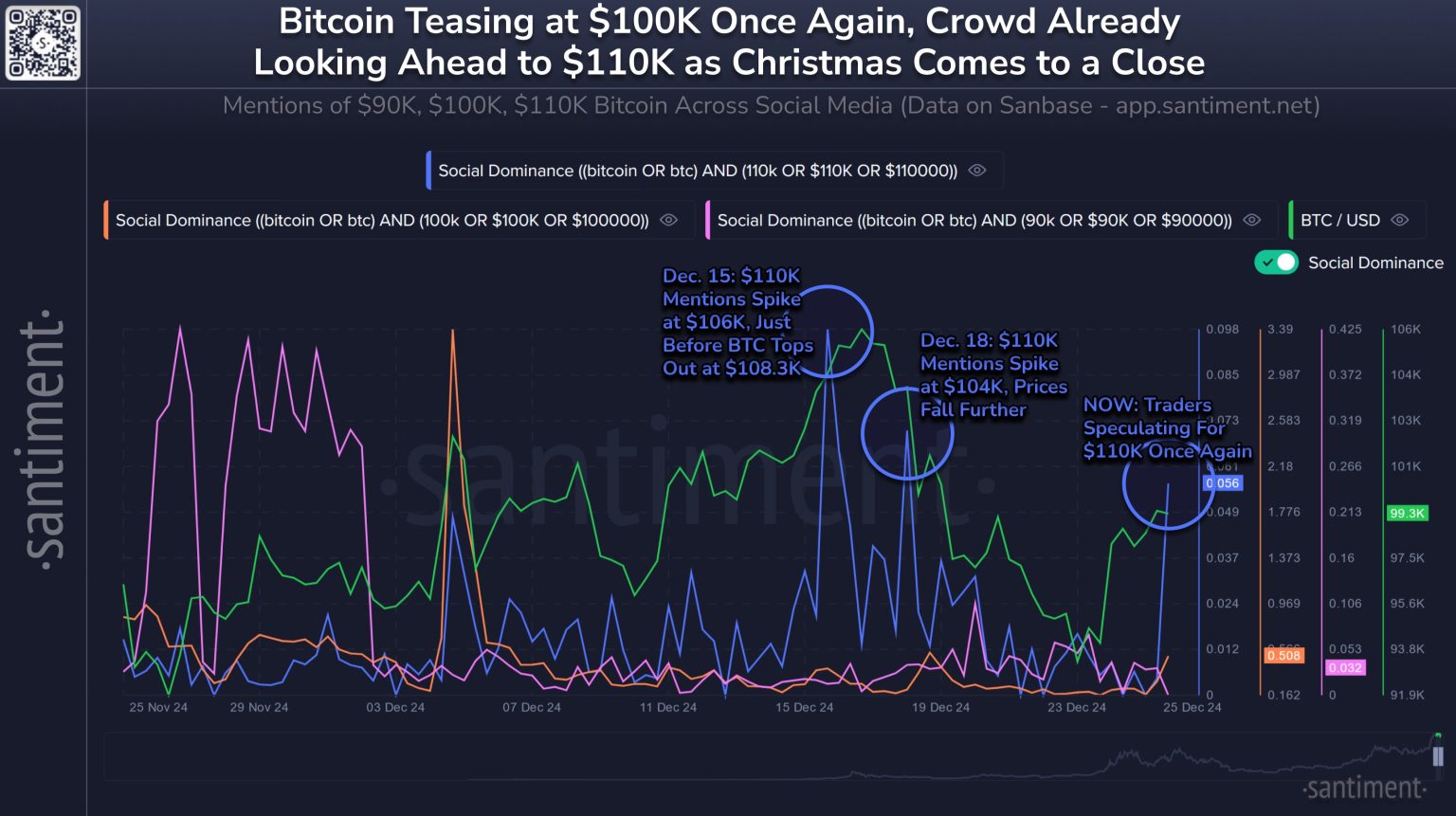

Bitcoin social media sentiment has taken a notable nosedive in 2025, despite the cryptocurrency reaching unprecedented price levels. As revealed by recent data, discussions surrounding Bitcoin on platforms like X have decreased by about a third, prompting many analysts to reevaluate Bitcoin’s market dynamics. This decline in Bitcoin online discussions contrasts sharply with the bullish price trends observed earlier in the year, spurred by significant events in the political landscape. With Bitcoin’s price fluctuating dramatically, market analysis now seeks to understand how social sentiment impacts future valuation and community engagement. As interest wanes, the Bitcoin community must navigate the complexities of engagement and sentiment to sustain momentum in an increasingly cautious market.

The evolving landscape of Bitcoin discourse in online forums is a compelling area of interest, especially following the recent downturn in public engagement. Despite achieving remarkable price milestones, conversations about cryptocurrencies like Bitcoin have witnessed a steep decline, raising questions about community activity and investment sentiment. This phenomenon, marked by diminished participation in Bitcoin dialogues, highlights a potential shift in how enthusiasts and investors perceive the market. Observations around Bitcoin’s price fluctuations and corresponding social media metrics underline the intricate relationship between market sentiment and community interactions. As we delve into these alternative expressions of Bitcoin discussions, understanding how they influence both individual and collective investment strategies becomes crucial.

| Key Point | Details |

|---|---|

| Decrease in Posts | Bitcoin posts on X dropped by 32% in 2025, totaling 96 million. |

| Search Trends | Search interest for Bitcoin declined after a spike in late 2024, with only modest increases in mid-2025. |

| Notable Events | Peak posts occurred with Trump’s inauguration and the announcement of a Strategic Bitcoin Reserve. |

| Leading Advocates’ Activity | Prominent figures like Michael Saylor and Adam Back continued to post positively about Bitcoin. |

| General Sentiment | Overall crypto sentiment remained low into 2026 despite Bitcoin price fluctuations. |

| Fear & Greed Index | Index stayed in fear zones even as Bitcoin’s price rose, indicating a bearish outlook. |

Summary

Bitcoin social media sentiment has seen a notable decline in 2025, with a significant drop in discussions and posts across various platforms despite price records. This decline suggests a disconnection between market performance and public interest, highlighting potential concerns among investors as the sentiment remains largely bearish heading into 2026. The ongoing analysis of social media activity around Bitcoin indicates a need for better understanding of market dynamics and investor psychology.

The Decrease in Bitcoin Social Media Sentiment

In 2025, Bitcoin’s social media sentiment saw a significant decline, with many users expressing reduced engagement across platforms. According to data shared by Jameson Lopp, the volume of posts featuring the term ‘Bitcoin’ on X dropped by 32%, indicating a waning interest among enthusiasts and casual users alike. This decline occurred despite Bitcoin reaching new record prices, showcasing a disconnection between market performance and community engagement. Increased competition from alternative digital assets may also contribute to this sentiment shift, as traders and investors explore emerging opportunities beyond Bitcoin.

Furthermore, even amidst notable price peaks, social discourse around Bitcoin has struggled to maintain momentum. As the cryptocurrency approached new highs of $126,080 in early October, sentiment remained low, reflecting a cautious approach from the community. The trend highlights a critical aspect of market psychology: while price rallies can generate interest, they do not always translate into active engagement and discussions. This underlines the necessity for Bitcoin advocates to rekindle social media conversations to reignite community enthusiasm and attract new participants.

Frequently Asked Questions

What does the decline in Bitcoin social media sentiment indicate for future price trends?

The decline in Bitcoin social media sentiment in 2025, alongside decreasing online discussions, suggests potential caution among investors. Historically, lower engagement on social media can correlate with less market enthusiasm, possibly impacting Bitcoin price trends negatively. Monitoring shifts in social media sentiment can provide early insights into upcoming market movements.

How have Bitcoin online discussions influenced market analysis in 2025?

Bitcoin online discussions have shown a marked decline in 2025, which directly influences market analysis by indicating a waning interest among participants. The notably high activity following significant events, such as Trump’s inauguration, contrasts the overall downward trend in discussions, highlighting that sustained engagement is crucial for positive market sentiment and subsequent price movements.

What is the significance of Bitcoin’s search decline among investors?

The search decline for Bitcoin in 2025, evidenced by lower Google Trends data, suggests a reduction in curiosity and potential investment from new participants. This decline can affect market liquidity and overall confidence, indicating that investor interest might be fading even amidst record prices.

How does Bitcoin community engagement impact market stability?

High Bitcoin community engagement typically fosters a stable market environment, with active discussions driving positive sentiment. However, the drop in engagement observed in 2025 could signify increased volatility, as lower community participation often leads to reduced buy support during price fluctuations.

Can Bitcoin price trends influence social media sentiment?

Yes, Bitcoin price trends can significantly influence social media sentiment. As prices rise, social media discussions often reflect heightened optimism, while price drops tend to generate fear and skepticism. In 2025, despite an initial price surge, negative sentiment dominated social media discussions, highlighting how sharply falling prices can dampen enthusiasm.

What role did key influencers play in Bitcoin’s social media sentiment in 2025?

Key influencers like Michael Saylor and Adam Back played a pivotal role in shaping Bitcoin’s social media sentiment in 2025, with their frequent positive posts counterbalancing the broader decline. Their engagement likely helped maintain some level of confidence within the community, even as overall discussions decreased.

How is social sentiment around Bitcoin expected to evolve in 2026?

While Bitcoin’s social sentiment has been bearish entering 2026, recent analytics show a potential shift as short-term confidence starts to improve. As the Fear & Greed Index indicates potential recovery signs, we may see a resurgence in positive sentiment and community engagement that could affect market dynamics moving forward.

What are the implications of Bitcoin’s significant events on social media sentiment?

Significant events, such as political developments or major price milestones, often trigger spikes in Bitcoin social media sentiment. The fluctuations noted in early 2025 suggest that these events can temporarily boost interest, but maintaining sustained conversation is crucial for long-term sentiment stability and market performance.