| Key Point | Detail |

|---|---|

| Current Price Action | Solana’s price has recently traded down to $128, dropping from above $135. |

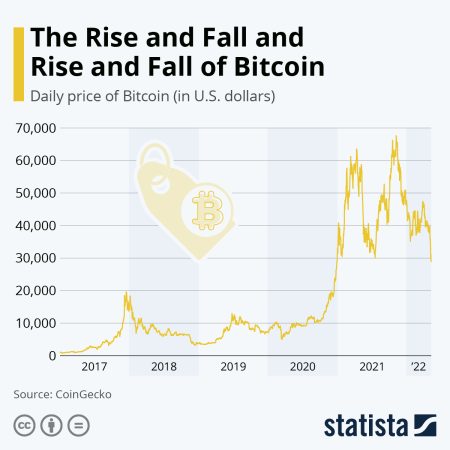

| Influencing Factors | Bitcoin‘s movement influences Solana’s market sentiment. |

| Bearish Outlook | Indicators suggest a possible dip below $120 for Solana. |

| Market Sentiment | Increased volatility and economic uncertainties are contributing to bearish sentiment. |

| Derivative Metrics | Long liquidations have surpassed $20 million, indicating a crowded bullish position. |

| Support and Resistance Levels | Key support is at $125-$126, with resistance at $137. |

| Institutional Flows | US spot Solana ETFs showed net inflows of over $47 million last week. |

Summary

The Solana price is currently facing significant downward pressure as it dips below $130, raising concerns about a potential fall to $120. This bearish trend is compounded by increased selling pressure in the market and the influence of Bitcoin’s price movements. As economic uncertainties loom and with a predominance of long liquidations in Solana’s derivatives, the outlook remains cautious. Traders should closely monitor support levels that, if breached, may signal further declines in the Solana price.

The Solana price is currently experiencing significant fluctuations, creating a buzz in the cryptocurrency community. Recently, the value dropped to lows near $128, raising concerns about a potential plunge below the critical support level of $120. Analysts are closely monitoring this trend, with Solana price predictions indicating that further declines could be influenced by Bitcoin’s market performance. As the cryptocurrency market trends shift, traders are eager for Solana price analysis, particularly in light of the recent sell-offs. Understanding the dynamics of the SOL forecast amidst these changes is essential for anyone looking to navigate the competitive altcoin landscape.

As we delve into today’s discussion, let’s explore the current situation surrounding Solana’s market performance. The value of SOL, the native cryptocurrency of the Solana blockchain, has sparked interest due to its recent volatility and the implications of broader crypto trends. Predictions regarding Solana’s future price trajectory are influenced by various factors, including the impact of Bitcoin’s fluctuations on market sentiment. This exploration into the price movements and market behavior will provide insights into potential outcomes for Solana investors. By analyzing the shifts in trader sentiment and market dynamics, we can better understand the altcoin’s position within the ever-evolving cryptocurrency landscape.

Understanding the Current Solana Price Dynamics

As Solana’s price trend reflects significant volatility, recent trading activity has shown prices plunging below the pivotal $130 mark. This decline indicates a predominant bearish sentiment within the market, primarily driven by significant selling pressure. The technical indicators suggest that traders are scrutinizing the Solana price closely, particularly the support levels below $130. If this trend continues, and the price breaches key support zones, predictions for Solana could forecast further declines, potentially touching the $120 level as sellers remain dominant.

Recent fluctuations in the cryptocurrency market underscore how external factors, such as Bitcoin’s price movement, influence the broader trading environment for altcoins like Solana. The recent dip in Bitcoin to approximately $90,600 has compounded fears in the altcoin market, establishing a detrimental influence on SOL’s price action. As investors shift their focus to the emerging patterns in Solana price prediction, it becomes increasingly evident that the cryptocurrency landscape remains unpredictable, making accurate forecasting of SOL trends challenging.

The Role of Bitcoin in Solana’s Price Trends

Bitcoin’s influence on the cryptocurrency market cannot be overstated, particularly regarding its effects on other altcoins, including Solana. Observations suggest a direct correlation between Bitcoin’s price movements and Solana’s performance, where potential drops in Bitcoin invariably create parallel dips in altcoins. Currently, as Bitcoin faces selling pressure leading to a drop, Solana has also succumbed to a similar fate, indicating vulnerabilities within its structure that could expose it to further declines. Traders eyeing Solana must remain vigilant to Bitcoin’s trends, as they hold the key to understanding Solana’s price trajectory.

Market analysts spotlight that the future Solana price trajectory heavily relies on Bitcoin’s performance and the accompanying market sentiment. If Bitcoin stabilizes or begins an upward trend, it could rejuvenate interest in SOL, propelling its price higher and potentially reversing the bearish outlook. Conversely, if Bitcoin continues to slide, market analysts predict that Solana might test lower price levels, including the pivotal $120 mark. The interplay between Bitcoin’s movements and Solana’s price predictions will be crucial in shaping investor strategies moving forward.

Current Market Sentiment Impacting Solana Prices

Market sentiment plays a pivotal role in determining the performance of cryptocurrencies, with Solana witnessing a notable shift as fears of economic instability loom. The current bearish sentiment is exacerbated by unexpected fluctuations that create uncertainty among traders and investors. The notable increase in long liquidations, surpassing $20 million, signifies a considerable shift in market behavior, indicating that traders may be retreating amid fear of continued downturn. The cryptocurrency market trends suggest that as sentiment worsens, Solana’s price might face additional pressure, especially if support levels fail to hold.

Additionally, while recent reports indicate net inflows into US spot Solana ETFs, such investment activities may not significantly impact the pricing trajectory in the current environment defined by high volatility. As liquidations of long positions dominated, the outlook may remain grim unless there’s a substantial shift in market sentiment or an infusion of new investment capital. Investors should analyze the broader market trends and sentiments affecting Solana price before making strategic decisions, knowing that bullish rallies often require a stable and optimistic investor outlook.

Technical Analysis of Solana Price Movement

Delving into the technical analysis of Solana’s price trends reveals critical insights into its future trajectory. Currently positioned below the 20-day and 50-day exponential moving averages, the bearish structure raises alarms about further potential declines. Key indicators, including the negative MACD histogram and RSI approaching oversold territory, underscore vulnerability in the price structure. Traders looking at the Solana price prediction must consider these technical markers as they reflect a market conditioned for possible bearish outcomes, particularly if support levels collapse.

A failure to maintain the support at $125-$126 could catalyze a rapid decline towards the $120 threshold, amplifying bearish investor sentiment. Analysts are paying close attention to resistance levels around $137, which may serve as a critical pivot point. If Solana manages to bounce back and regain traction above this resistance, it could signal a bullish reversal. However, without clear signs of recovery, the technical outlook remains bleak, and further analysis will be necessary to navigate the complexities of Solana’s price movements against broader market trends.

Future Predictions for Solana Price Forecast

Given the present market conditions and the technical analysis of Solana, several potential price forecasts are emerging. The likelihood of breaching $120 hinges on the prevailing market dynamics influenced by Bitcoin’s performance and overall liquidity. With bearish trends dominating the timeframe, established support levels are being keenly observed to gauge future movement. A sustained bearish trend could lead to retesting lower price levels not experienced since December 2025, while on the flip side, signs of recovery might bring $145 back into view as a target for the bulls.

In addition to market conditions, traders may also want to consider potential external factors like regulatory changes or macroeconomic events which can significantly sway market sentiment. Crucial to Solana’s price prediction is the interplay between these external influences and technical indicators. As such, investors should remain prepared for both downward pressures and possible short-term reversals as the market adapts to changing conditions, highlighting the necessity for adaptable trading strategies.

Understanding Solana’s Market Position Against Competitors

In the ongoing battle among cryptocurrencies, Solana positions itself uniquely against its competitors, notably Ethereum and Binance Smart Chain. While Solana has marked a commendable milestone in real-world asset integration, this achievement has not shielded it from prevailing volatility characterizing the broader market. As sentiments shift, Solana needs to distinguish itself by demonstrating consistent performance and resilience against both market fluctuations and ongoing competition. Investors observing Solana’s forecast must consider how it positions itself against these key adversaries to anticipate future trends.

To maintain competitiveness, Solana’s ability to provide innovative solutions and drive user adoption will be essential for price recovery and long-term stability. While technical analysis points to current vulnerabilities, the growth in adoption and utility will significantly influence Solana price forecasts and overall market performance. The upcoming months will be critical as Solana navigates through these turbulent waters, potentially revealing insights into its capability to carve out a sustainable foothold in an increasingly competitive landscape.

Investment Opportunities in Solana Amidst Market Changes

Despite the current challenges affecting Solana, savvy investors may find emerging opportunities amidst the volatility. As prices dip, particularly if they approach the pivotal $120 level, a potential buying window could arise for long-term investors willing to withstand short-term fluctuations. Historical trends suggest that significant dips often precede rallies, offering investment opportunities for those with a stronger risk tolerance. Adopting a long-term perspective may yield better returns as Solana attempts to gain momentum.

Moreover, understanding the implications of increasing institutional interest could also shape investment strategies. The recent net inflows into Solana ETFs signal growing confidence among larger players in the market. As more institutions consider diversifying their portfolios with SOL, it may bolster the altcoin’s price when the overall market sentiment rebounds. Therefore, investors keeping a close watch on institutional flows alongside market dynamics will be well-positioned to leverage potential returns as the cryptocurrency landscape continues to evolve.

Monitoring Global Economic Influences on Solana Price

Global economic factors play a crucial role in the cryptocurrency market, and Solana is no exception. With rising economic uncertainties and potential regulatory changes looming, investors are increasingly cautious, leading to increased volatility in cryptocurrency asset prices. Solana’s susceptibility to these changes underscores the importance of tracking macroeconomic trends that could impact its price trajectory. As economic indicators fluctuate, they carry substantial implications for SOL’s appeal to a broader investor base.

Economic forecasts suggest that instability or downturns could further impact market sentiment, propelling Solana prices downward. Monitoring these global economic trends will be key for investors as they seek to understand the correlation between economic performance and Solana’s evolving price landscape. Being informed about these shifts not only offers insight into maintaining robust investment strategies but also provides a framework for evaluating Solana’s resilience in times of economic turbulence.

Frequently Asked Questions

What is the current Solana price and recent trends in the cryptocurrency market?

As of January 20, 2026, the Solana price has decreased to approximately $128, showing a 4% decline over the last 24 hours. This downward trend is influenced by increased selling pressure across the cryptocurrency market, particularly as Bitcoin’s value fell to around $90,600. These factors suggest a bearish sentiment for Solana.

How do Solana price predictions indicate further declines?

Current Solana price predictions suggest that if the support level at $125-$126 fails, Solana could dip to $120 or lower. The technical analysis indicates a potential for bearish trends, particularly following a significant decrease in open interest for SOL futures and negative movements in derivatives metrics.

What factors influence the Solana price in the current market?

The Solana price is currently influenced by several factors, including broader market trends, Bitcoin’s price movements, and global economic uncertainties. Increased selling pressure and an overwhelming bullish sentiment leading to liquidations have contributed to recent price drops.

How is Bitcoin’s influence impacting Solana price dynamics?

Bitcoin’s influence on Solana price is significant; as Bitcoin’s price sees declines, it tends to create negative sentiment across altcoins like Solana. The current pullback in Bitcoin’s value is expected to amplify Solana’s downside vulnerability and might lead to further price drops.

What does Solana price analysis suggest about future performance?

Solana price analysis indicates a bearish outlook, especially with the price trading below key support levels. Technically, the indicators such as the moving averages and RSI suggest that SOL may continue to experience downward pressure, with a possible test of the $120 price point.

What is the Solana price forecast for the upcoming weeks?

The Solana price forecast indicates a potential decline towards $120, especially if the current support levels are breached. Market sentiment surrounding Bitcoin and broader economic factors will play a crucial role in determining the short-term trajectory of SOL.

Are there any recent inflows or outflows affecting Solana price?

Recent institutional flows show mixed results for Solana, with net inflows into US spot Solana ETFs exceeding $47 million last week. However, this could be undermined by spot-driven selling, leading to potential outflows that may impact Solana’s price negatively.

What trading strategies can be considered given the current Solana price volatility?

Given the current volatility in Solana price, traders may consider strategies that involve shorting in the event of further declines below $130. Monitoring key support and resistance zones around $120 and $137 can also help inform trading decisions.