| Key Point | Details |

|---|---|

| Announcement Date | January 20, 2026 |

| New Trading Pairs | BTC/U and LTC/USD1 |

| Trading Mode | Full Margin Leverage |

| Launch Time | 08:00 (UTC) |

| Source | Official Announcement by Binance |

Summary

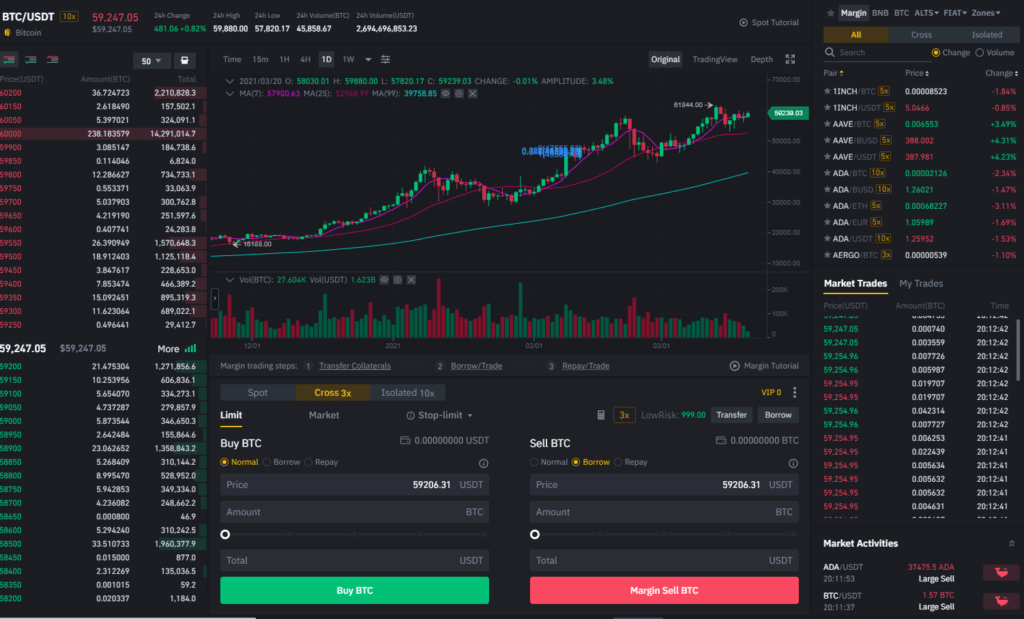

Binance Margin Trading has taken a significant step by introducing BTC/U and LTC/USD1 trading pairs in full margin mode. Scheduled for a launch on January 20, 2026, at 08:00 (UTC), this update expands the trading opportunities for users looking to leverage their positions. By utilizing full margin leverage, traders on Binance can enhance their potential returns, although it also comes with increased risks. Overall, the addition of these pairs highlights Binance’s commitment to providing a comprehensive trading experience.

Binance Margin Trading is set to revolutionize how traders engage with the crypto markets, especially with its latest addition of the BTC/U and LTC/USD1 trading pairs. This full margin trading capability allows users to leverage their positions significantly, opening up new avenues for maximizing potential profits. As avid followers of crypto trading news eagerly await Binance updates, these enhancements promise to heighten the trading experience on one of the world’s largest exchanges. With tools designed for both seasoned investors and newcomers, Binance Margin Trading aims to provide a platform that accommodates diverse trading strategies. Explore these exciting developments and discover how full margin leverage can transform your trading journey today!

In the evolving landscape of cryptocurrency investment, Binance offers a unique margin trading feature that enhances the dynamics of trading. With the introduction of trading pairs like BTC/U and LTC/USD1, investors can now engage in leveraged trading, a strategy that permits increased buying power through comprehensive margin options. This is particularly appealing for those who keep a close eye on crypto trading news and seek the latest Binance updates for making informed trading decisions. By delving into the nuances of margin trading, traders can better understand how these features can optimize their portfolios and potentially yield higher returns. Experience the thrill of advanced trading strategies as you explore the extensive capabilities of Binance’s margin trading system.

Introduction to Binance Margin Trading

Binance Margin Trading is a powerful feature that allows traders to borrow funds to increase their exposure in the cryptocurrency market. With the recent addition of BTC/U and LTC/USD1 full margin leverage trading pairs, Binance is further enhancing its competitive edge in the crypto trading landscape. This new offering, effective from January 20, 2026, at 08:00 UTC, presents traders with more options to maximize their profits through leveraged positions on these popular cryptocurrency pairs.

The inclusion of BTC/U and LTC/USD1 in the full margin mode signifies Binance’s commitment to providing innovative trading solutions that keep pace with the evolving needs of traders. With full margin trading, users can leverage their existing capital more effectively, which is crucial for maximizing returns in a highly volatile market. Traders should stay informed about the latest changes and updates from Binance to leverage these new trading pairs effectively.

Understanding Full Margin Trading

Full margin trading on Binance allows users to fully utilize their trading capital, offering higher leverage options compared to standard margin trading. This means that traders can open larger positions by borrowing actual amounts relative to their account equity, increasing their potential profits significantly. However, this also comes with increased risks, as losses can also be magnified. It is essential for traders to comprehend these dynamics before engaging in full margin trading.

With the addition of BTC/U and LTC/USD1 trading pairs, traders can now tap into the potential of two key cryptocurrencies while employing full margin strategies. To navigate the complexities of margin trading efficiently, receiving regular crypto trading news and insights can be beneficial. Staying updated with the latest market trends, Binance updates, and risk management strategies can help traders make informed decisions while trading on these newly introduced pairs.

Key Benefits of BTC/U and LTC/USD1 Trading Pairs

The introduction of BTC/U and LTC/USD1 as full margin leverage trading pairs on Binance opens up several lucrative opportunities for traders. Firstly, Bitcoin, being the most sought-after cryptocurrency, paired with USD provides a robust trading option for those keen on trading the leading crypto asset. Meanwhile, Litecoin’s pairing with USD allows traders to capitalize on the market sentiments surrounding altcoins, diversifying their trading strategies effectively.

Moreover, these trading pairs enable traders to enter positions with lower capital outlay due to the leverage capabilities offered. This aspect of margin trading is particularly appealing in a market characterized by volatility, allowing traders to amplify their returns on successful trades. As traders engage with these new offerings, understanding the nuances of market movements and having a strategy in place becomes imperative.

Effective Strategies for Trading BTC/U and LTC/USD1

To maximize profitability while trading BTC/U and LTC/USD1, traders should adopt effective strategies that consider market fluctuations, trends, and technical analysis tools. Utilizing tools such as candlestick patterns, trend lines, and key support/resistance levels can provide valuable insights into potential market movements. This data-driven approach enables traders to make informed decisions when entering and exiting leveraged positions.

Another essential strategy revolves around risk management. Given the high leverage environment of full margin trading, it is crucial for traders to implement stop-loss orders and diversify their investments. Limiting exposure to any single trade can mitigate losses significantly, allowing traders to remain active in the market even in adverse situations. Staying updated with crypto trading news and Binance updates will also provide a competitive edge when shaping trading strategies.

Impact of Binance Updates on Trading Performance

Binance consistently updates its trading platform and offerings to enhance user experience and security. With the announcement of the new BTC/U and LTC/USD1 trading pairs, traders can expect the platform to introduce additional features that facilitate smoother margin transactions. Keeping an eye on Binance updates is crucial for all margin traders as these updates can significantly impact trading performance, liquidity, and the overall trading environment.

Moreover, Binance’s user-centric approach often results in enhancements that cater to traders’ needs, such as better margin calculation tools, improved trading interfaces, and extensive educational resources. By utilizing these features effectively, traders can refine their trading strategies and optimize their performance in a competitive market where information is key.

Navigating the Risks of Margin Trading

While margin trading offers the allure of increased profits through leverage, it also carries inherent risks that traders must navigate cautiously. Fluctuations in cryptocurrency prices can lead to substantial losses if positions are not managed correctly. Understanding the principles of margin calls and liquidation is essential for any trader considering the full margin leverage trading of BTC/U and LTC/USD1 pairs.

Educating oneself on risk management strategies, such as setting appropriate leverage ratios and utilizing automated trading systems, can help mitigate some of these risks. Additionally, engaging in thorough market analysis and employing a disciplined trading approach will enable traders to protect their investments while exploring the potential of margin trading.

The Role of Market Analysis in Margin Trading

Market analysis plays a pivotal role in margin trading, especially with new trading pairs like BTC/U and LTC/USD1. Both fundamental and technical analysis provide insights that can guide traders in making informed decisions. Fundamental analysis involves evaluating market news, trends, and regulatory developments that could affect cryptocurrency valuations.

Conversely, technical analysis focuses on price action and historical data to identify potential entry and exit points for trades. By appraising these two analytical approaches, traders can formulate strategies that take advantage of the volatility associated with new trading pairs in the Binance ecosystem.

Future Trends in Margin Trading

As cryptocurrency trading continues to evolve, future trends in margin trading are expected to become more sophisticated. Innovations such as advanced trading algorithms and AI-driven analytics are likely to influence how traders approach the market. The ability to leverage data effectively will empower traders to make faster and more accurate trading decisions when dealing with pairs like BTC/U and LTC/USD1.

Furthermore, as platforms like Binance expand their offerings, we can anticipate a growing demand for complex margin trading strategies that consider not just single asset pairs, but various correlations across multiple assets. This holistic view may redefine strategies as traders adapt to an increasingly dynamic trading environment.

Staying Ahead with Educational Resources

Education is a fundamental aspect of successful trading, particularly in the realm of margin trading. Binance provides a rich library of resources tailored to help both novice and experienced traders comprehend the intricacies of trading strategies, risk management, and market forecasting. Leveraging these educational materials can significantly enhance a trader’s ability to confidently navigate the complexities of trading BTC/U and LTC/USD1.

In addition to Binance’s resources, engaging with community forums and webinars can foster a shared knowledge environment. By interacting with other traders, individuals can gain insights into varying perspectives and strategies, allowing for a well-rounded understanding of the market and its movements. This continuous learning process will position traders to achieve greater success in their margin trading endeavors.

Frequently Asked Questions

What are the new trading pairs available in Binance Margin Trading?

Binance Margin Trading has recently added BTC/U and LTC/USD1 trading pairs in full margin mode, effective January 20, 2026. This expansion allows traders to leverage these cryptocurrencies effectively.

What is full margin trading on Binance?

Full margin trading on Binance allows users to borrow funds up to the full amount of the margin, enabling higher leverage on trading pairs like BTC/U and LTC/USD1. This strategy can amplify both potential profits and risks.

How does leverage work in Binance Margin Trading?

In Binance Margin Trading, leverage allows traders to control a larger position using borrowed funds. For example, with LTC/USD1 leverage, traders can take positions that exceed their account balance, increasing potential gains or losses.

What are the risk factors involved in Binance Margin Trading?

Margin trading on Binance, including new pairs such as BTC/U and LTC/USD1, involves significant risks. Traders should be aware of the possibility of amplified losses, especially if market conditions turn unfavorable.

Where can I find the latest updates on Binance Margin Trading?

For the latest updates on Binance Margin Trading, including new trading pairs and features, check the official Binance website or follow crypto trading news platforms for real-time updates.

How can I start margin trading on Binance?

To start margin trading on Binance, users need to create an account, complete the necessary verification processes, and then deposit funds. After that, they can access the margin trading options, including the new BTC/U and LTC/USD1 pairs.

Is Binance Margin Trading suitable for all traders?

Binance Margin Trading is typically suitable for experienced traders who understand the risks of high leverage. Beginners are encouraged to educate themselves about margin trading strategies and risk management before participating.