| Key Point | Detail |

|---|---|

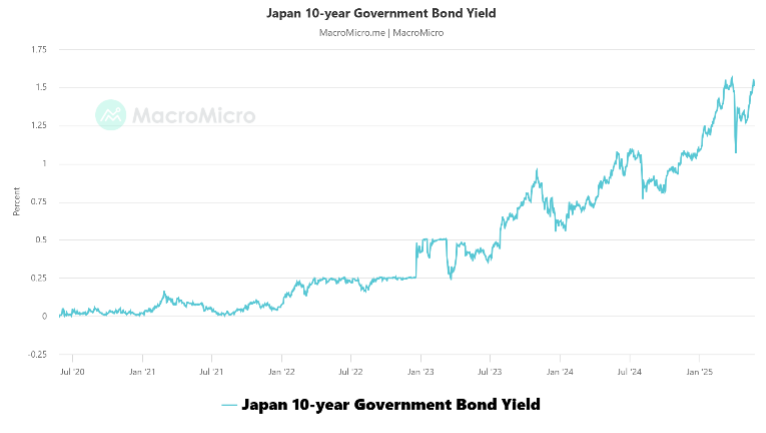

| 40-Year Japanese Government Bonds Yield | Surpassed 4% for the first time since 2007 |

| 10-Year Japanese Government Bonds Yield | Increased by 3.0 basis points to 2.3%, highest since February 1999 |

| 20-Year Japanese Government Bonds Yield | Increased by 4.0 basis points to 3.295% |

Summary

Japanese government bonds yield has seen significant movement recently, particularly with the 40-year bonds exceeding 4%, marking a historic point since their introduction in 2007. This increase indicates a rising trend in the long-term interest rates, reflecting investor sentiment and economic conditions in Japan. The recent hikes in yields across various durations, including the 10-year and 20-year bonds, showcase a broader shift in the market, which could influence both borrowing costs and investment strategies moving forward.

The yield on Japanese government bonds has been making headlines lately, particularly as the yields on 40-year Japanese bonds have surpassed 4% for the first time since their debut in 2007. This significant milestone marks a turning point in the bond market trends, reflecting shifting investor sentiments and potential changes in interest rates in Japan. As market analysts closely monitor Japanese bonds news, the implications of rising government bond yields could have far-reaching effects on the economy. From attracting foreign investment to influencing domestic borrowing costs, these shifts are particularly crucial in the context of Japan’s longstanding low-rate environment. Understanding the dynamics of Japanese government bonds yield provides investors and stakeholders alike with valuable insights into future market movements and economic stability.

As the landscape of fixed income securities evolves, the interest rates associated with Japanese debt instruments are increasingly in the spotlight. Recent fluctuations, especially concerning 40-year and 10-year bonds, highlight the broader trends influencing the bond market. With historical peaks being reached, investors are keen on deciphering the underlying causes of these yield changes and their potential impact on the economy. The rise in long-term yields is indicative of changing monetary policies and could signal a shift in investor confidence. By keeping abreast of the latest developments in the world of Japanese bonds, stakeholders can better navigate the complexities of government debt investment.

Significance of Rising Yields on Japanese Government Bonds

The recent surge in the yield on 40-year Japanese government bonds marks a significant milestone in the financial landscape, as it exceeds 4% for the first time since its introduction in 2007. This change reflects a broader trend in government bond yields that indicates a shift in investor confidence and expectations surrounding Japan’s economy. Higher yields often signal an increase in interest rates, which can impact borrowing costs and consumer spending.

Furthermore, rising yields on Japanese government bonds are indicative of changing economic conditions and market trends. As yields climb, the attractiveness of newly issued bonds versus existing ones increases, leading to potential shifts in investor portfolios. This dynamic could affect the overall bond market in Japan, as investors reassess their strategies in light of these developments. Monitoring government bond yields is crucial for understanding the future trajectory of interest rates and economic health.

Impact of Government Bond Yields on the Economy

The yields on government bonds, particularly the recent highs on Japanese bonds, directly influence the economy by affecting interest rates. When yields rise, as observed with the 10-year and 20-year bonds, it generally leads to an increase in borrowing costs for consumers and businesses alike. This can suppress economic growth as loans for homes, cars, and other investments become more expensive, leading to decreased consumer spending and investment.

Additionally, the bond market trends resulting from higher yields can create volatility in equity markets as investors chase the returns now available in bonds. Fluctuations in government bond yields can create a ripple effect through financial systems, influencing everything from mortgages to corporate financing, thus underscoring the importance of monitoring these trends closely. As investors react to changes in yield on Japanese government bonds, we may see shifts in economic strategies and financial planning.

Comparative Analysis: 10-Year vs. 40-Year Japanese Government Bonds

The performance of 10-year and 40-year Japanese government bonds highlights the variations in investor expectations over different time horizons. As reported, the yield on the 10-year bonds has recently reached 2.3%, while the long-term 40-year bonds have surpassed the notable threshold of 4%. This disparity illustrates how interest rates in Japan are being anticipated differently based on the bond’s maturity.

Investors typically favor shorter-term bonds in stable economic conditions due to lower risk, while long-term bonds yield higher returns owing to the increased uncertainty over a longer period. The current yields suggest that those investing in 40-year bonds are expecting significant economic changes ahead, prompting a reevaluation of their investment strategies against the backdrop of Japanese bonds news and prevailing market sentiments.

Trends in the Japanese Bond Market

The rise in yields across the board signals a shift in the Japanese bond market, showcasing evolving investor confidence and expectations. Not only is the 40-year yield surpassing 4% a landmark event, but it also pans out against the backdrop of global interest rate changes, with many economies adjusting their strategies post-pandemic. Investors are now scrutinizing Japanese bonds more closely for opportunities in an environment of rising rates.

The bond market trends suggest that investors are repositioning their portfolios in response to these yield changes, including divesting from riskier assets in favor of government securities that are increasingly attractive. As yields continue to rise, the long-term implications for Japan’s economy could lead to increased investment in infrastructure and other growth initiatives, thereby impacting economic recovery and growth trajectories.

Japanese Bonds News: What Investors Should Know

For investors keeping an eye on the financial news, the recent movement in Japanese government bonds is a critical focal point. With yields rising significantly, particularly for the 40-year bonds, investment strategies may need recalibration. The prevailing narrative suggests a changing economic environment, where traditional safety is becoming more expensive in terms of opportunity costs.

The Japanese bonds news reflects broader trends influencing the global economy, including uncertainty in geopolitical landscapes and inflationary pressures leading to anticipated increases in interest rates. Investors must remain vigilant in analyzing these developments, as they can affect everything from currency exchange rates to foreign direct investment flows within Japan.

The Future of Interest Rates in Japan: Predictions and Analysis

While current yields on Japanese government bonds reflect a certain level of optimism in the economy, predictions regarding future interest rates are complex. Analysts suggest that if the trend of rising yields continues, we could see a progressive shift towards higher interest rates across the board. This would impact not only government borrowing but also consumer loans and mortgages, potentially leading to a tightening of liquidity in the market.

Moreover, fluctuations in yields signal potential changes in the monetary policy approach of the Bank of Japan. As stakeholders analyze these trends, the future of interest rates will be closely monitored, particularly as Japan navigates post-pandemic economic recovery. Understanding the implications of government bond yields on interest rates will be paramount for both domestic and international investors.

Long-Term Investments in Japanese Bonds: An Outlook

Long-term investments in Japanese bonds, particularly those nearing or surpassing the 40-year mark, present unique opportunities and risks for investors. The recent rise in yields indicates potential profit opportunities for those willing to lock in rates for extended periods. However, as the market dynamic evolves, the attractiveness of holding longer-term securities in a rising interest rate environment warrants careful consideration.

Investors must weigh the benefits of receiving higher yields against the risk of future rising interest rates impacting bond prices. As government bond yields change, the real returns on these long-term investments could fluctuate markedly, making them a crucial component of a diversified investment strategy. Ongoing research and monitoring of Japanese bonds news will be essential for informed decision-making in this sector.

Influence of Global Market Trends on Japanese Government Bonds

The influence of global market trends on the Japanese bond market cannot be understated, particularly as yields fluctuate in response to international economic developments. With Japan as a major player in the global economy, changes in interest rates and bond yields in other countries can quickly resonate within Japan’s bond markets. Investors are closely watching how the dynamics of global inflation and central bank policies affect Japanese government bonds.

Additionally, shifts in investor sentiment globally can lead to a rebound effect on Japanese bond yields. For instance, as other economies tighten monetary policy, investors may turn towards the relative safety and yield of Japanese bonds, causing shifts in demand and resulting in yield adjustments. Continuous monitoring of intermarket relationships will be key to navigating the Japanese bond landscape effectively.

Understanding the Risks in Long-term Bond Investments

As investors look to the long term in Japanese bonds, understanding the risks associated with these investments is crucial. With the yield on 40-year Japanese government bonds now above 4%, it presents a tempting opportunity; however, it comes with risks inherent to fluctuations in interest rates. Longer dated bonds are more sensitive to interest rate changes, which means that as rates rise, the prices of existing bonds may fall, eroding potential profits.

Moreover, investors must consider the impact of inflation on their returns, especially when holding bonds for extended periods. If inflation outpaces bond yields, the real value of returns could diminish. Thus, thorough research and risk management strategies are essential for anyone considering a stake in long-term Japanese government bonds.

Frequently Asked Questions

What does it mean that the yield on 40-year Japanese government bonds has surpassed 4%?

The yield surpassing 4% indicates a significant rise in the returns investors can expect from 40-year Japanese government bonds. This milestone is the first of its kind since the bonds were issued in 2007, suggesting a shift in the bond market trends that may reflect changing economic conditions or interest rates in Japan.

How do rising yields on Japanese government bonds affect the bond market trends?

Rising yields on Japanese government bonds, such as the recent increase in 10-year and 20-year bonds, indicate higher interest rates, which can influence overall bond market trends. Higher yields typically lead to lower bond prices, as existing bonds with lower yields become less attractive to investors, impacting market dynamics.

What is the recent news regarding interest rates in Japan affecting Japanese government bonds?

Recent reports indicate that interest rates in Japan are on the rise, evidenced by the increase in yields on various government bonds. Specifically, as of January 20, 2026, the yield on 10-year bonds reached 2.3%, marking the highest level since February 1999, demonstrating the upward movement in the interest rates affecting Japanese government bonds.

How should investors react to the changes in Japanese government bonds yield?

Investors should closely monitor the changes in the yields of Japanese government bonds, especially with the 40-year bonds exceeding 4%. Such changes can signal potential investment opportunities as higher yields may attract investors looking for better returns. Additionally, understanding the implications of interest rates in Japan can help investors make informed decisions.

Why are changes in government bond yields important to financial markets?

Changes in government bond yields, like those seen in Japanese government bonds, are crucial as they serve as benchmarks for other interest rates across the economy. These changes can influence borrowing costs, investment strategies, and overall economic growth, making them vital for financial markets and investors.