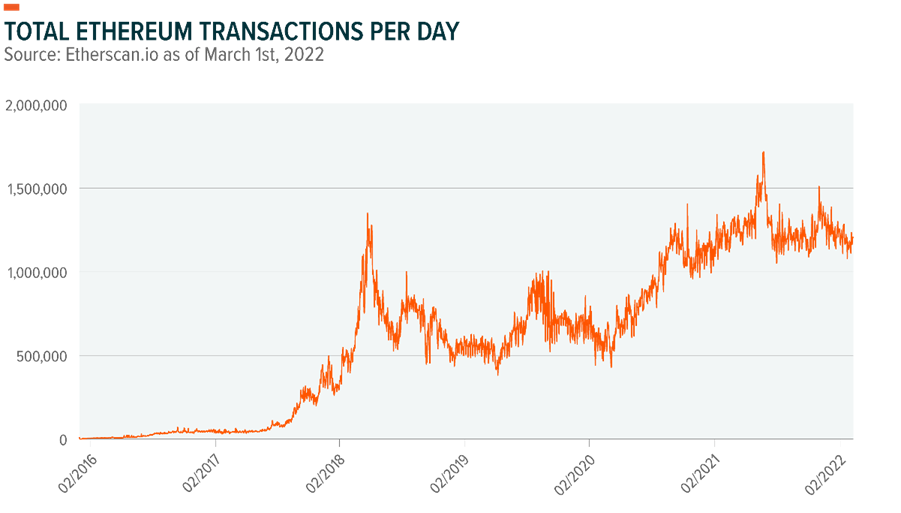

Ethereum transaction volumes have recently captured attention as the network sets remarkable records, handling up to 2.88 million transactions in a single day. This surge in activity highlights not only Ethereum’s capacity for high throughput but also the effectiveness of its Layer 2 Ethereum scaling solutions. With average transaction fees remaining low despite the increased usage, the Ethereum blockchain analysis indicates a promising trend towards a more efficient and cost-effective network. As the mainnet evolves, it’s gradually transforming into a robust settlement layer, which enhances security while fostering innovative capabilities on upper layers. However, it’s crucial to interpret these volumes with caution, as they can sometimes include non-economic activities, such as address poisoning, particularly indicated in stablecoin transactions.

The realm of Ethereum transaction activity reveals a dynamic landscape where scalability and efficiency are paramount. With the rise of Layer 2 solutions, Ethereum demonstrates an incredible ability to manage a myriad of transactions, proposing a layer of complexity over a secure foundation. This dual approach provides a framework that not only maintains low transaction fees but also improves network agility amidst rising claims of high throughput. Furthermore, as we delve deeper into Ethereum blockchain analysis, we uncover patterns and trends that help understand the true nature of these transaction volumes. It is essential to differentiate between meaningful economic activities and trivial ones, as this can greatly impact our interpretation of Ethereum’s ongoing growth.

| Key Point | Details |

|---|---|

| Historical Transaction Volume | Ethereum experienced a peak of 2.88 million transactions in a single day. |

| Transaction Fees | Average transaction fees remained low during high transaction volumes. |

| Technological Developments | Layer 2 scaling efforts are yielding positive results for transaction efficiency. |

| Mainnet Performance | The Ethereum mainnet can handle increased usage while transitioning to a more efficient system. |

| Modular Architecture | The structure separates foundational security from execution complexity, similar to traditional financial systems. |

| Caution in Metrics | Recent transaction volumes may include low-value activities, necessitating a careful analysis of economic activity. |

Summary

Ethereum transaction volumes have showcased remarkable growth, particularly highlighted by a record of 2.88 million transactions in one day. This impressive volume reflects the ongoing enhancements within Ethereum’s technology and architecture, particularly through Layer 2 solutions that maintain low fees. As the network scales and adapts, it is imperative to interpret transaction volumes cautiously, ensuring clarity between genuine economic activity and smaller, potentially misleading actions. Overall, the continued evolution of Ethereum signifies its potential for sustainable growth within the blockchain ecosystem.

Understanding Ethereum Transaction Volumes

Ethereum transaction volumes are a crucial indicator of the network’s activity and efficiency. As reported, Ethereum managed to process an impressive 2.88 million transactions in one day, marking a significant peak in its operational capabilities. This surge indicates not only the growing interest in decentralized applications (dApps) but also the effectiveness of Ethereum’s infrastructure in handling high-volume transactions. Analysts closely monitor these volumes to gauge the platform’s performance and its capacity to support scalability.

However, it’s essential to interpret these transaction volumes carefully. The rise in transactions can include various activities, some of which may not reflect genuine economic utility. For example, certain types of transactions, such as those caused by address poisoning or low-value stablecoin transfers, can inflate the statistics. Hence, while high transaction volumes suggest increased usage, they can also signal the need for deeper blockchain analysis to differentiate between meaningful interactions and unproductive noise.

The Impact of Ethereum Scaling Solutions on Transaction Fees

Ethereum’s scaling solutions, particularly Layer 2 technologies, play a pivotal role in reducing transaction fees on the network. As the Ethereum community focuses on expanding the ecosystem, these solutions facilitate higher throughput and cheaper transactions, allowing users to engage with decentralized finance (DeFi) platforms without incurring prohibitive costs. Lower transaction fees are essential for attracting a broader user base and fostering continued innovation within the Ethereum space.

More efficient scaling not only enhances user experience but also contributes to the overall sustainability of the Ethereum blockchain. As the network transitions towards Layer 2 solutions, the pressure on the mainnet decreases, helping to maintain low fees even during periods of high demand. This delicate balance between scalability and cost will be pivotal as Ethereum aims to solidify its position in the competitive landscape of blockchain technology.

Layer 2 Ethereum: A Game Changer in High Throughput

Layer 2 Ethereum solutions, such as rollups and state channels, represent a significant leap towards achieving high throughput within the Ethereum network. These innovations allow for an increased number of transactions to be handled off-chain, drastically improving the speed and efficiency of the Ethereum ecosystem. By aggregating multiple transactions and processing them collectively, Layer 2 solutions can offer rapid settlement times while minimizing the load on the mainnet.

As users embrace Layer 2 technologies, they can expect not just faster transactions but also a more robust environment for experimentation and development. This transition supports Ethereum’s long-term vision of becoming a versatile platform that accommodates a diverse array of applications, from gaming to finance. The high throughput enabled by Layer 2 without compromising security is thus an essential factor in fostering a thriving Ethereum community.

The Role of Ethereum Blockchain Analysis in Transaction Monitoring

Blockchain analysis has emerged as a critical component in understanding Ethereum’s transaction dynamics. Through detailed analysis, stakeholders and developers can gain insights into transaction patterns, identifying key trends such as spikes in activity that may correlate with specific events or announcements within the community. By leveraging analytical tools, users can better comprehend the implications of transaction volumes on economic behavior.

Moreover, as Ethereum continues to evolve, ongoing blockchain analysis will be essential for maintaining transparency and credibility. With the rise of various Layer 2 solutions and the introduction of new protocols, monitoring transaction fees and volumes will help in validating claims about network activity and user engagement. These insights not only sustain trust among users but also guide future developments within the Ethereum infrastructure.

Evaluating Ethereum’s Network Efficiency during High Volume

Evaluating Ethereum’s network efficiency during periods of high transaction volume is fundamental for understanding its operational success. The recent peak of 2.88 million daily transactions illustrates the network’s growing capacity to handle significant loads without substantial increases in transaction fees. Analyzing how efficiently the network processes these transactions can provide key insights into the performance of existing scaling solutions and highlight areas for improvement.

Furthermore, this analysis can shed light on the effectiveness of the current modular architecture, which is designed to separate concerns between security and transaction processing. By examining network behavior under high load conditions, developers can optimize existing Layer 2 solutions and introduce innovative features that better cater to users’ needs. A comprehensive view of network efficiency not only informs developers but also supports stakeholder confidence in the Ethereum platform.

Challenges in Measuring Real Economic Activity on Ethereum

Despite the promising transaction volumes reported by Ethereum, challenges remain in accurately measuring real economic activity. The presence of low-value transactions, such as those linked to address poisoning or speculative trading, can distort perceptions of genuine usage. Careful consideration must be given to these anomalies to ensure that assessments of the Ethereum network reflect actual economic engagement rather than inflated metrics.

Understanding these challenges is crucial for investors and developers alike, as misinterpretation of transaction data could lead to misguided strategies. Robust methodologies for distinguishing between valuable and less pertinent transactions will enhance the reliability of Ethereum blockchain analysis and foster trust within the ecosystem. As the platform evolves, bolstering clarity around economic activity will be integral in driving sustained growth.

Future Outlook for Ethereum: Balancing Growth and Costs

The future of Ethereum will hinge on its ability to balance growth with the management of transaction costs. As the network continues to scale through Layer 2 implementations, stakeholders must remain vigilant about the economic implications of increased usage. While high throughput is promising, ensuring that transaction fees remain accessible for everyday users is crucial for maintaining broad adoption.

Continued emphasis on efficient scaling solutions will play a key role in achieving this balance. As Ethereum seeks to fortify its position as a leading blockchain platform, understanding the interplay between transaction volumes, fees, and user experience will be paramount. Stakeholders must engage in proactive measures to optimize the network infrastructure while safeguarding against potential pitfalls associated with rapid growth.

The Importance of Modular Architecture in Ethereum’s Success

The modular architecture of the Ethereum blockchain is fundamental to its scalability and success. By separating the mainnet’s security functions from the complex execution layers found in Layer 2 solutions, Ethereum is poised to deliver a more efficient and user-friendly platform. This architecture allows for flexibility in upgrading and implementing new features, ensuring that the network can adapt to the changing demands of its users seamlessly.

Moreover, the modular design aligns Ethereum more closely with traditional financial infrastructures, offering users familiarity alongside blockchain innovation. As developers continue to enhance Ethereum’s capabilities, the focus on modularity will facilitate the quick adaptation of the platform to support high-volume transactions, while maintaining its reputation for security and reliability.

Decentralized Finance and Its Impact on Ethereum Transactions

The growth of decentralized finance (DeFi) has profoundly impacted Ethereum transaction dynamics. As more users engage with DeFi protocols, the network experiences a surge in transaction volume, contributing to both excitement and challenges within the ecosystem. This boom in activity necessitates a closer look at Ethereum’s capacity to handle the increased load and its implications for transaction fees.

In conclusion, as DeFi continues to expand, Ethereum’s ability to manage high transaction volumes will be crucial for sustaining growth within this innovative sector. Developers must prioritize the implementation of effective scaling solutions to ensure that fees remain manageable and that users can transact quickly and efficiently. This focus will not only support the DeFi movement but also reinforce Ethereum’s status as a leading blockchain platform.

Frequently Asked Questions

What are the current trends in Ethereum transaction volumes?

Ethereum transaction volumes have seen significant spikes, with reports indicating that the network processed about 2.88 million transactions in a single day. This record showcases Ethereum’s capability to achieve high throughput while maintaining relatively low transaction fees.

How do Ethereum scaling solutions impact transaction volumes?

Ethereum scaling solutions, particularly Layer 2 technologies, play a crucial role in enhancing transaction volumes on the Ethereum network. By allowing faster and cheaper transactions, these solutions help accommodate the growing demand, ensuring that the mainnet can handle increased activity without compromising performance.

What is the significance of low transaction fees in relation to Ethereum transaction volumes?

Low transaction fees combined with high Ethereum transaction volumes indicate a healthy network environment. This scenario suggests that Ethereum’s technological advancements, particularly through Layer 2 scaling solutions, are effectively reducing costs while enhancing user engagement.

How does the Ethereum blockchain analysis reflect on transaction activities?

Ethereum blockchain analysis helps in understanding transaction volumes and patterns. Despite records of high transaction activity, analysts caution that a portion of recent volumes may stem from low-value operations like address poisoning, particularly in stablecoin transactions, which can distort perceptions of genuine economic activity.

What role does high throughput play in Ethereum’s long-term strategy?

High throughput is essential to Ethereum’s long-term strategy, allowing the network to support a growing ecosystem of applications and users. As Ethereum transitions towards a modular architecture, high throughput facilitated by Layer 2 solutions will be critical in maintaining network efficiency while continuing to innovate.

Are recent spikes in Ethereum transaction volumes sustainable?

While recent spikes in Ethereum transaction volumes are promising, sustainability may be challenged by factors such as the potential for low-value transactions. Careful analysis is required to discern whether these volumes reflect genuine economic use, especially as the landscape of Ethereum transaction fees and scaling solutions evolves.

What challenges does Ethereum face regarding transaction volumes and fees?

Despite the impressive transaction volumes, Ethereum faces challenges such as ensuring low transaction fees during high demand and addressing the impact of low-value transactions on overall metrics. Ongoing improvements through Layer 2 solutions aim to mitigate these challenges and support sustainable growth.