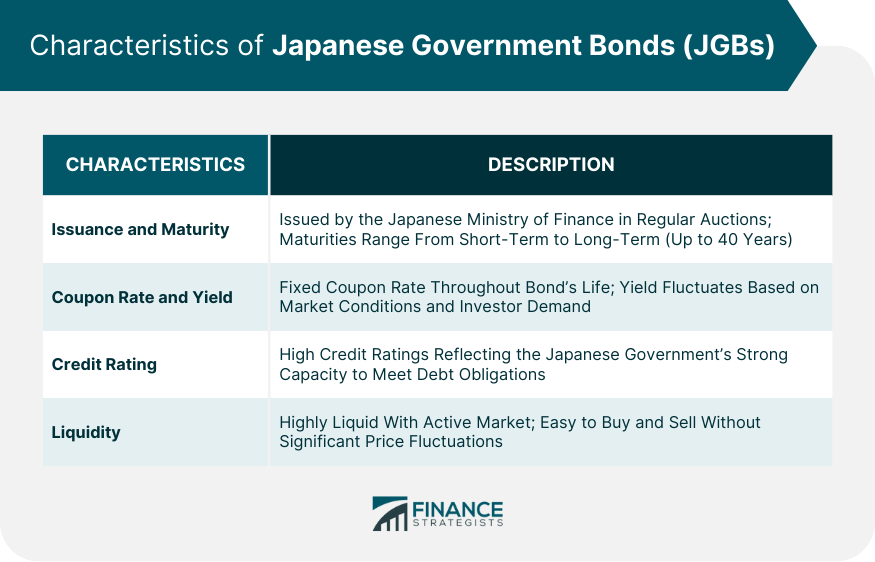

Japanese Government Bonds, commonly known as JGBs, play a crucial role in Japan’s financial landscape, influencing both domestic and international investment strategies. Recently, Japan’s second-largest bank announced plans to substantially increase its JGB holdings, a move that could reshape the bond market significantly. As yields on Japanese government bonds climb, Japanese investors are expected to pivot their investments away from U.S. Treasuries and focus more on their domestic bonds. This shift not only reflects confidence in Japan’s economic stability but also highlights an essential aspect of financing support that Japan offers in the global market. With the evolving landscape of JGBs, investors should monitor these changes closely to determine their impact on investment portfolios and overall financial strategy.

The landscape of Japanese bonds, particularly government-issued securities, is at a pivotal moment as institutional players like Japan’s prominent banking institutions make strategic decisions to enhance their bond portfolios. Following the recent announcements about increased allocations to Japanese Government Bonds, it is evident that domestic markets are gaining traction amongst local investors. This trend suggests a potential recalibration of capital flows, redirecting funds from foreign debt instruments like U.S. Treasuries back to the homeland. Such dynamics underscore the importance of JGBs in the broader economic context and their function as a stable investment vehicle. As the demand for JGBs rises, it presents intriguing opportunities for market participants who understand the implications of these shifts.

| Key Point | Details |

|---|---|

| Arthur Hayes’ Statement | Japan’s second-largest bank plans to significantly increase its holdings of Japanese Government Bonds (JGB) after yield fluctuations end. |

| Impact of Rising Yields | As JGB yields rise, Japanese investors may prefer the domestic market over U.S. Treasuries. |

| Funding and Investment Trends | This shift will impact Japan’s financing capabilities, potentially affecting support for ‘Pax Americana’. |

Summary

Japanese Government Bonds are becoming increasingly attractive as local yields rise, prompting Japan’s second-largest bank to increase its holdings. This trend indicates a potential shift of investment away from U.S. Treasuries towards domestic options, reflecting a change in investor behavior driven by yield dynamics. The implications of this shift underscore the importance of monitoring Japanese Government Bonds for future investment strategies.

The Rise of Japanese Government Bonds Post-Yield Fluctuations

Japan’s second-largest bank is poised to boost its investments in Japanese Government Bonds (JGB) as yield fluctuations stabilize. This strategic move comes at a time when government bond yields are on the rise, indicating a robust shift in investor sentiment. As yields increase, Japanese investors are expected to divert their funds toward domestic JGBs, favoring local investments over foreign options such as U.S. Treasuries. This change reflects growing confidence in the Japanese economy, encouraging financial institutions to capitalize on JGBs as a safer and more rewarding investment.

The increased holdings of JGBs by major banks can lead to greater stability in Japan’s financial markets. As liquidity improves and interest in domestic bonds rises, the risk of capital flight to foreign investments decreases. Furthermore, with more capital being allocated to JGBs, the Japanese government can maintain robust financing support necessary for its domestic initiatives, enhancing the overall economic landscape in Japan. This trend signals a pivotal moment for Japanese Government Bonds, highlighting their crucial role amid shifting market dynamics.

Impact of Rising Yields on Investment Strategies

As Japanese government bond yields rise, the strategies of both institutional and individual investors are likely to evolve. A notable trend is that investors who previously favored U.S. Treasuries might reconsider their allocation, gravitating towards the stability and potential returns offered by JGBs. The attraction of Japanese Government Bonds becomes even more appealing with the diminishing volatility in their yields, allowing investors to anticipate more predictable income streams. Analysts expect this shift will lead to a rebalancing of portfolios, emphasizing the importance of domestic bonds in securing investor confidence.

Moreover, the recalibration of investment strategies can stimulate Japan’s economy by ensuring that funds remain within the local market. Increased investments in JGBs not only provide necessary financial support for government initiatives but also foster investor loyalty to the Japanese financial system. As domestic investors become more committed to JGB holdings, this may enhance Japan’s overall financial stability, enabling it to mitigate potential external economic shocks effectively.

The Role of Japanese Investors in Shaping Financial Markets

Japanese investors play a pivotal role in the shaping of financial markets, particularly through their significant influence on the demand for Japanese Government Bonds. As domestic investors adjust their strategies in response to rising yields, their preferences will profoundly impact market dynamics. Should confidence in JGBs continue to grow, it could lead to heightened competition among financial institutions vying for a share of the domestic bond market. This shift would not only solidify the status of JGBs but also bolster their importance in the global investment landscape.

Moreover, the increasing allocations to JGBs highlight a trend wherein Japanese investors prioritize security and stable returns. This behavior illustrates a broader understanding of risk management within financial portfolios, particularly in turbulent economic climates. By committing resources to Japanese Government Bonds instead of U.S. Treasuries, these investors are signaling a strong belief in the resilience of the Japanese economy and its financial instruments.

The Implications for U.S. Treasuries and Global Markets

The shift in investment from U.S. Treasuries to Japanese Government Bonds has significant implications for global markets. As Japanese investors funnel more capital into JGBs, the demand for U.S. Treasuries could wane, leading to potential fluctuations in their yield. This shift may also provoke reactions from other global investors who typically look to Japan’s bond market as an indicator of stability and investment attractiveness. As the landscape of international finance evolves, this could mark a pivotal shift in capital flows worldwide.

Furthermore, the U.S. Treasury market might experience a ripple effect from Japan’s increased focus on domestic bonds. If Japanese investors increasingly perceive JGBs as offering better value, it may prompt other international players to reconsider their investment strategies as well. This diversification away from U.S. assets could influence global interest rates and overall investment strategies, potentially leading to tighter financial conditions for the U.S. economy as foreign demand wanes.

Financing Support and Economic Stability in Japan

The potential increase in JGB holdings by Japan’s second-largest bank is crucial for enhancing the country’s financing support. By investing more in domestic bonds, financial institutions can directly support government projects, infrastructure developments, and various economic initiatives aimed at revitalizing Japan’s economy. This financing support is fundamental for ensuring the continuity of government programs and maintaining public confidence in the financial system, especially in post-pandemic recovery phases.

Moreover, the robust demand for JGBs reinforces economic stability, which is essential for Japan’s long-term growth trajectory. By securing adequate funding through increased bond sales, Japan can pursue aggressive fiscal policies that may lead to increased employment opportunities, infrastructure investments, and overall economic development. This dynamic not only protects the domestic economy from external shocks but also demonstrates the resilience of Japan’s financial strategies in a globally interconnected marketplace.

Understanding Japan’s Second-Largest Bank’s Role

Japan’s second-largest bank plays a significant role in the country’s financial landscape, particularly concerning its investments in Japanese Government Bonds. By increasing JGB holdings, the bank not only bolsters its portfolio but also contributes to Japan’s broader economic stability. The bank’s actions can serve as a benchmark for other financial institutions, illustrating the growing importance of domestic bonds in an era of fluctuating yields and economic uncertainties.

The decision by Japan’s second-largest bank to pivot towards JGBs reflects a strategic approach to capital allocation that prioritizes stability and long-term gains. This move not only meets the bank’s investment objectives but also reassures stakeholders and investors of its commitment to supporting Japan’s economy. By effectively utilizing JGBs, the bank can enhance its role as a cornerstone of financial stability, ensuring that domestic capital remains robust in the face of global competition.

Market Sentiment Towards Japanese Government Bonds

Market sentiment towards Japanese Government Bonds has been evolving, especially amidst rising yields. A stabilizing bond market can lead to revitalized investor confidence, prompting both domestic and international investors to reassess their positions on JGBs. As bonds exhibit less volatility, investors are more likely to perceive these instruments as viable avenues for long-term asset growth and as safe-haven options in turbulent times.

Furthermore, as Japanese investors increasingly favor JGBs over U.S. Treasuries, this sentiment could catalyze a broader shift in how global investors approach the Japanese market. The perception of JGBs as dependable and predictable can attract a wave of institutional investment, enhancing the liquidity and depth of the bond market. Therefore, understanding market sentiment is crucial for recognizing trends and predicting future movements in JGB holdings and overall financial stability in Japan.

The Global Context of Japan’s Bond Market

Japan’s bond market operates within a complex global context influenced by various external factors, including international interest rates, geopolitical events, and macroeconomic policies. As Japanese Government Bonds gain traction among local investors, the country’s financial system may strengthen its position relative to other markets. Investors around the globe often regard Japan’s JGBs as a benchmark, thus influencing market reactions and expectations concerning bond yields worldwide.

Additionally, the interplay between Japanese bonds and U.S. Treasuries serves as a focal point in global financial discussions. As capital shifts towards JGBs, questions arise about the implications for U.S. interest rates and the corresponding effects on global liquidity. Studying Japan’s bond market in this larger context is essential for understanding the broader ramifications of Japan’s evolving economic landscape and the future trajectory of international investment strategies.

Frequently Asked Questions

What are Japanese Government Bonds (JGB) and who invests in them?

Japanese Government Bonds (JGB) are debt securities issued by the Government of Japan to finance public expenditure. Primarily, Japanese investors, such as individuals and financial institutions, invest in JGBs, viewing them as safe and secure investment options. Recently, Japan’s second-largest bank has indicated a significant increase in JGB holdings, reflecting a strong domestic appetite for these bonds.

How do Japanese Government Bonds (JGB) compare to U.S. Treasuries?

Japanese Government Bonds (JGB) and U.S. Treasuries are both government-issued debt instruments. While JGBs are primarily held by domestic investors, U.S. Treasuries attract a global investor base. As Japanese government bond yields rise, analysts suggest that Japanese investors may prefer JGBs over U.S. Treasuries, impacting capital flows and international financing dynamics.

What impact do rising yields on Japanese Government Bonds (JGB) have on Japanese investors?

Rising yields on Japanese Government Bonds (JGB) can influence Japanese investors’ behavior by making these bonds more attractive due to potentially higher returns. As JGB yields increase, there may be a shift in investment strategies, with Japanese investors redirecting their funds from U.S. Treasuries back to the domestic JGB market, which could strengthen the domestic economy.

Why is financing support from Japanese Government Bonds (JGB) important?

Financing support from Japanese Government Bonds (JGB) is crucial for maintaining Japan’s economic stability and ensuring that the government can fund essential services and infrastructure projects. As Japan’s second-largest bank plans to increase its JGB holdings, the ability to finance public expenditures through JGBs plays a vital role in supporting Japan’s economic framework, especially in global contexts like ‘Pax Americana’.

What recent changes have occurred regarding Japanese Government Bonds (JGB) holdings?

Recent statements indicate that Japan’s second-largest bank is set to significantly boost its holdings of Japanese Government Bonds (JGB) following fluctuations in yields. This move reflects a strategic shift towards increasing domestic investments, with expectations that higher JGB yields will encourage more Japanese investors to favor local bonds instead of U.S. Treasuries.