Bitcoin liquidity is a critical factor influencing the cryptocurrency market, especially as it reacts to major fund movements and trading patterns. Recently, the dynamics of Bitcoin liquidity have been shaken, resulting in significant price impacts due to low trading volume and a thin order book. As large investors like BlackRock’s iShares Bitcoin Trust face net outflows, the flow of capital in and out of the Bitcoin market has become a key indicator of market trends. ETF Bitcoin flows have taken a dramatic turn, highlighting the interplay between liquidity and Bitcoin price resilience. Understanding these trends is essential for navigating current market conditions and predicting future movements in the cryptocurrency landscape.

The concept of liquidity in Bitcoin trading encompasses how easily assets can be bought or sold without causing drastic price fluctuations. In recent weeks, the liquidity of Bitcoin has faced unprecedented challenges, primarily driven by fluctuations in ETF investments and large-scale withdrawals. As a result, what once was a dynamic trading environment now displays signs of volatility, reflecting a broader trend in cryptocurrency liquidity that is being closely watched by market analysts. Investors are increasingly focused on trading volumes and their relationship to Bitcoin price changes, making it crucial to stay informed about ETF Bitcoin movements and the overall market health. These liquidity patterns reveal intricate links between macroeconomic factors and the performance of digital currencies.

| Key Point | Details |

|---|---|

| Bitcoin liquidity emergence | Liquidity issues arise as major funds reduce holdings, leading to a thinner order book. |

| Significant outflows | U.S. spot Bitcoin ETFs experienced net outflows totaling $1.58 billion in a week. |

| Market sensitivity | A thin liquidity environment means that each sell order considerably impacts prices. |

| Influence of large funds | Major players like BlackRock and Fidelity are leading redemption trends. |

| Negative feedback loop | Reduced liquidity can lead to sharp price decreases due to selling pressure outpacing demand. |

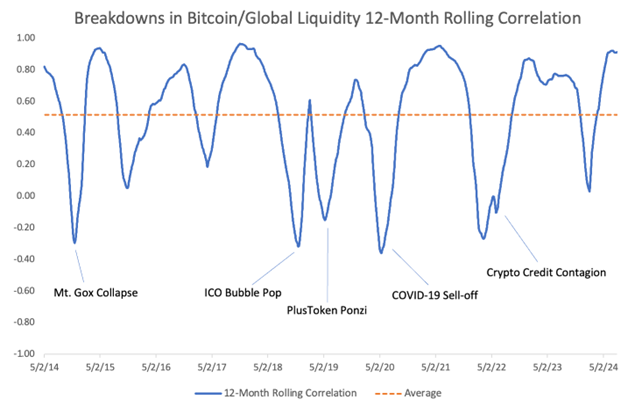

| Correlation with macro factors | Banking rate changes and geopolitical tensions impact Bitcoin’s performance. |

| Impact of derivatives | Call options influence the price direction, especially during negative ETF flows. |

| Future outlook | Persistence of outflows and price reactions will determine Bitcoin’s resilience. |

Summary

Bitcoin liquidity has become a pressing concern as major funds have dramatically reduced their holdings, leading to significant outflows and affecting market dynamics. With the thinning order book, even minimal selling pressure can lead to pronounced price drops, creating a negative feedback loop for the market. Investors must watch for patterns in ETF flows and price movements to gauge stability in Bitcoin liquidity, especially influenced by macroeconomic factors.

Understanding Bitcoin Liquidity and Its Impact on Market Stability

Bitcoin liquidity plays a crucial role in maintaining market stability. Recently, Bitcoin liquidity has evaporated, significantly impacting the cryptocurrency landscape. When liquidity decreases, every dollar of selling leads to substantial price fluctuations, making the cryptocurrency market more volatile. This phenomenon is especially pronounced when large institutional frameworks, like exchange-traded funds (ETFs), experience significant outflows. The connection between Bitcoin liquidity and market fluctuations emphasizes the importance of a deep order book, allowing for smoother trades without large price swings.

As we’ve seen with recent trends where U.S. spot Bitcoin ETFs faced net outflows of $1.58 billion in just a few days, the thin order books exacerbate the situation. Large institutional investors are more capable of driving prices down with minimal selling volume due to decreased liquidity. This highlights not only the immediate effects on Bitcoin’s price but also broader implications for overall cryptocurrency liquidity. If institutional demand continues to wane and Bitcoin trading volume shrinks, investors may find the market increasingly unstable, shifting attention from speculative gains to risk management.

The Role of ETF Bitcoin Flows in Market Dynamics

ETF Bitcoin flows are pivotal in shaping market dynamics, particularly in terms of how they correlate with Bitcoin’s price impact. Recently, the flows witnessed a sharp reversal from inflows to significant outflows, marking a troubling trend for market participants. The behavior of funds like BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund provides an insightful look into real-money demand and investor sentiment, showcasing a broader trend of pulling back from Bitcoin exposure. This trend has cascading effects on Bitcoin liquidity, making the already thin order book even more fragmented.

In times of outflows, even the slightest selling pressure can have outsized impacts on Bitcoin prices and, consequently, on the varied cryptocurrency markets dependent on Bitcoin’s performance. While inflows historically help establish a base demand that supports Bitcoin’s price levels, consistent outflows can lead to a downward spiral. Monitoring these ETF flows is crucial, as they not only reflect current investor attitudes but also influence future positioning and Bitcoin liquidity in the broader market.

Analyzing Bitcoin Market Trends Amid Decreased Liquidity

Bitcoin market trends are intricately tied to liquidity levels, with decreased liquidity creating a ripple effect in price dynamics. In recent weeks, fluctuations in Bitcoin’s price have correlated closely with the liquidity available in the market, as the recent report indicated an order-book depth approximately 30% below 2025 highs. Such low liquidity levels mean that even small sell orders can disproportionally affect Bitcoin prices, making the market particularly volatile. With macroeconomic factors at play, these trends highlight the challenges Bitcoin faces in stabilizing its value amidst shifting sentiments.

Moreover, with institutional investors increasingly dominating Bitcoin trading volume, their decisions—often influenced by broader market conditions—can greatly shift market dynamics. The latest trends indicate that Bitcoin liquidity not only affects immediate price levels but also forecasts future market conditions. As liquidity tightens, the potential for price recovery diminishes, leading to caution among traders and investors alike. Understanding these trends becomes essential for anyone looking to navigate the current state of the Bitcoin market.

The Interplay Between Bitcoin Price Impact and Trading Volume

The relationship between Bitcoin’s price impact and trading volume is fundamental to understanding market trends. High trading volume typically indicates increased interest and participation, which can support higher prices. Conversely, when trading volume wanes, especially during periods of outflow from institutional investments, Bitcoin’s price becomes more susceptible to declines. The recent net outflows from major Bitcoin ETFs underscore this connection, suggesting that the lack of robust trading volume could hinder Bitcoin’s ability to maintain its price levels amidst volatility.

What is particularly concerning is how these patterns continue to evolve. If the current trading volume trend persists with continued redemptions, we could witness not only significant declines but also extended recovery times, putting further strain on Bitcoin liquidity. Thus, tracking this interplay between trading volume and price movements is crucial for investors looking to anticipate market shifts and manage their portfolios effectively.

Implications of Reduced Cryptocurrency Liquidity on Investor Strategy

Reduced cryptocurrency liquidity is a wake-up call for investors, signaling a need to reassess strategies in the face of growing volatility. Fewer market participants and lower trading volumes mean that investors might see sharper price swings in response to selling pressure. For those holding Bitcoin or related assets, this environment necessitates a more calculated approach, whether through hedging or diversifying asset allocations. Active monitoring of both macroeconomic indicators and market liquidity will become essential as the landscape shifts.

Moreover, understanding the confluence between Bitcoin liquidity and other market factors is vital in forming a robust investment strategy. The ability to navigate this environment will separate seasoned investors from those who react impulsively to market developments. This underscores the necessity for clear strategies, including regular assessments of market sentiment, liquidity conditions, and potential price impacts linked to trading volumes.

Navigating Risk Amidst Negative Market Sentiments

In the current market environment, characterized by negative sentiments and reduced liquidity, navigating risk has never been more important. Investors are urged to remain vigilant as market conditions shift rapidly. With established patterns of outflows and an uptick in selling pressure, it becomes essential to monitor Bitcoin liquidity levels closely. This vigilance enables investors to preempt risk and respond effectively to potential downturns.

Moreover, understanding the psychological aspects behind market movements can empower investors to foresee significant price drops linked to liquidity issues. By combining technical analysis with a solid grasp of market sentiment, investors can better equip themselves to manage risks and even identify potential bargain opportunities amidst a descending market trend.

The Future of Bitcoin: Recovery Paths and Their Challenges

Forecasting the future of Bitcoin necessitates an understanding of recovery paths and the challenges they may face. Currently, as the market contends with liquidity issues and heightened volatility, any path to recovery is contingent upon restoring confidence among institutional investors who heavily influence Bitcoin’s trading volume. Addressing liquidity concerns through increased participation will be crucial for a sustainable upward trajectory in Bitcoin prices.

Furthermore, the interrelationship between macroeconomic factors and Bitcoin’s performance suggests that recovery will not only depend on internal crypto-market developments but also on broader economic conditions. As long as the environment remains unpredictable, Bitcoin’s recovery will continue to face challenges, making it essential for investors to adopt flexible strategies in order to adapt to an evolving market landscape.

Assessing Market Depth and Its Influence on Bitcoin Trends

Market depth is a critical component that significantly influences Bitcoin trends and price behavior. The recent report indicating that market depth has diminished dramatically underlines the inherent volatility stemming from reduced liquidity. Investors should understand that when market depth is shallow, every transaction can lead to exaggerated price movements, making it critical to assess how deep orders of Bitcoin trading volumes can mitigate or exacerbate these fluctuations.

As Bitcoin trends evolve, market depth will remain a crucial factor in assessing future price stability. Investors should prioritize data analytics that focus on depth metrics, enabling them to gauge potential price impacts better and adjust their strategies accordingly. By remaining keenly aware of market depth, traders can find opportunities while also strategically navigating the downsides of lower liquidity.

The Effect of Macroeconomic Factors on Bitcoin Liquidity and Price

Macroeconomic factors hold substantial sway over Bitcoin liquidity and price trajectories. Recent geopolitical events and financial market fluctuations have not only pressured Bitcoin’s trading environment but have also heightened overall investor caution. Rising yields in U.S. Treasuries, coupled with tariff-related uncertainties, cast a shadow over high-beta assets like Bitcoin, prompting a reevaluation of investment strategies among major funds.

As these macroeconomic elements continue to shift, they will play a vital role in determining investor behavior towards Bitcoin and, consequently, its liquidity conditions. Recognizing the broader economic landscape is essential for understanding potential future price movements and facilitating a more informed investment position. As Bitcoin navigates this turbulent environment, macro-driven liquidity considerations will become increasingly important.

Frequently Asked Questions

How does Bitcoin liquidity impact cryptocurrency market trends?

Bitcoin liquidity is critical as it dictates how easily Bitcoin can be bought or sold without creating significant price fluctuations. High liquidity typically accompanies favorable market trends, while low liquidity can lead to volatile price changes, especially during high-stress market situations.

What are ETF Bitcoin flows and their significance to Bitcoin liquidity?

ETF Bitcoin flows refer to the buying and selling activities of Bitcoin exchange-traded funds (ETFs). These flows significantly impact Bitcoin liquidity; substantial inflows can enhance market liquidity, while large outflows can create selling pressure, reducing liquidity and increasing price volatility.

How do Bitcoin trading volumes correlate with Bitcoin liquidity?

Bitcoin trading volume directly correlates with liquidity; higher trading volumes indicate greater market interest and liquidity, allowing for smoother transactions. Conversely, low trading volumes can result in decreased liquidity, making price movement more sensitive to sales or purchases.

What is the impact of Bitcoin price on cryptocurrency liquidity?

Bitcoin price affects cryptocurrency liquidity since higher prices can attract more investors, increasing liquidity. However, sharp declines in price can lead to panic selling, which may evaporate liquidity as fewer buyers are willing to enter the market, exacerbating price drops.

How can investors assess Bitcoin’s liquidity trends?

Investors can assess Bitcoin liquidity trends by analyzing trading volumes, order book depth, and ETF inflow/outflow patterns. A thinner order book or declining trading volume often indicates lower liquidity, which can pose risks during volatile market conditions.

What role does the order book depth play in Bitcoin trading liquidity?

Order book depth represents the available buy and sell orders at various price levels. A deeper order book enhances liquidity by allowing larger trades without significantly impacting the price, while a shallower book may result in drastic price changes with single trades.

Why is monitoring ETF Bitcoin flows important for understanding Bitcoin liquidity?

Monitoring ETF Bitcoin flows is essential as they reflect institutional interest and demand for Bitcoin. Significant outflows may signal reduced liquidity and can lead to market instability, while inflows typically indicate strong demand and can bolster overall market confidence.

What challenges do investors face in low liquidity Bitcoin markets?

In low liquidity Bitcoin markets, investors may experience higher volatility and slippage, where trades execute at less favorable prices than expected. These conditions can increase the risk of losses during market downturns or rapid price fluctuations.

How does macroeconomic news affect Bitcoin liquidity?

Macroeconomic news, such as changes in interest rates or geopolitical events, can influence Bitcoin liquidity. Positive news may boost investor confidence and liquidity, while negative developments can lead to market retreats, shrinking liquidity and increased volatility.

Can technical indicators help predict Bitcoin liquidity trends?

Yes, technical indicators such as moving averages, volume analysis, and volatility measures can help traders predict Bitcoin liquidity trends. Identifying patterns and shifts in these indicators may assist investors in anticipating potential market movements.