| Key Point | Details |

|---|---|

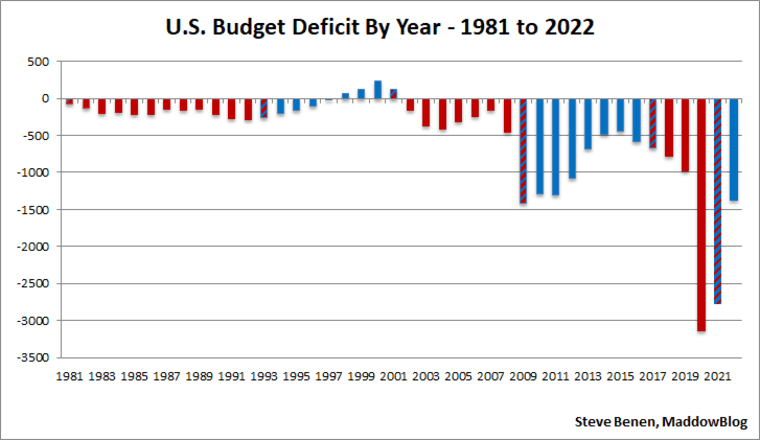

| Objective | Reduce the U.S. deficit to 3% of GDP. |

| Authority | U.S. Treasury Secretary Steven Mnuchin. |

| Timeframe | Before the end of President Trump’s term. |

Summary

U.S. deficit reduction is a critical goal set by Treasury Secretary Mnuchin, who aims to decrease the national deficit to 3% of GDP by the conclusion of President Trump’s term. This initiative underlines the administration’s commitment to fiscal responsibility and sustainable economic growth, addressing both current and future financial challenges faced by the country.

U.S. deficit reduction has emerged as a critical focus for policymakers, especially as the nation grapples with soaring national debt. Transformative deficit reduction strategies are being debated, especially under the guidance of the Trump administration’s economic policies. Treasury Secretary Mnuchin has outlined ambitious plans to scale the deficit down to 3% of GDP by the end of the current presidential term. With the nation’s economic outlook in mind, these efforts may significantly impact fiscal discipline and future growth. Understanding the relationship between GDP and deficit levels is essential as we navigate the complexities of these initiatives.

Efforts to mitigate the national financial imbalance are paramount as discussions around fiscal sustainability take center stage. With a spotlight on reducing the shortfall, policymakers scrutinize various approaches that can effectively curb government overspending. The economic strategies outlined by the current administration, particularly those from Treasury Secretary Mnuchin, aim for a pronounced impact on the nation’s fiscal landscape. By analyzing the interplay between national income and deficit levels, stakeholders can better understand how these measures shape the overall economic forecast for the United States. As the nation anticipates these changes, the importance of sustainable fiscal practices continues to grow.

Understanding U.S. Deficit Reduction Goals

In recent addresses, U.S. Treasury Secretary Mnuchin has emphasized the administration’s commitment to reducing the federal deficit. The goal set is to achieve a deficit that amounts to no more than 3% of the Gross Domestic Product (GDP) by the end of President Trump’s term. This ambitious target reflects an attempt to stabilize the U.S. economy and improve fiscal health, which has garnered attention amid various economic policies implemented by the Trump administration.

To grasp the implications of this deficit reduction goal, it is essential to consider its impact on national and global economic dynamics. A reduced deficit can bolster investor confidence, stabilize interest rates, and enhance the overall economic outlook for the U.S. Furthermore, with strategic deficit reduction strategies, the government aims not only to stabilize debt ratios but also foster sustainable growth that can lead to an increase in GDP over time.

The Role of the Trump Administration in Economic Policies

The Trump administration has implemented various economic policies aimed at fostering growth while managing the national debt. Under Treasury Secretary Mnuchin’s guidance, these policies are designed to stimulate economic activity and curb the deficit simultaneously. This dual approach focuses on fostering a favorable business environment through tax cuts and deregulation, hoping that such measures can lead to increased revenues and ultimately help reduce the deficit as a percentage of GDP.

Critics may argue that the policies endorsed by the Trump administration, including aggressive tax cuts, could exacerbate the deficit in the short term. However, the administration defends these moves by arguing that they are necessary to promote investment and job creation, which in turn will enhance economic growth and improve revenue collections. The ongoing debate surrounding these policies underscores the complexity of managing the nation’s fiscal situation while striving for a robust economic performance.

Evaluating the U.S. Economic Outlook with Deficit Reduction Strategies

In the context of the U.S. economic outlook, it’s crucial to analyze how effective deficit reduction strategies can lead to a more stable financial future. The administration’s focus on spending cuts, alongside potential job growth from economic policies, aims to create a balanced budget in the long run. A strategic approach to decreasing the national deficit not only provides fiscal discipline but also prepares the economy for potential downturns.

Moreover, as the GDP continues to fluctuate in response to domestic and international pressures, maintaining a manageable deficit becomes even more critical. Implementing effective economic strategies is essential to ensure that growth is sustainable and resilient. The interplay between GDP growth, deficit levels, and overall economic policies will largely dictate how the U.S. positions itself in the global market—thus, a keen focus on these factors can inform better policy decisions in the future.

Assessing the Impact of GDP on Deficit Reduction

Gross Domestic Product (GDP) plays a pivotal role in shaping the conversation around U.S. deficit reduction. As the total economic output, GDP reflects the nation’s ability to generate income, which is critical when discussing the deficit’s sustainability. A growing GDP typically means higher government revenues, enabling better management of the national debt and encouraging investments back into the economy.

Conversely, if GDP growth stalls, it poses significant challenges for maintaining the desired deficit reduction goals. With Treasury Secretary Mnuchin’s assertion that the aim is to achieve a deficit reduction to 3% of GDP, any economic downturn could jeopardize that goal. Therefore, keeping a close watch on GDP trends is vital, as it is intrinsically linked to both fiscal policy effectiveness and long-term economic health.

Future Challenges in U.S. Deficit Reduction

Despite the goals announced by Treasury Secretary Mnuchin regarding U.S. deficit reduction, several challenges loom on the horizon. Economic uncertainties, such as trade tariffs and potential recession threats, could impede progress toward achieving a 3% deficit target. Moreover, political disagreements over fiscal policies can further complicate the pathway to sustainable deficit reduction.

There is also the challenge of reconciling growth with fiscal responsibility. While policies that stimulate economic growth are essential, they must be balanced with the necessity of controlling expenditures. Moving forward, the administration will need to navigate these challenges carefully to meet its fiscal promises and stabilize the nation’s economic position.

Evaluating the Effects of Treasury Secretary Mnuchin’s Policies

Since taking office, Treasury Secretary Mnuchin has been at the forefront of discussions about U.S. economic policy, particularly regarding deficit reduction. His policies have sparked debate, as they are seen as pivotal to achieving the ambitious target of reducing the deficit to 3% of GDP. Mnuchin’s approach often emphasizes the importance of tax reform and regulatory changes to stimulate investment.

However, many experts question whether these policy measures alone can yield the promised results. There are concerns that aggressive tax cuts may initially expand the deficit, which could complicate the administration’s ability to rein in spending effectively. Thus, the real challenge lies in ensuring that Mnuchin’s strategies can indeed translate into sustainable economic growth and ultimately, a healthier fiscal landscape.

The Interplay of Economic Growth and Deficit Control

As we analyze the relationship between economic growth and deficit control, it is essential to recognize the intertwined nature of these elements. A healthy economy, characterized by rising GDP, can facilitate better management of deficits and debts. This economic growth can provide the necessary revenues to fund government initiatives while simultaneously driving deficit reduction efforts.

However, achieving this balance is often fraught with challenges. The Trump administration’s policies aim to create a stimulating environment for growth, but they must also ensure that fiscal discipline is maintained. An effective strategy requires careful coordination between promoting economic activity and combating rising deficits. This balance is crucial for not only meeting the current goals but also fostering long-term economic prosperity.

Public Perception of Deficit Reduction Efforts

Public perception plays a significant role in shaping the effectiveness of deficit reduction efforts. As Treasury Secretary Mnuchin outlines the administration’s goals, the public’s acceptance and understanding of these initiatives can impact their success. Engagement with citizens about the importance of controlling the deficit can foster greater support for complex fiscal policies.

Furthermore, transparency in communication is crucial. When the government clearly articulates how deficit reduction strategies will benefit the economy—such as stabilizing interest rates or fostering job growth—public support can increase. Thus, managing public perception is as critical as the policies themselves in ensuring a successful path toward reducing the deficit.

The Future of U.S. Fiscal Policy and Economic Stability

Looking ahead at the future of U.S. fiscal policy, it is imperative to prioritize strategies that foster economic stability while reducing the deficit. With the changes in global economic conditions and evolving local challenges, the government must remain adaptive. Continuous evaluation of the effectiveness of implemented policies will be fundamental to achieving sustainable fiscal health.

Moreover, collaboration with economic experts, industry leaders, and lawmakers will be essential to create a concerted effort toward achieving both growth and reduced deficits. By fostering such collaborations, the administration can work toward ensuring that the U.S. maintains a robust economic presence on the global stage while effectively managing its fiscal responsibilities.

Frequently Asked Questions

What strategies are in place for U.S. deficit reduction during the Trump administration?

The Trump administration has implemented various deficit reduction strategies, aiming to decrease the deficit to 3% of GDP by the end of President Trump’s term. These strategies include tax reforms, deregulation initiatives, and changes in federal spending.

How do GDP and deficit levels affect U.S. economic outlook?

The relationship between GDP and deficit levels is crucial for the U.S. economic outlook. A growing GDP typically improves the deficit situation by increasing government revenue, which is essential for effective U.S. deficit reduction.

Who is responsible for U.S. deficit reduction policies under the Trump administration?

U.S. Treasury Secretary Mnuchin plays a key role in shaping and advocating for deficit reduction policies under the Trump administration, working towards achieving the goal of reducing the deficit to 3% of GDP.

What are the expected impacts of deficit reduction strategies on the economy?

U.S. deficit reduction strategies are expected to have mixed impacts on the economy. While reducing the deficit can lead to improved fiscal health and lower interest rates, it may also require spending cuts that could affect economic growth in the short term.

What is the timeline for achieving U.S. deficit reduction goals?

The timeline for achieving U.S. deficit reduction goals set by the Trump administration is aligned with President Trump’s term, targeting to reduce the deficit to 3% of GDP by 2024.

Can U.S. deficit reduction strategies lead to long-term economic stability?

Yes, if effectively implemented, U.S. deficit reduction strategies can contribute to long-term economic stability by ensuring sustainable fiscal policies, reducing national debt levels, and maintaining investor confidence.