| Cryptocurrency | Percentage Change |

|---|---|

| Solana (HSDT) | 6.45% |

| SharpLink (SBET) | 5.36% |

| Circle (CRCL) | 2.62% |

| Strategy (MSTR) | 1.64% |

| Bitmine (BMNR) | 0.94% |

| Coinbase (COIN) | 0.78% |

Summary

The cryptocurrency sector rising reflects a significant shift in market dynamics, as it defied the downward trend observed in traditional stock markets. Notably, digital assets like Solana (HSDT) surged by 6.45%, indicating a growing investor confidence and interest amidst a generally cautious economic environment. This divergence highlights the resilience of the cryptocurrency market and its potential as an alternative investment channel. As more traders and institutions recognize the opportunities within this space, the trend of rising cryptocurrencies is likely to continue, paving the way for future growth and innovation.

The cryptocurrency sector is rising, showcasing resilience and momentum even as the U.S. stock market shows signs of decline. Recent data reveals that while traditional indices like the Dow Jones and S&P 500 faced slight decreases, digital assets surged in performance. Notably, Solana (HSDT) led the charge with a remarkable gain of 6.45%, highlighting the divergent trends between cryptocurrencies and traditional financial markets. This uptick reflects larger cryptocurrency trends that suggest a growing appetite for digital currencies among investors seeking alternatives to conventional assets. As financial markets analysis becomes increasingly focused on crypto performance, it’s clear that innovative assets like Solana are setting new benchmarks in the ever-evolving investment landscape.

In the dynamic world of digital currencies, the recent upswing of the cryptocurrency sector represents a significant shift in market behavior. While the major indices of the U.S. stock arena are experiencing declines, altcoins and tokens are gaining traction with impressive growth rates. Among these standout performers, Solana (HSDT) has emerged as a leader, reflecting burgeoning interest in decentralized finance and cryptocurrency as viable investment avenues. The rise in crypto assets marks an important pivot in investment strategy, with enthusiasts and analysts alike closely monitoring these cryptocurrency developments. With insights drawn from financial markets analysis, one can clearly see that the landscape is changing, making way for these disruptive digital assets.

Cryptocurrency Sector Rising Amidst Stock Market Declines

In recent trading sessions, the U.S. stock market closed on a downward trajectory, with major indices such as the Dow Jones, S&P 500, and Nasdaq all reporting slight losses. Yet, amid these declines, the cryptocurrency sector has shown remarkable resilience, rising against the prevailing trend. This signals a potential shift in investor sentiment, highlighting the growing interest and confidence in digital assets as an alternative investment strategy. The strong performance of cryptocurrencies, despite a less favorable environment for conventional equities, underscores the evolving landscape of financial markets.

The rise of cryptocurrencies, particularly Solana (HSDT) which increased by 6.45%, points to the underlying strength within this digital asset class. Investors are increasingly turning to crypto as they seek diversification and potential higher returns. As financial markets grapple with volatility in traditional assets, cryptocurrencies are establishing themselves as viable options for traders and long-term investors alike, reflecting broader currency trends that favor digital over fiat.

Analyzing Cryptocurrency Trends and Future Potential

Examining the current cryptocurrency trends reveals a bullish outlook for digital assets moving forward. An increase in recent trading volumes, particularly for coins like Solana (HSDT) and others in the top-performing brackets, suggests renewed interest from retail and institutional investors. Additionally, as more platforms for blockchain-based trading become available, such as the decentralized RWA trading platform mentioned by msx.com, the entry barriers for new investors continue to diminish, positioning cryptocurrencies for future growth.

As the cryptocurrency market evolves, constant performance analysis is vital for understanding the long-term viability of these digital assets. With reports indicating that platforms are integrating crypto assets into traditional portfolios, including stocks and ETFs, analysts suggest that this hybrid approach could invite a new wave of investment capital into cryptocurrencies. Therefore, understanding cryptocurrency performance, leveraging tools for financial markets analysis, will be essential for both prospective and seasoned investors looking to capitalize on this burgeoning asset class.

Key Developments in the Cryptocurrency Market Post-U.S. Stock Declines and Solana’s Leadership Role

Recent fluctuations in the U.S. stock market have prompted many investors to reassess their portfolios, leading to a notable interest in cryptocurrency as a potential hedge against traditional market volatility. Specifically, Solana (HSDT) has emerged as a leader, showcasing impressive gains while broader markets faced setbacks. By examining key developments in the crypto space, investors can gain insights into market dynamics that favor digital coins versus traditional stocks.

The importance of cryptocurrencies like Solana can be attributed not only to their performance but also to the underlying technology and utility they provide. As we see broader adoption across various industries, the institutional interest in these assets remains strong, potentially paving the way for even greater acceptance and growth in the future. This trend aligns with the increasing focus on decentralized finance (DeFi) and non-fungible tokens (NFTs), further showcasing the versatility and appeal of cryptocurrencies.

The Role of Financial Markets Analysis in Crypto Investment Strategies

As the cryptocurrency sector continues to rise, a robust financial markets analysis is crucial for effective investment strategies. The comparative study between crypto performances and the U.S. stock market reveals patterns that can aid investors in navigating this complex landscape. By leveraging technical and fundamental analysis, investors can better assess the viability of their crypto holdings and make informed decisions that align with their financial goals.

Utilizing market analysis tools can significantly enhance a trader’s ability to interpret the rising trends within the cryptocurrency sector. Understanding the correlation between cryptocurrency assets and traditional equities allows for strategic positioning, especially in volatile market conditions. Whether focusing on direct cryptocurrency investment or exploring related sectors such as blockchain technology, financial markets analysis equips investors with the knowledge needed to tailor their investment approaches effectively.

Frequently Asked Questions

Why is the cryptocurrency sector rising while the U.S. stock market declines?

The cryptocurrency sector is currently experiencing a rise even as the U.S. stock market shows signs of decline, with major indices like the Dow Jones and S&P 500 closing slightly lower. This indicates a burgeoning interest and optimism in cryptocurrencies, driven by factors such as technological advancements and market sentiment favoring digital assets.

What are the latest cryptocurrency trends following the recent surge in Solana (HSDT)?

Recent cryptocurrency trends highlight a significant surge in Solana (HSDT), which rose by 6.45%. This trend suggests a growing investor confidence in the token, reflecting broader market dynamics where cryptocurrencies are increasingly viewed as viable investment options amidst stock market fluctuations.

How does the performance of Solana (HSDT) influence crypto performance metrics?

The strong performance of Solana (HSDT), indicated by a 6.45% increase, positively influences overall crypto performance metrics. This spike can attract more investors, potentially lifting other cryptocurrencies and reinforcing the notion that the cryptocurrency sector is resilient, even when traditional financial markets face challenges.

What does the rise of the cryptocurrency sector indicate for financial markets analysis?

The rise of the cryptocurrency sector signals a shift in financial markets analysis, wherein cryptocurrencies are increasingly factored into investment strategies. Analysts now view crypto assets as critical components of market behavior, especially during times of volatility in the U.S. stock market.

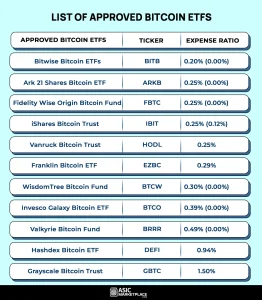

Which cryptocurrencies are currently leading the pack following the rise in the cryptocurrency sector?

Following the rise in the cryptocurrency sector, notable leaders include Solana (HSDT) with a 6.45% increase, SharpLink (SBET) at 5.36%, and Circle (CRCL) which rose by 2.62%. Such performances suggest that these assets are gaining traction among investors and are likely to play pivotal roles in future cryptocurrency trends.