The Pendle staking mechanism, known as sPENDLE, introduces a fresh yet controversial approach to crypto staking within the Pendle Protocol. As users flock to this innovative system, key issues surrounding token entrenchment and incentive disparities have come to light. Current vePENDLE stakers enjoy remarkable annualized yields, reaching up to 24%, thanks to significant bonuses that vastly outshine the modest returns available to new participants—often capped at just 7%. This stark disparity raises concerns about the long-term viability of attracting new stakers if the yields remain unattractive. To ensure the sustainability of Pendle’s ecosystem, it will be crucial to enhance its revenue streams through platform upgrades like Boros and Pendle V2, ultimately driving better cryptocurrency incentives for all users, regardless of their staking approach.

Introducing Pendle’s new liquid staking initiative, sPENDLE, marks a pivotal shift in the way users engage with cryptocurrency rewards. This staking model, which seeks to replace the older vePENDLE system, aims to streamline the staking experience while addressing lingering issues related to incentive distribution and user participation. Although sPENDLE promises a more accessible staking experience, the current yields for newcomers remain significantly lower than those enjoyed by long-term vePENDLE holders. The disparity between these two staking methodologies underscores the urgent need for Pendle to optimize its protocol to boost overall staking yields and ensure a balanced ecosystem. To fully realize the potential of sPENDLE, it will be essential to cultivate strong interest among new users through effective strategies that elevate staking incentives and promote long-term engagement.

| Key Point | Details |

|---|---|

| Incentive Imbalance | The new staking mechanism is facing issues with incentive distribution, benefiting existing vePENDLE stakers more than new sPENDLE stakers. |

| Existing Staker Advantages | Current vePENDLE stakers can earn annual returns of 16%-24% thanks to significant multiplier bonuses. |

| New Staker Yields | New stakers in the sPENDLE model can only expect yields of about 5%-7%, which is not attractive enough. |

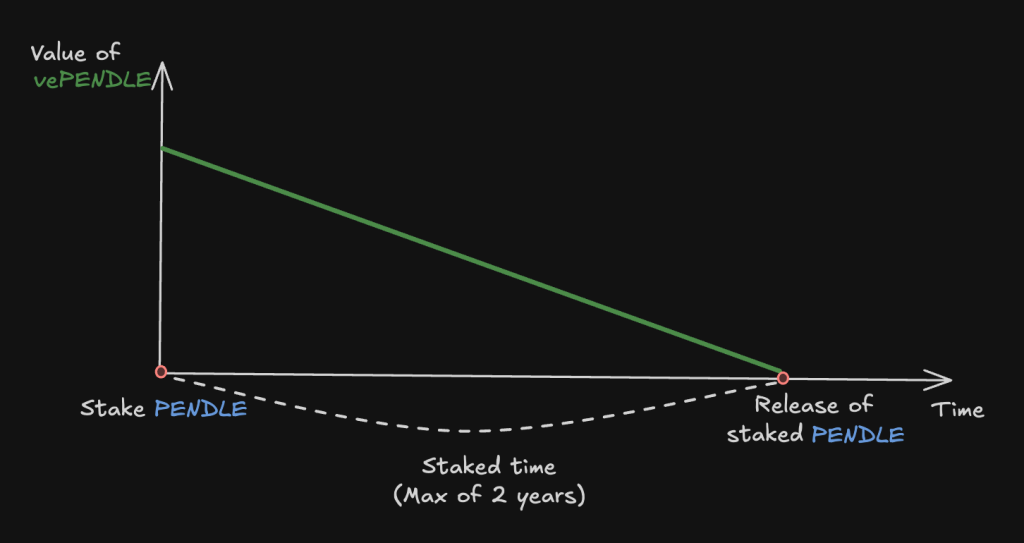

| Lock-up and Yield Structure | The average lock-up period for vePENDLE is 1.54 years, yielding a multiplier bonus of 3.31 times as it unlocks. |

| Impact on Circulating Supply | Without a revision to boost staking yields, the intended reduction in circulating supply may not occur. |

| Future Considerations | The success of the sPENDLE staking mechanism depends on increasing protocol revenue and adjusting yield incentives. |

Summary

The Pendle staking mechanism aims to create a more balanced incentive structure for token holders. However, the current design shows an incentive imbalance that favors existing vePENDLE stakers, resulting in significantly higher yields for them compared to new sPENDLE stakers. To truly achieve its goal of reducing circulating supply, the Pendle staking mechanism must enhance protocol revenue and provide more competitive yields for newcomers.

Understanding the Pendle Staking Mechanism

The Pendle staking mechanism, known as sPENDLE, represents a significant innovation in the world of decentralized finance (DeFi). By replacing the traditional multi-year lock-up model associated with vePENDLE, sPENDLE aims to enhance liquidity and appeal to a broader audience. However, it has been noted that sPENDLE might not effectively achieve “token entrenchment,” a condition desired by many investors to mitigate circulating supply. This issue stems from the imbalance in incentives offered to participants, particularly when comparing new stakers with existing vePENDLE holders.

Currently, vePENDLE stakers enjoy impressive annualized returns, ranging from 16% to 24%, due to substantial multiplier bonuses, as opposed to the significantly lower yields of 5% to 7% available for new sPENDLE stakers. This discrepancy poses a challenge for Pendle, as low yields may not entice enough new stakers to participate in the sPENDLE program. Therefore, the effectiveness of the Pendle staking mechanism will depend not only on generating attractive staking yields but also on the strategic amplification of protocol revenue through upcoming enhancements in the Pendle ecosystem.

The Challenge of Incentive Imbalance in Staking

One of the main challenges faced by Pendle’s staking mechanism is the evident imbalance in incentives, particularly between new and existing participants. The existing vePENDLE holders benefit from a long-term commitment, resulting in higher staking yields that significantly outpace those offered to new users. This uneven distribution of rewards could lead to a stagnation in the influx of new capital into the staking mechanism, as potential users weigh the value of locking up their tokens against the attractive returns experienced by veteran stakeholders.

For the sPENDLE staking to be successful, these incentive structures need to be revised. It’s crucial that Pendle enhances its staking mechanisms to attract new participants by offering competitive yields. This means not only raising yields but also ensuring they provide compelling rewards that justify the risk of staking. Moreover, looking to the future, if Pendle V2 and Boros manage to boost protocol revenue effectively, the overall benefits for sPENDLE holders could see a turnaround, ultimately increasing demand for participation in this novel staking environment.

Exploring Token Entrenchment and Its Implications for Pendle Stakeholders

Token entrenchment is a critical concept within decentralized finance, representing a strategy aimed at reducing the circulating supply of tokens by incentivizing stakeholders to lock their holdings for extended periods. In the case of Pendle, achieving effective token entrenchment through its new sPENDLE staking may contribute to price stability and improved market perception. However, for this strategy to succeed, the incentives must be crafted in a way that genuinely encourages staking over speculation.

If Pendle can overcome the existing barriers to token entrenchment by enhancing yields for new stakers and providing attractive cryptocurrency incentives, it may effectively shift the dynamics of participation within its ecosystem. Stakeholders are increasingly looking for platforms that not only promise stable returns but also offer a pathway towards greater engagement and commitment. Hence, addressing the discrepancies in staking rewards will be essential for Pendle to foster a robust and participatory staking environment.

Anticipating Future Developments in Pendle’s Staking Model

Future developments surrounding Pendle’s staking model are anticipated to be pivotal in resolving the current issues of incentive imbalance. With the launch of sPENDLE, the platform is entering a new era, transitioning from a multi-year lock-up model to a more fluid staking mechanism. It is essential for Pendle to evaluate the implications of this change critically and make necessary adjustments. Enhancements in staking protocols and measures that can genuinely uplift the yields for new stakers will be crucial in attracting individuals who are curious yet cautious about long-term commitments in DeFi projects.

Part of the success of Pendle’s evolving staking model relies on its ability to leverage new technologies and revenue streams through initiatives such as Pendle V2 and Boros. By boosting protocol revenue through smart integrations and user-focused features, Pendle could significantly enhance staking yields, making it an attractive choice for both new and existing participants. Ultimately, the focus should be on creating a balanced ecosystem where all stakeholders feel valued, thereby leading to a more sustainable model for token entrenchment and market stability.

Exploring the Benefits of vePENDLE Staking for Long-Term Investors

For long-term investors, vePENDLE staking presents numerous advantages that enhance both yield potential and community engagement. By committing to vePENDLE, investors secure a position that allows them to benefit from greater annualized returns, capitalizing on the multiplier bonuses associated with extended lock-up periods. This mechanism not only rewards patience but also ensures that investors have a vested interest in the overall health and performance of the Pendle ecosystem.

Moreover, vePENDLE stakers play a crucial role in shaping the governance of the Pendle platform. By holding vePENDLE, investors gain influence over decision-making processes that can directly impact the future of the protocol. This connection fosters a sense of ownership and accountability that often leads to more sustained interest in the project, thereby nurturing a strong community of like-minded individuals committed to the long-term success of Pendle.

Potential Strategies for Increasing Staking Yields in Pendle

To address the imbalance in staking yields that is currently prevalent within Pendle’s ecosystem, various strategies can be deployed. One crucial method is to refine the reward structure to provide more attractive options for new stakers. This could involve creating limited-time yield boosts or phased rewards that gradually increase as users demonstrate commitment through longer lock-up periods. Such measures would appeal to new participants who seek both safety and the opportunity for lucrative returns.

Additionally, transparency in how staking yields are generated and allocated can foster trust and attract a wider audience. By educating potential users about the mechanisms behind staking rewards and how these yields can grow over time, Pendle can entice more investors to consider participatory roles in the ecosystem. Ultimately, enhancing communication and leveraging community feedback about preferences can be powerful tools in realigning Pendle’s staking incentives for better engagement.

Impact of Pendle’s New Mechanisms on Cryptocurrency Markets

Pendle’s introduction of the new staking mechanism sPENDLE may significantly influence broader cryptocurrency market trends. As DeFi continues to mature and evolve, mechanisms that facilitate liquidity and stakeholder engagement are becoming increasingly relevant. Pendle’s attempt to innovate through sPENDLE highlights the ongoing need for projects to adapt and respond to the demands of their user base, offering not only robust staking yields but also a dynamic environment for investment and participation.

As the DeFi landscape becomes more competitive, Pendle’s effectiveness in restructuring its staking options may set a precedent for other platforms dealing with similar challenges in incentive alignment. If Pendle succeeds in attracting a larger pool of participants through improved staking conditions, it could spark a movement among other projects to follow suit, thus reshaping how staking is perceived within the cryptocurrency ecosystem. Therefore, stakeholders should closely monitor Pendle’s developments as they may herald significant shifts in market dynamics.

Conclusion: Navigating Pendle’s Staking Landscape for Sustainable Growth

Navigating Pendle’s staking landscape presents both challenges and opportunities for investors aiming for sustainable growth in the cryptocurrency space. The initial imbalance in incentives observed between vePENDLE and sPENDLE stakers illustrates the complexity of maintaining a healthy staking environment. However, with proactive measures focused on improving yield offerings and aligning incentives appropriately, Pendle has the potential to create a thriving ecosystem that benefits both new entrants and existing holders.

Conclusively, the success of Pendle’s sPENDLE staking mechanism will depend significantly on its ability to adapt to user feedback, enhance yields, and amplify protocol revenue. By ensuring that all participants feel incentivized, Pendle can not only stabilize its ecosystem but also set a benchmark for future DeFi projects seeking to address similar issues in incentive structures. As these developments unfold, stakeholders are encouraged to remain engaged and informed, as this could lead to transformative opportunities in their investment journeys.

Frequently Asked Questions

What is the Pendle staking mechanism and how does sPENDLE work?

The Pendle staking mechanism involves using sPENDLE, a newly launched token that aims to replace the traditional vePENDLE model. sPENDLE allows users to stake their tokens, offering a way to earn rewards and participate in governance. Unlike vePENDLE, which requires a multi-year lock-up, sPENDLE aims to provide more flexibility while incentivizing users to stake their tokens.

How does token entrenchment relate to Pendle’s staking mechanism?

Token entrenchment in Pendle’s staking mechanism refers to the strategy of reducing the circulating supply of the token by incentivizing long-term staking. While sPENDLE was designed to enhance this process, current data suggests that existing vePENDLE stakers receive much higher yields, leading to a potential imbalance in incentives for new stakers.

What are the staking yields associated with Pendle’s vePENDLE staking?

VePENDLE staking currently offers significant staking yields ranging from 16% to 24%, largely due to multiplier bonuses provided to existing stakers. In contrast, new investors staking through sPENDLE can only achieve yields of approximately 5% to 7%, indicating a disparity that may hinder the effectiveness of the new staking mechanism.

Why might Pendle’s staking mechanism face incentive imbalance issues?

Pendle’s staking mechanism may face incentive imbalance issues as the attractive yields for vePENDLE stakers create a situation where new users are less motivated to stake their tokens. As existing users can earn significantly higher returns, the low yields for new stakers fail to attract a sufficient volume, hindering the desired token supply reduction.

What steps must Pendle take to enhance yields in their staking mechanism?

To improve staking yields within the Pendle staking mechanism, the protocol must focus on rapidly increasing revenue through features like Boros and the upcoming Pendle V2. This could help raise overall staking yields and attract new users, ultimately fostering a more balanced incentive structure that encourages participation from both new and existing stakers.

What is the impact of transitioning from vePENDLE staking to sPENDLE on user participation?

The transition from vePENDLE staking to sPENDLE is expected to impact user participation by offering a more liquid option for staking. However, if the incentives don’t align properly—with existing vePENDLE stakers earning higher yields—it may lead to a slower adoption rate for sPENDLE and prevent effective token entrenchment.

How does cryptocurrency incentives play a role in Pendle’s staking mechanism?

Cryptocurrency incentives are crucial in Pendle’s staking mechanism as they drive user behavior and determine participation levels. The current structure, where vePENDLE stakers receive much higher earnings, highlights the importance of aligning these incentives to ensure that new stakers feel encouraged to join the ecosystem and lock their tokens.

What are the expectations for sPENDLE’s impact on Pendle’s overall token supply?

The expectation for sPENDLE’s impact on Pendle’s overall token supply is to reduce circulation through effective token entrenchment. However, if the sPENDLE staking yields remain unattractive compared to vePENDLE, achieving this goal may be challenging without significant protocol revenue enhancements.