Decentralized custody is redefining the landscape of asset management in the crypto world, yet recent developments have cast a shadow over its potential. The recent announcement from the decentralized custody startup Entropy, which is backed by prominent investors like a16z, revealed its imminent shutdown and the return of funds to investors. Entropy aimed to challenge traditional centralized crypto custody alternatives, employing advanced technologies like multi-party computation to secure digital assets. However, after four years of development and two rounds of layoffs, the company has faced significant challenges in sustaining a viable business model. This situation highlights the broader issues facing crypto startups, which must navigate a complex market that is increasingly hostile since 2025.

In the rapidly evolving world of cryptocurrency, innovative solutions for asset protection, such as decentralized asset safeguarding, are gaining traction. The unfortunate discontinuation of the Entropy platform illustrates the myriad obstacles that crypto ventures encounter, particularly in a climate of tightening regulations and market shifts. As more investors look for reliable crypto asset management options, the need for robust decentralized solutions remains urgent. Despite the challenges, the foundations laid by startups like Entropy could pave the way for future initiatives that successfully address the needs of the market. With ongoing interest from venture capital firms, the evolution of decentralized security measures could redefine investor confidence in the crypto ecosystem.

| Key Points |

|---|

| Entropy, a decentralized custody startup, has announced its shutdown and will return funds to investors. |

| The company was backed by a16z and completed a $25 million seed round in 2022. |

| Entropy aimed to provide an alternative to centralized crypto custody using advanced technologies. |

| The decision to cease operations came after challenges in achieving a viable business model. |

| The closure reflects a tough environment for crypto startups in the last couple of years. |

Summary

Decentralized custody has been a significant topic in the cryptocurrency landscape, especially with the recent shutdown of the startup Entropy. Rooted in its innovative approach to provide secure, decentralized asset management, Entropy struggled to develop a sustainable business model despite significant investments. As the market presents increasing challenges for crypto startups, the importance of viable operational strategies becomes even more apparent. This closure emphasizes the need for robust frameworks as the industry evolves.

Entropy’s Unfortunate Closure: A Cautionary Tale for Crypto Startups

The cryptocurrency landscape has seen its fair share of ups and downs, and the closure of Entropy, a decentralized custody startup, serves as a critical case study for emerging crypto ventures. Founded with the vision to provide decentralized custody solutions as an alternative to traditional centralized institutions, Entropy attracted significant interest with its innovative technology. Backed by renowned venture capital firm a16z, the startup raised approximately $27 million, including a $25 million seed round that included participation from key players like Dragonfly and Coinbase Ventures. Despite these promising investments, the harsh reality of the volatile crypto market led to Entropy’s shutdown, highlighting just how challenging it can be for startups in this space to find sustainable business models that can endure past the initial growth phase.

The decision to wind down operations and return funds to investors was not taken lightly. Entropy’s founder, Tux Pacific, revealed that after thorough research and multiple iterations of their business model, it became evident that their venture could not maintain the growth expected by investors in the current financial climate. As 2025 brought increased scrutiny and tighter funding environments for crypto startups, many companies, including Entropy, faced insurmountable challenges in achieving the ambitious growth typically anticipated by venture capital investments. This situation sparks a broader discussion about the resilience needed for crypto startups navigating the complexities of funding and market demands.

The emphasis on governance and technology in Entropy’s operations showcased potential pathways for innovation within the crypto storage domain. By leveraging advanced technologies like multi-party computation and threshold cryptography, Entropy aimed to offer a level of security and accessibility that could redefine asset management for the crypto community. Yet, the technical advantages alone were not sufficient to ensure market viability. Investors and founders alike must now reevaluate what success looks like in an era where decentralized solutions are becoming more commonplace but are also facing their moment of reckoning due to harsh market realities.

Moreover, the closure of Entropy serves as a bellwether for the crypto industry at large, signaling a need for startups to not only innovate but also to create robust strategies that reflect the broader economic context. Future ventures will need to prioritize adaptability and careful market analysis to avoid the pitfalls encountered by their predecessors, setting a precedent for a more sustainable approach to crypto custody alternatives. This introspection is necessary, especially as the market continues to evolve, and emerging startups seek their place without falling victim to similar outcomes.

The Impact of Decentralized Custody Solutions on the Crypto Market

Decentralized custody solutions like those offered by startups such as Entropy have been pivotal in transforming the way digital assets are managed and secured. The reliance on decentralized models seeks to address the trust issues associated with centralized custody, providing users with enhanced security features such as multi-party computation techniques. In recent years, the demand for crypto custody alternatives has surged as investors increasingly seek solutions that empower them with greater control over their assets without the risks tied to centralized institutions. However, the shutdown of Entropy underscores the challenges facing these innovations in a rapidly evolving industry.

While decentralized custody technologies promise greater security and autonomy, the commercial viability of these solutions remains in question. As evidenced by Entropy’s experience, the transition from concept to a sustainable business model can be fraught with obstacles. Without addressing the fundamental financial structures that underpin these startups, even the most advanced technologies may struggle to find traction in a competitive market. Thus, the industry must consider ways to support decentralized models through mentorship, strategic partnerships, and tailored investment strategies that cater specifically to the unique dynamics of crypto startups.

Moreover, the decline of significant players in the decentralized custody space raises questions about the overall strategy that startup founders should adopt. With rising competition and evolving regulatory scrutiny, entrepreneurs must balance innovation with prudent business practices to ensure longevity and stability in their operations. This aspect becomes particularly crucial as new players enter the field—with varying degrees of technical advancement and funding capabilities—competing for user trust and market share. Each venture that emerges must learn from the lessons of pioneers like Entropy, taking critical insights into account to avoid a similar fate while bolstering the entire ecosystem of decentralized custody offerings.

As the landscape continues to shift, stakeholders in the industry—including investors, developers, and regulators—must collaborate to create frameworks that promote sustainable growth. This includes fostering an environment that encourages innovation but also prioritizes the assessment of market demand and practical implementation strategies. In conclusion, decentralized custody solutions represent a promising yet challenging frontier within the broader cryptocurrency market, and addressing these challenges head-on can cultivate a more robust and resilient future.

Lessons Learned From Entropy: The Future of Decentralized Startups

The dissolution of Entropy offers valuable lessons for both current and aspiring crypto startups. One of the most notable takeaways is the importance of aligning business models with realistic growth projections. The drive for high-impact growth often overshadows the necessity for a sustainable and resilient operational strategy. In the case of Entropy, even with a strong foundation and advanced technology, the startup could not maintain the required pace of growth amidst the challenging market conditions. Therefore, future startups should not only focus on technological innovation, but also ensure that their growth strategies are built on solid ground and informed by market research and realistic projections.

Additionally, embracing a culture of flexibility and adaptability within a startup’s operational framework is crucial. Entropy’s repeated adjustments in strategy illustrate the necessity for startups to pivot quickly in response to changing market conditions or investor expectations. Startups should develop a culture that values iterative development and rapid response to feedback, ensuring they can navigate the complexities of the crypto landscape effectively. This adaptability is vital as the decentralized custody sector evolves, and new entrants will need to forge a path that balances innovation with responsiveness.

Moreover, a significant aspect of Entropy’s experience is the role that investor expectations play in shaping the trajectory of global crypto startups. The desire for venture-capital-level growth can often pressure startups to scale quickly, sometimes at the expense of thorough market validation. As noted by Tux Pacific, the need to return funds to investors due to the inability to meet growth targets reflects a broader issue within the startup ecosystem. It’s a reminder that robust investor relationships and transparent communication regarding growth capacities can mitigate the risks of misaligned expectations.

For the decentralized custody sector to flourish, startups must prioritize building realistic growth benchmarks and engaging in meaningful dialogues with their investors. As the industry continues to evolve, the insights gained from the shutdown of Entropy can serve as a valuable framework for startups aiming to innovate while ensuring their long-term sustainability and success in a challenging environment.

Frequently Asked Questions

What happened to the decentralized custody startup Entropy?

The decentralized custody startup Entropy, backed by a16z, announced its shutdown and plans to return funds to investors after struggling to achieve a sustainable business model despite significant funding.

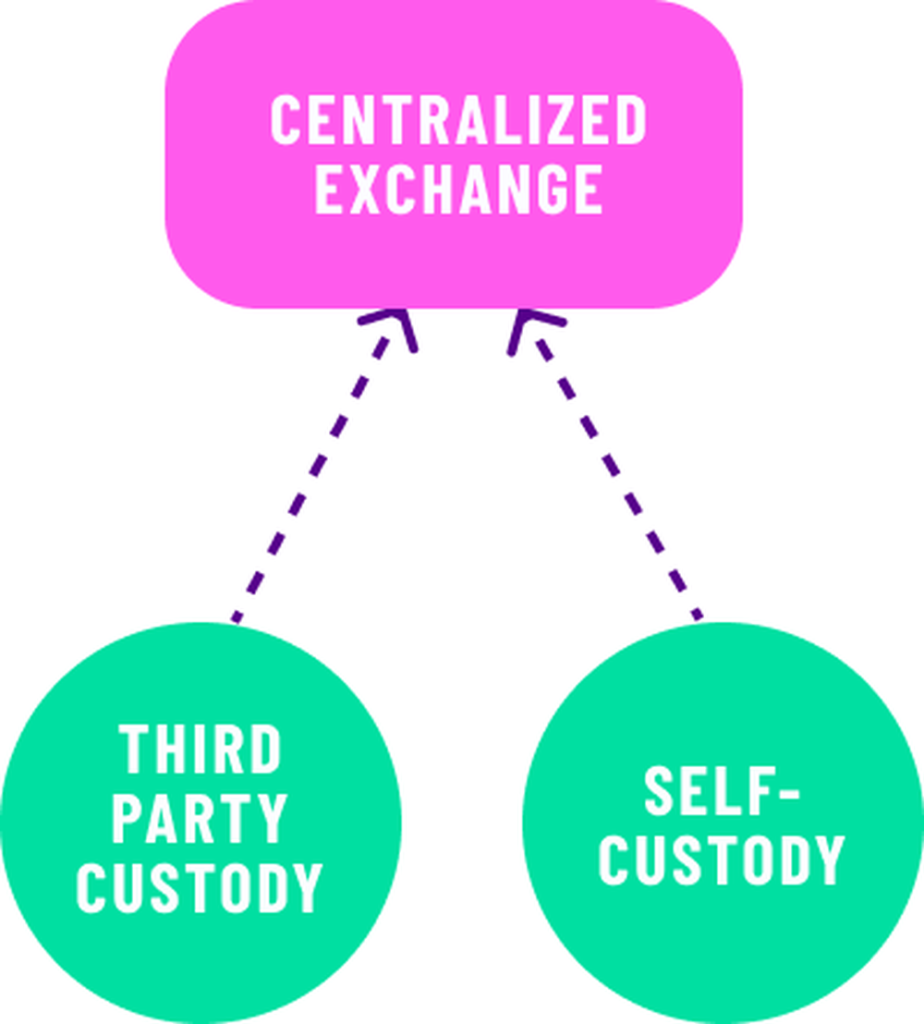

How does decentralized custody work compared to centralized crypto custody?

Decentralized custody utilizes technologies like multi-party computation and threshold cryptography to provide secure asset management, avoiding single points of failure common in centralized crypto custody solutions.

What lessons can other decentralized custody startups learn from Entropy’s shutdown?

Entropy’s shutdown highlights the importance of a viable business model and adaptability in the decentralized custody space, especially given the increasing challenges faced by crypto startups in a changing market.

What were the main technologies used by Entropy in their decentralized custody solution?

Entropy utilized multi-party computation, threshold cryptography, and trusted execution environments to enhance security and facilitate cross-chain asset management in their decentralized custody platform.

How significant was the a16z investment in Entropy’s growth?

The a16z investment played a crucial role in Entropy’s initial growth, with a $25 million seed funding round that helped shape its decentralized custody offerings, though it ultimately couldn’t sustain the required venture-capital-level growth.

Are there other crypto custody alternatives aside from Entropy?

Yes, there are several crypto custody alternatives that focus on decentralized solutions, each with unique technologies and approaches that differ from traditional centralized custody services.

What challenges do decentralized custody startups face in the current market?

Decentralized custody startups are facing increased challenges such as market volatility, regulatory uncertainties, and heightened competition, all of which impact their ability to secure funding and sustain growth.

How can investors assess the viability of decentralized custody startups?

Investors should evaluate decentralized custody startups based on their business model, technology stack, market positioning, and ability to adapt to changing industry conditions, especially in light of events like Entropy’s shutdown.