Nakamoto Bitcoin holdings have recently come into the spotlight as the company, formerly known as KindlyMD, rebrands itself to better align with its ambitions in the rapidly evolving Bitcoin ecosystem. By transitioning to Nakamoto, the company reinforces its commitment to maintaining and enhancing its Bitcoin treasury, which currently boasts a staggering 5,400 BTC worth over $500 million. This move signifies a crucial step for Nakamoto as it seeks to define its role and influence within the cryptocurrency market. As the Bitcoin market value continues to grow, understanding Nakamoto’s strategic investments is essential for those looking to grasp the future landscape of digital assets. With Nakamoto’s holdings garnering attention, crypto enthusiasts and investors alike are keen to see how this high-profile entity will navigate and support the burgeoning Bitcoin community.

With its recent rebranding, Nakamoto has positioned itself at the forefront of the digital currency revolution, highlighting the importance of its substantial Bitcoin holdings. Previously operating under the name KindlyMD, this organization is now a key player in the cryptocurrency market, emphasizing its role as a steward of a significant Bitcoin treasury. The accumulation of approximately 5,400 Bitcoins reflects not only Nakamoto’s commitment to cryptocurrency but also hints at strategic movements within the Bitcoin landscape. As the interest in digital currencies grows, stakeholders are increasingly curious about how Nakamoto will leverage its position to influence the Bitcoin market’s stability and trajectory. The focus on their Bitcoin ecosystem involvement suggests that they are set on solidifying their impact in the evolving realm of digital finance.

| Key Point | Details |

|---|---|

| Company Name Change | KindlyMD has been renamed to Nakamoto. |

| Purpose of Name Change | The name change aligns the company’s image with its long-term strategy in the Bitcoin ecosystem. |

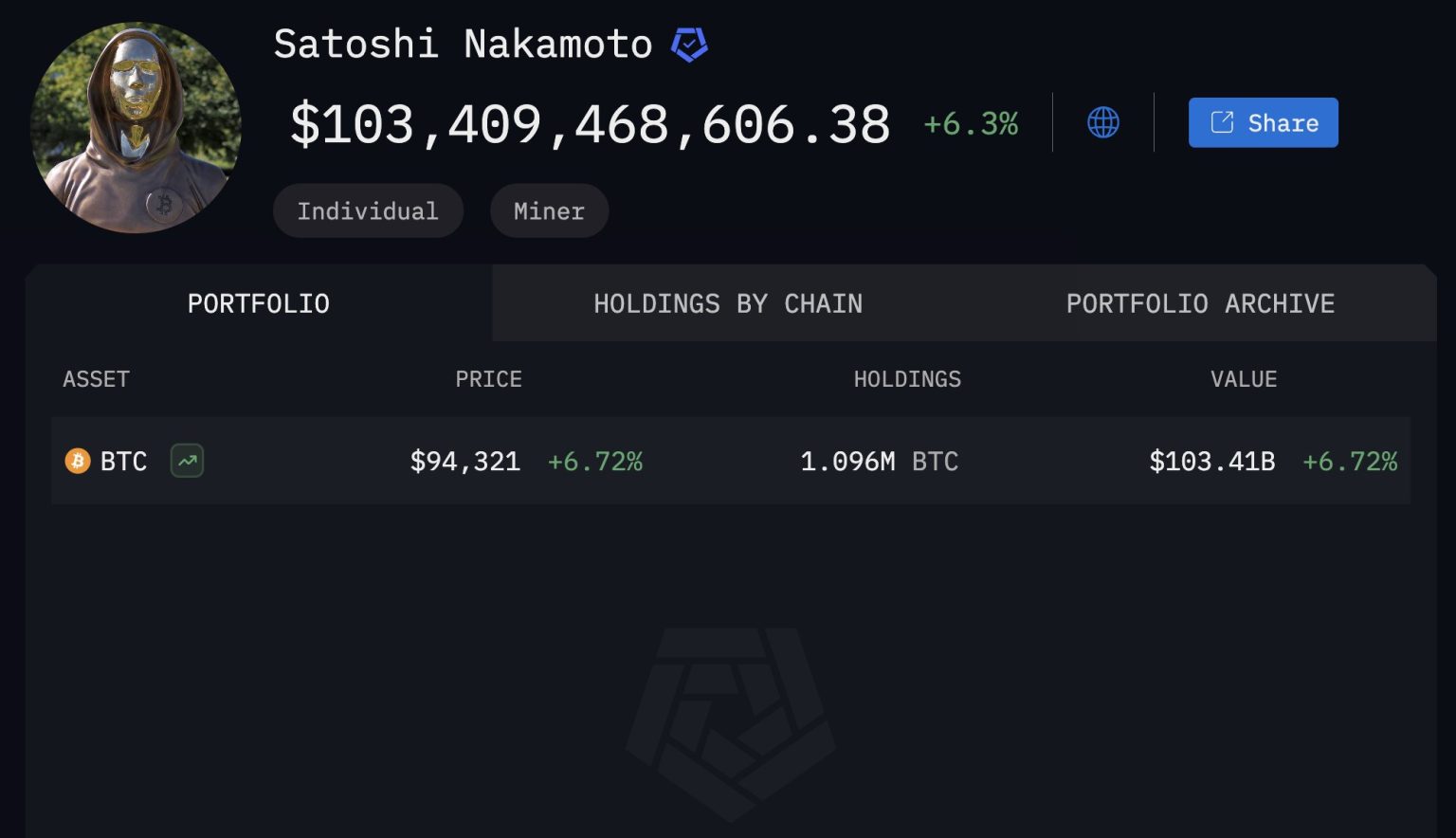

| Bitcoin Holdings | Nakamoto holds approximately 5,400 BTC. |

| Market Value of Holdings | The market value of Nakamoto’s Bitcoin holdings exceeds $500 million. |

| Company Strategy | Nakamoto aims to promote plans that support the long-term success of Bitcoin. |

Summary

Nakamoto Bitcoin holdings reflect a significant commitment to the cryptocurrency sector, with the company amassing 5,400 BTC valued at over $500 million. This strategic move not only rebrands KindlyMD to better represent its mission but also positions Nakamoto as a pivotal player in the Bitcoin ecosystem, emphasizing its commitment to the long-term success and sustainability of Bitcoin.

Nakamoto Bitcoin Holdings: A Strategic Move in the Bitcoin Ecosystem

The recent rebranding of KindlyMD to Nakamoto signifies a pivotal shift for the company within the Bitcoin ecosystem. By adopting a name that resonates with the foundational principles of Bitcoin, Nakamoto aims to strengthen its position as a key player in the Bitcoin treasury space. This strategic decision not only reflects the company’s commitment to promoting Bitcoin’s long-term success but also clarifies its objectives to its stakeholders, investors, and customers. Furthermore, the company’s substantial Bitcoin holdings suggest an unwavering belief in the currency’s potential for growth and stability in a rapidly evolving market.

Nakamoto’s disclosure of its holdings, amounting to around 5,400 Bitcoins, underscores its serious investment in the Bitcoin market. With a market value that exceeds $500 million, these holdings place Nakamoto in a competitive position among other companies in the Bitcoin treasury sector. As the company continues to expand its influence, it can potentially leverage its assets to catalyze innovation within the broader Bitcoin ecosystem, challenging traditional financial systems and redefining digital currency investment.

Frequently Asked Questions

What are Nakamoto Bitcoin holdings and why are they significant?

Nakamoto Bitcoin holdings refer to the holdings of approximately 5,400 BTC disclosed by Nakamoto, formerly known as KindlyMD. These holdings are significant as they represent a market value exceeding $500 million, showcasing the company’s serious commitment to the Bitcoin treasury strategy within the Bitcoin ecosystem.

How did Nakamoto accumulate its Bitcoin holdings?

Nakamoto accumulated its Bitcoin holdings through a carefully implemented Bitcoin treasury strategy. By strategically investing in Bitcoin, the company has positioned itself as a significant player in the Bitcoin market value landscape.

What does the rebranding from KindlyMD to Nakamoto imply for its Bitcoin strategy?

The rebranding to Nakamoto implies a stronger alignment with the company’s long-term strategy in the Bitcoin ecosystem. It reflects a commitment to promote initiatives that support the growth and success of Bitcoin, further enhancing their Bitcoin holdings and overall market value.

What impact do Nakamoto Bitcoin holdings have on the Bitcoin market?

Nakamoto’s Bitcoin holdings, valued at over $500 million, have the potential to influence the Bitcoin market by instilling confidence in investors and highlighting the value of investing in Bitcoin. Such significant holdings can also impact market dynamics, liquidity, and perceptions of Bitcoin as a viable asset class.

What role does Nakamoto play in the Bitcoin ecosystem?

Nakamoto, as a Bitcoin treasury company, plays a crucial role in the Bitcoin ecosystem by promoting long-term investments in Bitcoin and contributing to its adoption and stability. Their Bitcoin holdings serve to reinforce trust in Bitcoin’s value and viability in the financial markets.

Is Nakamoto’s Bitcoin treasury strategy unique among companies?

While other companies may adopt Bitcoin treasury strategies, Nakamoto’s substantial holdings of approximately 5,400 BTC set it apart, significantly impacting its branding and positioning within the Bitcoin ecosystem, and showcasing a unique commitment to Bitcoin market value.

How does Nakamoto’s Bitcoin value compare to other holdings in the market?

Nakamoto’s Bitcoin holdings, with a market value exceeding $500 million, place it among the prominent holders in the Bitcoin market. Compared to other companies and institutional investors, Nakamoto’s substantial stake illustrates its strategic approach to harnessing the influence of Bitcoin within the broader financial landscape.