Bitcoin support is witnessing a remarkable resurgence as the cryptocurrency sector anticipates pivotal changes in legislation inspired by prominent figures like US President Donald Trump. In his recent address at the World Economic Forum, Trump hinted at forthcoming pro-crypto regulations that could significantly influence Bitcoin’s market positioning. With hopes of bringing Bitcoin back to a bullish trend, investors are keenly analyzing Bitcoin price trends while monitoring macro support for Bitcoin. The crypto market is abuzz with speculation, as analysts suggest that Trump’s commitment to legislation could help break through current price ceilings. As Bitcoin eyes the ambitious target of $90,000, merely engaging with these developments can inform traders about impending shifts in crypto market trends and potential recovery phases.

Recent developments in cryptocurrency support have created an atmosphere of optimism surrounding Bitcoin’s future. Influential statements from political leaders like Donald Trump regarding crypto legislation have sparked discussions about new regulatory frameworks that could enhance Bitcoin’s performance. The prospect of Bitcoin recovery seems feasible as market analysts observe macroeconomic indicators and their potential impact on overall cryptocurrency valuations. As enthusiasts and investors explore alternative avenues for financial freedom within the cryptocurrency realm, understanding the nuances of Bitcoin market dynamics becomes increasingly critical. By keeping tabs on the shifting landscape, stakeholders can better navigate the complexities of the evolving crypto environment.

| Key Points | Details |

|---|---|

| Trump’s Pro-Crypto Legislation | Trump’s World Economic Forum speech hinted at signing new pro-crypto legislation that could positively impact Bitcoin’s market position. |

| US Market Response | Following Trump’s speech, Bitcoin gained 1.7% as US markets reacted positively, with the S&P 500 also showing gains. |

| Japanese Bond Market Sensitivities | The rise in Japanese bond yields has raised concerns over fiscal vulnerabilities that could impact crypto markets. |

| Bitcoin’s Price Action | Recent price movements indicate a strong support line, with traders optimistic about potential rebounds. |

Summary

Bitcoin support has received a significant boost from recent political statements, enhancing its market outlook. With Trump hinting at upcoming pro-crypto legislation, investors are urged to stay informed as these developments unfold. The interplay between global economic factors and Bitcoin’s price behaviors will be vital to watch in the coming weeks.

Trump’s Crypto Legislation: A Game Changer for Bitcoin

The recent statements made by US President Donald Trump at the World Economic Forum have reignited hopes in the crypto community, particularly for Bitcoin (BTC). His announcement regarding forthcoming crypto legislation has been perceived as a potential catalyst for a significant price recovery, pushing Bitcoin’s price closer to the pivotal $90,000 mark. Analysts are optimistic that this legislative push could create a ripple effect throughout the crypto market, particularly as Trump emphasizes America’s ambition to remain the ‘crypto capital of the world.’ Such declarations not only impact investor sentiment but are also crucial amid ongoing discussions about Bitcoin’s regulatory framework.

Furthermore, the assurance of pro-crypto legislation being signed ‘very soon’ aligns with the growing market demand for clear regulations and support structures in the evolving landscape of cryptocurrencies. This could lead to enhanced institutional participation and mainstream acceptance, significantly impacting Bitcoin’s price trajectories. As the legislative environment becomes more favorable, Bitcoin may experience an influx of capital, benefiting from an environment rich with macro support. This context sets up a compelling scenario for a robust recovery, underscoring the potential for Bitcoin to reclaim its former highs.

Bitcoin Price Analysis: Understanding Market Movements

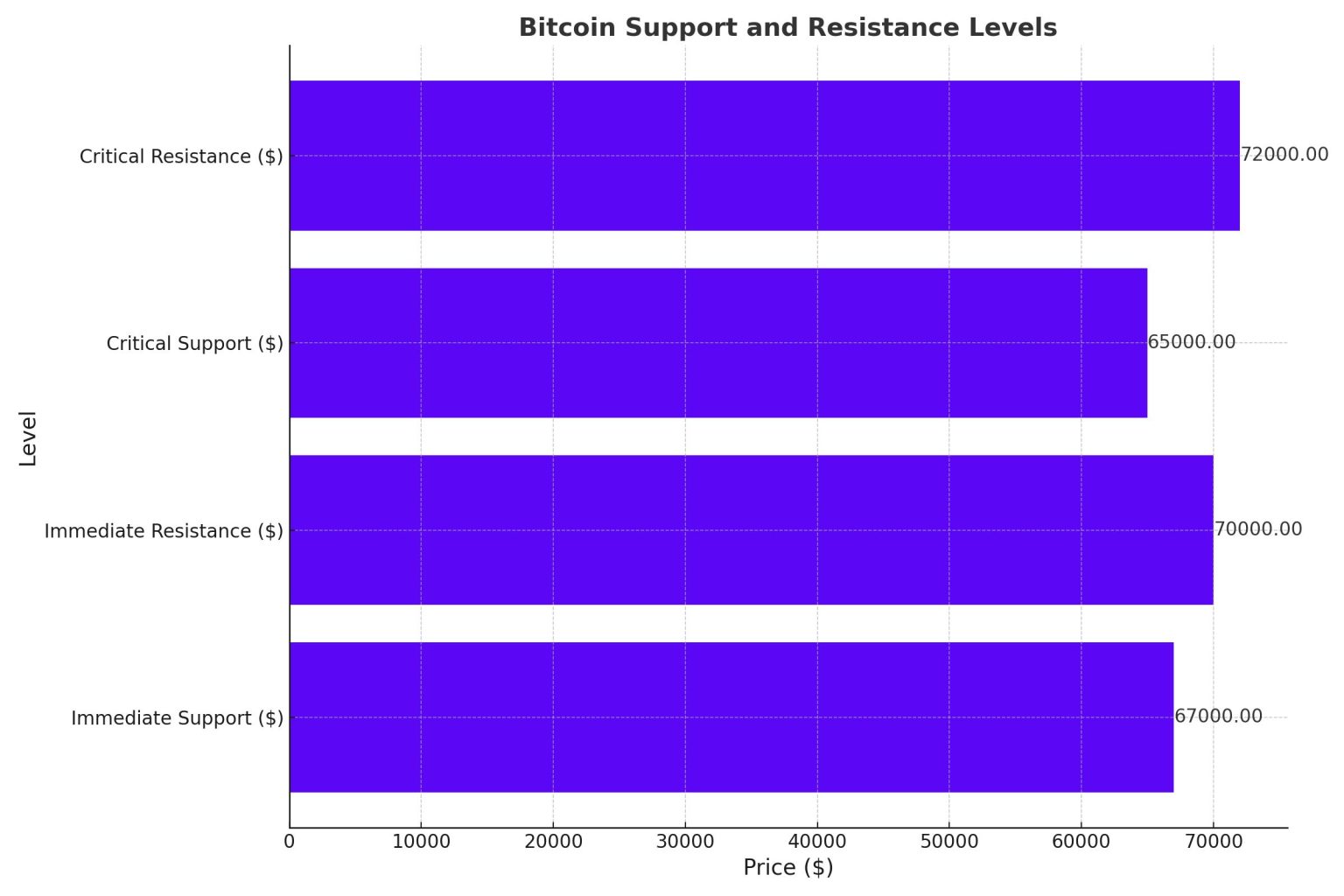

Analyzing Bitcoin’s price movements in the current market context reveals a complex interplay of macroeconomic factors and investor psychology. The recent upward tick in BTC’s price can be attributed to Trump’s pro-crypto statements, which have provided a much-needed boost to market morale. Traders and analysts are closely monitoring price trends, especially as Bitcoin approaches crucial resistance levels. According to reports, the establishment of a strong buying wall indicates a resilient support line, suggesting that investors are prepared to act at predefined price points. This kind of technical analysis is essential for forecasting Bitcoin’s future, especially in light of Trump’s legislative actions.

Amidst these developments, the volatility experienced in January has created a unique landscape where Bitcoin is primed for a significant rebound. The closure of previous trading gaps in CME Group’s Bitcoin futures market illustrates a tightening in price movements, potentially stabilizing the market ahead. Additionally, the advice from seasoned traders to monitor local lows reflects an awareness of market trends that could prompt opportunistic buying. Hence, as Bitcoin navigates through these dynamics, understanding price analysis becomes crucial for investors seeking to capitalize on the anticipated recovery.

Macro Support for Bitcoin Amidst Global Economic Changes

Macro support plays a crucial role in Bitcoin’s pricing strategy, especially now as global economic conditions shift. The discourse surrounding Bitcoin’s future becomes even more relevant in the wake of rising Japanese bond yields, which have reportedly reached levels not recorded since 1999. This macroeconomic backdrop presents both challenges and opportunities for Bitcoin, revealing vulnerabilities within traditional markets while simultaneously underscoring Bitcoin’s potential as an alternative asset. The interaction of these global economic indicators with Bitcoin’s value highlights the necessity for investors to remain engaged with macroeconomic trends.

Moreover, as traditional markets react to changing bond yields and fiscal policies, Bitcoin’s positioning as a hedge against inflation and market instability becomes increasingly relevant. With Trump’s commitment to bolster the crypto sector, there’s optimistic speculation around Bitcoin’s resilience. Investors are thus advised to keep a vigilant eye on macroeconomic developments, as any favorable legislation from Trump could reinforce Bitcoin’s support levels while also encouraging a bullish sentiment across the crypto market. In this interconnected environment, Bitcoin stands to gain significant traction if macro trends continue to align favorably.

Tracking Crypto Market Trends and Their Impact on Bitcoin

In the rapidly evolving world of cryptocurrencies, observing current market trends provides valuable insight into Bitcoin’s performance. The recent hints from Donald Trump about new crypto legislation have sparked a renewed interest in crypto assets, fostering a positive outlook on Bitcoin’s future. Market analysts suggest that keeping track of how such legislative moves align with investor sentiment can offer a predictive perspective on Bitcoin price swings. Given the recent correlation between BTC price movements and macroeconomic cues, those delving into these trends will glean critical information on when to buy or sell.

Additionally, notable shifts in market volume and volatility often precede substantial price movements. As investor interest heightens following Trump’s remarks, it becomes essential to monitor trends akin to this recent relief bounce. Being aware of such patterns could indicate impending price corrections or promising upward trajectories in Bitcoin. Thus, an acute awareness of market trends, combined with the backdrop of legislative promises from Trump, positions traders to navigate the crypto landscape more adeptly and leverage opportunities for profit.

The Implications of Bitcoin Recovery on Investor Confidence

As Bitcoin seeks to recover from its recent lows, the implications for investor confidence are substantial. A recovery will likely enhance trust among traders and institutional investors alike, affirming the notion that Bitcoin still holds value amidst macroeconomic uncertainties. The pronounced upward movement tied to Trump’s anticipated legislation could not only elevate Bitcoin’s status as an investment but could reclaim its image as a stable asset class in the narratives surrounding digital currencies. Investors are likely to react positively to signs of recovery, suggesting a return of bullish sentiment within the market.

Moreover, indicators such as sustained price support and growing daily trading volumes can further bolster investor confidence during this recovery period. With the BTC community eager to see how these macro factors play out alongside legislative developments, the sense of urgency builds within the market. Such dynamics create an environment ripe for investment, as confident traders may seize opportunities to augment their portfolios ahead of any significant price rallies. Therefore, Bitcoin’s recovery not only represents a technical analysis breakthrough but also serves as a barometer for broader market health and investor sentiment.

Exploring Bitcoin’s Future Outlook Post-Trump’s Speech

Following Trump’s recent World Economic Forum speech, speculation surrounding Bitcoin’s future has intensified. His commitment to advancing crypto legislation could potentially shift the dynamics of market activity significantly. Experts argue that regulatory clarity fostered by such legislation will be pivotal for Bitcoin, allowing investors to enter the market without hesitation. As the crypto sector undergoes this transformative phase, Bitcoin is expected to lead the charge, reflecting broader trends of acceptance and integration into the financial ecosystem.

In this context, analysts are keenly examining Bitcoin’s market structure and how it can adapt to rapid changes, including regulatory adjustments and macroeconomic pressures. The expected modernization of the legal framework around crypto could be essential for institutional adoption, leading Bitcoin into a new era. A proactive approach to legislation, as hinted by Trump, could help establish a more favorable environment for Bitcoin investments, leading to enhanced liquidity and price appreciation. Consequently, Bitcoin stands on the brink of significant evolution, making its outlook bright, contingent upon effective legislative management.

Investor Strategies for Navigating Bitcoin’s Landscape

As Bitcoin continues to exhibit both volatility and resilience, investors must develop strategic frameworks to navigate its landscape effectively. Understanding the nuances between market trends and macroeconomic signals will be essential in capitalizing on potential opportunities. By incorporating technical indicators and recognizing price support levels influenced by both legislative announcements and market sentiment, traders can better position themselves for upcoming movements in Bitcoin’s valuation.

Furthermore, adapting investment strategies to include both short-term and long-term perspectives becomes imperative, considering the swift changes in the regulatory landscape. For instance, as new legislation emerges, it may prompt shifts in investment behavior, with some investors choosing to hold long positions in anticipation of sustained price growth. Others may opt for shorter-term trades to take advantage of momentary rebounds. Therefore, developing a well-rounded strategy that encompasses both approaches could enhance returns and safeguard against unforeseen market downturns as Bitcoin charts its course into the future.

The Role of Technical Indicators in Bitcoin Trading

In the context of Bitcoin trading, technical indicators play a crucial role in shaping investment decisions. Tools like moving averages, Relative Strength Index (RSI), and Fibonacci retracements allow traders to assess market momentum, support and resistance levels, and potential reversal points. As Bitcoin approaches the crucial $90,000 mark post-Trump’s speech, traders utilize these indicators to evaluate potential entry and exit points, bolstering their market strategies.

Moreover, understanding market volumes in conjunction with these indicators can provide deeper insights into the strength of price movements. For instance, a surge in trading volume alongside price appreciation may signal a robust bullish trend, suggesting that investor sentiment is shifting positively. Consequently, technical analysis ensures traders remain informed about market dynamics, better equipping them to respond to Bitcoin price fluctuations, ultimately influencing their capability to optimize returns as legislative developments unfold.

Frequently Asked Questions

What does Bitcoin support mean in the context of Trump’s pro-crypto legislation?

Bitcoin support refers to the price levels at which Bitcoin tends to stop falling and reverse its trend. With President Trump’s recent statements about signing pro-crypto legislation, market participants are optimistic about potential macroeconomic support for Bitcoin, which can positively influence its price and encourage investment.

How will Trump’s crypto legislation affect Bitcoin price analysis?

Trump’s upcoming crypto legislation is expected to provide structural support for Bitcoin, which could lead to increased investor confidence and potentially drive the Bitcoin price higher. Analysts are monitoring how legislative changes will shape Bitcoin price trends and overall market sentiment.

What are the current crypto market trends related to Bitcoin support?

Recent news, including Trump’s promise of pro-crypto legislation, has sparked optimism in the crypto market. Bitcoin’s price has shown signs of recovery as it approaches macro support levels. Investors are closely watching these trends to gauge potential price movements and reversals.

Can Bitcoin recovery be expected with Trump’s pro-crypto announcements?

Yes, Bitcoin’s recovery is likely to be fueled by macroeconomic support from Trump’s pro-crypto initiatives. Historically, positive news surrounding regulations can lead to upward price corrections, which may set the stage for Bitcoin’s recovery from recent lows.

How does macro support for Bitcoin affect long-term investment strategies?

Macro support for Bitcoin, bolstered by potential legislative changes such as those proposed by Trump, provides a favorable environment for long-term investments. Investors are encouraged to integrate these macro factors into their strategies, as a supportive regulatory framework could enhance Bitcoin’s stability and growth prospects.