| Key Point | Details |

|---|---|

| One-Bank Model | Widely adopted but non-mandatory, this model limits small exchanges’ access to banking. |

| Regulatory Review | Top regulators are evaluating the one-to-one exchange-bank practice that may hinder competition. |

| Impact on Smaller Exchanges | Exclusive banking partnerships create high barriers for new entrants, reinforcing dominance of large exchanges. |

| Market Concentration | Trading dominated by a few large platforms, leading to deep liquidity and fewer choices for consumers. |

| Legislative Delays | The Digital Asset Basic Act, expected to overhaul crypto regulations, has been postponed to 2026. |

| Focus on Innovation | Lawmakers aim to balance innovation with safety for financial and non-financial firms. |

Summary

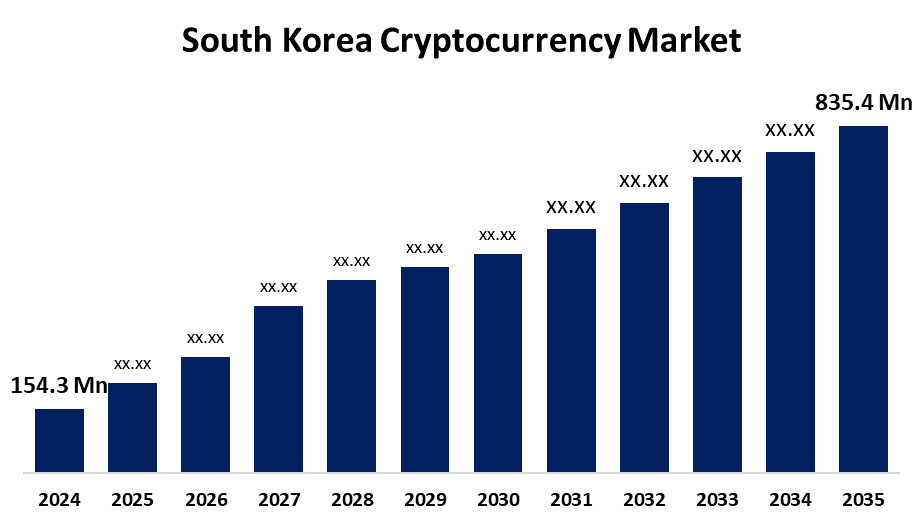

The South Korea crypto market is currently undergoing significant scrutiny as regulators aim to create a fairer environment for all participants. Amid concerns over the dominance of a few large exchanges, there’s a push to review and potentially revise the one-exchange-one-bank model. This could lead to increased opportunities for smaller exchanges, fostering competition and innovation within the market. Legislative changes, including the anticipated Digital Asset Basic Act, are crucial steps that could reshape the regulatory landscape. However, ongoing delays highlight the complexities of regulating this rapidly evolving asset class. Overall, the South Korean crypto market is on the brink of transformation, with regulators looking to enhance fairness and support diverse market players.

The South Korea crypto market is at a pivotal juncture, as regulators strive to establish more equitable conditions for all participants. Amidst the rising prominence of cryptocurrencies, the Financial Services Commission (FSC) is actively assessing current crypto regulations in South Korea, particularly the challenges faced by smaller exchanges due to stringent banking rules. The prevalent model of specifically linking one crypto exchange to a single bank significantly restricts the avenues available for small crypto exchanges, creating barriers that favor larger platforms involved in Korean won trading. As these large exchanges benefit from enhanced liquidity and accessibility, the FSC’s review aims to foster a competitive landscape that encourages diversity among market players. With discussions around the current limitations gaining traction, the future of the South Korean cryptocurrency environment appears poised for transformation, aiming to support innovation while balancing regulatory mandates.

In recent years, the digital currency sector within Korea has experienced significant shifts, compelling authorities to reassess the regulatory framework governing this dynamic market. The continuous evolution of the cryptocurrency ecosystem has prompted the Financial Services Commission to scrutinize the interactions between exchanges and financial institutions, as this relationship is crucial for the expansion of smaller trading platforms. By examining the disparities that arise from exclusive banking partnerships, particularly under the existing one-exchange-one-bank rubric, South Korean lawmakers are looking to enhance competition and inclusivity within the industry. The push for more inclusive practices seeks to dismantle the dominance of leading exchanges that currently uphold a monopolistic hold over Korean won trading, thereby allowing smaller players to thrive. As a result, the potential updates to crypto regulations in South Korea may bring about a flourishing environment that prioritizes both innovation and consumer choice.

Overview of Banking Rules in South Korea

In recent years, South Korea has implemented a range of banking rules aimed at enhancing the stability and integrity of its financial markets. These regulations have particularly impacted the cryptocurrency sector, where the one-exchange-one-bank model has become the norm. This model, while not legally binding, restricts each cryptocurrency exchange to a single banking partner, making it difficult for smaller exchanges to access essential banking services. As a result, the competitive landscape of the South Korean crypto market has become increasingly skewed, favoring larger players who benefit from better liquidity and customer trust.

With the Financial Services Commission and the Fair Trade Commission currently reviewing these banking rules, there is potential for significant reform. Stakeholders argue that the stringent banking requirements create an unlevel playing field, disproportionately disadvantaging smaller exchanges that struggle to establish partnerships with banks. A more flexible regulatory framework would not only encourage fair competition but also provide consumers with a wider array of options, thus fostering innovation and efficiency in the crypto market.

Impact of Crypto Regulations on Smaller Exchanges

The existing crypto regulations in South Korea significantly affect smaller exchanges, often pushing them out of the market due to high entry barriers. These regulations were instituted to enhance financial transparency and risk management but have led to an environment where only a few large exchanges can thrive. Without access to banking services, smaller exchanges find it challenging to operate effectively, limiting their ability to offer Korean won trading and other essential services. This concentration of trading volume in a few major platforms has profound implications for market dynamics, reducing competition and consumer choice.

A detailed examination commissioned by the government reveals that the one-to-one exchange-bank model could be overly restrictive, particularly for newer and smaller players. By enforcing uniform standards for all exchanges regardless of their size and operational capacity, regulators may inadvertently stifle growth and innovation in the crypto sector. Therefore, it is crucial for regulators to assess and potentially revise these crypto regulations to create a more inclusive framework that supports the participation of diverse market players.

Liquidity Challenges in the South Korean Crypto Market

Liquidity remains a key challenge in the South Korean crypto market, particularly for smaller exchanges. The dominate market presence of a few large platforms creates a scenario where deeper liquidity is concentrated, leading to faster transaction times and a more appealing trading environment for users. As a result, consumers are drawn to these established platforms, perpetuating a cycle of dominance that further sidelines smaller exchanges. Not only does this hinder competitive fairness, but it also curtails innovation due to a lack of diverse market offerings.

The struggles smaller exchanges face to secure banking relationships severely limit their ability to introduce competitive features, such as unique trading pairs or user incentives. This liquidity gap ultimately discourages new entrants from participating in the market, stifling the development of a robust and dynamic cryptocurrency ecosystem. For the South Korean crypto sector to maintain its global relevance, measures must be taken to lower these barriers and promote equitable access to banking and trading facilities.

Future of Crypto Regulations in South Korea

The future of crypto regulations in South Korea is currently in a state of flux, particularly with the ongoing review of the banking ties between crypto exchanges and financial institutions. The impending Digital Asset Basic Act, once expected to bring substantial regulatory change, has experienced delays, moving its anticipated submission from 2023 to 2026. This bill has the potential to reshape the landscape for digital assets, aiming to introduce stablecoins backed by the Korean won, along with clear guidelines for their issuance and management.

As regulators deliberate on these changes, one of the central concerns is balancing innovation with safety. The Financial Services Commission’s commitment to enabling both financial and non-financial companies to engage in the crypto space points to a forward-thinking approach. However, it is vital that these efforts do not compromise the necessary regulatory protections put in place to ensure market stability and consumer protection. Therefore, the ultimate success of South Korea’s crypto regulations will hinge on their ability to adapt to an evolving landscape while fostering competition and innovation.

The Role of Financial Services Commission in Crypto Regulation

The Financial Services Commission (FSC) plays a pivotal role in shaping the direction of crypto regulation in South Korea. Its responsibilities extend to overseeing the entire financial system, including the emerging crypto market. In recent years, the FSC has been particularly focused on ensuring that regulations for cryptocurrency exchanges are robust and capable of preventing financial malpractice, such as money laundering through strict compliance requirements. However, critics argue that the commission’s stringent measures disproportionately benefit larger firms while disadvantaging smaller competitors that are struggling to comply.

The FSC’s recent initiatives to review banking rules for cryptocurrency exchanges signify a recognition of these issues. By examining the existing one-exchange-one-bank model and its implications for market competition, the FSC is positioning itself to foster a more inclusive regulatory environment. Moving forward, it will be crucial for the FSC to balance its regulatory objectives effectively, promoting a fair crypto landscape that encourages innovation while safeguarding the financial system against potential risks.

Challenges with Banking Partnerships for Crypto Exchanges

Building banking partnerships is one of the foremost challenges cryptocurrency exchanges face in South Korea. The reliance on a single bank for operations limits exchanges’ abilities to offer services, including Korean won trading, which is essential for attracting users. Most smaller exchanges lack the resources and leverage to negotiate advantageous banking relationships, further cementing the industry’s barriers to entry. Consequently, the restrictive banking model creates significant hurdles for newer players aiming to capture market share.

Furthermore, these challenges arise amidst increasing scrutiny from regulators focused on transparency and financial stability. While efforts to combat illicit activities in the crypto market are important, they have inadvertently resulted in a system that favors well-established exchanges. For the South Korean crypto market to thrive long-term, collaborative measures between regulators and banks must be established to provide more equitable access to financial services for all market participants.

The Influence of Small Crypto Exchanges in South Korea

Despite the challenges they face, small crypto exchanges play an important role in diversifying the South Korean cryptocurrency landscape. They often cater to niche markets and provide unique services that larger platforms may overlook. By offering alternative tokens and user-friendly experiences, smaller exchanges can foster innovation and competition, driving the overall growth of the crypto market. Moreover, their presence encourages a variety of trading options within the ecosystem, appealing to different segments of the cryptocurrency audience.

However, the ongoing banking restrictions and the dominant position of larger exchanges limit their impact. Policymakers must recognize the value smaller exchanges bring to the market and implement more inclusive regulatory measures that enable their growth and sustainability. By supporting a broader range of exchanges, the South Korean crypto market can enhance liquidity, foster innovation, and ultimately empower consumers with greater choices.

Anticipated Changes in the Digital Asset Regulatory Framework

As South Korea grapples with the complexities surrounding cryptocurrency regulation, anticipated changes in the digital asset regulatory framework promise to reshape the landscape significantly. The emerging Digital Asset Basic Act is expected to introduce comprehensive guidelines that would not only address stablecoin issuance but also offer clarity around the operational requirements for both large and small exchanges. Stakeholders are hopeful that these regulations will promote a healthier and more competitive market conducive to innovation.

However, the delays in implementing these changes raise concerns about the readiness of the South Korean crypto market to adapt to future regulatory demands. Ongoing dialogues among regulators, financial institutions, and market participants will be critical in ensuring that newly proposed laws align with the realities and challenges faced within the industry. Ultimately, achieving a balanced regulatory approach could enhance the overall stability and global competitiveness of the South Korean crypto market.

Supporting Financial Institutions and Crypto Integration

The relationship between financial institutions and cryptocurrency exchanges is crucial for the successful integration of digital assets within the South Korean economy. As regulators like the Financial Services Commission explore possibilities for improvement, fostering collaboration between banks and exchanges could yield beneficial synergies. Such partnerships can facilitate smoother transactions, increase user trust, and provide necessary liquidity to smaller exchanges that struggle in the current banking climate.

Moreover, well-defined guidelines that govern these relationships will support the regulatory framework, enabling banks to safely engage with the crypto sector. As both sectors evolve, it will be essential for financial institutions to develop a deeper understanding of cryptocurrencies and their potential, ensuring that they can effectively cater to the demands and needs of a growing client base interested in digital assets.

Frequently Asked Questions

What are the current crypto regulations in South Korea affecting small exchanges?

South Korea’s crypto regulations heavily influence smaller exchanges, particularly through the one-exchange-one-bank model. This system requires each exchange to partner with a single domestic bank, limiting banking access for smaller platforms and reinforcing the dominance of larger exchanges in the Korean won trading market.

How does the banking rules in South Korea impact cryptocurrency trading?

Banking rules in South Korea, particularly the requirement for exchanges to establish exclusive relationships with banks, critically impact cryptocurrency trading. These regulations create high entry barriers for new and small crypto exchanges by restricting access to essential services such as Korean won deposits and withdrawals, thus favoring larger platforms.

Are there any changes to the one-exchange-one-bank model in the South Korean crypto market?

Regulators in South Korea, including the Financial Services Commission, are reviewing the one-exchange-one-bank model to assess its impact on competition. While not a legal requirement, this practice has become entrenched and may hinder smaller exchanges from entering the Korean crypto market.

What is the role of the Financial Services Commission in South Korea’s crypto market?

The Financial Services Commission (FSC) plays a pivotal role in regulating the South Korean crypto market. It oversees the coordination between crypto exchanges and banks, examining how these relationships affect competition and market access, particularly for smaller crypto exchanges.

What challenges do small crypto exchanges face in South Korea?

Small crypto exchanges in South Korea face significant challenges, primarily due to stringent banking rules that require them to partner with specific banks. This leads to high entry barriers, limited access to Korean won trading, and an environment where larger exchanges dominate due to better liquidity and customer trust.

What potential changes are expected in South Korea’s crypto regulations?

Anticipated changes in South Korea’s crypto regulations include a potential shift in the exclusive banking partnerships model, as regulators seek to foster a more competitive environment in the crypto market. Risks associated with current regulations may be reassessed to enable better access for smaller exchanges.

How concentrated is the cryptocurrency market in South Korea?

The cryptocurrency market in South Korea is highly concentrated, with a few large exchanges commanding the majority of Korean won trading volume. This concentration limits options for users and creates a cycle where smaller crypto exchanges struggle to gain traction due to liquidity and visibility challenges.

What is the Digital Asset Basic Act and why is it significant?

The Digital Asset Basic Act is a forthcoming legislative change that aims to reshape South Korea’s approach to cryptocurrency regulation, including stablecoin issuance backed by the Korean won. This act is significant as it addresses fundamental regulatory concerns and seeks to promote innovation while ensuring market safety, although its submission has now been postponed to 2026.