| Key Point | Details |

|---|---|

| Analog January Phenomenon | A digital detox movement encouraging less screen time, affecting how people engage with crypto. |

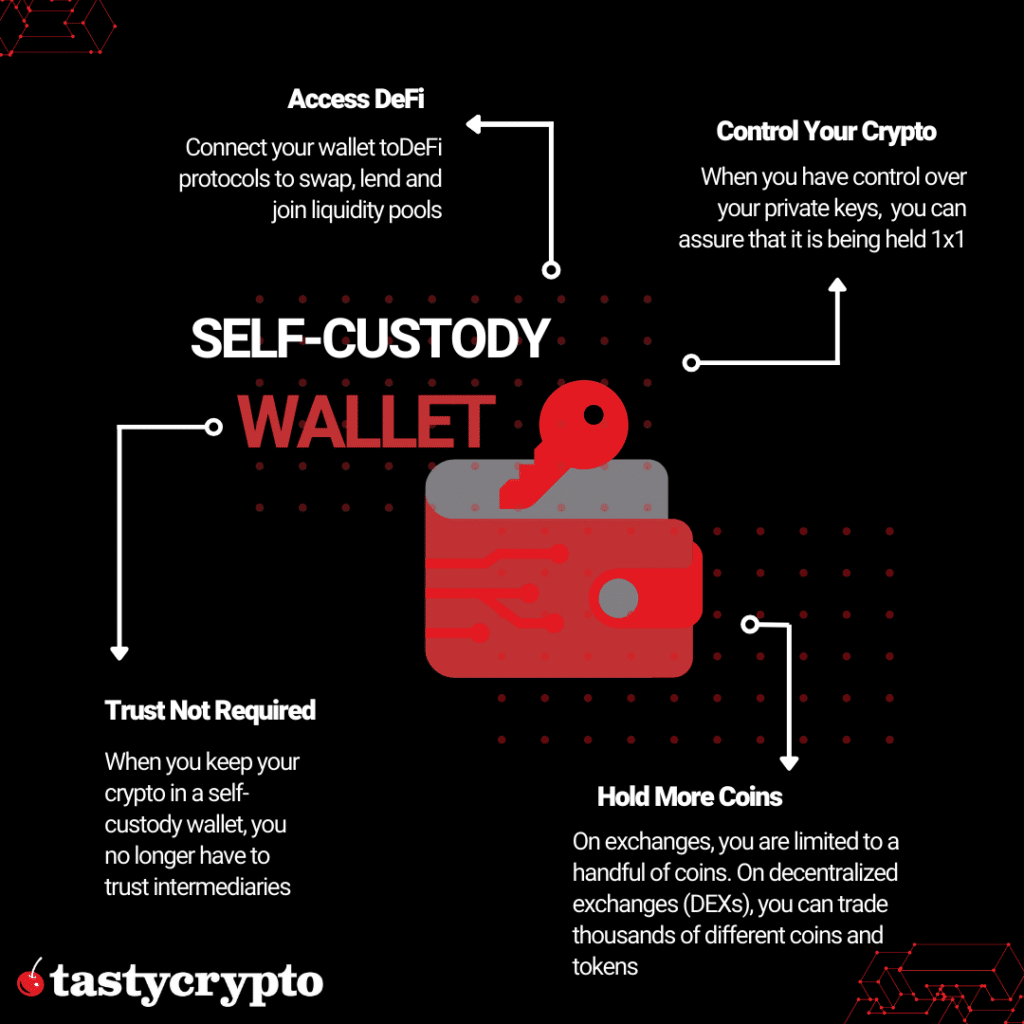

| Self-Custody Growth | With increased volatility and risk in crypto markets, more investors are opting for self-custody of their Bitcoin. |

| Hardware Wallet Demand | The market for hardware wallets is growing significantly, indicating a shift towards secure, offline custody. |

| Security Concerns | Increased hacking incidents and physical threats are prompting users to adopt more secure custody measures. |

| Psychological Shift | The rise of self-custody reflects a broader cultural movement towards offline living and digital minimalism. |

Summary

Bitcoin self-custody has emerged as a crucial way for individuals to take control of their digital assets amid increasing volatility and security concerns. As trends like Analog January prioritize digital detox and reduced screen time, many crypto investors are recognizing the value of self-custody solutions, which allow them to protect their investments while minimizing exposure to online threats. By utilizing hardware wallets and cold storage methods, users not only enhance their security but also align their financial strategies with a growing cultural shift towards simplified, offline living.

Bitcoin self-custody has emerged as a crucial strategy for investors looking to secure their digital assets amidst a changing financial landscape. As the global movement of Analog January encourages a break from constant screen time, individuals are increasingly exploring self-custody solutions to manage their Bitcoin holdings. Emphasizing cold storage methods, such as hardware wallets, allows users to maintain full control over their investments while minimizing exposure to online threats. This cultural shift towards a digital detox is transforming Bitcoin from an asset marked by volatility to a secure, offline investment strategy. By prioritizing self-custody, investors are not only safeguarding their wealth but also adapting to a lifestyle that values privacy and security.

The trend of personal control over digital currencies is gaining momentum, as many investors shift towards decentralized management of their assets. This approach, often referred to as self-management or independent custody, allows individuals to minimize their online engagements while maximizing security through offline methods. With a focus on secure storage options, including physical devices and traditional vaults, more users are recognizing the benefits of maintaining their wealth away from potentially compromised platforms. This evolution in asset management underscores the importance of personal responsibility in safeguarding investments, especially in an era where data breaches and malicious hacks are rampant. As this movement towards minimal digital interaction continues, the concept of self-custody is likely to redefine how cryptocurrency is perceived and utilized.

Understanding Bitcoin Self-Custody in the Age of Digital Detox

Bitcoin self-custody is the practice of securely managing one’s own Bitcoin without reliance on third-party services like exchanges or custodians. As the world embraces movements like ‘Analog January’, which promotes digital detox, the appeal of self-custody has grown significantly. Individuals looking to distance themselves from the constant barrage of digital notifications find solace in managing their own assets offline. This desire to engage less with screens aligns perfectly with the ethos of self-custody, as it encourages individuals to take personal responsibility for their financial security while minimizing exposure to online threats.

Moreover, Bitcoin self-custody offers a tangible sense of ownership that resonates with the principles of digital minimalism. In an era where cyber threats are prevalent, adopting self-custody solutions, such as hardware wallets, ensures a safer way to hold digital assets. Hardware wallets enable users to store their private keys offline in cold storage, effectively removing them from online vulnerabilities. This is especially crucial as the risk of hacking and phishing attempts have escalated, making self-custody an essential practice for individuals prioritizing security and control over their financial future.

The Growing Popularity of Hardware Wallets for Secure Crypto Storage

Hardware wallets are becoming the go-to solution for individuals prioritizing secure storage of their cryptocurrency. These devices operate offline, which significantly reduces the risk of cyber-attacks. With the hardware wallet market projected to expand at a rapid pace, moving from a valuation of $0.56 billion to an anticipated $2.58 billion by 2031, it’s clear that more investors are recognizing the importance of protecting their digital assets. This surge in hardware wallet usage is a direct reflection of the rising concerns surrounding online security and the increasing sophistication of theft tactics, which have even led to real-world violence against crypto holders.

As the functionality of hardware wallets continues to evolve, users are presented with features that enhance not just security but also usability. The ability to create multiple accounts with distinct PIN codes allows cryptocurrency owners to segregate their assets, minimizing risks in the event of a breach or a physical attack. This strategy underscores an important aspect of modern self-custody: it’s not merely about keeping assets secure but also about employing tactical methods to deal with potential threats. Therefore, adopting hardware wallets represents a significant step towards a safer and more autonomous financial landscape.

Why Cold Storage is Essential for Cryptocurrency Safety

Cold storage refers to methods of storing your cryptocurrency offline, rendering it virtually impervious to online threats. As concerns over hacks and digital theft grow, cold storage solutions are becoming an essential component of any serious investor’s strategy. Unlike hot wallets connected to the internet, cold storage methods—such as hardware wallets or paper wallets—provide an additional layer of protection by keeping private keys disconnected from online vulnerabilities. The increasing incidents of hacking have resulted in losses of billions, emphasizing the necessity of moving assets into cold storage to safeguard wealth.

The adoption of cold storage aligns seamlessly with the philosophy of ‘digital detox’, as it encourages investors to step back from the constant monitoring of their assets and instead adopt a long-term perspective. Individuals who participate in initiatives like Analog January are likely to prefer cold storage options that minimize their digital footprint. The practice of moving assets into cold storage not only enhances security but also promotes a mindset focused on thorough investment and financial independence rather than daily market fluctuations.

The Impact of Digital Minimalism on Crypto Custody Practices

The rise of digital minimalism, epitomized by movements like ‘Analog January’, is reshaping the way investors approach their cryptocurrency custody methods. As people strive for a more focused and less digital-dominated lifestyle, many are reevaluating their investment strategies and turning to self-custody solutions. This mindset encourages individuals to take control of their assets by minimizing reliance on online trading platforms and exchanges. By opting for self-custody, investors can embrace a lifestyle that aligns with their values of simplicity and reduced digital consumption.

Furthermore, the emphasis on digital minimalism dovetails with the idea of secure storage methods. The draw towards hardware wallets and cold storage resonates with those looking to disengage from constant information overload while ensuring the safety of their digital assets. As individuals shift their priorities towards balance and mindfulness, the approach to cryptocurrency custody is likely to mirror these changes, prioritizing methods that allow for less digital interaction while maintaining robust security measures.

Embracing Self-Custody Solutions in a Volatile Market

The cryptocurrency market’s inherent volatility prompts investors to seek safer custody solutions for their assets. Self-custody solutions offer a compelling alternative to reliance on exchanges that may be vulnerable to rapid market swings and external attacks. With Bitcoin and other cryptocurrencies increasingly seen as stores of value, the strategy of self-custody enables individuals to safeguard their holdings while weathering market fluctuations. This approach minimizes anxiety associated with price volatility, allowing investors to adopt a long-term view of their investments instead of being constantly drawn into the chaos of daily price determination.

Moreover, adopting self-custody solutions encourages a deeper engagement with one’s investment. Investors must understand the implications of managing their private keys, which fosters a sense of responsibility and knowledge about their holdings. As individuals assess the risk of trusting centralized institutions with their investments, self-custody becomes more attractive, particularly during turbulent market conditions. This shift emphasizes the importance of individual empowerment within the cryptocurrency landscape and the role of self-custody solutions in enhancing financial resilience.

Analyzing the Benefits of a ‘Set-and-Forget’ Custody Approach

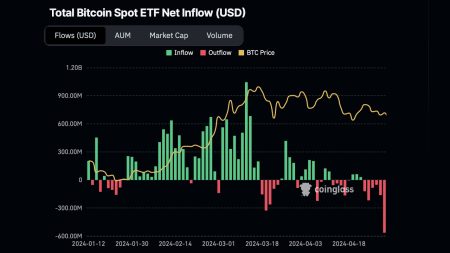

The ‘set-and-forget’ approach to custody refers to the strategy of minimizing active management of investments, often enabled through custodial solutions such as ETFs. However, as the landscape evolves, many investors are questioning whether relinquishing control is the best strategy for their unique circumstances. While conventional ETFs provide convenience, the movement towards self-custody signals a desire for greater sovereignty over one’s digital assets. Investors are increasingly adopting self-custody methods that allow them to set their strategies without the need for perpetual oversight, thereby still enjoying the benefits of a more hands-off investment style.

Ultimately, individuals must balance the convenience of custodial services with the empowerment of self-custody. As the cryptocurrency environment matures, investors are discovering that they can still implement a ‘set-and-forget’ approach while actively managing their own custody solutions. By leveraging cold storage practices and hardware wallets, they can set their strategies, minimizing risks while avoiding the complexities of constant monitoring. This dual approach highlights the flexibility investors now have in navigating the crypto landscape while remaining committed to the principles of financial independence and security.

The Role of Google Trends in Monitoring Custody Behavior Shifts

Google Trends serves as a powerful tool for tracking public sentiment and behavior patterns, particularly in the dynamic world of cryptocurrency. During events like ‘Analog January’, trends can reveal significant shifts in how individuals approach their digital assets, including a surge in interest regarding self-custody solutions. By analyzing search terms associated with digital detox and cold storage, stakeholders can gain insights into evolving investor preferences and behaviors. This real-time data allows for a nuanced understanding of how cultural movements are influencing attitudes toward crypto custody.

Furthermore, leveraging tools like Google Trends can help identify key moments in the financial landscape that spur increased interest in secure storage practices. The rising discussions around digital fatigue can catalyze a more profound conversation about the importance of self-custody and offline strategies. For investors concerned about market volatility and cyber risks, being aware of these trends can drive informed decisions regarding custody methods, ultimately shaping the future of how cryptocurrency is perceived and managed.

Addressing Security Concerns in the Cryptocurrency Landscape

As the cryptocurrency landscape continues to evolve, security has become a paramount concern for investors. With record levels of hacking incidents targeting individual wallets, the demand for secure custody solutions has skyrocketed. The rise of hardware wallets is a direct response to these escalating threats, offering users a way to protect their private keys offline and out of reach from cybercriminals. This proactive approach to security speaks to the wider narrative of digital minimalism—focusing on securing wealth while withdrawing from the constant surveillance of digital platforms.

Investors, particularly high-net-worth individuals, are increasingly adopting advanced security measures to mitigate risks. The phenomenon of $5 wrench attacks, where criminals resort to physical violence to extract cryptocurrency holdings, underscores the need for strategic asset management. Enhanced security features such as multiple PIN codes and the use of separate accounts for different asset classes are vital practices in today’s risk-laden environment. As more people adopt these practices, the conversation around cryptocurrency custody will inevitably evolve to emphasize not only digital strategies but also personal security and operational choices.

The Future of Cryptocurrency Storage: Merging Digital and Analog Practices

As we look towards the future of cryptocurrency storage, the intersection of digital and analog practices is becoming increasingly significant. The preferences emerging from movements like ‘Analog January’ suggest that individuals are not just seeking digital solutions but are also interested in integrating simpler, less technologically reliant methods into their investment strategies. This evolution indicates a broader cultural trend that values personal engagement and responsibility in finance, leading to the anticipated growth of self-custody solutions. Investors are beginning to appreciate the merits of removing their cryptocurrencies from online platforms and placing them in secure offline environments.

This merging of practices also highlights a shift in focus towards resilience and sustainability in asset management. As threats, both digital and physical, continue to manifest, investors are likely to gravitate towards custody options that prioritize security and personal safety. Combining the principles of digital minimalism with advanced storage technologies—like hardware wallets and cold storage—will characterize the future of cryptocurrency management. By embracing these dual strategies, individuals can navigate the complexities of the market while remaining grounded in their values, effectively safeguarding their assets in an ever-evolving digital landscape.

Frequently Asked Questions

What is Bitcoin self-custody and why is it important?

Bitcoin self-custody refers to the practice of individuals managing their own Bitcoin wallets and private keys rather than relying on third-party services like exchanges. This approach is crucial as it enhances security, reduces the risk of hacks or theft, and aligns with the principles of financial sovereignty, allowing users to store their assets safely in hardware wallets or cold storage.

How do hardware wallets improve Bitcoin self-custody?

Hardware wallets are designed to securely store Bitcoin private keys offline, providing a robust self-custody solution. By keeping the keys disconnected from the internet, they significantly lower the risk of hacking, making them an ideal choice for anyone serious about protecting their investments. They are essential tools in the cold storage strategy to enhance security.

What are self-custody solutions for Bitcoin investors?

Self-custody solutions for Bitcoin investors include hardware wallets, cold storage options, and even paper wallets. These methods allow users to control their private keys and reduce exposure to online threats. With the rise of digital detox trends like Analog January, more investors are seeking these solutions to safeguard their crypto assets without the distractions of constant price checking.

Why is cold storage essential for Bitcoin self-custody?

Cold storage is essential for Bitcoin self-custody as it keeps private keys completely offline, protecting them from online hackers and phishing attacks. This method involves storing Bitcoin in hardware wallets or other offline solutions, ensuring that users maintain full control over their assets without the risk associated with connected devices.

What can Bitcoin holders do to protect against theft in self-custody?

To protect against theft while utilizing Bitcoin self-custody, holders should employ hardware wallets with features like multiple accounts and separate PIN codes. This allows users to create distress or honey-pot wallets, distributing their Bitcoin holdings to minimize losses in case of physical attacks or coercion.

How does the trend of digital detox like Analog January impact Bitcoin self-custody?

The trend of digital detox, particularly during initiatives like Analog January, encourages individuals to disconnect from screens and minimize online activities. This shift has led to a growing interest in Bitcoin self-custody as investors seek to manage their assets offline, reducing anxiety around market volatility and fostering a more secure way to hold their investments.

What role do seed phrases play in Bitcoin self-custody?

Seed phrases are crucial for Bitcoin self-custody as they provide a secure method for recovering wallets and accessing funds. Users must keep their seed phrases private and secure, as anyone with access can control the associated Bitcoin. Properly managing these phrases is essential to maintaining the integrity of self-custody solutions.