The US yield spread has reached a multi-year high, raising significant questions regarding its potential impact on various financial markets, particularly Bitcoin. As the gap between long-term and short-term US Treasury yields widens, investors are increasingly concerned about the implications this trend may have on the Bitcoin market outlook. Analysts warn that rising long-term bond yields could exert downward pressure on Bitcoin prices, especially in the context of ongoing economic challenges, including Japan’s bond sell-off. With Bitcoin price predictions becoming increasingly bearish, the relationship between the yield spread and the performance of BTC is under intense scrutiny. Understanding the dynamics of US treasury yields and their impact may provide crucial insights for investors navigating these turbulent waters.

As we delve into the widening gap between long-term and short-term bond yields in the United States, it becomes crucial to examine how this yield differential may influence alternative assets like cryptocurrency. The significant interaction between US yield curves and Bitcoin’s price trajectory invites a deeper investigation into the broader financial implications. Should the long-term yield continue to climb, the resulting pressures could reshape investor sentiment, redirecting funds away from high-risk assets like Bitcoin. This phenomenon not only underlines the importance of comprehending bond market fluctuations but also highlights how they correspond with Bitcoin’s volatility. Thus, understanding the intricacies of the yield spread is critical for those looking to grasp Bitcoin’s potential future movements in light of prevailing economic factors.

| Key Point | Explanation |

|---|---|

| US Yield Spread at Multi-Year High | The US yield spread has reached its highest level since 2021, signaling potential pressures on Bitcoin and a bearish market outlook. |

| Impact on Bitcoin Prices | A wider yield gap typically means rising long-term yields, which could lead to lower Bitcoin prices as investors shift towards yield-generating assets. |

| Japan’s Role | The long-bond selloff in Japan has driven US yields higher, intensifying the pressure on Bitcoin and equities alike. |

| Predicted Bitcoin Bottom | Analysts predict that Bitcoin prices could bottom out between $40,000 and $50,000 by the end of 2026 due to these market conditions. |

| Gold’s Effect | Increased capital flow towards gold as a safer investment during high yield periods poses additional challenges for Bitcoin. |

Summary

The US yield spread has reached alarming heights, indicating significant implications for Bitcoin’s price trajectory. As rising long-term yields intensify market pressures, Bitcoin faces a challenging road ahead, potentially leading to a decline in value as investors pivot towards traditional assets yielding returns. This trend may not only hinder Bitcoin’s growth but could also reinforce the historic cycles observed within the crypto market, marking a pivotal moment for traders and investors to consider in their strategies.

Understanding US Yield Spread and Its Implications for Bitcoin

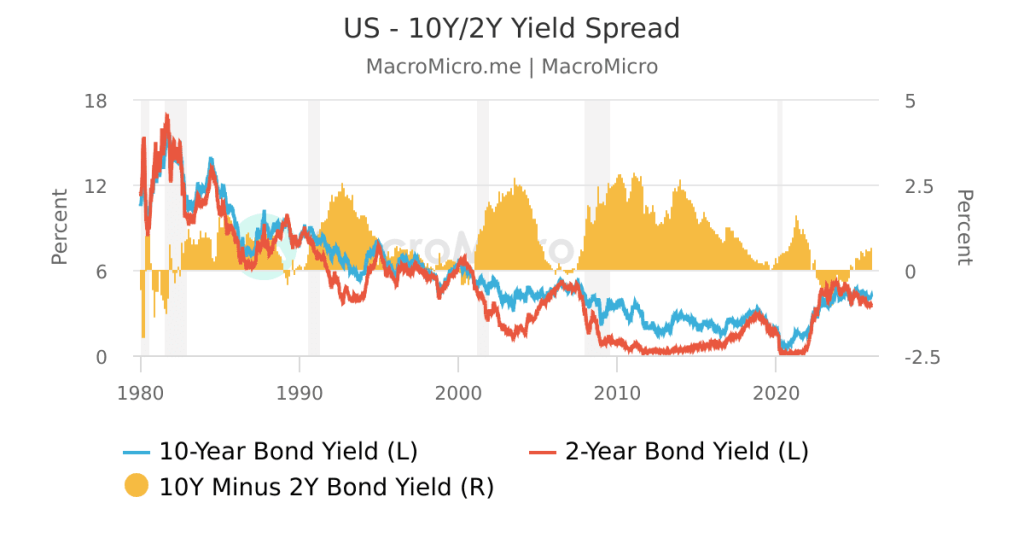

The US yield spread, representing the difference between long-term and short-term Treasury yields, is a crucial indicator of economic health and investor sentiment. Recently, the yield spread has reached levels not seen since 2021, raising alarms about the potential ramifications for Bitcoin prices. A wider spread often signals that investors expect stronger economic growth and potentially rising inflation, prompting them to seek safer, yield-generating assets. As long-term bond yields rise, the attractiveness of non-yielding assets like Bitcoin diminishes, potentially resulting in downward pressure on its price.

The growing gap between the US and Japan’s bond yields is a key driver of the current market dynamics. With Japan’s 30-year bond yield reaching a record 3.92%, the upward movement in US Treasury yields is likely to follow suit. This situation creates an environment where investors may pull capital from riskier assets such as Bitcoin in favor of government bonds, which can provide a better yield. Therefore, the widening yield spread not only reflects macroeconomic shifts but also significantly influences Bitcoin’s market outlook, which may turn bearish as equities and cryptocurrencies suffer from the pressure of rising long-term yields.

The Impact of Rising Long-Term Bond Yields on Bitcoin

Rising long-term bond yields present a complex challenge for Bitcoin as they increase the opportunity cost of holding non-yielding assets. Investors typically prefer assets that can generate returns, particularly when bond yields are climbing. As investors shift their focus towards fixed-income securities, the demand for riskier assets like Bitcoin may decrease, leading to a potential decline in price. The recent statements from financial analysts suggest that as the yields continue to rise, Bitcoin could struggle to maintain its value, especially if it approaches the $40,000-$50,000 range predicted for late 2026.

Moreover, if the trend of rising long-term yields persists, we may see an increased preference for traditional inflation hedges such as gold. Bloomberg Intelligence has pointed out that gold’s historical performance as a safe haven may lure investors away from Bitcoin, further complicating its price movements. This dynamic plays a crucial role in shaping investor psychology and market behavior, highlighting the interconnectedness of bond yields, equities, and cryptocurrency markets. As higher yields become the norm, Bitcoin’s ability to reclaim critical levels, such as $100,000, could become increasingly challenging.

Bitcoin Market Outlook Amid Changing Economic Conditions

The current economic landscape, characterized by rising long-term bond yields and a widening yield spread, signals a potentially bearish outlook for Bitcoin. Analysts like David Roberts of Nedgroup Investments warn that the strain on equity markets due to sustained yield increases may also adversely impact cryptocurrencies. As market participants recalibrate their expectations in response to higher yields, Bitcoin could be viewed as a less favorable option compared to equities and bonds that offer tangible returns. This reevaluation creates a chilling effect on Bitcoin’s price trajectory for the foreseeable future.

The influence of traditional assets on Bitcoin’s market positioning cannot be understated. As fixed-income securities become increasingly attractive due to their yields, the demand for Bitcoin could dwindle, particularly among institutional investors seeking stability amidst uncertainty. The anticipated pressure from rising US Treasury yields, alongside growing investor hesitance, suggests a challenging environment for Bitcoin’s recovery. In light of these factors, the cryptocurrency must navigate a complex web of economic signals to establish a more favorable market outlook.

Strategies for Navigating Bitcoin in a High-Yield Environment

In a high-yield environment, investors interested in Bitcoin must adopt strategic approaches to mitigate risk. One critical strategy is diversification across various asset classes, including traditional equities, bonds, and gold, allowing investors to hedge against volatility in cryptocurrency markets. By spreading investments, individuals can protect their portfolios from the adverse effects of a rising yield spread while still participating in the potential upside of Bitcoin. This approach provides a balance between risk and reward, crucial in an uncertain financial landscape.

Another important strategy involves closely monitoring economic indicators and adjusting positions accordingly. Investors should keep a keen eye on US Treasury yields and other macroeconomic signals that may impact Bitcoin prices. Understanding the broader economic context can help guide investment decisions and timing for entering or exiting positions. Staying informed about developments in both the bond and cryptocurrency markets will empower investors to make sound decisions amid changing conditions and increasing yield spreads.

The Relationship Between Bitcoin and Equity Markets

The interdependence between Bitcoin and equity markets has become more pronounced as rising yields exert pressure on both asset classes. As long-term yields increase, the correlation between Bitcoin and equities suggests that both may face headwinds simultaneously. This relationship has significant implications for investors, as a downturn in equities often spills over into the cryptocurrency space, leading to increased volatility in Bitcoin prices. Understanding this dynamic is essential for crafting effective investment strategies during periods of economic uncertainty.

Furthermore, analysts have noted that when equities struggle due to rising yields, investors may feel compelled to shift their focus towards more stable assets. This migration can further challenge Bitcoin’s market position, as many investors may prefer to hold equities or bonds that are generating returns. Consequently, the overall health of the equity markets is likely to influence Bitcoin’s performance, underscoring the interconnected nature of these financial instruments amid shifting economic landscapes.

Impact of Economic Deficits on Bitcoin Prices

Economic deficits play a crucial role in shaping the outlook for Bitcoin and other risk assets. As governments grapple with rising debt levels, particularly those in economies like Japan, the subsequent policy responses can lead to significant volatility in financial markets. Investors often react to fiscal policies and deficits by adjusting their portfolios, which can affect Bitcoin demand. If deficits lead to rising long-term yields, as is currently seen, this could suppress Bitcoin prices, creating a challenging environment for the cryptocurrency.

Moreover, the perception of economic stability greatly influences investor confidence in assets like Bitcoin. High deficits can spark fears of inflation or economic downturns, prompting investors to seek refuge in other assets. Bitcoin’s status as a non-yielding asset makes it particularly vulnerable in such scenarios. As markets navigate these turbulent economic conditions, understanding the impact of economic deficits on Bitcoin can provide critical insights for investors seeking to capitalize on price movements.

Bitcoin Price Predictions Based on Current Yield Trends

As the yield spread hovers at a multi-year high, Bitcoin price predictions have become increasingly cautious. Analysts project that if current trends persist, Bitcoin may face significant resistance in breaking through key psychological levels. The anticipated decline to a range between $40,000 and $50,000 by the end of 2026 aligns with broader market assessments that account for rising long-term yields. The confluence of these factors suggests that bullish breakthroughs could remain elusive in the near future, necessitating a re-evaluation of strategies for potential investors.

Furthermore, market participants must remain vigilant as external factors, such as global economic developments and policy changes, can steer Bitcoin prices further. If the yield spread continues to widen, the expected impact on Bitcoin’s market appeal may lead to more conservative investment approaches that prioritize risk management over aggressive growth strategies. Understanding these price predictions in conjunction with yield trends provides a comprehensive perspective for investors looking to navigate the complexities of the cryptocurrency market amidst a changing economic reality.

Global Influence of US Treasury Yields on Bitcoin

US Treasury yields significantly influence global financial markets, including Bitcoin. As US long-term yields rise, they not only affect domestic investors but also resonate across international markets. Other countries, particularly those with close economic ties to the US, often mirror these movements, creating a ripple effect that can impact Bitcoin pricing. Investors tracking US yields must also consider how global economic dynamics play into the cryptocurrency landscape, especially during periods of heightened volatility.

The interconnectedness of global markets means that shifts in US Treasury yields can also influence investor sentiment and behavior globally. Higher yields can lead to a flight to safety, with investors favoring bonds over cryptocurrencies like Bitcoin. This trend may hinder Bitcoin’s potential to attract foreign investment, further complicating its market outlook. In such scenarios, understanding the broader implications of US Treasury yields becomes vital for Bitcoin investors hoping to gauge market dynamics and make informed decisions.

Investment Considerations Amidst Rising Yields

Investors looking to navigate Bitcoin’s turbulent waters amidst rising yields should consider several factors. First, assessing one’s risk tolerance is crucial. Those who are risk-averse may want to adopt a more conservative approach, potentially decreasing their exposure to Bitcoin in favor of yield-generating assets. Secondly, diversifying the portfolio can help mitigate risks associated with rapid shifts in the cryptocurrency market, allowing investors to balance their holdings effectively.

Additionally, remaining informed about economic trends and yield movements is essential for strategic investment decisions. Keeping abreast of regulatory developments, market sentiment, and macroeconomic indicators that impact yields will provide investors with a competitive edge in predicting Bitcoin price movements. By employing these considerations, individuals can better position themselves in the face of uncertainty and make sound judgments regarding their investments in Bitcoin.

Frequently Asked Questions

What is the current status of the US yield spread and its potential impact on Bitcoin?

The US yield spread is currently at its highest level since 2021, indicating that long-term yields are rising. This widening gap can significantly impact Bitcoin prices, as higher yields generally pressure non-yielding assets like Bitcoin. Investors may shift towards safer assets with yields, which can lead to a bearish outlook for Bitcoin.

How does the rise in US treasury yields affect Bitcoin price predictions?

As US treasury yields increase, particularly among long-term bonds, it creates a higher opportunity cost for holding Bitcoin, which does not yield interest. This dynamic can lead to lower Bitcoin price predictions, as higher yields may deter investment in riskier assets like Bitcoin.

What is the relationship between the US yield spread and Bitcoin’s market outlook?

The relationship between the US yield spread and Bitcoin’s market outlook is intricate. A wider yield spread often signals higher long-term Treasury yields, which could lead to a bearish outlook for Bitcoin as investors prefer safer, interest-bearing assets over volatile cryptocurrencies.

Could the impact of the yield spread on Bitcoin lead to a market downturn?

Yes, the impact of the yield spread on Bitcoin could potentially lead to a market downturn. Higher yields can decrease appetite for high-beta assets like Bitcoin, resulting in downward pressure on Bitcoin prices as market participants seek the safety of fixed-income investments.

What factors are contributing to the current US yield spread and how does this affect Bitcoin?

Current factors contributing to the US yield spread include economic deficits and rising long-term yields, particularly influenced by Japan’s bond market. As long-term yields rise, they can negatively affect Bitcoin prices, leading to a pessimistic market outlook for the cryptocurrency.

Why is a widening US yield spread significant for investors in Bitcoin?

A widening US yield spread is significant because it often implies higher long-term borrowing costs and reduced returns on riskier assets like Bitcoin. Investors may be cautious as they reevaluate their positions in Bitcoin amid rising yields, potentially leading to lower demand and price drops.

What economic conditions might cause the US yield spread to widen further and how could this impact Bitcoin?

Economic conditions such as increased government spending, inflation concerns, and market reactions to central bank policies could cause the US yield spread to widen further. This would likely exert more pressure on Bitcoin, resulting in price declines as investors favor assets that provide yield.

How do changes in the US yield spread correlate with Bitcoin’s price volatility?

Changes in the US yield spread often correlate with Bitcoin’s price volatility; as yields rise, Bitcoin tends to be more volatile due to its status as a high-beta asset. Investors may react quickly to interest rate changes, leading to significant price swings in Bitcoin.