Market cycle performance plays a pivotal role in understanding the dynamics of cryptocurrency investments, especially as we step into a new phase of market evolution. Zhu Su, the founder of Three Arrows Capital, highlights the importance of recognizing potential asset rotation paths through “analogical reasoning.” His insights suggest that the upcoming trends could reveal how ETH’s performance may mirror BTC’s success in prior cycles. Furthermore, he predicts that SOL could follow a trajectory similar to ETH, while HYPE might replicate SOL’s past gains, leading to LIT potentially performing like SUI. By analyzing these patterns, investors can make informed decisions tailored to anticipated crypto asset rotation.

When discussing the fluctuations in cryptocurrency markets, terms like asset fluctuation patterns and investment cycle analysis come to the forefront. Zhu Su, the visionary behind Three Arrows Capital, emphasizes the significance of drawing parallels between previous and current cycles. He notes that we might witness a cyclical repetition where the performance of Ethereum (ETH) could echo that of Bitcoin (BTC) from earlier trends. Additionally, projections suggest that Solana (SOL) might experience growth akin to that of Ethereum in its ascent, while HYPE could showcase a similar rally as SOL in earlier phases. Such analyses help inform trading strategies and investment decisions in the ever-evolving crypto landscape.

| Asset | Corresponding Previous Cycle Asset | Comparison/Insight |

|---|---|---|

| ETH | BTC | ETH may perform similarly to BTC in the previous cycle. |

| SOL | ETH | SOL may perform similarly to ETH in the previous cycle. |

| HYPE | SOL | HYPE may perform similarly to SOL in the previous cycle. |

| LIT | SUI | LIT may perform similarly to SUI in the previous cycle. |

Summary

Market cycle performance is crucial to understand potential asset movement within the cryptocurrency landscape. As Zhu Su highlights, by utilizing analogical reasoning, we can draw parallels from past cycles to predict future asset performance. His insights suggest that assets like ETH, SOL, HYPE, and LIT may follow in the footsteps of BTC, ETH, SOL, and SUI from previous cycles, respectively. This analysis provides valuable guidance for investors looking to navigate the upcoming market transitions effectively.

Understanding Market Cycle Performance

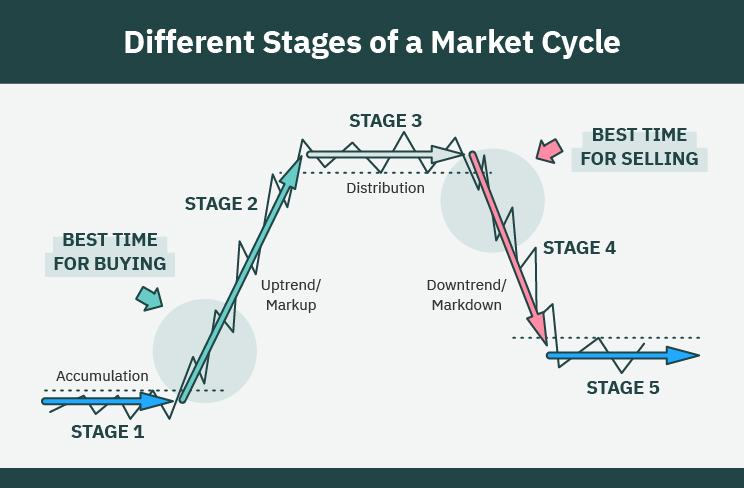

Market cycle performance is a critical concept in the world of cryptocurrency investing. As investors navigate the market, understanding how various assets perform through different phases of a market cycle can inform better investment strategies. Zhu Su, the renowned founder of Three Arrows Capital, emphasizes this concept through his post on analogical reasoning in asset rotation. Utilizing past performance as a guide, Su’s insights suggest that the upcoming market cycle will showcase a rotation of crypto assets, where established patterns might help predict future outcomes.

For instance, Su draws a parallel between ETH’s anticipated performance in the new cycle and BTC’s past performance in previous cycles. This ETH BTC comparison opens a conversation on how major cryptocurrencies might influence one another as market dynamics shift. As ETH continues to gather momentum and innovations like Ethereum 2.0 develop, observing BTC’s historical growth can provide clues about ETH’s potential price trajectories and volatility.

The Impact of Asset Rotation on Investment Strategies

Asset rotation is a strategy that takes advantage of the cyclical nature of markets by moving investments from one asset to another based on their expected performance. Zhu Su’s assertion points to a systematic reevaluation of prominent crypto assets as we shift into a new market cycle. Particularly, he posits that SOL’s trajectory may align with ETH’s prior performance, suggesting that investors might consider SOL as a timely entry point, stimulating discussions on the SOL HYPE LIT performance.

Furthermore, recognizing that each asset may reflect the successes or struggles of its predecessors can enhance investment decisions. For example, if HYPE is expected to resonate with SOL’s past growth, investors might start allocating funds towards HYPE while considering potential risks and rewards. Understanding this dynamic asset rotation can help create a well-rounded portfolio that adapts to market fluctuations and optimizes returns.

Analogical Reasoning in Crypto Asset Performance

Analogical reasoning, as proposed by Zhu Su, showcases the importance of learning from historical data to make informed predictions in the cryptocurrency market. This method draws connections between past and present asset performances, thus creating insights into potential future success. For instance, if investors saw BTC excel during a previous cycle, and ETH is now mirroring those patterns, this reasoning encourages an affirmative investment stance on ETH moving forward.

The beauty of this approach also extends to emerging assets such as LIT and their potential to replicate the performance of even newer cryptocurrencies like SUI. By finding correlations in market behavior, traders can take calculated risks and participate actively in the fragmented yet rapidly evolving landscape of digital currencies. With a structured approach to analogical reasoning, the opportunities for financial gains in cryptocurrency become clearer.

Analyzing the Future of Ethereum and Bitcoin

The evolving narrative surrounding Ethereum (ETH) and Bitcoin (BTC) continues to garner significant attention, particularly as market cycles shift. Many investors are scrutinizing the potential for Ethereum to replicate the historical performance of Bitcoin, which has established itself as a beacon of stability and growth within the crypto landscape. Zhu Su’s observations highlight a critical moment for ETH, as its advancements in technology and scalability position it favorably against BTC.

Investors are keen to examine how Ethereum’s advancements—such as the shift to proof-of-stake—may influence its performance trajectory compared to Bitcoin. As the crypto community anticipates Ethereum potentially following Bitcoin’s footsteps, understanding these dynamics could present lucrative investment opportunities. By continuously analyzing these two major cryptocurrencies, traders can refine their strategies and potentially enhance returns as new market cycles emerge.

The Role of Emerging Assets: SOL, HYPE, and LIT

As the cryptocurrency landscape grows increasingly competitive, emerging assets such as SOL, HYPE, and LIT are capturing investor interest. Zhu Su’s correlations hint at a promising future for SOL, where its performance trajectory might mirror the established successes of Ethereum. This potential similarity in growth patterns emphasizes the importance of diversification and careful asset selection during investment strategy planning.

In particular, the hype surrounding SOL indicates strong community backing and speculative interest, setting a foundation for its growth. Additionally, as LIT’s performance parallels that of SUI, seasoned investors may leverage such analogies to navigate the market effectively. Understanding the interplay between these emerging assets can be pivotal in optimizing portfolios for the next market cycle.

Navigating the New Market Cycle with Strategic Insights

As the cryptocurrency market enters a new cycle, equipped with the insights shared by Zhu Su, investors must navigate with strategic foresight. Recognizing the analogical connections between asset performance can be instrumental in making calculated investment moves. By evaluating the anticipated rotation of assets, one can uncover opportunities that align with historical trends and support sustainable capital growth.

Moreover, integrating LSI strategies, such as examining the interdependencies among ETH, BTC, SOL, HYPE, and LIT, allows investors to make data-driven decisions. This multi-faceted approach to understanding market cycles will become crucial in identifying profitable avenues while minimizing risks associated with market volatility.

Predictions for HYPE and LIT in Upcoming Cycles

Investors are increasingly intrigued by the potential trajectories of HYPE and LIT, especially in light of Zhu Su’s predictions regarding asset performance architecture in crypto. Understanding HYPE’s potential implications for SOL’s past success is essential as it prepares to enter a more mature market stage. The emphasis on HYPE reflects the sentiment across the crypto community, where speculation and belief in future project potentials become driving forces for investment.

In a similar vein, LIT represents a fascinating proposition as it aligns itself with the success of SUI. Investors must remain vigilant in watching the developments surrounding both HYPE and LIT, assessing each asset’s growth potential based on historical data and current market factors. By leveraging predictions and recognizing patterns, traders can make educated choices that maximize returns regardless of market conditions.

Utilizing Crypto Trends for Informed Decisions

With an ever-evolving crypto landscape, utilizing current trends will be critical for informed investment decisions. The reflections shared by Zhu Su not only provide insight but also offer a roadmap for navigating upcoming market cycles. Following the trends, whether it be in the performance of BTC, ETH, SOL, HYPE, or LIT, allows investors to align themselves with the natural asset rotations that typify the crypto markets.

Investors can leverage trend analysis to identify momentum in specific assets while optimizing their allocations accordingly. This approach compels investors to embrace a proactive stance in their portfolio management, enhancing their ability to tap into the fluctuating, yet profitable, nature of cryptocurrency markets. Understanding and capitalizing on crypto trends will be paramount as the next wave of opportunities unfolds.

Key Takeaways for Future Cryptocurrency Investments

As Zhu Su’s observations illuminate the pathways for understanding market cycles, key takeaways emerge for cryptocurrency investors eager to navigate this dynamic landscape. Learning through analogical reasoning not only prepares investors for potential asset rotations but also fosters a mindset geared towards adaptive decision-making. Such insights encourage a forward-thinking approach that anticipates market fluctuations and harnesses opportunities.

Moreover, recognizing the importance of established cryptocurrencies like ETH and BTC, alongside rising stars such as SOL, HYPE, and LIT, underlines the necessity for diversification. This balanced investment strategy can mitigate risks and uncover significant growth potentials as new market cycles unfold. By integrating these takeaways into investment practices, traders can enhance their overall success rate in the crypto space.

Frequently Asked Questions

What did Zhu Su mean by market cycle performance in relation to crypto assets?

Zhu Su, founder of Three Arrows Capital, emphasizes the importance of understanding market cycle performance when evaluating crypto assets. He suggests using analogical reasoning to predict future asset rotations, indicating that ETH’s performance may resemble BTC’s previous cycle behavior.

How can crypto asset rotation affect market cycle performance?

Crypto asset rotation refers to the shift in performance from one asset to another during different market cycles. According to Zhu Su, understanding this rotation is key to comprehending market cycle performance, as it can provide insights into potential future gains based on past trends of assets like ETH, BTC, and SOL.

What similarities did Zhu Su identify in crypto assets regarding market cycle performance?

Zhu Su identified potential similarities in market cycle performance among several crypto assets: he believes ETH might mirror BTC’s performance from its past cycle, SOL could reflect ETH’s trajectory, HYPE might follow SOL’s performance, and LIT could resemble SUI’s previous outcomes.

Why is the ETH BTC comparison significant for understanding market cycle performance?

The ETH BTC comparison is significant as it aids in predicting market cycle performance based on historical trends. Zhu Su suggests that analyzing how these two leading assets have interacted in past cycles can offer valuable insights into future rotations and potential returns in upcoming cycles.

What role does SOL play in Zhu Su’s analogical reasoning about market cycle performance?

In Zhu Su’s analogical reasoning about market cycle performance, SOL is projected to follow a path similar to ETH during previous cycles. This insight can help investors understand potential patterns and prepare for the next crypto asset rotation.

How does the concept of HYPE relate to market cycle performance?

The concept of HYPE in market cycle performance is linked to the expectation and response of investors towards newer assets. Zhu Su posits that HYPE’s performance could mimic that of SOL from the last cycle, suggesting that market enthusiasm plays a crucial role in asset rotation.

What insights does Zhu Su provide regarding LIT’s performance in the context of market cycles?

Zhu Su suggests that LIT’s performance may reflect the historical trends of SUI in previous market cycles. This insight into market cycle performance underscores the importance of analogical reasoning for predicting the future trajectories of emerging crypto assets.