Cryptocurrency regulation is becoming increasingly vital as authorities strive to manage the swiftly evolving landscape of digital currencies. Recent statements from SEC Chairman Paul Atkins highlight the urgent need for clarity in the jurisdictional division between the SEC and the Commodity Futures Trading Commission (CFTC). This week marks a turning point for the crypto assets market as lawmakers prepare to implement a bipartisan market structure bill designed to establish comprehensive investor protection in crypto. By navigating the regulatory gray area, authorities aim to foster innovation while ensuring the safety of investors engaging in this dynamic marketplace. As key discussions unfold, the focus remains on creating a balanced framework that nurtures both growth and accountability in the sector.

The landscape of digital currency governance is in a state of flux, as regulatory bodies seek to establish a coherent framework for overseeing virtual currencies. With pressing discussions about the appropriate allocation of powers between regulatory agencies, particularly the SEC and the CFTC, clarity is essential for fostering a stable environment. Recent legislative measures, including a bipartisan bill, aim to define how crypto markets can operate effectively while ensuring robust protections for participants. This dialogue is crucial for dispelling the uncertainties that currently shroud financial investments in blockchain technologies. As the crypto ecosystem continues to evolve, the emphasis on creating a structured and secure regulatory environment cannot be overstated.

Understanding Cryptocurrency Regulation

Cryptocurrency regulation is gaining increasing importance as governments around the world seek to define their stance on digital assets. Recently, SEC Chairman Paul Atkins emphasized the urgency of clarifying the jurisdictional division between the SEC and the Commodity Futures Trading Commission (CFTC). This clarification is critical in moving cryptocurrencies out of the regulatory gray area, ensuring that both regulators work cohesively to foster a safe environment for innovation while safeguarding investor interests.

The potential signing of a bipartisan market structure bill by President Trump symbolizes a pivotal shift in how cryptocurrencies will be governed within the United States. The bill seeks to establish a framework that not only supports the growth of the crypto assets market but also lays down robust measures for investor protection in crypto transactions. It reflects a collective recognition among lawmakers that a coherent regulatory approach must be developed to enhance market integrity and consumer confidence.

The Role of SEC and CFTC in Crypto Regulation

The distinction between the SEC and CFTC is essential for understanding how cryptocurrency regulation will evolve. The SEC primarily focuses on protecting investors and regulating securities, while the CFTC oversees derivatives and commodities transactions. This jurisdictional division can often lead to confusion in the crypto space, especially since many crypto assets may fall into both categories. SEC Chairman Paul Atkins’ assertion regarding the need for clarity signifies that both agencies must align their strategies to create cohesive regulatory policies that benefit the market as a whole.

By delineating the roles of the SEC and CFTC more explicitly, regulators can foster an environment that encourages investment in the crypto sector while ensuring compliance and ethical trading practices. The anticipated bipartisan market structure bill is intended to enhance this cooperation, providing clearer guidelines on which assets fall under each regulator’s authority. This step is crucial for achieving a balanced regulatory landscape that mitigates risks associated with fraud and market manipulation, thereby instilling greater trust among investors.

The Future of Crypto Assets Market

The future of the crypto assets market appears promising, especially in light of recent discussions regarding regulatory frameworks. With SEC Chairman Paul Atkins advocating for a more defined regulatory approach, the industry is poised for significant growth. The introduction of legislation aimed at embracing innovation while protecting investors indicates a shift towards a more mature market. Enthusiasts and investors alike are watching closely, as clearer regulations could pave the way for sustainable market dynamics.

Moreover, the forthcoming bipartisan market structure bill signifies a collective effort to create an environment conducive to innovation. By incorporating investor protection measures, this bill aims to ensure that as the market evolves, it remains a safe landscape for both new and seasoned participants. Consequently, this proactive regulatory stance can attract institutional investment, thereby enhancing the overall legitimacy and stability of the crypto assets market.

Investor Protection in the Crypto Space

Investor protection is a primary concern highlighted by SEC Chairman Paul Atkins in his recent statement. As the cryptocurrency market matures, the need for robust mechanisms to safeguard investors becomes increasingly critical. The potential bipartisan market structure bill aims to establish clear standards that protect individuals engaging in crypto investments, thereby enhancing consumer trust. By proactively addressing this issue, regulators signal their commitment to fostering a safe trading environment.

Additionally, defining investor protection in the context of cryptocurrencies involves ensuring transparency, accountability, and fair practices across the board. This can not only aid in preventing fraud but can also help mitigate the risks associated with volatility in the crypto markets. Regulators must work collaboratively to create guidelines that effectively balance innovation with necessary safeguards, ultimately leading to a healthier market where investors feel secure.

The Significance of a Bipartisan Market Structure Bill

The anticipated bipartisan market structure bill represents a crucial step forward for cryptocurrency regulation in the United States. With the support of regulatory leaders such as SEC Chairman Paul Atkins, this legislation aims to clarify the roles of regulatory bodies while fostering innovation in the digital assets sector. A well-defined regulatory framework will contribute significantly to bringing the crypto assets market out of its current gray area, which is vital for long-term growth and stability.

Moreover, the bipartisan nature of the bill indicates a growing consensus among lawmakers on the importance of cryptocurrencies for the economy. By encouraging collaboration between parties, this initiative can mitigate potential regulatory conflicts. This approach ensures a balanced system that upholds investor protection while allowing for the creativity and technological advancements necessary for the evolution of the crypto market. The successful passage of this bill could set a precedent for other countries grappling with similar issues.

Jurisdictional Division between SEC and CFTC

The jurisdictional division between the SEC and CFTC is crucial for determining how cryptocurrencies will be regulated. As the landscape of financial markets evolves, this demarcation needs to be clarified to avoid overlapping regulations that could confuse investors. SEC Chairman Paul Atkins has underscored the importance of defining these respective roles to enhance regulatory efficiency and investor confidence in the crypto assets market.

A clear jurisdictional framework will help delineate which assets fall under the purview of each regulator, thereby streamlining oversight processes. This clarity not only protects investors but also builds a more coherent approach towards market structure and innovations in the cryptocurrency space. Establishing such boundaries will encourage the continued growth of digital assets while also ensuring compliance with the laws designed to protect market participants.

Challenges Facing Cryptocurrency Regulation

As the cryptocurrency market rapidly evolves, regulators face several challenges in establishing effective policies. One of the most significant challenges is navigating the dichotomy between fostering innovation and ensuring investor protection. SEC Chairman Paul Atkins’ remarks highlight the necessity for regulators to strike a delicate balance that encourages technological advancement without compromising the safety of investors in the crypto assets market.

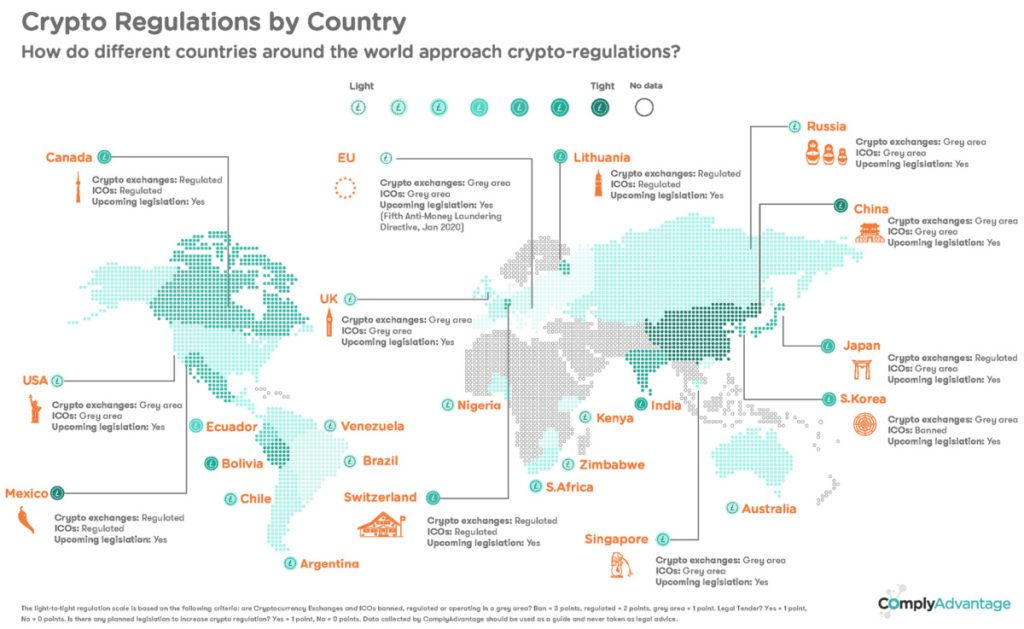

Additionally, the lack of a uniform regulatory framework across jurisdictions poses obstacles for investors and businesses alike. Each country may enforce different rules and definitions concerning digital assets, leading to an uneven playing field. Addressing these regulatory discrepancies is paramount for building a secure and structured investment environment. Only through collaborative efforts among global regulators can the challenges of cryptocurrency regulation be effectively managed.

The Importance of Legislative Support in Crypto Regulation

Legislative support is vital for establishing a robust regulatory framework for cryptocurrencies. The upcoming bipartisan market structure bill highlights the importance of political consensus in shaping the future of cryptocurrency regulation. Not only does it clarify the roles of the SEC and CFTC, but it also signals lawmakers’ recognition of the potential impact that the crypto assets market could have on the overall economy.

Such legislative initiatives not only pave the way for clearer regulatory guidelines but also serve to inspire confidence among investors. By demonstrating a commitment to effective regulation, lawmakers can enhance investor trust in the crypto space. This, in turn, can lead to increased participation from both individual and institutional investors, thereby fostering a more vibrant and secure cryptocurrency market.

The Path Ahead for Crypto Innovation

The pathway for crypto innovation lies in a well-defined regulatory framework that embraces the potential of digital assets while ensuring investor safety. SEC Chairman Paul Atkins has voiced the necessity of moving the crypto assets market beyond regulatory ambiguity, thereby fostering an environment ripe for technological advancements. The anticipated bipartisan market structure bill could serve as a catalyst for this evolution, effectively balancing the interests of regulators, businesses, and investors.

As the regulatory landscape evolves, it will be crucial for stakeholders in the crypto space to engage in ongoing discussions with lawmakers. Collaboration between innovators and regulators can help to shape policies that facilitate growth without compromising regulations designed for consumer protection. This proactive approach will help ensure that as the crypto market matures, it remains a domain of trust and innovation.

Frequently Asked Questions

What is the SEC Chairman’s recent statement on cryptocurrency regulation?

SEC Chairman Paul Atkins has highlighted the significance of current developments for cryptocurrency regulation. He emphasizes the need for Congress to clarify the jurisdictional division between the SEC and the Commodity Futures Trading Commission (CFTC) to better regulate the crypto assets market.

How does the bipartisan market structure bill impact cryptocurrency regulation?

The bipartisan market structure bill aims to delineate the regulatory responsibilities of the SEC and CFTC concerning crypto assets. This legislative effort seeks to bring clarity and enhance investor protection in the cryptocurrency space, promoting a more structured and secure environment for market participation.

Why is investor protection important in the crypto assets market?

Investor protection is crucial in the crypto assets market because it helps prevent fraud, misrepresentation, and market manipulation. The SEC’s focus on regulatory clarity, as supported by recent statements, aims to ensure that investors can engage with cryptocurrency confidently, knowing that their rights are safeguarded.

What is the role of the SEC and CFTC in cryptocurrency regulation?

The SEC and CFTC have distinct roles in cryptocurrency regulation. The SEC primarily oversees securities related to crypto assets, while the CFTC manages commodities. Recent discussions, including statements from SEC Chairman Atkins, call for a clearer jurisdictional division to enhance regulatory effectiveness and protect investors.

How will upcoming regulations affect the cryptocurrency market?

Upcoming regulations, including the anticipated bipartisan market structure bill, are intended to transform the current regulatory gray area of the crypto assets market. By establishing clear guidelines and enhancing investor protection, these regulations aim to foster innovation while ensuring a safer environment for cryptocurrency investors.

| Key Points |

|---|

| SEC Chairman Paul Atkins emphasizes the significance of this week for cryptocurrencies, advocating for clearer jurisdictional divisions. |

| He supports Congress in delineating responsibilities between the SEC and the CFTC. |

| The primary focus for investors is to eliminate regulatory ambiguities in the crypto market. |

| Atkins anticipates a bipartisan market structure bill being signed by President Trump. |

| The proposed bill aims to foster innovation while safeguarding investor rights. |

Summary

Cryptocurrency regulation is crucial at this juncture, as stakeholders seek clarity in the legal landscape. SEC Chairman Paul Atkins has highlighted the importance of defining roles between regulatory bodies to protect investors and promote innovation. This week, discussions by Congress may lead to significant legislative changes aimed at bringing crypto assets into a more regulated framework, which will benefit both the market and its investors.

Related: More from Regulation & Policy | UK FCA to Consider Cryptos for Gambling Payments | Judge Halts Binance Effort to Arbitrate US Cryptocurrency Claims