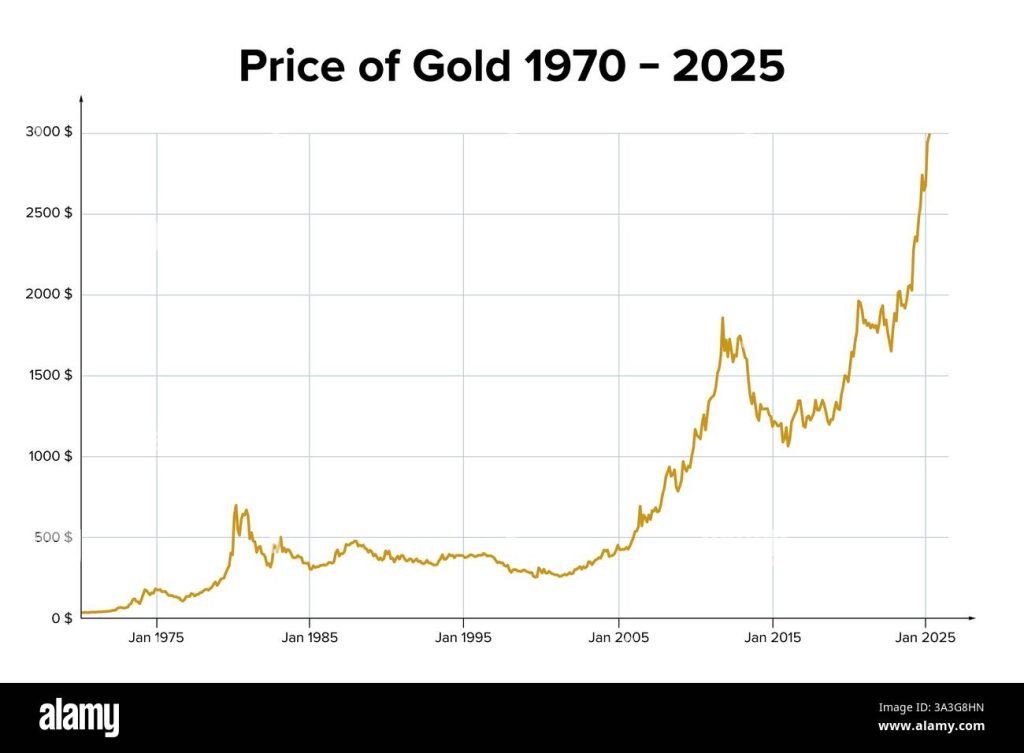

Gold prices have been on an extraordinary upward trajectory, recently hitting an all-time high of $4,967 per ounce. This surge has ignited interest among investors keen to understand the gold market trends that are fueling this rise in gold prices. Market analysts suggest that this remarkable climb is largely driven by non-speculative funds, hinting at a more stable investment climate in the precious metal. The diminishing number of bullish gold positions implies that current investors are likely more focused on long-term gains rather than short-term speculation. As the dollar weakens and economic uncertainties loom, the allure of investing in gold continues to beckon savvy individuals looking to secure their wealth in these volatile times.

The recent escalation in the value of gold has captivated both seasoned investors and newcomers alike. With the precious metal reaching unprecedented heights, discussions around market dynamics and capital flows have gained heightened relevance. Terms like bullish sentiment and strategic asset allocation are now essential in evaluating how investors are reacting to fluctuations in the gold market. As traditional buyers pivot towards greater stability, an understanding of these shifts—involving non-speculative investments and inherent market psychology—becomes crucial. The interplay of various economic factors increasingly positions gold as a go-to asset for those seeking refuge amid fluctuating financial landscapes.

| Key Point | Details |

|---|---|

| Analyst Commentary | Jeremy Boulton noted the continued rise of gold prices, which reached a historic high. |

| Current Gold Price | Gold prices peaked at $4,967 per ounce recently. |

| Bullish Positions | Bullish positions dwindled from over 300,000 contracts to around 200,000 contracts. |

| Price Increase Since January 2025 | Gold prices have risen by over $2,000 per ounce since January 2025. |

| Market Dynamics | Current buyers are not speculating, suggesting more stable positions. |

| Impact of Dollar Value | The value of the dollar has weakened as gold prices increased, hinting at changes in foreign exchange reserves. |

Summary

Gold prices have shown significant potential for further increases according to recent analyses. As the market is primarily driven by non-speculative funds, and with current conditions indicating stable positions rather than speculative investments, it is possible for gold prices to continue their upward trend. Analysts suggest that both the decline in bullish contracts and the weakening dollar contribute to a unique market environment conducive to higher gold prices.

Understanding the Current Gold Market Trends

As the gold market continues to evolve, analysts have noted a significant shift in the dynamics driving prices. The ascent to historic peaks, like the recent $4,967 per ounce, is indicative of changing market conditions and investor behavior. Many financial analysts are attributing this rise predominantly to non-speculative funds entering the market, which contrasts sharply with the speculative buying often seen in the past. It appears that many investors are treating gold not just as a commodity for quick gains, but rather as a secure investment option and a hedge against economic uncertainties.

This shift towards stability in gold investments is also reflected in current data concerning bullish positions. Although previously, speculative positions soared with over 300,000 contracts, current figures show a decline to about 200,000 in bullish contracts. This decline suggests a cautious approach among investors, focusing on long-term value rather than quick returns. As the global economic landscape shifts, the foundational dynamics of the gold market are adjusting to the realities of investor confidence and market stability.

Frequently Asked Questions

What are the current trends in the gold market affecting gold prices?

Current trends in the gold market indicate a bullish sentiment, with recent surges in gold prices reaching historic peaks. Analysts note that this upward movement is largely driven by non-speculative funds rather than speculative investors, contributing to a more stable demand for gold.

How do non-speculative funds influence the rise in gold prices?

Non-speculative funds have significantly impacted the rise in gold prices as they represent long-term investment strategies, contrasting with speculative trading. This type of investment assures a steadier demand, which can help maintain higher gold prices over time.

What factors are contributing to the recent rise in gold prices?

The recent rise in gold prices can be attributed to a combination of factors including a weakened dollar, shifting foreign exchange reserve compositions by countries, and persistent global economic uncertainties that drive investors towards gold as a safe haven asset.

Are bullish gold positions an indicator of future gold price trends?

Yes, bullish gold positions can serve as an indicator of future gold price trends. However, current data shows that while bullish positions previously exceeded 300,000 contracts, they have now decreased to around 200,000, suggesting potential constraints on further price increases.

What should investors consider when investing in gold based on recent price movements?

Investors should consider the stability provided by non-speculative funds in the gold market, as recent price movements suggest that these positions offer a more reliable approach compared to short-term speculative trades. Understanding market conditions and global economic indicators is crucial when investing in gold.

Why might the demand for gold prices be stable despite economic fluctuations?

The stability in demand for gold prices, despite economic fluctuations, can be attributed to increasing reliance on gold as a safe haven asset. Investors are drawn to gold during times of economic uncertainty, contributing to a consistent demand that underpins gold prices.