Tokenization is rapidly emerging as a revolutionary force in the financial landscape, especially in the context of digital currencies and decentralized finance. At the 2026 World Economic Forum, the topic sparked vibrant discussions, highlighting how tokenization can enhance financial inclusion by democratizing investment opportunities for a broader audience. Experts, including financial leaders from both traditional banks and the crypto sector, expressed optimism about the potential of this technology to drive efficiency through real-time settlements, drastically reducing transaction costs. However, the debates also underscored pressing concerns about sovereignty and regulatory challenges that could shape the future of tokenized assets. As we delve into the implications of tokenization, understanding its role in reshaping finance technology becomes essential for navigating the evolving global economy.

The emergence of asset digitization, often referred to in terms like tokenization and secure digital representation, is transforming how we perceive ownership and transaction processes. This innovative approach promises to enhance accessibility in financial markets, particularly by elevating financial inclusion for diverse investor bases. Moreover, discussions around decentralized finance, which aims to operate without centralized authorities, shed light on the potential benefits and risks associated with this shift. Notably, these debates at major forums like Davos highlight the tension between adopting cutting-edge financial technologies and addressing regulatory frameworks, which are crucial for maintaining market stability. By exploring the discourse surrounding tokenization and its implications, we gain insights into the future trajectory of global finance.

| Key Point | Speaker | Main Argument |

|---|---|---|

| Tokenization enhances financial system efficiency. | Brian Armstrong, CEO of Coinbase | It enables real-time settlements and democratizes investment access. |

| Evolution of financial markets and securities. | Valérie Urbain, CEO of Euroclear | Tokenization can reduce issuance costs and broaden investor access. |

| Need for financial literacy alongside increased investment opportunities. | François Villeroy de Galhau, Governor of the Banque de France | Without financial literacy, tokenization may lead to negative outcomes. |

| Ultimate goal of full tokenization by 2028 seems optimistic. | Bill Winters, CEO of Standard Chartered Bank | The shift towards digital settling of assets is inevitable. |

| Government control over money supply will remain. | Brad Garlinghouse, CEO of Ripple | Ripple aims to bridge traditional and decentralized finance, not challenge sovereignty. |

Summary

Tokenization is a transformative force within the financial landscape, offering numerous benefits such as enhanced efficiency, reduced costs, and improved access to investment opportunities. The discussions among leaders at the Davos debate highlight the need for a balanced approach, incorporating regulatory frameworks and financial literacy to harness the full potential of this emerging technology. As the world continues to evolve towards digital solutions, the implications for sovereignty and regulation will remain key topics of interest within the realm of tokenization.

The Rise of Tokenization in Finance

Tokenization is rapidly emerging as a transformative force in the world of finance. At the recent Davos meeting, industry leaders discussed how leveraging digital currencies through tokenization can enhance the efficiency of financial transactions by facilitating real-time settlements. By converting tangible assets into digital tokens, the finance sector can significantly reduce transaction costs and eliminate cumbersome processes that have plagued traditional financial systems. As businesses look to optimize operations, the push toward tokenized assets is seen as a way to improve liquidity and streamline investor access.

Moreover, the impact of tokenization extends beyond mere operational efficiency. It presents an opportunity to democratize investment access, allowing a more diverse range of investors to participate in markets previously dominated by institutional players. This shift towards inclusivity can help bridge the gap between affluent individuals and those who have been traditionally excluded from investment opportunities, thus fostering a more equitable financial landscape. With the right regulatory framework, tokenization could significantly advance financial inclusion, particularly in developing economies.

Challenges of Sovereignty and Regulation in Tokenization

While tokenization holds great promise, it also raises significant challenges concerning sovereignty and regulation. As representatives from traditional banks and crypto leaders convened at the World Economic Forum, concerns were voiced about the tensions between decentralized finance (DeFi) and government control over monetary systems. Experts like Brian Armstrong highlighted that the perceived explosion of tokenization could blur the lines of sovereignty, creating a need for a cohesive regulatory framework that adapts to the decentralized nature of digital currencies.

Governments, such as those represented by François Villeroy de Galhau of the Banque de France, emphasize the importance of maintaining control over the financial systems to ensure stability. The balance between innovation and regulatory oversight is crucial; without sufficient understanding and financial literacy among the populace, the risks associated with tokenized assets may outweigh their benefits. Historical precedents remind us that unregulated financial innovations can lead to economic destabilization, making the Davos debate a critical venue for establishing guidelines that will govern the future of tokenization.

Decentralized Finance’s Role in Tokenization

Decentralized finance (DeFi) plays a pivotal role in the discussion of tokenization, as it inherently champions a financial ecosystem free from traditional banking constraints. During the Davos debate, figures like Brad Garlinghouse of Ripple articulated a vision for harmonizing DeFi with established financial mechanisms, rather than outright challenging governmental authority. This strategic approach underscores the necessity for cooperation between traditional finance and emerging technologies. The marriage of these two worlds is central to fostering a more integrated and innovative financial system.

The potential of DeFi to enhance access to a broader array of financial services cannot be overstated. By utilizing blockchain technology, tokenization can facilitate microtransactions and provide liquidity to underbanked communities globally. This represents a significant step towards financial inclusion, allowing individuals in remote regions to access credit, savings, and investment avenues typically restricted in conventional finance. However, the key lies in creating frameworks that ensure regulatory compliance while supporting innovation in these decentralized platforms.

Financial Literacy in the Era of Tokenization

As tokenization gains traction, it becomes increasingly critical to address the issue of financial literacy. François Villeroy de Galhau’s comments at the Davos debate highlight the challenges that may arise if individuals lack the knowledge to navigate a tokenized financial landscape. Without adequate understanding, investors could fall prey to risks inherent in digital currencies and tokenized assets, leading to potential financial disasters. This concern stresses the necessity for educational programs that empower investors to make informed decisions in the evolving market landscape.

Educational institutions, governments, and financial organizations must collaborate to enhance financial literacy in the age of digital currencies. This collective effort can help equip individuals with the skills needed to engage with tokenized investments confidently. As the financial ecosystem shifts towards digital assets, fostering a well-informed populace becomes crucial. Empowering investors through education can contribute significantly to the stability and longevity of tokenization efforts while promoting broader acceptance and understanding of financial technologies.

The Role of Traditional Banks in the Tokenization Movement

Despite the rapid rise of tokenization, traditional banks remain key players in this evolving landscape. Leaders like Valérie Urbain from Euroclear convey the sentiment that banks must adapt to these changes by embracing the evolution of financial markets. Rather than viewing tokenized assets as a challenge to their existence, banks have the opportunity to innovate products and services that integrate these advancements, thereby capturing new revenue streams and enhancing customer engagement.

Furthermore, the collaboration between traditional banks and tokenization advocates can lead to unprecedented efficiencies in asset management and transaction processing. Banks can leverage their experience in regulatory compliance to guide the development of safe tokenization practices, creating a framework that supports innovation while protecting investors. By doing so, they can position themselves as leaders in the tokenization movement, ensuring that they remain relevant in a rapidly changing financial ecosystem.

The Future of Digital Currencies and Tokenization

The future of digital currencies is inextricably linked to the progress of tokenization. As discussed at the Davos Forum, the transition towards an economy where the majority of assets are tokenized is not just a possibility but an inevitability. Leaders across various sectors highlighted that the potential to streamline cross-border transactions and reduce costs can revolutionize how businesses operate and engage with consumers. Digital currencies, underpinned by robust tokenization frameworks, are set to reshape the global financial architecture.

However, embracing this future requires navigating complex implementations that involve both technological advancements and regulatory considerations. Stakeholders must work together to create standards that ensure interoperability among various tokenized platforms while safeguarding user interests. The ongoing dialogue about digital currencies at critical forums like Davos will undoubtedly influence policy-making and shape the trajectory of this financial revolution.

Investing in Tokenization: Opportunities and Risks

Investing in tokenization presents a unique array of opportunities and risks, as illuminated during the discussions at Davos. The ability to access a wider market of tokenized assets can create investment diversification, but it also introduces volatility and the potential for loss. Investors must approach this dynamic realm with caution, ensuring they comprehend the underlying technologies and market behaviors associated with tokenized assets.

Engaging in a deeper analysis of the risks involved is critical as financial stakeholders adapt to this new environment. For instance, questions surrounding the security of digital wallets and the regulatory landscape must be pivotal considerations in any investment strategy. As more information becomes available and as educational resources improve, investors will be better positioned to navigate the complexities of tokenization and make informed choices aligned with their financial objectives.

Tokenization as a Catalyst for Financial Innovation

Tokenization acts as a catalyst for financial innovation by fostering new ways of conducting transactions and managing assets. By converting physical and illiquid assets into tradeable digital tokens, opportunities arise for new markets and revenue streams. The discussions at the Davos debate are indicative of how this technology can not only enhance operational efficiencies but also introduce innovative financial products that cater to diverse consumer needs.

Moreover, as industries increasingly recognize the potential of blockchain and tokenization, we can expect a surge in startups and initiatives aiming to leverage these advancements. This environment of innovation is vital for encouraging competition, driving down costs, and improving overall service quality. Consequently, tokenization encourages continuous adaptation and growth within the financial sector, making it a key component of the future economic landscape.

Global Perspectives on Tokenization and Regulation

Global perspectives on tokenization reveal a complex landscape marked by varying regulatory stances and cultural attitudes towards digital finance. During the Davos debates, it was evident that countries are navigating the balance between encouraging innovation and ensuring consumer protection. For instance, while some nations embrace tokenization as a progressive step towards modernization in finance, others approach it with skepticism, primarily focused on potential risks and the need for stringent oversight.

Engaging with international peers and embracing best practices can help create a cohesive regulatory environment that allows for safe development of tokenization. As countries share insights and learn from one another, the potential for harmonizing regulations could enhance both global cooperation and market confidence. This dialogue ensures that as tokenization continues to evolve, it does so in a manner that is consistent with international standards, promoting stability and fostering innovation.

Frequently Asked Questions

What is tokenization in the context of digital currencies?

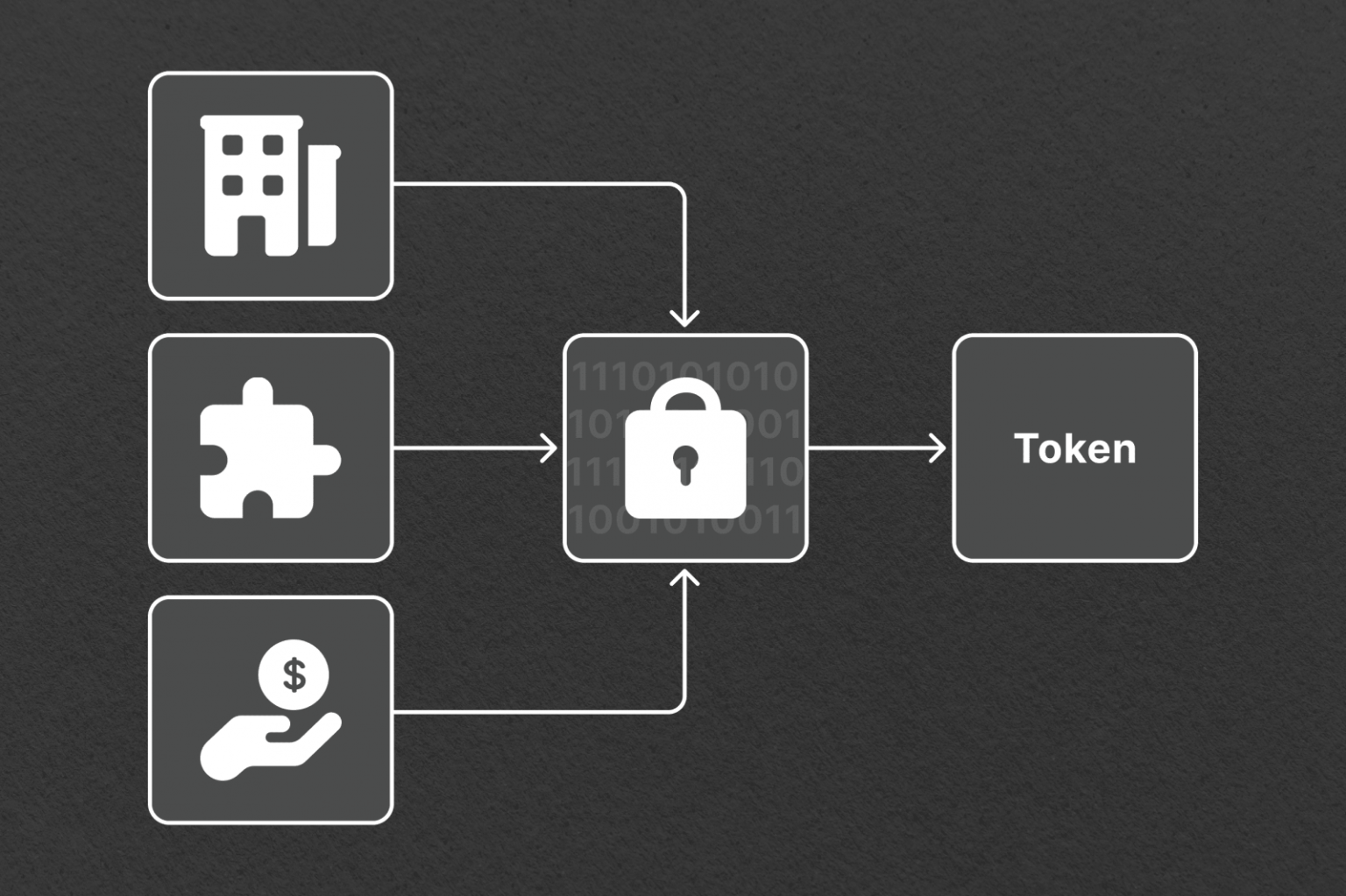

Tokenization refers to the process of converting rights or ownership of physical assets or sensitive information into digital tokens on a blockchain. In the realm of digital currencies, tokenization enables faster transactions, real-time settlements, and enhances security. This transformative technology is pivotal for advancing financial inclusion by allowing broader access to investment opportunities.

How does tokenization contribute to financial inclusion?

Tokenization plays a crucial role in financial inclusion by democratizing access to financial products. By digitizing assets and allowing them to be traded on decentralized platforms, tokenization makes it easier for underrepresented populations to invest and participate in the financial markets, thus fostering greater economic participation.

Can tokenization reshape decentralized finance (DeFi)?

Absolutely! Tokenization is a foundational element of decentralized finance (DeFi). It enables the creation of a wide variety of financial instruments that can function without traditional intermediaries, thereby increasing efficiency and access to finance. By leveraging tokenization, DeFi platforms can offer innovative solutions that appeal to diverse investor classes.

What are the regulatory challenges associated with tokenization?

While tokenization presents many advantages, it also raises significant regulatory challenges. Regulators face the task of establishing frameworks that ensure investor protection and financial stability without stifling innovation. Topics like governance, compliance, and the sovereignty of national currencies need to be addressed to enable a safe adoption of tokenized assets.

How is tokenization viewed in the Davos debate on financial technology?

During the Davos debate, tokenization was highlighted as a promising avenue within financial technology that could revolutionize financial markets. Experts discussed its potential to lower costs and streamline issuance cycles while acknowledging the need for regulatory frameworks to manage the risks associated with its widespread adoption.

What future does tokenization hold for traditional financial institutions?

The future of tokenization for traditional financial institutions appears primarily positive. Stakeholders, such as banks and financial service providers, are exploring how to integrate tokenized assets into their operations, as the trend toward digitization is anticipated to be irreversible, greatly affecting how assets are managed and settled.

How does tokenization affect the trust foundation of the financial system?

Tokenization can enhance the trust foundation of the financial system by increasing transparency and reducing fraud risk through blockchain technology. However, it also necessitates that all stakeholders, including investors and regulatory bodies, develop a comprehensive understanding of these innovations to foster a secure financial environment.

Is tokenization a realistic goal for the finance sector by 2028?

While it may seem ambitious to achieve comprehensive tokenization of the financial sector by 2028, industry leaders suggest that the trend is firmly established. Many expect a significant shift towards digital forms of asset management and settlement within the next few years, characterized by increasing collaboration between traditional finance and decentralized finance initiatives.