly influence trading behaviors, especially concerning ETF inflows. When Bitcoin experiences spikes in volatility, many institutional investors may quickly de-risk their positions, leading to outflows rather than inflows. This temporary disruption can create an environment where previous bullish momentum dissipates, reinforcing the underlying fragility of current market dynamics. Understanding how volatility affects Bitcoin trading strategies is essential for any investor looking to navigate these turbulent waters.

The interplay between Bitcoin’s inherent volatility and ETF trading dynamics presents a unique puzzle for market analysts. The current landscape suggests that authorized participant activity—creating and redeeming ETF shares—often follows a market structure rather than driven by underlying Bitcoin demand. In times of heightened volatility, this market structure can distort the perceived health of inflows, masking the true state of investor sentiment and leading to potential misinterpretations of bullish signals.

Delta-Neutral Strategies and Bitcoin ETFs

Delta-neutral trading strategies play a significant role in shaping the inflows and outflows of Bitcoin ETFs. This trading technique allows institutional investors to hedge their positions effectively, balancing their exposure with long and short Bitcoin contracts. For instance, when these investors buy Bitcoin ETF shares while simultaneously shorting futures, they can profit from price discrepancies without assuming full exposure to the risks typical of individual Bitcoin transactions. Such strategies become particularly appealing when market conditions remain stable, allowing for consistent profits through basis convergence.

However, as volatility increases or margin costs tighten, these delta-neutral strategies may become less sustainable. Hedge funds and institutional players must continuously assess their risk exposure, and any change in market dynamics can lead to rapid unwinding of positions. Therefore, while Bitcoin ETF inflows may initially signal bullish activity, the underlying mechanics of delta-neutral positioning can obscure true investor sentiment, highlighting the importance of understanding these complexities in trading analysis.

The Psychology Behind ETF Market Dynamics

The psychology of investors, particularly institutional ones, heavily influences ETF market dynamics in the crypto sector. Institutional demand is often characterized by a herd mentality, where decisions to participate can become contingent upon the actions of others within their peer group. This social behavior can lead to reinforcing cycles of inflows and outflows, as institutions react to perceived pressures or market trends rather than executing independently based on sound analysis. Understanding this psychological landscape is paramount for grasping why Bitcoin ETFs might experience sudden shifts in capital flow.

Additionally, factors such as fear of missing out (FOMO) or fear of loss can heavily influence institutional decisions. When ETF inflows showcase positive trends, other institutions may rush to participate, thereby driving up demand indiscriminately. Conversely, when volatility strikes, fear can lead to a rapid exit, resulting in notable outflows. Hence, the psychology of institutional investors is crucial for interpreting ETF inflows within the broader context of the crypto market and understanding how this behavior contributes to market trends.

Assessing Market Signals Through ETF Flows

Analyzing ETF flows can provide critical insights into the overall health of the Bitcoin market. For instance, a substantial influx of capital into ETFs could indicate renewed confidence among investors, suggesting a potential floor for Bitcoin prices. However, as Jamie Coutts points out, it is crucial to assess whether these flows genuinely correlate with positive sentiment or are an artifact of market structure. A thorough investigation into these signals allows market analysts to differentiate between transient surges and longer-term trends, important for predicting future price movements.

Moreover, connecting Bitcoin ETF flows to underlying market conditions, such as interest rates or regulatory signals, further informs investment strategies. A nuanced approach to analyzing these flows can help investors identify whether inflows are sustainable and what implications they hold for future market dynamics. In a market as turbulent as cryptocurrency, understanding how to contextualize ETF flow data is essential for making informed trading decisions.

Risks Associated with Fluctuating Liquidity

As liquidity conditions fluctuate within the Bitcoin market, the associated risks become evident, especially for institutional investors engaging with ETFs. When there are rapidly changing market conditions, the ability of market makers to provide liquidity can diminish, potentially leading to significant price discrepancies between ETFs and their underlying assets. These conditions can affect the effectiveness of arbitrage strategies, creating risks that investors must navigate carefully, particularly when trading around critical market events.

Moreover, changes in liquidity can also lead to misrepresentations of market strength, as positive flows may mask underlying weaknesses. For instance, inflows into Bitcoin ETFs could occur amidst declining actual Bitcoin prices, revealing a fragile market environment. Investors must take liquidity into account, understanding that as conditions tighten, the mechanisms keeping ETF prices aligned with Bitcoin can falter, explaining the need for a cautious approach when interpreting positive flow signals.

Market Sentiment and Future Outlook for Bitcoin

Market sentiment regarding Bitcoin and its ETFs remains volatile as institutional players navigate a complex landscape of economic indicators and market conditions. The recent inflows into Bitcoin ETFs could be interpreted as a sign of increasing confidence; however, analysts emphasize the need to consider underlying dynamics that may contradict surface-level appearances. The sentiment driving these inflows largely depends on broader market conditions, including interest rate policies and economic stability, factors that are critical to maintaining momentum within the cryptocurrency space.

Looking ahead, the future of Bitcoin ETF inflows largely hinges on whether institutional investors can regain confidence and successfully navigate the dual challenges of volatility and liquidity. A genuine bottoming process requires a broader commitment from investors willing to support Bitcoin without the cushions of strategic hedging. As Bitcoin evolves and matures as an asset class, the transformation of investor sentiment will play a crucial role in determining the sustainability of future ETF inflows.

Frequently Asked Questions

What are the recent trends in Bitcoin ETF inflows and their implications for Bitcoin trading analysis?

Recently, Bitcoin ETFs saw substantial inflows, with a reported $561.8 million on February 2, 2026, after a prior streak of outflows totaling nearly $1.5 billion. This shift may signal a change in sentiment in the crypto market, but analysts caution that the inflows may not reflect genuine bullishness in Bitcoin trading analysis, as they could be driven by delta-neutral strategies rather than new directional demand.

How do ETF market dynamics influence institutional demand for Bitcoin?

ETF market dynamics play a crucial role in shaping institutional demand for Bitcoin. When ETF shares are created or redeemed, the activity can sometimes mask the true intention behind the trades, which may be more about arbitrage than actual investment in Bitcoin. This highlights the importance of understanding the motivations behind inflows, as they might result from institutions seeking to balance their exposure rather than wanting to invest directly in the crypto asset.

How do volatility effects on Bitcoin impact ETF inflows?

Volatility effects on Bitcoin critically influence ETF inflows. When market volatility increases, the attractiveness of delta-neutral strategies diminishes, leading to potential reversals in inflows. As institutions navigate rising margins and increased risks, this may cause a rapid decrease in ETF inflows, suggesting that sustainable demand is tied to stable volatility conditions in the Bitcoin market.

What role does delta-neutral trading play in Bitcoin ETF inflows?

Delta-neutral trading significantly impacts Bitcoin ETF inflows by allowing institutions to hedge their positions while still creating demand for ETF shares. This approach involves buying ETF shares and simultaneously taking oppositional positions in Bitcoin futures, which can lead to inflows that don’t necessarily represent strong bullish sentiment but rather reflect strategic market maneuvers aimed at maintaining exposure amid uncertain price movements.

Are recent Bitcoin ETF inflows indicative of a market bottom?

While recent Bitcoin ETF inflows have led to speculation about a market bottom, analysts suggest that true bottoming conditions require more than just positive flow numbers. A sustainable bottom would likely involve ongoing inflows coupled with a decrease in margin pressure and volatility, indicating a genuine willingness among investors to accumulate Bitcoin rather than merely engaging in speculative trades.

What are the implications of ETF inflows for understanding crypto market trends?

ETF inflows provide valuable insights into crypto market trends by reflecting institutional behavior and strategic positioning rather than straightforward investment interest. As inflows can be driven by factors such as delta-neutral trades and arbitrage opportunities, understanding these dynamics is essential for accurate analysis and forecasting of future developments in the crypto space.

How do authorized participants impact Bitcoin ETF flows and market stability?

Authorized participants are key players in Bitcoin ETF flows, executing creations and redemptions that help maintain the ETF’s price alignment to its net asset value. Their activity can introduce significant market dynamics, as their trading decisions are influenced by market structure rather than direct investment interest in Bitcoin. This can lead to volatility and may obscure the true demand for the underlying asset, affecting market stability.

What is the relationship between Bitcoin ETF inflows and futures trading strategies?

The relationship between Bitcoin ETF inflows and futures trading strategies is complex. Institutions often engage in simultaneous spot and futures positions to achieve delta-neutral exposure, which can lead to misleading inflows that seem bullish while the actual market sentiment may be risk-off. Understanding this interplay is critical for investors looking to navigate the dynamics of Bitcoin’s price and institutional demand.