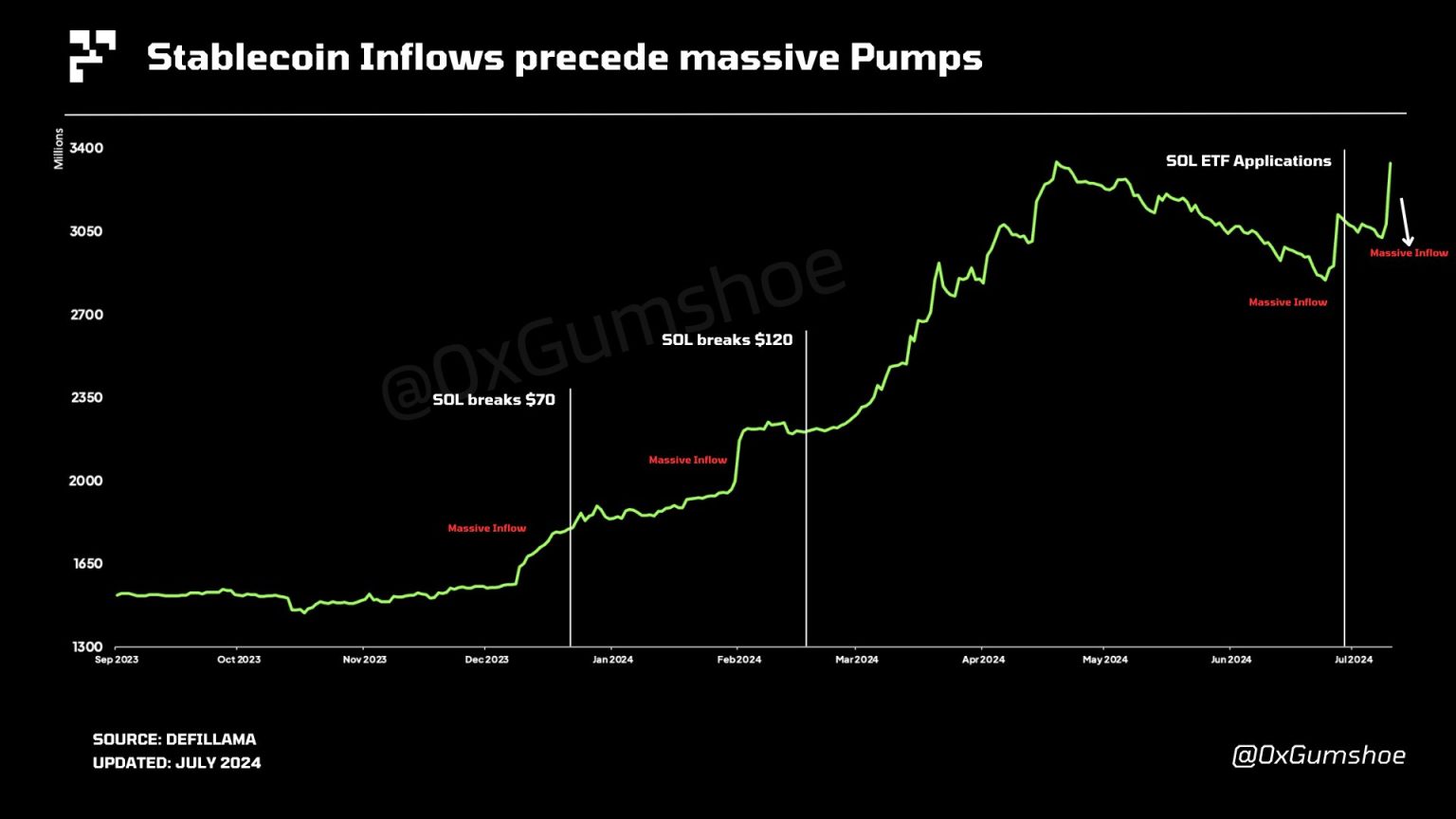

In recent Solana news, the Solana stablecoin inflow has surged significantly, marking a notable increase of $1.3 billion in just over a week. This remarkable growth not only highlights the rising popularity of Solana within the crypto market analysis but also contrasts sharply with the concurrent Ethereum supply drop of $3.4 billion. As the stablecoin trends continue to evolve, these inflows suggest a renewed confidence and interest in Solana’s capabilities and infrastructure. Insights from Artemis data illustrate how the landscape of digital currencies is shifting, attracting investors eager to capitalize on these opportunities. For those tracking the dynamics of the cryptocurrency market, Solana’s stablecoin inflow represents a critical trend worth monitoring closely.

Delving deeper into the dynamics of the cryptocurrency ecosystem, recent data revelations have spotlighted Solana’s remarkable upswing in stablecoin investments. The latest research indicates that the influx of these digital funds has positioned Solana at the forefront, contrasting with declining reserves in established networks like Ethereum. As analysts sift through the implications of this shift, the surge in Solana’s stability-backed currency paints a compelling picture of emerging trends in the blockchain space. With the ever-evolving landscape of digital assets, understanding these shifts in stablecoin allocations is crucial for stakeholders and investors alike. These insights provide a window into the vibrant, rapidly changing market, setting the stage for potential opportunities in the future.

| Platform | Stablecoin Inflow/Outflow | Change in Value |

|---|---|---|

| Solana | + $1.3 billion | Largest inflow reported |

| Ethereum | – $3.4 billion | Supply decreased |

Summary

Solana stablecoin inflow has positioned the platform at the forefront of the cryptocurrency market, as evidenced by the recent report showing an influx of $1.3 billion within just seven days. This remarkable growth contrasts sharply with Ethereum, which experienced a decrease in its stablecoin supply by $3.4 billion. The substantial interest in Solana’s stablecoin ecosystem highlights a significant shift towards this blockchain, suggesting increasing investor confidence and potential future growth.

Solana Stablecoin Inflow: A Record Surge

Recent reports from Odaily Planet Daily News highlight a significant surge in stablecoin inflow within the Solana ecosystem. According to Artemis data, Solana experienced an impressive inflow of $1.3 billion in stablecoins over just one week. This remarkable growth is indicative of rising confidence among investors in Solana’s capabilities, suggesting a robust trajectory for the platform amidst the ever-evolving crypto landscape.

In contrast to Solana’s positive momentum, Ethereum has faced a contraction in its supply, seeing a reduction of $3.4 billion over the same period. This divergence in market behavior showcases Solana’s potential to capture liquidity in a market often dominated by Ethereum. As more investors explore stablecoin trends, analyzing how Solana leverages this inflow could provide vital clues about the future of DeFi protocols operating on its blockchain.

Impact of Stablecoin Trends on Crypto Market Analysis

Stablecoins continue to play a pivotal role in crypto market dynamics, and the recent influx into Solana emphasizes this trend. Stablecoins, being less volatile, serve as a safe haven for investors navigating market uncertainties. The surge in Solana’s stablecoin inflow not only reinforces its position in the market but also highlights a growing preference for alternative platforms beyond Ethereum, which has long been the dominant player.

Market analysts are closely watching these stablecoin trends as they assess the overall health of the crypto market. With tools like Artemis data insights, traders and investors can identify patterns and make informed decisions. As Solana capitalizes on this inflow, it may attract further institutional interest, catalyzing additional growth opportunities and potentially altering the landscape for established players like Ethereum.

Solana vs. Ethereum: A Shift in Stablecoin Dynamics

The recent stablecoin inflow into Solana presents a fascinating contrast to the situation faced by Ethereum. While Solana witnessed a remarkable increase in liquidity, Ethereum’s ongoing supply drop raises questions about its stability and potential for growth going forward. The contrasting trends should prompt investors to evaluate their positions in these two major blockchain ecosystems.

This shift in stablecoin dynamics could indicate a broader change in market sentiment, as investors seek more scalable and innovative platforms. The data reveals that while Ethereum has been a stronghold for many years, Solana’s ability to draw substantial stablecoin inflow signals a possible renaissance for alternative blockchains. Crypto enthusiasts and analysts alike are eager to see whether this trend will persist and lead to a new phase of competition in the industry.

The Role of Artemis Data in Understanding Market Trends

Artemis data has emerged as a vital resource for analyzing market trends within the crypto space, particularly regarding stablecoin movements. The platform’s ability to provide real-time insights allows investors to gauge the health of various blockchains and their attractiveness to issuers of stablecoins. This data has become crucial in interpreting not just the inflow to Solana but also the broader implications for the market.

By utilizing Artemis data, market analysts can track pivotal shifts and make data-driven predictions. Observing Solana’s substantial inflow against the backdrop of Ethereum’s supply reduction can help institutions and individual investors strategize effectively. The insights provided by such comprehensive analyses are indispensable for anyone looking to navigate the complex waters of cryptocurrency investing.

The Future of Solana: Opportunities and Challenges Ahead

Looking forward, Solana’s record stablecoin inflow presents both exciting opportunities and challenges. As the blockchain continues to scale and attract liquidity, developers will need to ensure that the infrastructure can support increased activity without compromising performance or security. The current momentum could usher in a new wave of decentralized applications (dApps) built on Solana, further entrenching its position in the crypto market.

However, challenges remain as Solana contends with strong competitors, particularly Ethereum, which still holds a considerable share of stablecoin transactions. Navigating regulatory landscapes, ensuring network stability, and continuing to peak interest from investors are all imperative for Solana’s success. As analysts continue to dissect trends within the space, Solana’s ability to sustain and grow its stablecoin inflow could be pivotal in defining its future.

Understanding Market Behavior Through Stablecoins

Stablecoins serve as crucial indicators of market behavior and investor sentiment. The recent surge of stablecoin inflow into Solana not only reflects investor confidence but also signifies a notable shift in preferences as traders look for stable alternatives amid market volatility. Understanding how these dynamics play out can provide insights into the broader health of the cryptocurrency market.

Moreover, observing changes in stablecoin trends can assist investors in predicting future movements and identifying emerging opportunities. As Solana benefits from its newfound status as a favorable destination for stablecoin holders, traders are poised to analyze how these shifts will influence overall market sentiment, potentially leading to new investment strategies.

Navigating the Ripple Effects of Solana’s Inflows

As Solana experiences a remarkable inflow of stablecoins, the ripple effects can be felt throughout the crypto ecosystem. This influx not only bolsters Solana’s immediate market standing but also potentially shifts the balance of power among blockchains. Investors are likely to re-evaluate their portfolios, leading to increased trading activity and possibly even influencing the prices of related cryptocurrencies.

In addition, such significant inflows could enhance Solana’s visibility among developers and investors alike. Continued growth may inspire more projects to be developed in Solana’s ecosystem, leading to innovations in DeFi and other sectors. As the overall cryptocurrency landscape evolves, staying aware of Solana’s developments will be crucial for anyone involved in crypto investment.

Analyzing Market Trends: Solana in Bifurcation from Ethereum

The bifurcation of Solana’s market trajectory from Ethereum is becoming increasingly pronounced, especially in light of the contrasting trends regarding stablecoins. As Solana’s liquidity swells due to a significant inflow of stablecoins, Ethereum’s diminishing supply might prompt a reevaluation of its desirability as a medium for transactions. Such divergent paths may indicate deeper market shifts that stakeholders must carefully consider.

Analysts observing this bifurcation can leverage Artemis data to gain a clearer understanding of both networks’ futures. With Solana appearing more attractive to stablecoin issuers, it raises the question of whether strategic shifts will occur within institutional investment, ultimately leading to a more diversified blockchain ecosystem as investor preferences continue to evolve.

Concluding Thoughts on the Future of Stablecoins and Their Blockchain Destinations

As the competition among blockchains heats up, understanding the stablecoin landscape is essential to grasping the future of the crypto market. The recent inflow to Solana signifies not only an uptick in investor confidence but also a potential rerouting of market focus away from the traditional giants like Ethereum. By closely monitoring stablecoin trends, investors can glean valuable insights about where the next wave of growth may occur.

In conclusion, as blockchain technology continues to mature, the role of stablecoins in shaping market dynamics cannot be underestimated. With Solana capitalizing on record inflows, it stands positioned to challenge existing norms within the crypto ecosystem. The next phases of development in the world of stablecoins will undoubtedly captivate market analysts and investors, shaping strategies for trading and development in the coming months.

Frequently Asked Questions

What does the latest Solana stablecoin inflow indicate about market trends?

The recent Solana stablecoin inflow, which saw an increase of $1.3 billion over the past week, indicates a growing interest and investment in the Solana ecosystem. This surge contrasts with the Ethereum supply drop of $3.4 billion, suggesting a potential shift in stablecoin preferences among crypto investors.

How does the Solana stablecoin inflow compare to Ethereum supply changes?

The Solana stablecoin inflow has significantly outpaced Ethereum’s supply changes, with Solana gaining $1.3 billion in stablecoin inflows while Ethereum experienced a supply drop of $3.4 billion. This disparity may highlight changing dynamics in stablecoin usage and investor sentiment within the crypto market.

What are the implications of the Solana stablecoin inflow for future crypto market analysis?

The increased Solana stablecoin inflow could have positive implications for future crypto market analysis, indicating potential growth and stability in the Solana network. With stablecoin trends indicating a shift, investors and market analysts will need to reassess their strategies in light of these developments.

What insights can we gain from Artemis data regarding Solana’s stablecoin inflow?

According to Artemis data insights, Solana’s stablecoin inflow of $1.3 billion over the last week marks the largest increase in the space, providing valuable information on investor confidence in Solana amidst broader market changes, including Ethereum’s supply drop.

Why is the Solana stablecoin inflow significant in the context of current Solana news?

The significance of the Solana stablecoin inflow is underscored by recent Solana news highlighting its rapid growth and appeal to investors. As the crypto landscape evolves, this influx represents a critical moment in stablecoin trends, possibly foreshadowing continued momentum for Solana.