| Key Point | Details |

|---|---|

| Launch of sPENDLE | Pendle introduces sPENDLE liquid staking, replacing the long-term vePENDLE locking mechanism. |

| Withdrawal Period | The new system reduces the withdrawal period from several years to just 14 days, enhancing user accessibility. |

| Token Features | sPENDLE tokens are transferable and composable, making participation in the system simpler for users. |

| Protocol Adoption | The previous vePENDLE system only attracted approximately 20% of the token supply, indicating low user engagement. |

| Revenue Allocation | Up to 80% of protocol revenue will be allocated for PENDLE buybacks under the new mechanism. |

| Emission Reduction | An algorithmic emission model is expected to reduce emissions by about 30%, improving sustainability. |

| vePENDLE Holder Benefits | Existing vePENDLE holders will get a reward multiplier of up to 4 times based on their remaining locking period. |

Summary

sPENDLE liquid staking signifies a major evolution in Pendle’s approach to DeFi. By moving away from the lengthy vePENDLE locking system, Pendle enhances user accessibility through a much shorter 14-day withdrawal period and offers more flexibility with its new token features. This strategic pivot not only aims to increase user participation but also implements a robust revenue allocation strategy and an emission reduction plan, indicating Pendle’s commitment to sustainability in the DeFi space. As sPENDLE liquid staking unfolds, it has the potential to redefine user engagement and investment returns in the DeFi ecosystem.

The recent launch of sPENDLE liquid staking marks a significant shift in the Pendle DeFi ecosystem, replacing the longstanding vePENDLE locking mechanism that dominated its operations. Designed to enhance user flexibility, sPENDLE reduces the withdrawal period from years to just 14 days, making it much more appealing for investors seeking liquidity. With features that allow for transferable and composable liquid staking tokens, Pendle aims to promote greater participation and engagement from its user base. This innovative approach not only addresses the limitations of the past but also introduces a fresh token emission model that is set to decrease overall emissions by around 30%. By allocating up to 80% of protocol revenue for PENDLE buybacks, the introduction of sPENDLE liquid staking exemplifies the ongoing evolution of decentralized finance innovations.

As the landscape of decentralized finance evolves, Pendle’s introduction of liquid staking alternatives signifies a pivotal moment for token holders. Instead of engaging with the conventional vePENDLE lock-in model, users can now enjoy enhanced liquidity and flexibility with liquid staking tokens. This transformation simplifies the investment process while ensuring that holders benefit from a more dynamic emission structure. By promoting a new era of staking that prioritizes efficiency and revenue utilization, Pendle is not just keeping pace with industry trends but is actively shaping the future of DeFi. With the potential for significant rewards and lowers barriers to entry, this shift opens up a new realm of opportunities for crypto investors.

Understanding the Transition to sPENDLE Liquid Staking

Pendle’s recent launch of the sPENDLE liquid staking token signifies a marked shift in how staking rewards are generated within the DeFi ecosystem. Previously, the vePENDLE locking mechanism required users to commit their tokens for extended durations, often leading to frustration due to limited flexibility. With the sPENDLE system, not only is the withdrawal period drastically reduced from years to just 14 days, but users now also have the ability to transfer and utilize their staking tokens in a more fluid manner, enhancing overall participation.

This transition emphasizes Pendle’s commitment to decentralization and user empowerment, aligning with the latest trends in decentralized finance innovations. The introduction of sPENDLE is expected to attract a broader segment of users by simplifying the staking process and making it more accessible to newcomers in the DeFi space. As a result, this mechanism can potentially enhance liquidity within the Pendle ecosystem, further solidifying its position in a competitive market.

The Advantages of sPENDLE Over vePENDLE

One of the most significant advantages of the sPENDLE liquid staking model is its innovative token emission structure, which aims to optimize rewards for users while minimizing inflationary pressures. By shifting to an algorithmic emission model, the Pendle team projects a reduction in overall token emissions by approximately 30%. This proactive strategy not only aids in maintaining the token’s value but also incentivizes early adopters who transition from the vePENDLE system with multipliers on their rewards.

Additionally, the new model allocates up to 80% of the protocol’s revenue for PENDLE buybacks. Such a robust financial strategy ensures that sPENDLE holders potentially benefit from increased token value over time. Transitioning users will appreciate this focus on sustainability and profitability, especially those who were previously discouraged by long lock-up periods and low participation rates inherent in the vePENDLE model.

Liquidity and Flexibility with Liquid Staking Tokens

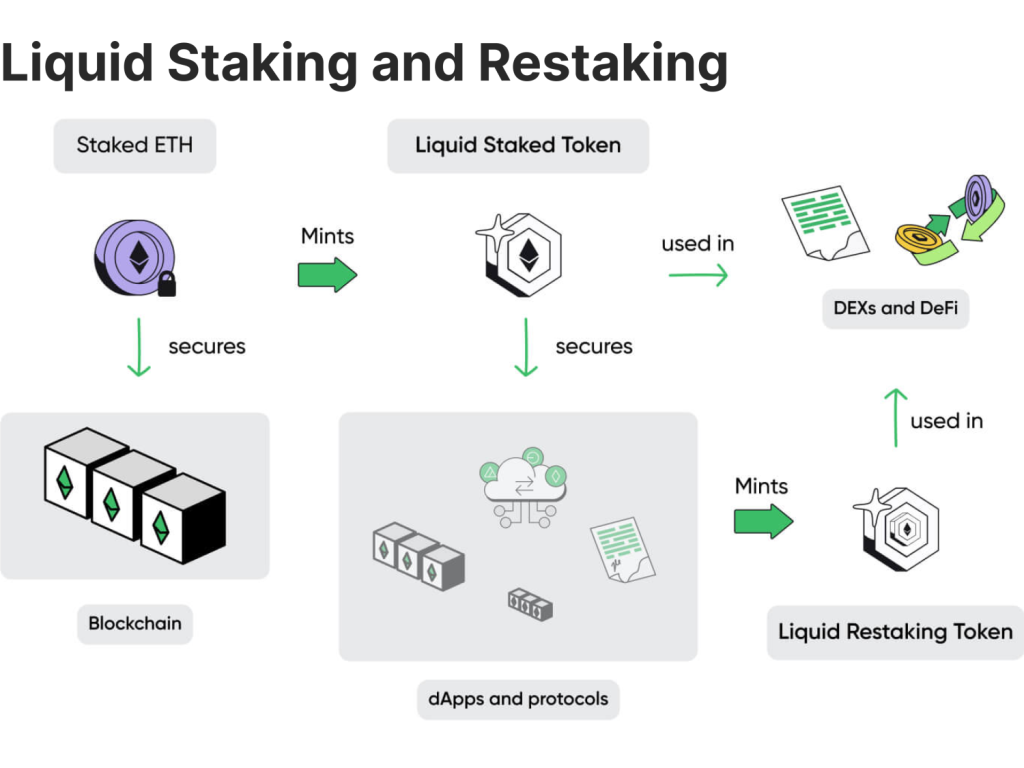

The rise of liquid staking tokens, like Pendle’s sPENDLE, represents a significant evolution in how crypto assets can be managed within DeFi platforms. Traditional staking mechanisms often involve locking up assets with minimal flexibility, leading to capital inefficiencies. By contrast, liquid staking enables users to maintain liquidity while earning yields on their staked tokens, thus allowing for better asset management strategies in fluctuating market conditions.

Moreover, the composable nature of sPENDLE tokens means they can be integrated into various DeFi protocols, enabling users to leverage their staked assets across multiple platforms. This interoperability paves the way for users to explore different yield farming opportunities while still benefiting from the staking process, significantly enhancing overall engagement within the ecosystem. Pendle’s approach is a testament to the growing trend of balancing reward maximization with user flexibility in decentralized finance.

The Importance of Decentralized Finance Innovations

Decentralized finance innovations, such as Pendle’s new sPENDLE liquid staking token, are pivotal in creating a robust and dynamic financial landscape in the crypto space. By offering improved liquidity options and user incentives, Pendle is setting a precedent that aligns with the evolving expectations of DeFi users. The need for flexibility and efficiency in staking mechanisms has never been more critical, as users look for ways to maximize their returns without sacrificing control over their assets.

As the decentralized finance space continues to mature, the demand for innovative solutions that address user pain points will only grow. Pendle’s focus on implementing a more accessible and rewarding staking model is just one example of how projects can stay ahead of the curve. By embracing innovations like sPENDLE, Pendle is not only enhancing its own ecosystem but also contributing to the overall advancement of decentralized finance technology.

How sPENDLE Will Change PENDLE Token Economics

The launch of the sPENDLE liquid staking token is poised to significantly reshape PENDLE’s token economics. With the original vePENDLE system having attracted just 20% of the token supply, the transition to sPENDLE is expected to draw a much larger user base. The proposed buyback allocation of up to 80% of the protocol’s revenue will further reinforce the demand for PENDLE, driving its utility and scarcity within the market.

Moreover, the introduction of a reward multiplier for existing vePENDLE holders reflects Pendle’s strategic focus on community engagement and retention. The gradual decrease in multiplier benefits incentivizes users to adapt quickly while rewarding loyal customers who have supported the ecosystem over the years. This meticulous planning in token economics will not only enhance individual user experiences but also lead to a healthier and more sustainable ecosystem, fostering long-term growth and stability.

The Mechanics Behind the Algorithmic Emission Model

Pendle’s implementation of an algorithmic emission model within the sPENDLE framework is a significant leap in optimizing token supply and maintaining economic stability. This model allows for automated adjustments to token emissions based on real-time market conditions and participation rates, effectively reducing excess supply and protecting token value. With a projected reduction of around 30% in overall emissions, Pendle is proactively addressing concerns around inflation that often plague DeFi projects.

The algorithmic approach not only aligns with advanced economic principles but also instills confidence in users regarding the sustainability of their investments. By utilizing a responsive emission strategy, Pendle seeks to create a balanced ecosystem where token holders can enjoy reliable returns while the protocol maximizes its growth potential. Users can engage with the platform knowing that they are part of a forward-thinking and resilient economic structure.

Rethinking Staking Strategies with sPENDLE

The introduction of sPENDLE has prompted a rethinking of how individuals approach staking strategies in DeFi. With significantly reduced lock-up times and enhanced liquidity options, users can now devise more flexible staking strategies that align with their financial goals. This shift towards short-term commitments allows users to pivot more quickly in response to market movements, optimizing their potential returns.

Moreover, the composable nature of sPENDLE liquid staking tokens means they can be utilized across various DeFi applications, allowing users to participate in yield farming or swap tokens seamlessly. This multifaceted strategy equips investors with the tools they need to maximize their profits while enjoying the benefits associated with liquid staking. As more users recognize these advantages, Pendle is likely to see increased adoption, positioning it as a leader in the DeFi space.

Leveraging Community Engagement with sPENDLE

Community engagement has always been a cornerstone of successful DeFi projects, and Pendle’s transition to the sPENDLE liquid staking token highlights this importance. By rewarding existing vePENDLE holders with significant multipliers, Pendle provides a clear incentive for community members to remain active participants in the ecosystem. This strategy not only fosters loyalty among current users but also attracts newcomers who see tangible rewards for their participation.

Additionally, Pendle’s emphasis on transparency and user feedback during the transition to sPENDLE reinforces the community’s trust in the protocol. By prioritizing user experience and addressing previous pain points in the vePENDLE system, Pendle strengthens its relationship with its user base. As the DeFi landscape continues to evolve, the importance of community support in driving project success cannot be underestimated, and Pendle’s initiatives in this area are integral to its long-term sustainability.

Frequently Asked Questions

What is sPENDLE liquid staking and how does it replace vePENDLE?

sPENDLE liquid staking is a new token offered by Pendle that replaces the long-term vePENDLE locking mechanism. Unlike the previous model that required users to lock their tokens for years, sPENDLE reduces the withdrawal period to just 14 days, making it more flexible for users to participate in the protocol.

How does the sPENDLE token improve upon the existing Pendle DeFi system?

The sPENDLE liquid staking token enhances the Pendle DeFi experience by allowing for transferable and composable tokens, facilitating easier user participation compared to the prior vePENDLE model, which had limited accessibility due to its lengthy locking period.

What benefits do existing vePENDLE holders receive with the launch of sPENDLE?

Existing vePENDLE holders will benefit from a reward multiplier of up to 4 times based on their remaining locking period, which provides an incentive to transition to the new sPENDLE liquid staking model, helping enhance their overall earning potential in the Pendle ecosystem.

What changes does sPENDLE bring to the token emission model in Pendle DeFi?

The introduction of the sPENDLE liquid staking token comes with an algorithmic emission model that is designed to reduce overall emissions by approximately 30%. This new approach aims to create a more sustainable and efficient token emission strategy within Pendle’s DeFi framework.

How does Pendle plan to use the protocol revenue generated from sPENDLE liquid staking?

With the launch of sPENDLE, Pendle intends to allocate up to 80% of the protocol revenue for PENDLE buybacks. This strategic use of revenue aims to enhance the value of the sPENDLE token and reward its holders effectively.