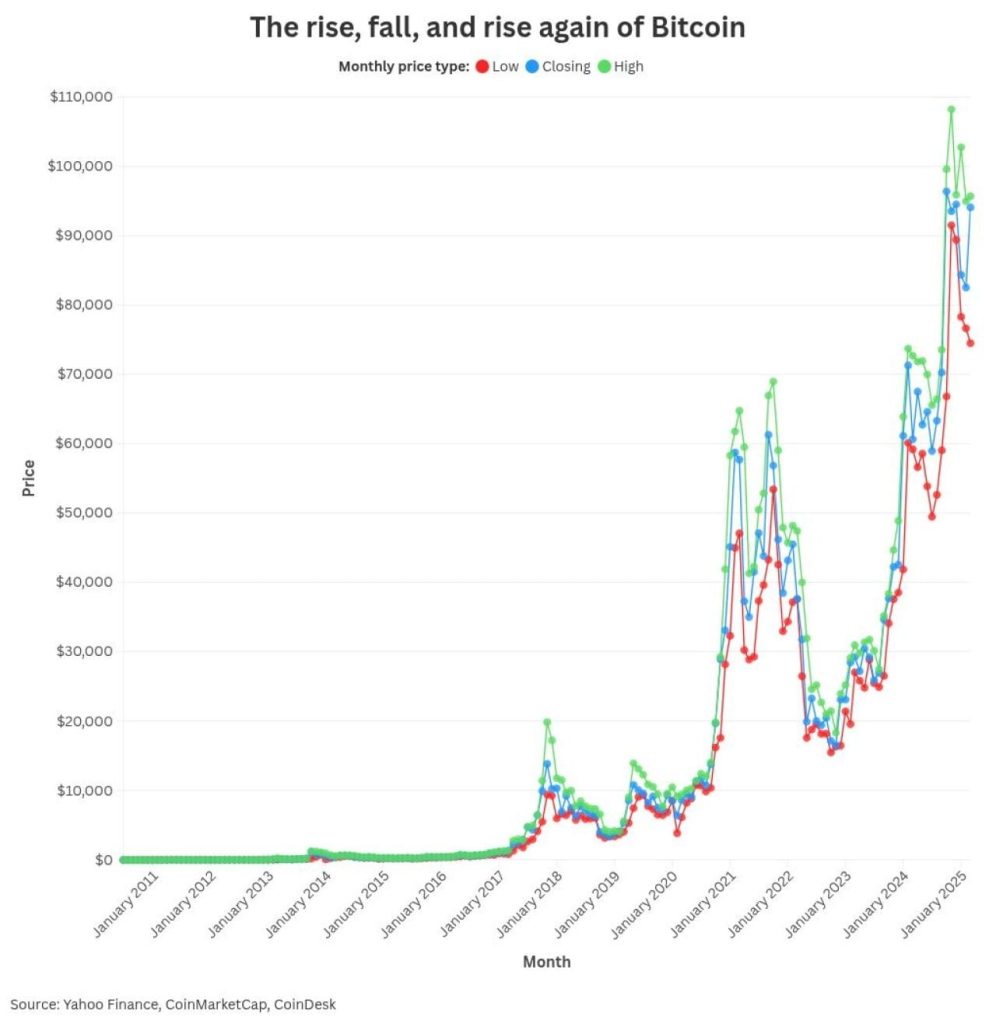

As Bitcoin price levels fluctuate, market analysts are closely monitoring crucial support zones that may dictate BTC’s future trajectory. Recently, the digital currency has demonstrated bearish signals, particularly as it dipped below $90,000, igniting discussions about the current Bitcoin price and potential downtrends. Understanding Bitcoin support levels such as the critical thresholds around $84,000 and $80,000 is fundamental for investors navigating this bear market Bitcoin analysis. Market trends indicate a shift; as profit cycles turn negative, the BTC price forecast raises concerns about further devaluation. Keeping an eye on these pivotal price levels will be essential for anyone looking to make informed decisions in this evolving cryptocurrency landscape.

In the realm of cryptocurrency trading, the significance of Bitcoin’s pricing benchmarks cannot be overstated. With the recent downturn in the market, investors are advised to pay particular attention to these valuation points as they represent critical areas where buyer interest may arise. As Bitcoin enters a phase of contraction, discussions around metrics like the prevailing Bitcoin value and support boundaries become increasingly relevant. Analysts are utilizing various tools to assess the market’s direction, while bearish trends prompt deeper examinations of BTC’s pricing forecasts and historical performance. Understanding these factors will equip traders with the knowledge needed to navigate the shifting tides of the Bitcoin market.

| Key Point | Details |

|---|---|

| Current Market Status | Bitcoin is in an early bear phase, with a significant support level at $84K. |

| Profitability Metrics | On-chain profitability metrics have turned negative, indicating a shift from profits to losses. |

| Support Levels to Watch | Key support levels: $90,000 (75th percentile) and $84,000 (buyer congestion zone). |

| Market Trends | Historical data suggests that similar conditions preceded previous bear markets. |

| Future Predictions | Analysts predict potential BTC price drops to as low as $58,000 in the near term. |

Summary

Bitcoin price levels are crucial to monitor as the digital asset enters a bear market phase. With the price recently falling below the $90,000 mark and key support identified around $84,000, traders and investors need to be vigilant. The transition from profitability to loss among Bitcoin holders signals a shift in market sentiment, potentially leading to further declines. Understanding these Bitcoin price levels will be essential for navigating the upcoming market landscape.

Understanding Bitcoin’s Current Market Dynamics

As Bitcoin enters its early bear phase, observers are keenly analyzing the market dynamics that have influenced its price. With the recent drop below the $90,000 threshold, Bitcoin’s market sentiment has shifted significantly, prompting traders to reassess their strategies. Technical indicators are suggesting that investor behavior is becoming increasingly cautious. As the current Bitcoin price moves further from its recent highs, crucial support levels are being closely monitored by market participants looking for signals of potential recovery or further declines.

The deterioration in Bitcoin’s profitability cycle, as indicated by recent on-chain metrics, is a troubling sign for those who are bullish on the asset. The calculated shift from profit realization to losses highlights investor apprehension as the overall market sentiment teeters on the brink of a significant downturn. Analysts have pointed out that these kinds of shifts in investor behavior typically precede deeper corrections in the market, which complicates predictions for upcoming Bitcoin price levels.

Bitcoin Price Forecast: Key Support Levels to Monitor

As the Bitcoin market continues to experience volatility, the focus has shifted to key price levels that may serve as potential support during this downturn. Analysts have identified the support zone between $80,000 and $84,000 as critical areas for Bitcoin. This range has witnessed significant buyer congestion, indicating it might hold up against potential further declines. If the current Bitcoin price breaks through this zone, it could trigger panic selling among investors, leading to a cascade of selling pressure that could further exacerbate the downturn.

Investors should closely watch the vicinity around the $84,000 level, as its ability to act as a firm support may dictate Bitcoin’s trajectory in the coming months. Historical data shows that this area has been a battleground for bullish and bearish traders alike, meaning that its breach could mark a substantial shift in market sentiment. If Bitcoin manages to hold above this key support, it could provide a foundation for a potential recovery, contradicting current bear market analysis.

Analyzing Bitcoin’s Bear Market Signals

The transition from a bull market to a bear market is marked by various signals that traders and investors look to identify. Recent indications, such as the bearish cross on the MACD indicator highlighted by analysts, suggest that Bitcoin might be heading into a prolonged downturn. This historical pattern of price movements indicates that significant bear phases have followed similar bearish sentiment in the past, leading analysts to cautiously approach future BTC price forecasts.

As Bitcoin’s price levels dip and the market appears to be under pressure, traders are advised to remain vigilant and informed about the broader market conditions that could influence price fluctuations. The implications of a bear market can be far-reaching, affecting not just Bitcoin, but also the entire cryptocurrency landscape. Recognizing early indicators of market trends can empower investors to make timely decisions that mitigate risks inherent in a bearish environment.

Current Bitcoin Price and Its Implications

The current Bitcoin price serves as a key focal point for both traders and long-term investors. Having recently dipped below the $90,000 mark, the implications have raised questions about market stability moving forward. The sentiment is particularly palpable among those who entered the market during earlier bullish phases, as many now confront the reality of unrealized losses amidst a declining trend.

With Bitcoin’s price hovering around these crucial support levels, the next few trading sessions may determine the future of BTC in 2023. Analysts suggest that a defined recovery above the key support levels could reinvigorate the bullish sentiment, while a dip below these thresholds may lead to an extended period of price consolidation or further declines, making it essential for investors to remain informed about market trends.

Bear Market Bitcoin Analysis: Trends and Predictions

In the wake of the recent drop in Bitcoin’s price, a comprehensive bear market analysis has emerged highlighting potential trends that could shape the future trajectory of BTC. Key indicators suggest that sustained bearish sentiments may linger into 2026, with some forecasts suggesting Bitcoin could potentially test levels as low as $58,000. This possibility stems from ongoing selling pressure observed in the market and the critical role played by institutional investors in recent price movements.

The ability of Bitcoin to navigate these turbulent waters may heavily depend on broader market conditions and external economic factors. Historical data points to the cyclical nature of Bitcoin markets, where previous bear phases were succeeded by robust recoveries. Therefore, while current analysis suggests a bearish outlook for Bitcoin, the future remains unpredictable, and strategic responses may necessitate a reevaluation of market strategies.

Role of Buyer Congestion in Bitcoin’s Price Stability

Buyer congestion plays a crucial role in determining the stability of Bitcoin’s price during tumultuous market conditions. The significant accumulation seen between $80,000 and $84,000 demonstrates the interest from buyers reluctant to see Bitcoin fall further from these levels. These price band discussions are more than just numbers; they represent actual buying decisions made by market participants that could bolster Bitcoin’s defensive sentiment.

As the market grapples with bearish pressures, it’s critical for investors to understand the dynamics of how buyer congestion influences price movements. Support levels are often tested in volatile markets, and this current period is no exception. A robust defense around these levels may indicate that sellers are losing momentum, potentially paving the way for the buyers to regain confidence and stabilize Bitcoin’s price structure.

The Impact of On-Chain Profit/Dynamic Metrics on Bitcoin

The recent downturn in Bitcoin’s profitability cycle, particularly the shift into negative territory, underscores the importance of on-chain dynamics in assessing market health. Metrics such as net realized profit/loss provide insight into how investors are reacting to price movements. A declining profit margin signals that holders may be opting to lock in losses, indicating a shift in sentiment that may reinforce bearish conditions.

Understanding these on-chain metrics allows market participants to grasp the underlying forces at play. With Bitcoin’s profitability declining sharply, investors are left to ponder if current trends are symptomatic of a broader market malaise or merely a temporary reaction to external pressures. Monitoring these metrics closely can equip investors with the insights needed to navigate the bear market effectively.

Future Outlook: Can Bitcoin Rebound?

As Bitcoin navigates through this early bear phase, many investors are left wondering about its potential to rebound in the near future. The resilience displayed during past market corrections offers hope; however, the current sentiment suggests a more cautious approach as analysts predict extended periods of price consolidation or further declines. The support levels around $80,000 and $84,000 will be pivotal in assessing whether Bitcoin possesses the strength to stage a recovery.

Various forecasts predict that if Bitcoin can stabilize above its key support levels, it might trigger a resurgence in investor confidence, laying the groundwork for a potential upward trajectory. However, fluctuating market conditions and external economic factors could prolong this bear market, leaving many to continuously adapt their strategies based on Bitcoin’s evolving dynamics.

Navigating the Bitcoin Market Trends as BTC Prices Fluctuate

In times of market uncertainty, understanding Bitcoin market trends is essential for making informed investment decisions. The current backdrop of declining prices has prompted many to closely observe Bitcoin’s behavior in relation to bearish patterns that may emerge. As trends shift, early recognition of notable market changes can empower investors to take proactive measures to safeguard their portfolios.

Emerging trends show that market volatility can create unique opportunities for those equipped with the right knowledge. By employing analysis techniques that focus on support levels and historical price movements, investors may navigate these fluctuations strategically. Despite the current bearish outlook, keen observation of the market can reveal potential avenues for profit, allowing for resilience in the face of uncertainty.

Frequently Asked Questions

What are the key Bitcoin price levels to watch during the bear market?

As Bitcoin enters a bear market, the key price levels to watch include the critical support zones around $84,000 and $80,000. The congestion zone between $80,000 and $84,000 remains significant, as it represents a strong buyer interest that could prevent further declines. If Bitcoin loses these support levels, a deeper downward trend may occur.

How does the current Bitcoin price compare to historical support levels?

The current Bitcoin price has dropped below $90,000, which was previously a significant psychological barrier. Historical support levels of $84,000 and $80,000 are now being closely monitored, as they could dictate whether BTC continues its downtrend or finds stability. Traders should keep an eye on these levels to gauge market sentiment.

What implications does the bear market have for Bitcoin support levels?

In a bear market, Bitcoin support levels become increasingly important indicators of future price performance. The recent transition into negative profit cycles suggests that if Bitcoin fails to hold the $84,000 support, it may test lower levels, potentially revisiting the $80,000 mark, which could prompt further selling pressure.

What does the Bitcoin price forecast look like for the upcoming months?

Experts suggest that if the current downward trend persists, Bitcoin could potentially fall to around $58,000 by 2026. This forecast is based on observed market patterns during previous bear markets and the current market dynamics, including support levels that are being challenged.

How do Bitcoin market trends affect trading strategies?

Understanding Bitcoin market trends is vital for traders, especially during bear markets. Monitoring key support levels such as $84,000 and $80,000 helps traders determine entry and exit points. A weak derivatives market and losses from long-term holders could signal a need for adjustment in trading strategies to manage risk effectively.