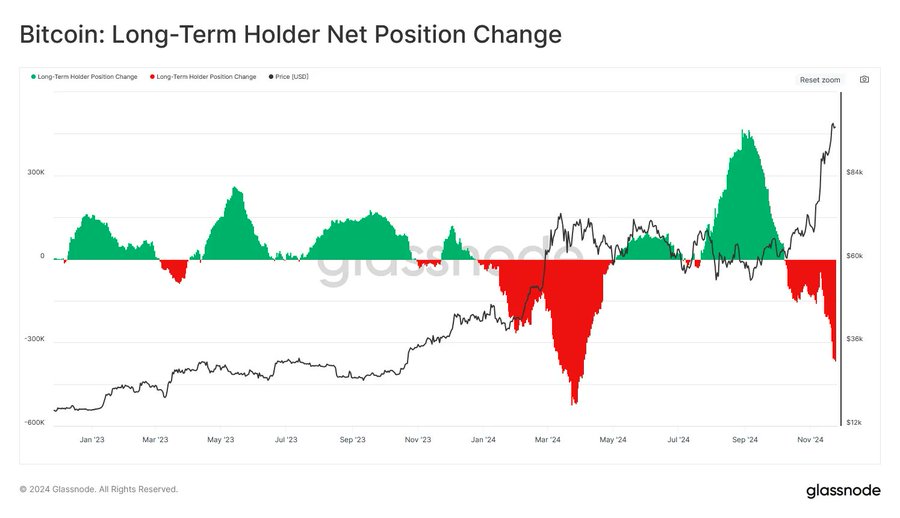

Long-term Bitcoin holders, individuals who have maintained their investments for over two years, are currently shaping the dynamics of the Bitcoin market as we approach 2024 and 2025. Recent analysis reveals that these investors have reached unprecedented levels of sales, setting a new record amidst a notable Bitcoin selling trend that diverges from previous cycles. The ongoing movements of these holders reflect a significant transition in the Bitcoin price cycle, suggesting a re-evaluation of their long-term investment strategies. Insights from CryptoQuant underline the revival in the supply of older Bitcoin, indicating that long-term holders are increasingly participating in the market sell-off. As this trend unfolds, the implications for the overall Bitcoin landscape will be critical to monitor in the coming months.

Investors who keep their Bitcoin investments for extended periods are witnessing significant market activity as we head into 2024. The trend of these seasoned holders selling their Bitcoin sets a unique precedent that contrasts sharply with prior price cycles. Analysis shows that the behavior of long-term investors, often cited as a bellwether for market health, is indicative of a much larger shift in cryptocurrency ownership and strategy. As these long-term holders reassess their positions, it raises important questions about the sustainability of current pricing and trends in the Bitcoin market. The data points revealed by platforms like CryptoQuant provide keen insights into this evolving landscape, showing that older Bitcoin is becoming increasingly liquid as holders adapt to the changing financial environment.

| Key Point | Details |

|---|---|

| Record Sales | Long-term holders of Bitcoin are achieving record sales in 2024 and 2025. |

| Bull Market Trends | This bull market’s selling patterns differ from previous cycles, reflecting seasoned investors’ behavior. |

| Investor Transition | A price cycle is occurring alongside a shift in investor behavior and ownership. |

| Revived Supply Data | According to CryptoQuant, sales of older coins (dormant for over 2 years) have spiked in 2024. |

| Historical Context | 2024 and 2025 show the highest revived supply in Bitcoin’s history, comparable to the end of the 2017 bull market. |

| Market Dynamics | The current selling trend is less noisy than previous cycles but involves significantly older coins. |

| Future Outlook | Current analysis indicates a reassessment by long-term holders, particularly after Bitcoin exceeded $40,000. |

| Potential Market Reaction | Future data in 2026 may clarify if this marks temporary exhaustion or the beginning of a new accumulation phase. |

| Comparative Performance | Bitcoin’s underperformance against other asset classes post-Q4 2025 raises concerns about the relevance of past price cycles. |

Summary

Long-term Bitcoin holders are currently navigating a remarkable phase in the cryptocurrency market characterized by record sales and evolving investor dynamics. With significant amounts of previously dormant coins re-entering circulation, there is a clear indication of strategic reassessments among these investors. As broader market conditions and potential shifts unfold, long-term holders should remain attentive to these trends, as they could provide invaluable insights into future market directions and opportunities.

Understanding the Impact of Long-term Bitcoin Holders

Long-term Bitcoin holders, defined as those who have held their investments for two years or more, have significantly influenced the Bitcoin market dynamics in 2024 and 2025. Recent data from CryptoQuant indicates that these seasoned investors have not only maintained their positions but are now also strategically selling portions of their holdings. This behavior is a clear indicator of their reassessment of market conditions as the price oscillates, notably surpassing the $40,000 mark. The trend is unprecedented, as the volume of older coins moving into circulation deviates substantially from patterns observed in previous bull markets.

The high levels of revived supply from long-term holders have set 2024 and 2025 apart from earlier cycles like those in 2017 and 2021. In the past, surges in revived supply generally coincided with a robust upward price momentum, fueled by speculative investor behavior. However, the current market landscape presents a stark contrast with less overall market excitement and a distinct shift towards older coins being sold. This might signal a transition not only in investor sentiment but also the potential for a price cycle adjustment as traditional indicators of value shift.

The Evolution of Bitcoin Selling Trends in 2024

The selling trends observed in 2024 showcase a strategic shift among Bitcoin holders, particularly the long-term investors who have typically been characterized by their patience and commitment. As detailed in the CryptoQuant analysis, there has been a notable increase in the selling of older unspent transaction outputs (UTXOs) that were dormant for about two years. This activity reflects a new phase in the Bitcoin cycle—a transition influenced by broader market variables and the perceived longevity of the current price ascension. With predictions of a potential bear market in 2026, these sellers may be acting preemptively to secure gains ahead of any downturn.

Moreover, this selling trend has stirred considerable discussions among market analysts and participants alike. Unlike previous instances where a surge in selling was met with immediate speculative interest leading to higher prices, the current situation is marked by hesitance among new investors. The revived supply from seasoned holders is doing more than just changing price levels; it’s altering the very fabric of Bitcoin’s ownership landscape. This has implications for future price stability and investor psychology as the cryptocurrency market continues to evolve.

Bitcoin Price Cycle Analysis: Looking Towards 2026

As we analyze the current Bitcoin price cycle in light of the ongoing shifts among long-term holders, the outlook for 2026 raises pressing questions. Historically, Bitcoin has adhered to a four-year price cycle, where significant price peaks are followed by bear markets. Recent forecasts suggest a potential decline below current levels—anticipated to dip towards lower valuations reminiscent of previous downturns. Such retracements could lead long-term holders to reconsider their investment strategies and further influence market behavior as 2026 approaches.

Market observers are debating whether the established four-year price cycle still holds relevance amid the current complexities. The stark contrast in selling behaviors compared to previous cycles suggests that while market dynamics change, they may not necessarily fit traditional models. Understanding the underlying factors driving long-term holders to sell, whether out of caution or profit-taking, will be critical to forecasting Bitcoin’s market trajectory going forward. The year 2026 may not only redefine price expectations but also challenge existing notions of long-term investment in the crypto landscape.

The Role of CryptoQuant Analysis in the Bitcoin Market

CryptoQuant’s analytical framework has become essential for understanding the movements of long-term Bitcoin holders, specifically through the lens of revived supply. By providing data on dormant coins becoming active, the platform equips investors and analysts with critical insights into market trends. The information reveals that these long-term holders are adjusting their strategies, indicating a potential shift in market confidence. Consequently, such analysis highlights the importance of data-driven decision-making in navigating the complexities of the Bitcoin market.

In light of the analysis released by CryptoQuant, the dynamics of Bitcoin price cycles are now more complex than ever. With record sales of older coins, it is clear that long-term holders are reassessing their positions in response to shifting market sentiment. The actionable insights derived from on-chain data provide clarity to investors, allowing for better-informed decisions in a market characterized by volatility and uncertainty. Understanding the implications of this analysis will be critical for both immediate trading strategies and long-term investment planning.

Identifying Patterns in Long-term Investment Behavior

The behavioral patterns of long-term Bitcoin holders during the ongoing bull market reveal intriguing insights into the mindset of seasoned investors. While historically associated with unwavering commitment, recent data suggests these investors are becoming more adaptive, responding strategically to price movements and market signals. The emergence of a robust selling trend among older coins signifies a shift in strategy, where long-term holders are likely diversifying their portfolios or securing profits in anticipation of volatility. This adaptability may ultimately serve as an indicator of broader market sentiment and could shape the strategies of newer investors in the crypto space.

Furthermore, this shift in behavior among long-term holders sheds light on the evolving nature of investment in Bitcoin. As the market matures, the factors influencing long-term holders become more nuanced, encompassing aspects such as market saturation, price volatility, and external economic pressures. By examining these patterns closely, market participants can gain a clearer perspective on potential price cycles and the likelihood of sustained growth or contraction in Bitcoin’s value. Understanding the motivations behind long-term holders will be key for anticipating future trends and navigating investment strategies effectively.

Comparative Analysis of Bull Markets: 2017 vs 2024

Drawing comparisons between the current bull market of 2024 and the landmark cycles of 2017 provides critical insights into the distinct nature of this market phase. In 2017, Bitcoin experienced an explosive rise fueled by speculative investments and a flood of new participants, which ultimately climaxed with prices soaring above $20,000. In contrast, the ongoing cycle in 2024 is characterized by a deliberate selling trend from long-term holders, a behavior not heavily influenced by speculative hype but rather by strategic market reassessments. This contrast is vital for understanding the current market dynamics and predicting future patterns.

Analysts have pointed out that while the revived supply from long-term holders in 2024 draws parallels to the end-stage dynamics of the 2017 cycle, the lack of overwhelming market enthusiasm presents a different narrative. The sales of older coins by seasoned investors suggest a more cautious approach, potentially signaling an upcoming market correction as opposed to a speculative rally. This comparative analysis underscores the importance of understanding different market behaviors across cycles and the impact they have on Bitcoin’s price stability and long-term investment outlook.

The Future of Bitcoin in a Bear Market Cycle

As predictions for a potential bear market in 2026 loom, the future trajectory of Bitcoin and the strategies of long-term holders will come under scrutiny. With the market currently experiencing significant selling trends from long-term holders, questions arise about their next steps amidst declining prices. This phase can lead to fluctuations in buyer confidence, impacting new investors and overall market health. Long-term holders may opt to hold through short-term volatility or liquidate positions to reallocate capital elsewhere.

The anticipated bear market cycle introduces further complexities, especially given the precedents set by previous downturns. A bear market could test the resolve of long-term holders and reshape their investment strategies. Understanding how these investors respond to adverse conditions will provide valuable insights into market resilience, recovery prospects, and the integrity of Bitcoin as a long-term investment vehicle. The conclusion of this cycle may ultimately redefine relationships among long-term holders, newer investors, and the overall Bitcoin ecosystem.

Investor Sentiment: Transitions in Bitcoin Ownership

The phenomenon of long-term holders actively selling older coins signals a transformational shift in Bitcoin ownership and investor sentiment. Historically viewed as steadfast believers in Bitcoin’s future, these holders are now navigating a landscape marked by uncertainty and volatility. Their willingness to part with previously dormant assets reflects not only individual profit realization but also a broader reassessment of risk tied to market fluctuations. Such transitions in ownership dynamics are critical for understanding future price movements and investor psychology within the Bitcoin ecosystem.

As the Bitcoin market evolves, investor sentiment becomes a pivotal factor in determining market behavior. The shifts observed among long-term holders could act as precursors to a more significant trend, where heightened awareness and caution steer market engagement. This evolving sentiment underscores the importance of staying vigilant regarding market signals, as both new and seasoned investors respond to the changing climate. Recognizing the motivations of long-term holders can enhance an investor’s ability to navigate market challenges and capitalize on emerging opportunities.

Frequently Asked Questions

What are the selling trends among long-term Bitcoin holders in the Bitcoin market 2024?

In the Bitcoin market of 2024, long-term Bitcoin holders are experiencing record levels of selling. This trend is notable as it marks a shift from previous cycles, where selling typically coincided with significant price movements. Current data from CryptoQuant highlights the revival of long-dormant coins, suggesting that these holders are actively reassessing their positions as prices exceed $40,000.

How does the Bitcoin price cycle affect long-term Bitcoin holders?

The Bitcoin price cycle plays a crucial role for long-term Bitcoin holders, particularly in 2024 and 2025. Historical data shows that these holders have begun selling significant amounts of their assets, comparable to patterns observed at the end of the 2017 bull market. However, the current selling is characterized by older coins being moved rather than a response to immediate market noise, leading to questions about future price dynamics.

Are long-term investment strategies among Bitcoin holders impacted by the Bitcoin selling trend?

Yes, long-term investment strategies among Bitcoin holders are being impacted by the current Bitcoin selling trend. The influx of older coins into the market suggests that long-term holders are re-evaluating their investment strategies in response to current prices. As we move further into 2024, the trend might signal either a temporary exhaustion of sales or the beginning of a new accumulation phase.

What insights does CryptoQuant provide about long-term Bitcoin holders’ behavior during the 2024 bull market?

CryptoQuant’s analysis reveals that long-term Bitcoin holders are demonstrating unique behaviors during the 2024 bull market. Despite record sales from previously dormant coins, the selling is less about immediate market speculation and more about long-term strategy adjustment. This indicates that holders are mindful of market conditions and may be planning for future price cycles.

How might the behavior of long-term Bitcoin holders signal a shift in the Bitcoin market dynamics?

The behavior of long-term Bitcoin holders, particularly their selling of older coins, signal a potential shift in Bitcoin market dynamics. As they start to re-assess their positions, it could lead to a significant transition in ownership and investor sentiment. This shift may also indicate a departure from reliance on previous price cycles, raising questions about how subsequent market adjustments will unfold.

What does the historical comparison of long-term Bitcoin holders’ sales tell us about Bitcoin’s future?

The historical comparison of long-term Bitcoin holders’ sales, particularly the spike in 2024 and 2025, suggests a trend that warrants attention. These levels of revived supply are the highest recorded, hinting at a possible change in market psychology. As we reflect on past bull markets, understanding how these long-term holders will navigate future cycles can provide insights into Bitcoin’s price trajectory and overall market health.