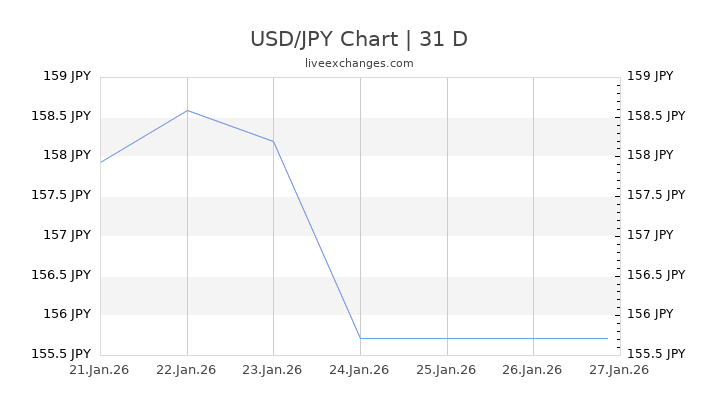

The USD/JPY exchange rate has made headlines recently as it has fallen to 154, marking its lowest point since November 14 of the previous year. This significant decline of 1.11% is turning heads in the financial world, prompting investors and analysts to scrutinize the factors influencing this shift. Currency exchange news has highlighted the role of various economic events in shaping foreign exchange rates, which are crucial for traders engaging in USD to JPY transactions. In light of the ongoing fluctuations, a careful USD JPY analysis reveals insights into Japan’s economic impact and how it intertwines with global market dynamics. As the situation unfolds, it’s essential to stay updated on the latest developments in this vital currency pair.

The fluctuations in the dollar-yen pairing are drawing increasing attention as analysts delve into the underlying causes of its recent downturn. At a recent low of 154, the value of the US dollar against the Japanese yen showcases the ongoing volatility in the global currency market. Observers are particularly interested in the broader implications this has for Japanese economic stability and trade relations. With shifts in exchange values like this one, the financial community is actively engaged in discussions about currency conversion trends and their wider economic ramifications. Understanding these dynamics is key for anyone involved in international markets, especially those looking to convert USD to JPY.

| Key Point | Details |

|---|---|

| Current Exchange Rate | 154 JPY per USD |

| Recent Movement | The exchange rate has fallen by 1.11% intraday |

| Historical Comparison | This is the lowest rate since November 14 of last year |

Summary

The USD/JPY exchange rate has recently fallen to 154, marking a significant drop and a new low since November 14 of the previous year. This decline of 1.11% intraday showcases the ongoing volatility in the currency markets and reflects broader economic factors at play. Investors and traders watching the USD/JPY exchange rate should remain vigilant, as fluctuations can impact various sectors including trade and investments.

Current Status of the USD/JPY Exchange Rate

As of now, the USD/JPY exchange rate stands at 154, marking a significant decline not seen since November 14 of the previous year. This shift represents a 1.11% drop during intraday trading, underlining the fluctuations present in the foreign exchange markets. Traders and investors are closely watching this development, as such changes can indicate broader trends affecting the financial landscape globally.

The recent fall in the USD/JPY exchange rate emphasizes the volatility often seen in currency markets. Factors influencing these movements include economic indicators, geopolitical events, and shifts in monetary policy. As a result, understanding the dynamics of USD to JPY conversions is crucial for anyone involved in international transactions or investments.

Factors Influencing the USD to JPY Exchange Rate

Several key factors drive the variations in the USD to JPY exchange rate. Economic data releases, such as employment figures, GDP growth rates, and inflation indicators from both the United States and Japan, play a pivotal role in shaping investor sentiment. When the U.S. economy shows signs of strength, the dollar often appreciates against the yen, and vice versa.

Additionally, central bank policies contribute significantly to exchange rate fluctuations. The Bank of Japan’s decisions on interest rates can have contrasts with the Federal Reserve’s policies, creating an attractive landscape for forex traders. Understanding these economic impacts provides insights into potential movements in the USD/JPY exchange rate.

Impact of Japan’s Economic Policies on Currency Exchanges

Japan’s economic policies have a profound impact on the country’s currency, particularly how the yen is valued against the dollar. The government’s approach towards fiscal stimulus, monetary policy, and trade relations can sway the USD/JPY exchange rates significantly. For instance, aggressive easing measures from the Bank of Japan typically result in a weaker yen against the dollar.

Furthermore, Japan’s export-driven economy means that currency value heavily leans towards its trade balance. If Japan realizes surplus exports, it could strengthen the yen as demand increases. Conversely, if imports exceed exports significantly, the yen may weaken against the U.S. dollar. Thus, monitoring Japan’s economic policies is crucial for understanding fluctuations in foreign exchange rates.

Currency Exchange News Affecting USD/JPY Rates

Keeping up with currency exchange news is vital for anyone involved in forex trading, especially concerning the USD/JPY pair. Recent news reports have highlighted a trend of weakening for the yen, attributing this to global economic pressures and shifts in trade dynamics. Such information allows traders to make informed decisions when trading USD to JPY.

Moreover, the influence of global markets and other currency pairs can also reverberate through the USD/JPY exchange rate. Developments elsewhere, including trade tensions and shifts in commodity prices, have the potential to affect investor behavior substantially. Thus, staying informed about current currency exchange news is essential for anticipating future currency movements.

Technical Analysis of the USD/JPY Currency Pair

Technical analysis is an essential tool for traders focusing on the USD/JPY exchange rate. By analyzing historical price trends, chart patterns, and trading volume, analysts can identify potential entry and exit points for their trades. This method offers insights into market psychology, which is especially useful given the recent downturn in the yen’s valuation.

Additionally, utilizing indicators like moving averages and the Relative Strength Index (RSI) can guide traders in forecasting future movements in the USD/JPY pair. With such techniques, traders can position themselves cautiously and potentially leverage the fluctuations in exchange rates for profitable opportunities.

Long-term Trends in the USD/JPY Exchange Rate

Examining long-term trends in the USD/JPY exchange rate reveals important insights for investors looking to engage with this currency pair. Historical data often show recurring patterns influenced by cycles of global economic growth and recession, which in turn affect foreign exchange rates. Understanding these trends can prepare traders for future risks and opportunities.

Recent patterns indicate that while short-term fluctuations may present trading opportunities, the long-term trajectory of the USD/JPY exchange rate is determined by macroeconomic fundamentals. Factors such as inflation expectations, interest rate differential, and overall economic stability play critical roles in shaping this pair for the long haul.

The Role of Geopolitical Events in Currency Movements

Geopolitical events significantly impact the USD/JPY exchange rate, underscoring the importance of global developments in currency trading. Events such as elections, trade agreements, or international conflicts can create uncertainty in the markets, leading investors to seek safety in established currencies like the yen or the dollar. Understanding these dynamics can help predict potential shifts in the exchange rate.

For instance, escalation in trade tensions between the U.S. and other countries could lead to volatility in the USD/JPY pair, influencing traders’ decisions. Staying abreast of global socio-political events provides traders with the necessary context to make informed decisions and adjust their strategies accordingly.

Market Sentiment and its Effect on USD/JPY

Market sentiment plays a tremendous role in determining the USD/JPY exchange rate, as trader emotions often drive price movements much more than hard data alone. When market sentiment is optimistic about the U.S. economy, the dollar tends to strengthen against the yen. Conversely, pessimism can lead to a decline in the USD, as seen in the recent downturn where the exchange rate hit a low of 154.

Understanding how sentiment is swayed by news, economic data releases, and geopolitical developments is crucial for forex traders. By gauging market mood, traders can position themselves in line with prevailing trends, potentially capturing profits from swift currency fluctuations.

Future Predictions for the USD to JPY Exchange Rate

Predicting future movements in the USD to JPY exchange rate remains complex, as it is influenced by a myriad of factors. Economic forecasts, changes in central bank policies, and global events will shape the upcoming trajectory of this currency pair. Analysts are closely monitoring these elements to make informed predictions about future valuations.

Moreover, many experts suggest keeping an eye on economic recovery signs post-pandemic, as this may heavily influence the USD/JPY rates. Any shifts in economic health or trade dynamics could spark significant movements, making it essential for traders to continue their analysis and adapt strategies based on emerging data.

Frequently Asked Questions

What factors are currently influencing the USD/JPY exchange rate?

The USD/JPY exchange rate is influenced by a variety of factors including Japan’s economic performance, monetary policy decisions from the Bank of Japan, and broader foreign exchange rates trends. Economic indicators such as GDP growth and inflation rates in Japan and the United States also play a significant role.

How has the recent decline in the USD to JPY exchange rate affected traders?

The recent decline of the USD to JPY exchange rate to 154 has created volatility in the currency markets, prompting traders to adjust their strategies. This decline represents a 1.11% drop, which could signal shifts in market sentiment and leads to increased currency exchange news coverage and analysis.

Where can I find the latest USD JPY analysis and updates?

For the latest USD JPY analysis, traders can refer to financial news websites, forex trading platforms, and economic analysis blogs that specialize in currency exchange rates. Keeping track of economic reports from Japan and the US can also provide insights into future trends.

What is the impact of Japan’s economy on the USD/JPY exchange rate?

Japan’s economic performance significantly impacts the USD/JPY exchange rate. Factors such as employment rates, export levels, and monetary policy can cause fluctuations. A strong Japanese economy may lead to a stronger JPY against the USD, while economic challenges could weaken the JPY.

How can I forecast movements in the USD to JPY exchange rate?

Forecasting movements in the USD to JPY exchange rate involves analyzing technical indicators, economic reports, and geopolitical events. Traders often use tools like moving averages and support/resistance levels, along with staying updated on currency exchange news.

What should investors consider when trading the USD/JPY currency pair?

Investors trading the USD/JPY currency pair should consider market volatility, economic indicators from both the US and Japan, and central bank policies. Understanding the historical trends and conducting a robust USD JPY analysis can also enhance trading decisions.