In a dramatic turn of events, BTC drops 88,000 USDT, marking a significant downturn for the cryptocurrency market. As of January 20, 2026, Bitcoin is reported at 87,985.1 USDT following a notable 24-hour decline of 5.18%. This Bitcoin price drop has stirred discussions among traders and investors, prompting a thorough BTC market analysis to understand the driving forces behind this sudden plunge. Cryptocurrency news outlets are buzzing with theories ranging from regulatory changes to macroeconomic pressures affecting Bitcoin’s stability. The BTC decline January 2026 highlights the volatility inherent in digital assets, signaling caution for those engaging in Bitcoin USDT trades.

Recently, the cryptocurrency landscape has witnessed a severe setback, with Bitcoin experiencing a plunge below the 88,000 USDT mark. This substantial dip serves as a reminder of the unpredictable nature of digital currencies, particularly as they navigate through fluctuating market conditions. Market analysts are keenly analyzing this Bitcoin downturn, looking to uncover the factors contributing to the current Bitcoin value drop. Investors and enthusiasts alike are absorbing the latest cryptocurrency updates while assessing potential strategies for future engagements. As the BTC market continues to evolve, keeping abreast of such significant events remains critical for anyone involved in this dynamic financial sector.

| Date/Time | Current BTC Price (USDT) | 24-Hour Price Change (%) | Source |

|---|---|---|---|

| 2026-01-20 22:33 | 87,985.1 | -5.18% | Odaily Planet Daily |

Summary

BTC drops 88,000 USDT, marking a significant downturn for the cryptocurrency market. On January 20, 2026, Bitcoin fell below the 88,000 USDT threshold, settling at approximately 87,985.1 USDT, which equates to a 24-hour decline of 5.18%. This decline raises concerns among traders and investors, igniting discussions around market volatility and the economic factors influencing cryptocurrency prices. The downward trend comes amid a backdrop of macroeconomic uncertainties, creating a cautious atmosphere within the trading community.

BTC Drops Below 88,000 USDT: Analyzing the Recent Decline

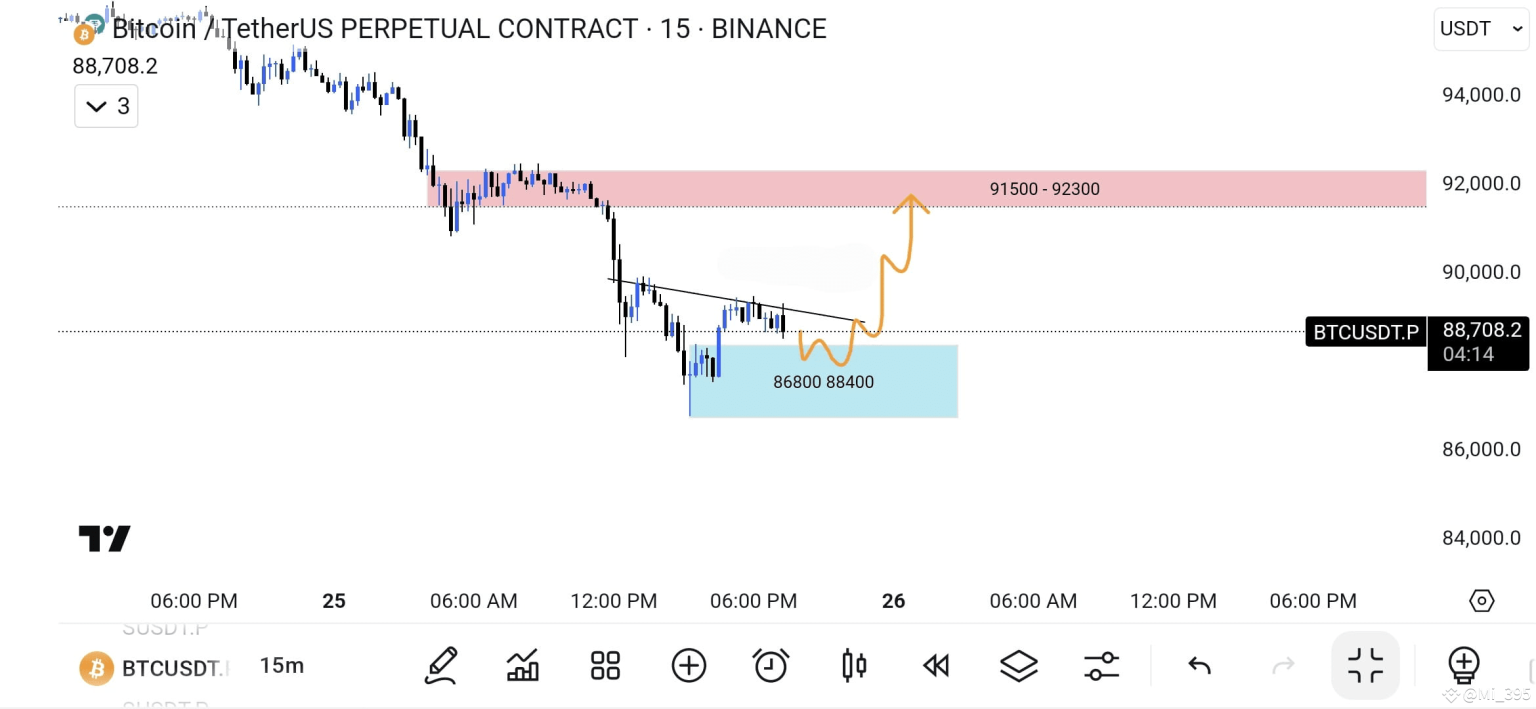

Recent reports indicate that Bitcoin (BTC) has plunged below the critical level of 88,000 USDT, registering a notable decline of 5.18% over the past 24 hours. This significant price drop has sent ripples through the cryptocurrency market, igniting concerns among investors and analysts alike. Historically, such drops can trigger a chain reaction as traders reevaluate their positions and sentiment shifts towards bearish outlooks. As the BTC market analysis continues to unfold, understanding the factors contributing to this decline will be essential for forecasting potential market corrections or recoveries.

In the wake of the BTC drop below 88,000 USDT, it’s imperative to monitor the broader cryptocurrency news landscape. Market fluctuations can often be attributed to varying factors, including macroeconomic data releases, regulatory changes, and trader sentiment. The Bitcoin market, known for its volatility, often reacts sharply to news regarding interest rates, economic growth, and potential changes in legislation that may affect crypto trading. For anyone involved in the cryptocurrency market, staying abreast of these developments is critical.

Understanding the Recent Bitcoin Price Drop: Key Factors at Play

The recent Bitcoin price drop requires investors to delve into the underlying factors driving such steep declines. Analysts suggest that various elements, including market correction tendencies, profit-taking behaviors, and external economic pressures, have contributed to the latest BTC decline in January 2026. As Bitcoin approaches notable support levels, it’s important for traders to consider how market sentiment plays a role in influencing these price movements. Keeping an eye on the BTC market analysis could provide valuable insight into future price trends.

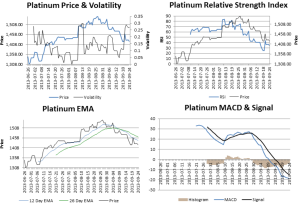

Furthermore, examining technical indicators could reveal significant entry and exit points for traders during this time of volatility. The analysis may include scrutinizing support and resistance levels, moving averages, and trading volumes, which could indicate whether current trends will continue. As BTC prices fluctuate, understanding the foundational elements behind these movements becomes essential for both short-term traders and long-term investors.

Bitcoin USDT News: Global Impacts and Investor Reactions

The implications of BTC falling below 88,000 USDT ripple through various global financial markets, impacting investor perspectives on cryptocurrencies as a whole. Many investors view Bitcoin as a hedge against traditional market uncertainties; therefore, a severe price decline can trigger waves of panic selling. There’s a notable concern about how the crypto market is reacting to macroeconomic conditions, with many speculating if Bitcoin’s role as a safe haven investment is under threat amid an unstable economic landscape.

In terms of investor reactions, the downturn has sparked discussions on trading strategies and risk mitigation tactics. While some investors may choose to adopt a wait-and-see approach amid the Bitcoin USDT news, others may opt to buy the dip, banking on future recoveries. Active participation in discussions about cryptocurrency trading psychology and market dynamics could help traders navigate this turbulent landscape.

The Current State of Crypto: Analyzing BTC Market Sentiment

The current state of the cryptocurrency market reflects mixed sentiment following BTC’s dip below 88,000 USDT. Market sentiment is crucial in determining how BTC will behave in the coming days and weeks, especially after marked volatility. Investors and analysts often rely on sentiment indicators and trading volumes to gauge the mood of the market and predict potential rebounds or further declines. In light of the recent drop, many are conscious of macroeconomic influences that may sway investor confidence.

Cryptocurrency’s nature means that sentiment can shift quickly; thus, continuous monitoring of market news and updates is essential for informed decision-making. The January 2026 BTC decline comes at a time when many analysts report heightened interest in alternative investments and evolving technologies. In understanding this complex sentiment landscape, traders can better position themselves to capitalize on emerging opportunities or protect against deepening losses.

Market Analysis: What’s Next for Bitcoin in 2026?

Market analysis remains critical to forecasting the next steps for Bitcoin following its recent price drop below 88,000 USDT. Analysts are busy dissecting market behavior, economic indicators, and investor sentiment in an effort to predict potential recovery points. The continuous evolution of the cryptocurrency landscape makes it imperative for traders to adapt their strategies accordingly; failure to do so might result in missed opportunities during bullish phases or increased exposure during bearish trends.

Experts suggest that keeping a closer eye on BTC market dynamics alongside external economic factors can prove beneficial. For instance, even slight changes in interest rates or regulatory announcements can significantly influence Bitcoin’s trajectory. Traders are urged to stay engaged with ongoing BTC market analysis and sought-after insights to better navigate the current landscape and make well-informed trading decisions.

Cryptocurrency News: The Effect of Regulatory Changes on BTC Price

In recent months, various regulatory changes have surfaced, prompting discussions on their potential impacts on BTC pricing. Each announcement often creates ripples across the broader cryptocurrency market, especially as investors react to how regulations may influence market activities. The recent BTC decline saw traders become hypersensitive to news regarding proposed regulations on stablecoin earnings and decentralized finance (DeFi), which can further pressure market sentiments.

Keeping abreast of cryptocurrency news and understanding regulatory implications will be paramount for traders aiming to succeed in 2026. A well-informed approach towards navigating these complexities will help investors protect their portfolios and seize emerging opportunities within a changing regulatory landscape. Ongoing engagement with market intelligence offers essential insights for anticipating potential market movements arising from legislative changes.

Navigating Volatility: Tips for Cryptocurrency Investors

Navigating the turbulent waters of cryptocurrency investments, especially during times of volatility like the recent BTC price drop, requires strategic planning and emotional resilience. For many, understanding volatility is key to managing investment risk and capitalizing on potential recovery periods. Traders are encouraged to develop a diversified investment strategy that balances risk by including various asset classes within their portfolios.

Moreover, staying grounded by setting price alerts or employing automatic trading strategies could help investors respond promptly to market fluctuations. In the aftermath of BTC dropping below 88,000 USDT, being prepared with contingency plans will allow traders to minimize losses while potentially reaping rewards from strategic buying opportunities if the market rebounds.

Future Predictions for BTC: What to Watch For

Looking ahead, there are several key indicators and events that cryptocurrency investors should watch for to gain insights into Bitcoin’s future performance. Analysts commonly advise keeping an eye on macroeconomic factors, such as inflation rates and central bank policies, that could influence market behavior. Furthermore, developments in blockchain technology and broader adoption rates of cryptocurrencies in commerce could shape Bitcoin’s trajectory significantly.

As we move further into 2026, it’s critical for investors to stay informed about global trends affecting the cryptocurrency landscape, including potential geopolitical tensions that may arise. Analyzing these forecasts alongside ongoing BTC market analysis can provide a clearer picture of what the future may hold for Bitcoin after its recent decline.

Lessons Learned from BTC’s January Decline

The January 2026 decline in BTC prices serves as a crucial learning opportunity for all cryptocurrency investors. Experiences from such market dips highlight the importance of having a well-defined trading strategy, which includes pre-established thresholds for entry and exit points. Emphasizing the need for due diligence and emotional fortitude, this episode emphasizes how crucial it is to not merely react to market sentiment but to analyze it effectively.

Investors who take the time to learn from these fluctuations can better prepare themselves for future challenges. By studying patterns from past downturns, traders improve their ability to anticipate market movements and respond proactively, allowing for robust portfolio management despite periods of volatility. Understanding the implications of BTC’s drop below 88,000 USDT is just one piece of the vast puzzle that forms the cryptocurrency market.

Frequently Asked Questions

What caused the recent Bitcoin price drop below 88,000 USDT?

The recent Bitcoin price drop below 88,000 USDT is attributed to a variety of market factors including selling pressure, investor sentiment, and broader economic influences. As of January 20, 2026, BTC has experienced a 5.18% decline in the last 24 hours, indicating market volatility.

How does the BTC decline in January 2026 impact cryptocurrency investors?

The BTC decline in January 2026, marked by a drop below 88,000 USDT, can impact cryptocurrency investors by causing panic selling or strategic buying opportunities. Investors need to analyze market trends and potential recovery signs when navigating this decline.

What are the possible future trends for Bitcoin following its drop to 87,985.1 USDT?

Following its drop to 87,985.1 USDT, possible future trends for Bitcoin include a potential recovery rally or continued bearish momentum. Investors should keep updated with cryptocurrency news and market analysis to anticipate BTC performance in the coming weeks.

Is the current BTC market analysis indicating a reversal trend?

The current BTC market analysis, highlighting the significant decline to below 88,000 USDT, suggests a cautious approach. Analysts will watch for key support levels and buying signals that may indicate a reversal trend in Bitcoin’s price.

What are the key factors influencing the Bitcoin USDT exchange rate now?

Key factors influencing the Bitcoin USDT exchange rate currently include market demand and supply dynamics, investor sentiment, macroeconomic news, and regulatory developments affecting the overall cryptocurrency landscape.