The BitConnect cryptocurrency scam has become synonymous with one of the most notorious financial frauds in the crypto space, where countless investors were lured by promises of guaranteed profits. Recently, the Indian Enforcement Directorate made headlines with the arrest of Nikunj Pravinbhai Bhatt and Sanjay Kotadia, two individuals implicated in this sprawling investigation that not only involves fraudulent investment schemes but also cryptocurrency extortion and a shocking kidnapping case. As the investigation unfolds, it has been revealed that a criminal gang extorted an astonishing 2,254 bitcoins and significant amounts of cash from their victims, with some of the stolen cryptocurrency being laundered through various wallet transactions. Meanwhile, authorities have frozen assets totaling around 190 million rupees to disrupt the operations linking back to this pervasive scam. With the total value of seized assets soaring to approximately 21.7 billion rupees, the BitConnect investigation continues to expose the darker side of the digital currency landscape.

The BitConnect scheme serves as a cautionary tale in the realm of digital investments, highlighting the risks associated with deceptive financial operations. This fraudulent platform, once touted for its revolutionary AI trading capabilities, has since been linked to severe legal repercussions, including kidnapping and extortion within the crypto ecosystem. As experts comb through the layers of this scheme, terms like “cryptocurrency fraud” and “investment scam” come to mind, reflecting the broader implications of trust in cryptocurrency markets. The actions of the Indian Enforcement Directorate reveal the complexities of pursuing justice in such intricate financial crimes, where assets are often hidden in the ever-evolving landscape of alternative currencies. Overall, the unraveling of BitConnect not only shakes investor confidence but also necessitates a critical examination of security and ethics in cryptocurrency trading.

| Key Points |

|---|

| Nikunj Pravinbhai Bhatt and Sanjay Kotadia arrested as alleged participants in the BitConnect cryptocurrency scam. |

| The investigation revealed the criminal gang extorted victims through kidnapping, acquiring 2,254 bitcoins, 11,000 litecoins, and 145 million rupees in cash. |

| Extorted bitcoins were converted into ETH and USDT, then transferred to multiple wallets. |

| The Indian Enforcement Directorate has frozen assets worth approximately 190 million rupees, including cryptocurrencies, stocks, and cash. |

| Total value of seized or frozen assets reached around 21.7 billion rupees to date. |

| BitConnect falsely advertised its AI trading bot, claiming it could generate a 40% return monthly to attract investors. |

| Investigations into the scandal are still ongoing. |

Summary

The BitConnect cryptocurrency scam has raised significant alarm due to recent arrests and extortion cases linked to its operations. With ongoing investigations revealing extensive criminal activities that resulted in the loss of vast amounts of money and assets, the importance of vigilance against such scams cannot be understated. Individuals are urged to educate themselves on cryptocurrency investments and be wary of schemes that promise unrealistic returns.

Understanding the BitConnect Cryptocurrency Scam

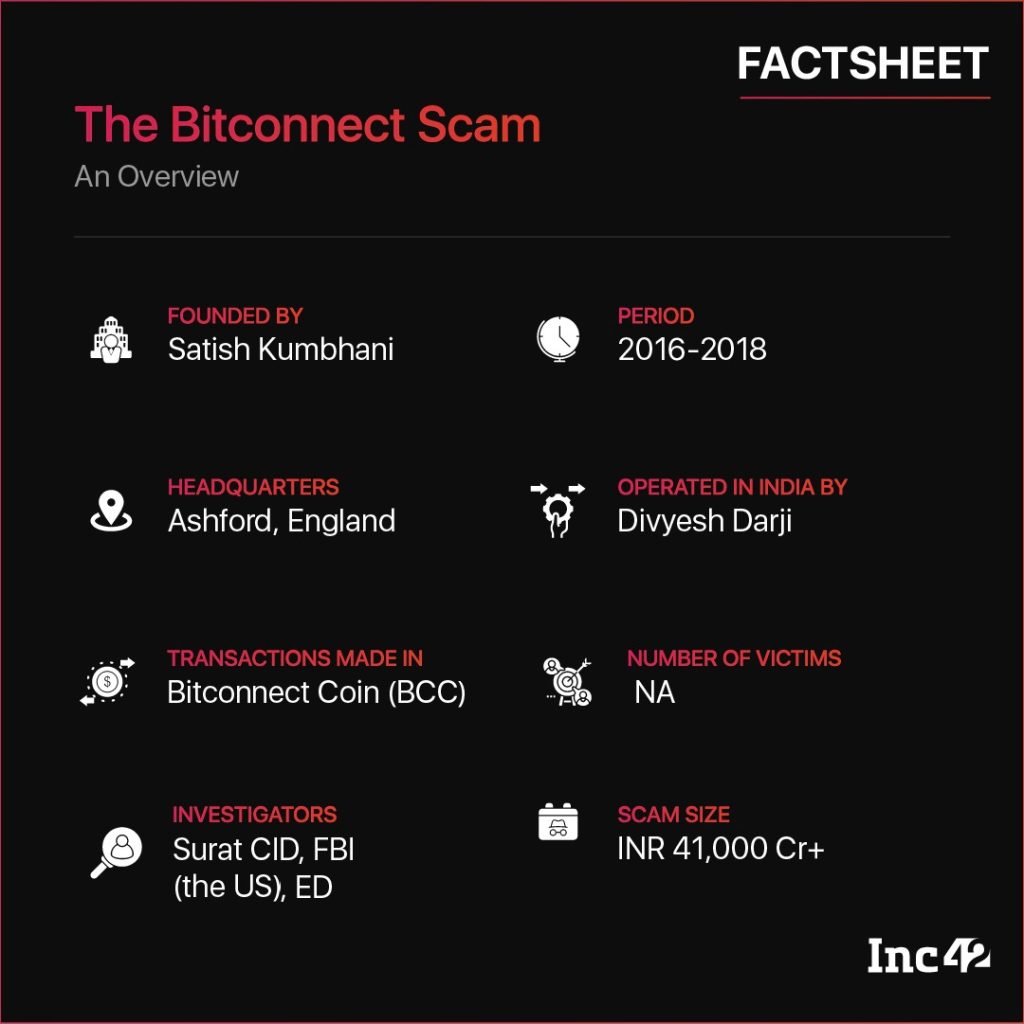

BitConnect emerged in the cryptocurrency landscape as a seemingly revolutionary project promising unrealistically high returns on investment. The scheme was primarily known for promoting its AI trading bot, which claimed to generate a 40% monthly profit for its users. However, this extravagant assertion turned out to be nothing more than a facade for one of the most notorious cryptocurrency scams of the decade. The fraudulent nature of BitConnect attracted thousands of unsuspecting investors, drawing them into a complex web of deceit and financial ruin.

As the Indian Enforcement Directorate has recently unveiled, the repercussions of the BitConnect cryptocurrency scam extend beyond mere financial loss for investors. The investigation has linked this fraudulent scheme to a series of shocking criminal activities, including extortion and kidnapping. Key figures in the scam, such as Nikunj Pravinbhai Bhatt and Sanjay Kotadia, have been arrested for their roles in these heinous acts, which saw an extensive criminal network extorting vast sums of cryptocurrency and cash from their victims.

Frequently Asked Questions

What is the BitConnect cryptocurrency scam and how did it operate?

The BitConnect cryptocurrency scam was a Ponzi scheme that falsely promised high returns on investments through its AI trading bot. It attracted unsuspecting investors with claims of generating 40% returns monthly, leading to massive losses when the scheme collapsed.

How has the Indian Enforcement Directorate acted against the BitConnect cryptocurrency scam?

The Indian Enforcement Directorate has arrested key figures like Nikunj Pravinbhai Bhatt and Sanjay Kotadia in connection with the BitConnect cryptocurrency scam. They are investigating the case, where substantial funds were reportedly extorted from victims.

What was the role of the Indian Enforcement Directorate in the BitConnect investigation?

The Indian Enforcement Directorate has taken a proactive role in the BitConnect investigation by arresting suspects, freezing assets totaling about 190 million rupees, and seizing cryptocurrency and other assets linked to the scam.

Were there any violent crimes associated with the BitConnect cryptocurrency scam?

Yes, the investigation into the BitConnect cryptocurrency scam uncovered cases of kidnapping and extortion, where a criminal gang was reported to have extorted 2,254 bitcoins and several million rupees from victims through threats and violence.

What happened to the assets involved in the BitConnect cryptocurrency scam?

Assets linked to the BitConnect cryptocurrency scam, including cryptocurrencies like bitcoin, litecoin, and approximately 190 million rupees in cash, have been frozen by the Indian Enforcement Directorate. The total value of seized assets has reached around 21.7 billion rupees.

What promises did BitConnect make that led to its downfall as a cryptocurrency scam?

BitConnect misled investors with the promise of high monthly returns, claiming its AI trading bot could generate a 40% profit. These unrealistic expectations led many to invest, ultimately resulting in significant financial loss when the scam unraveled.

Are there any ongoing investigations related to the BitConnect cryptocurrency scam?

Yes, the investigation into the BitConnect cryptocurrency scam is still ongoing, as authorities continue to unravel the network of extortion, kidnappings, and the flow of cryptocurrencies through various wallets.

What can investors learn from the BitConnect cryptocurrency scam?

Investors should be cautious of schemes promising unrealistic returns like those offered by BitConnect. It’s essential to conduct thorough research and verify the credibility of investment platforms before committing funds.