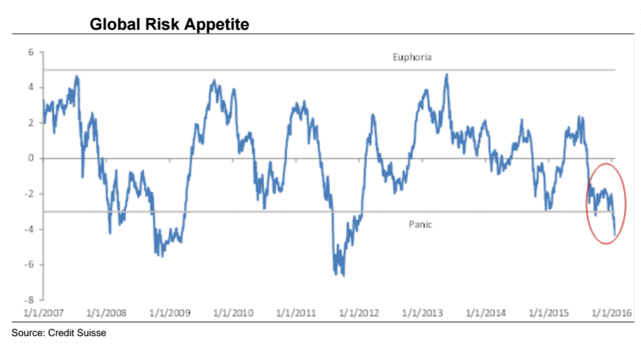

Global risk appetite has noticeably decreased over the past week, reflecting a growing caution among investors. Factors such as sudden shifts in the Japanese market and escalating geopolitical tensions have contributed to this defensive posture, resulting in weakened stock prices. Additionally, renewed focus on interest rates policy and its implications are central to understanding current financial conditions risks. As market participants grapple with these pressures, the volatility associated with the global landscape is increasingly apparent. Amidst this turmoil, trends in the cryptocurrency market are also showing heightened sensitivity to macroeconomic factors, leaving investors to ponder the path forward.

The current climate of investment sentiment has turned significantly risk-averse, as evidenced by recent developments affecting major markets. With apprehensions surrounding economic stability in key regions like Japan and rising geopolitical conflicts, stakeholders are re-evaluating their strategies. The implications of monetary policy adjustments are particularly crucial, as they shape financial landscapes and determine market behavior. Investors are also witnessing shifts in digital asset dynamics, which mirror broader economic fluctuations. As uncertainty reigns, understanding these interconnected elements becomes vital for navigating today’s complex investment environment.

| Key Point | Explanation |

|---|---|

| Cooling Global Risk Appetite | Market sentiment has weakened, leading to defensive positions and weaker stock prices. |

| Geopolitical Tensions | Increased tensions have made investors cautious, impacting market dynamics. |

| Japanese Market Volatility | Repricing of Japanese government bonds has global repercussions, raising financing costs. |

| Trade Friction Risks | Renewed risks between the US and Europe could exacerbate global financial conditions. |

| Impact on Cryptocurrency | Cryptos like Bitcoin show high sensitivity to interest rate changes and market volatility. |

Summary

Global risk appetite has cooled significantly over the past week, primarily due to escalating geopolitical tensions and changes in the Japanese market. This cooling effect is evident in weaker stock prices and heightened sensitivity to macroeconomic policies, impacting investors’ strategies across various asset classes, including cryptocurrencies.

Impact of Japanese Market Changes on Global Risk Appetite

Recent fluctuations in the Japanese market have sent shockwaves throughout global financial systems, causing a noticeable drop in risk appetite. QCP Asia highlights that the repricing of Japanese government bond yields has not only increased the costs for domestic financing but has also affected international markets. As investors reevaluate their strategies amid rising bond yields, concerns grow over cross-border exposure and overall market stability. Consequently, asset managers are turning increasingly conservative, opting for safer investment options rather than exposing themselves to the heightened risks associated with these market changes.

This reduction in global risk appetite is reflected in the sluggish performance of stock prices across various international markets. The interplay between the Japanese market dynamics and other geopolitical tensions signifies a potential turning point in investor sentiment. As stakeholders monitor the situation closely, it becomes crucial to understand how these local market shifts can trigger broader financial implications, influencing decisions on capital allocation and risk management strategies across various sectors.

Geopolitical Tensions and Their Influence on Financial Conditions

The resurgence of geopolitical tensions has become a primary concern for investors, significantly altering financial conditions worldwide. With the US and Europe embroiled in trade friction, statements regarding tariffs and potential countermeasures have escalated fears of a confrontational environment. Market participants are increasingly wary of how these political dynamics might tighten financial conditions and erode confidence, prompting a shift in focus from merely observing the rhetoric to assessing its real economic impacts.

Such geopolitical uncertainty not only undermines market stability but also exacerbates volatility across different asset classes. Investors are left reassessing their portfolios, shifting away from riskier assets to secure investments, thereby creating a ripple effect throughout the financial landscape. As these geopolitical tensions play out, the overall market sentiment will likely hinge on governmental actions and responses that could either mitigate or exacerbate current financial risks.

Interest Rates Policy and Market Volatility

With interest rates at the forefront of financial discussions, QCP Asia emphasizes the significant role that monetary policy plays in shaping market conditions. The uncertainty surrounding interest rate adjustments has created an environment rife with volatility, where minor misjudgments by policymakers can lead to substantial repercussions. As the market grapples with the implications of rate hikes or cuts, investor behavior becomes increasingly sensitive, impacting everything from stock and bond prices to commodities and cryptocurrencies.

The heightened sensitivity to interest rate policies underscores the interconnectedness of global markets. As financial conditions tighten, investors are likely to face greater challenges in navigating an increasingly complex landscape. Understanding how interest rate movements correlate with market sentiment is essential for investors looking to mitigate risks and capitalize on opportunities that may arise amidst prevailing uncertainty.

The Role of the Cryptocurrency Market in Today’s Financial Landscape

The cryptocurrency market continues to face significant challenges as it grapples with external pressures from interest rate fluctuations and geopolitical developments. As observed by QCP, Bitcoin and other major cryptocurrencies have exhibited behavior more akin to high-beta macro assets rather than serving as safe-haven tools. This shift highlights an essential aspect of the crypto market’s evolution, where external factors heavily influence asset performance, often leading to increased volatility in pricing.

Until there are more stable and clearer policy signals from global financial leaders, the cryptocurrency market remains reactive rather than proactive. Investors are continuously assessing the broader economic landscape, attempting to gauge the potential impact of interest rates and geopolitical tensions on their crypto positions. This ongoing interplay between macroeconomic indicators and the cryptocurrency market necessitates a keen understanding of both traditional and emerging asset classes for investors aiming to navigate these turbulent waters successfully.

Financial Condition Risks and Their Global Implications

As the global financial landscape becomes more precarious, the risks associated with tightening financial conditions are paramount. The latest insights from QCP Asia indicate a cautious tone prevalent among investors, with concerns centering on how these conditions might impact liquidity and access to capital. As financial institutions adopt more conservative lending practices, the implications extend beyond isolated markets, influencing global economic growth and stability.

The contraction of financial conditions can spur a cascading effect, leading to a slowdown in consumer spending and investment. Effective risk management strategies must consider these broader implications, as stakeholders assess their exposure to various financial instruments. By understanding and anticipating the risks tied to shifting financial conditions, investors can better position themselves to mitigate potential downturns and capitalize on opportunities in a fluctuating market.

Cross-border Investment Strategies Amidst Market Uncertainty

In the face of rising global risk aversion, investors are reevaluating their cross-border allocation strategies. QCP Asia points out that the recalibration of investment approaches is crucial for navigating an environment characterized by heightened uncertainty, particularly influenced by developments in markets like Japan and geopolitical tensions. As funding costs rise and risk premiums adjust, the importance of careful geographic and sectoral diversification becomes apparent.

Investors are increasingly aware that the interconnection between markets means that decisions made in one region can have profound impacts elsewhere. As such, adopting a dynamic investment strategy that remains responsive to ongoing market changes is vital. This includes a focus on local and international market signals that guide the evaluation of potential opportunities while minimizing exposure to regions that face significant systemic risks.

The Dynamics of Risk Appetite in a Changing Economic Environment

Risk appetite plays a pivotal role in shaping investment behaviors, especially during times of economic uncertainty. As noted by QCP, the recent dip in global risk appetite is indicative of a broader trend where investors are more cautious amid fluctuating market conditions. This cautiousness is fueled by various factors, including changes in monetary policy, geopolitical tensions, and evolving financial conditions, all contributing to the reluctance to engage in higher-risk investments.

Understanding the nuances of risk appetite enables market participants to strategize effectively. Investors must stay attuned to shifts in sentiment and market signals that could indicate altering levels of confidence within the financial system. By properly gauging risk appetite, stakeholders can make informed decisions that align with their financial goals while remaining agile in the face of an unpredictable economic landscape.

Future Outlook: Navigating a Volatile Market Landscape

Looking ahead, the financial markets are poised for continued volatility as stakeholders respond to ongoing developments in interest rates, geopolitical tensions, and market dynamics. QCP Asia underlines the necessity for investors to remain vigilant, prepared to adjust their strategies in response to emerging signals from global markets. The interplay of these elements will largely dictate market behavior, emphasizing the importance of adaptive risk management.

As investors gear up for a future characterized by uncertainty, maintaining a diversified portfolio will be crucial. This not only involves traditional investment avenues but also extends to embracing alternative assets like cryptocurrency, which, while recently pressured, continue to evolve as potential investment vehicles. Keeping a pulse on market trends and conditions will be vital for navigating the complexities that lie ahead in the rapidly changing financial environment.

Frequently Asked Questions

How have recent Japanese market changes affected global risk appetite?

Recent changes in the Japanese market have significantly impacted global risk appetite, leading investors to adopt a more defensive stance. The repricing of Japanese government bond yields has contributed to higher global financing costs, influencing risk premiums and cross-border investment strategies.

What role do geopolitical tensions play in shaping global risk appetite?

Geopolitical tensions, particularly renewed trade frictions between the US and Europe, have exacerbated concerns regarding global risk appetite. Such tensions increase uncertainty in financial markets, prompting investors to reevaluate asset allocations and adopt more cautious strategies.

How do interest rates policy changes influence global risk appetite?

Changes in interest rates policy are critical to global risk appetite. With markets exhibiting high sensitivity to policy misjudgments, expectations regarding interest rate hikes or cuts can shift investor sentiment rapidly, affecting asset valuations and financial conditions.

What financial conditions risks are currently affecting global risk appetite?

Current financial conditions risks include tight liquidity and elevated volatility, which directly impact global risk appetite. Investors are particularly wary of how macroeconomic indicators and monetary policies might affect overall market stability.

In what way is the cryptocurrency market connected to global risk appetite?

The cryptocurrency market’s performance is closely tied to global risk appetite, especially as assets like Bitcoin behave similarly to high-beta macro assets. Sensitive to interest rate changes and geopolitical developments, cryptocurrencies are currently struggling to gain a foothold as stable investments amid fluctuating market conditions.