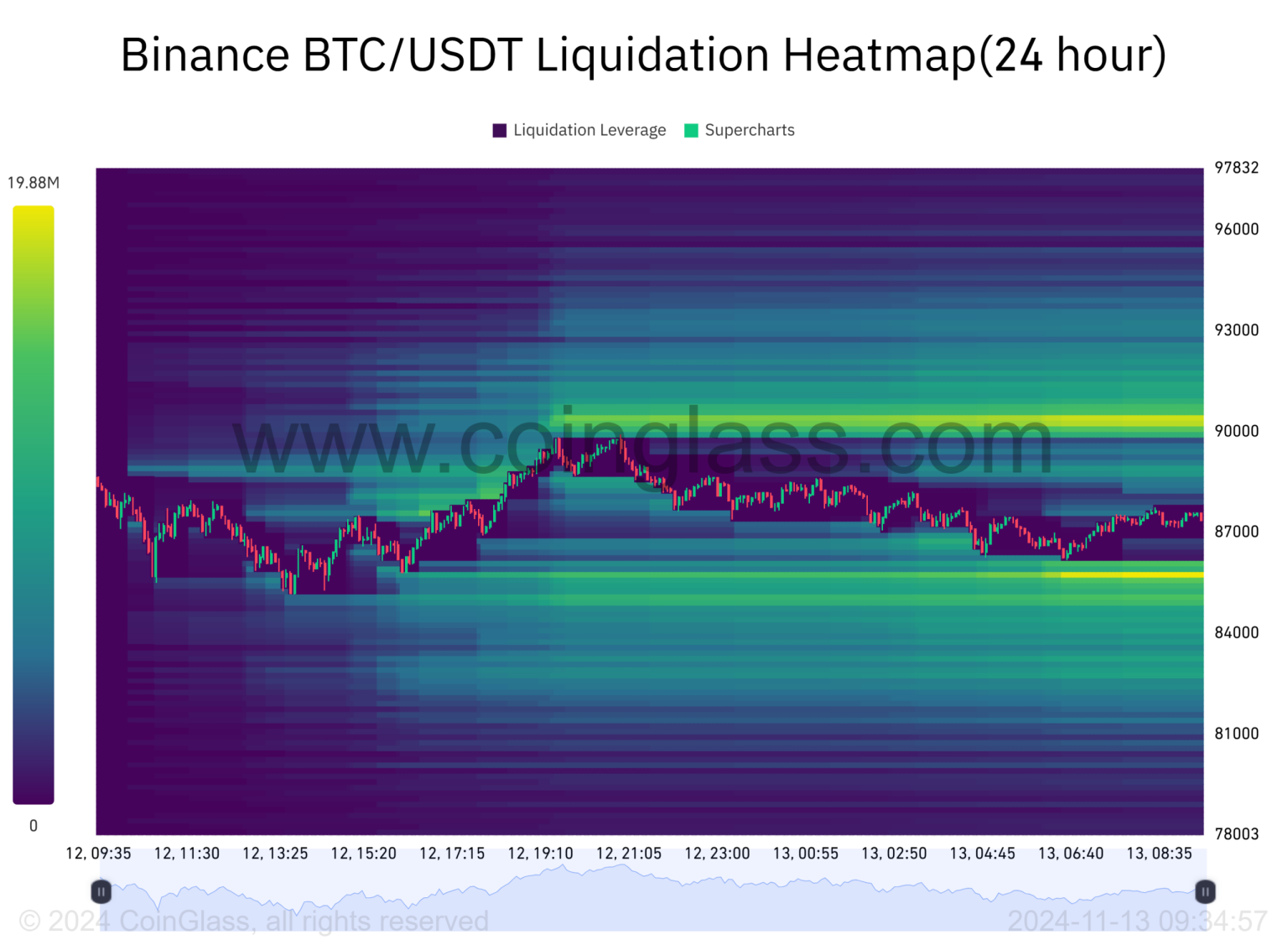

Bitcoin liquidations have surged dramatically, drawing attention across the cryptocurrency market as traders react to changing market conditions. In just the past 24 hours, total liquidations in the crypto space have reached a staggering $130 million, with Bitcoin liquidations specifically accounting for $30.75 million. The recent BTC price drop has prompted several traders to liquidate their positions, highlighting the volatility inherent in crypto trading. Liquidation statistics reveal that long positions were hit the hardest, totaling $91.31 million, while short positions faced liquidations of $38.85 million. This trend underscores the importance of vigilant Bitcoin analysis for anyone looking to navigate the tumultuous waters of cryptocurrency investment.

The recent upheaval in the world of virtual currencies has spotlighted significant events known as liquidations, particularly affecting Bitcoin. During a turbulent trading period, the cryptocurrency sector has witnessed unprecedented levels of forced closures on leveraged trades, impacting overall market stability. This phenomenon often occurs when traders are unable to maintain their positions amid sudden price fluctuations, leading to substantial loss of capital. Understanding these market dynamics is crucial for those involved in digital asset management, as it underscores the risks associated with high leverage in crypto investments. As such, a comprehensive examination of liquidation trends plays a vital role for investors keen on optimizing their strategies.

| Key Point | Value |

|---|---|

| Total Network Liquidations | $130 million |

| BTC Liquidations | $30.75 million |

| Long Position Liquidations | $91.31 million |

| Short Position Liquidations | $38.85 million |

Summary

Bitcoin liquidations have surged dramatically in the recent 24-hour period, totaling $130 million across the entire network. This figure highlights the extreme market volatility, with BTC specifically facing $30.75 million in liquidations. An analysis of the liquidations reveals that long positions were particularly impacted, accounting for $91.31 million, while short positions saw $38.85 million in liquidations. This dynamic illustrates the ongoing risks and fluctuations that traders face within the Bitcoin market.

Understanding Bitcoin Liquidations: Statistical Overview

In the cryptocurrency market, liquidations serve as a critical indicator of market volatility and trader sentiment. Over the last 24 hours, the liquidations across various crypto assets have surpassed a staggering $130 million, highlighting the turbulent nature of the current trading environment. Bitcoin (BTC) has experienced significant liquidation amounts, totaling $30.75 million, which underscores the challenges faced by traders during sudden price movements. Liquidation statistics are vital for understanding the impact of leveraged trading, where traders are forced to close positions to meet margin calls.

The breakdown of the recent liquidation figures reveals that long positions faced the brunt of the pressure, accounting for $91.31 million in liquidations. This suggests a wave of forced selling among traders betting on rising prices, indicating a bearish sentiment dominating the market. Meanwhile, short position liquidations totaled $38.85 million, illustrating that not all traders were caught on the wrong side of the market. Such statistics not only provide insight into current BTC price shifts but also reflect broader trends in crypto trading behavior that can alert potential investors about market sentiments.

Frequently Asked Questions

What are Bitcoin liquidations and how do they affect the cryptocurrency market?

Bitcoin liquidations occur when a trader’s position is automatically closed by the exchange due to insufficient margin to cover losses. These events can significantly impact the cryptocurrency market, as large liquidations often lead to sharp price movements, influencing BTC price drops and market sentiment.

How much have Bitcoin liquidations totaled recently?

In the past 24 hours, Bitcoin liquidations have totaled approximately $30.75 million, which is part of a wider trend where total liquidations across the cryptocurrency market reached $130 million.

What is the significance of liquidation statistics in crypto trading?

Liquidation statistics are crucial in crypto trading as they provide insights into market volatility and trader behavior. High liquidation values, such as the recent $130 million in liquidations, suggest increased market stress, often followed by BTC price drops.

What causes Bitcoin liquidations to spike?

Bitcoin liquidations typically spike when there is high volatility in the cryptocurrency market, often triggered by sudden price movements or shifts in market sentiment. For instance, recent market fluctuations have led to significant long and short position liquidations, with a total of $130 million liquidated across the market recently.

How do long and short position liquidations compare in Bitcoin trading?

In Bitcoin trading, long and short position liquidations vary based on market trends. Recently, long position liquidations accounted for $91.31 million, while short position liquidations totaled $38.85 million, indicating a bearish sentiment during that timeframe.

How can traders protect themselves from Bitcoin liquidations?

Traders can protect themselves from Bitcoin liquidations by managing their leverage carefully, setting stop-loss orders, and maintaining adequate margin in their accounts to absorb potential losses, especially during periods of significant price volatility.