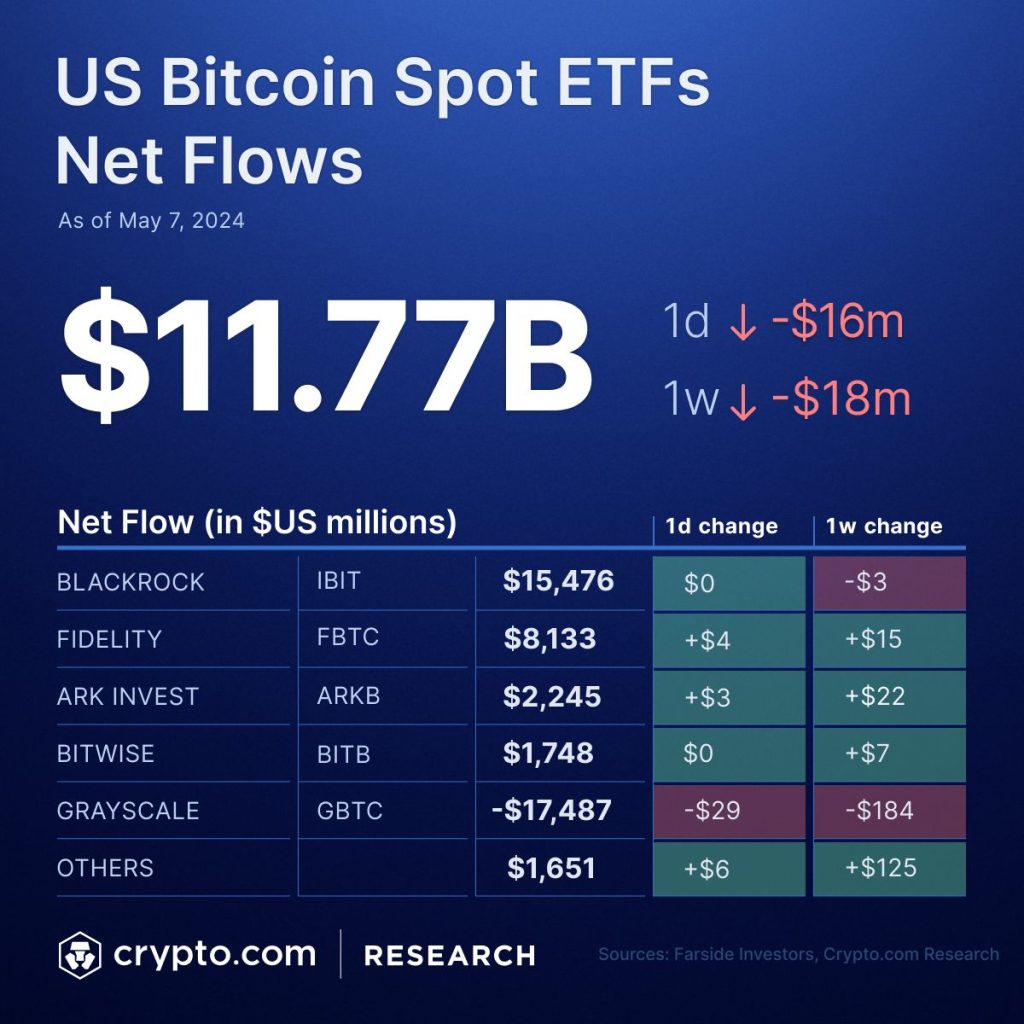

Today marks a significant shift in the Bitcoin ETF market, highlighted by a net outflow of 3,734 BTC. This decrease comes at a time when crypto enthusiasts are closely monitoring BTC outflow trends, especially in light of recent Bitcoin ETF news. In contrast, the Ethereum ETF faced a more substantial net outflow of 42,299 ETH, reflecting broader market uncertainties. Meanwhile, the Solana ETF managed to attract attention with a noteworthy net inflow of 36,370 SOL. These fluctuations underline the dynamic nature of the crypto ETF market and the intricate interplay between various digital assets.

In the ever-evolving landscape of cryptocurrency investments, the recent outflow from Bitcoin ETFs has raised eyebrows among market analysts and investors alike. The unexpected withdrawals are indicative of shifting investor sentiment, drawing a parallel to the Ethereum ETFs’ challenges with hefty withdrawals. As the crypto space continues to adjust, it’s crucial to understand how these fluctuations might affect future investments and market strategies. Additionally, contrasting inflow metrics from projects like Solana signal diverse opportunities within the sector. Overall, the ongoing developments in Bitcoin ETF net outflows provide critical insights for those engaged in cryptocurrency portfolios.

Bitcoin ETF Net Outflow Analysis

In recent developments, the U.S. Bitcoin ETF has faced significant net outflow, totaling 3,734 BTC just today. This trend appears to be a reflection of the current market sentiment, as investors weigh the risks and rewards of cryptocurrency investments. The 7-day net outflow of 7,706 BTC suggests a sustained pattern, indicating a potential shift in strategy for many institutional and retail investors alike. Market analysts are closely watching these figures, as Bitcoin ETF net outflow could signal bearish tendencies in investor confidence and future price predictions for Bitcoin.

Alongside the Bitcoin ETF’s challenges, the overall crypto ETF market is responding to varying pressures. Traders are looking beyond just Bitcoin, with Ethereum’s ETF also reporting a notable outflow of 42,299 ETH today. This divergence in asset flows highlights the complex dynamics of the market, as the Ethereum ETF recorded an impressive 7-day net inflow of 8,466 ETH. Such positive momentum for Ethereum, contrasted with Bitcoin’s struggles, may indicate shifting investor preferences or market reallocation towards alternative cryptocurrencies.

Trends in BTC Outflow and Ethereum’s Performance

The recent BTC outflow trends have sparked a broader conversation about investor behavior in the cryptocurrency landscape. With institutions withdrawing significant amounts from the Bitcoin ETF, it raises questions about the underlying factors driving these decisions. Analysts suggest that market volatility, regulatory news, and changing economic conditions could all be contributing to this outflow. Furthermore, as new opportunities arise with different crypto ETFs, investors may be reallocating their capital towards assets with better short-term prospects.

In parallel, Ethereum’s relatively strong performance could be attracting previously undecided investors. The Ethereum ETF’s 7-day net inflow of 8,466 ETH contrasts sharply with the Bitcoin ETF’s struggle, suggesting that market participants are increasingly viewing Ethereum as a more viable option amid the current crypto climate. Additionally, significant net inflows into the Solana ETF, recorded at 36,370 SOL today, further emphasize this trend of exploring diversified investments within the crypto asset space.

The Impact of Crypto ETF Market Dynamics

The dynamics within the crypto ETF market are evolving rapidly, especially with changes reflected in Bitcoin and Ethereum ETFs. The substantial net outflows observed in the Bitcoin ETF and the contrasting inflows in the Solana ETF illustrate a crucial market shift. Investors are not just reacting to the asset performance in isolation but are considering the broader implications this has on market stability and investment risk. Such movements can significantly influence the perception of cryptocurrencies as part of a balanced investment portfolio.

Furthermore, these shifts in capital flow among crypto ETFs unite into a larger narrative of market adaptation and investor strategy. As Bitcoin ETF news continues to discuss these outflows, it’s essential to consider how this affects market sentiment and the potential for price corrections. Awareness of these patterns is critical for traders and long-term investors as they navigate the complexities of the crypto landscape and search for stability amid fluctuations.

Analyzing Solana ETF Inflow Amidst Bitcoin and Ethereum Trends

The surge in the Solana ETF’s net inflow, showing an increase of 36,370 SOL today, points to a remarkable shift in investor interest. While Bitcoin and Ethereum ETFs are experiencing outflows, Solana’s positive performance suggests that investors are seeking more dynamic and potentially lucrative avenues within the cryptocurrency sector. This trend reflects an underlying recognition of Solana’s capabilities in scaling applications and supporting decentralized finance activities.

Moreover, with a continual positive trajectory, Solana’s ETF inflow could indicate that it may soon challenge the dominance of Bitcoin and Ethereum in the ETF marketplace. Investors appear to appreciate the unique benefits Solana offers, such as lower transaction fees and higher throughput. Observing these flows can provide insights into potential future market behavior, as Solana’s ascent may redefine investor strategies and shape the overall landscape of cryptocurrency ETFs.

Market Sentiment and Future Predictions for Bitcoin and Ethereum

The current market sentiment surrounding Bitcoin and Ethereum is incredibly nuanced, especially in light of recent ETF outflows. Investors are grappling with economic uncertainties that lead to this hesitance in Bitcoin investments, as reflected in the net outflows. Future predictions hinge on resolving various regulatory frameworks and the global economic outlook, which could either bolster or hinder investor confidence in these primary cryptocurrencies. As market fluctuations continue, traders must remain vigilant and adaptable.

As the crypto market evolves, a strong correlation between Bitcoin ETF net outflow and broader market expectations should not be overlooked. Although Bitcoin has long been considered a safe haven, these recent trends suggest that its perceived volatility might be causing investors to diversify into other segments, such as Ethereum and Solana. Overall, the interdependence of these digital assets in shaping market sentiment should guide investment decisions and strategies moving forward.

The Role of Institutional Investors in Crypto ETF Outflows

Institutional investors play a crucial role in shaping the dynamics of the cryptocurrency ETF landscape. Their decisions can heavily influence net flows in both Bitcoin and Ethereum ETFs. Recent reports indicate that institutions withdrawing from the Bitcoin ETF may be reallocating their investments toward emerging projects like Solana, which directly impacts overall market liquidity and sentiment. Understanding institutional behavior is vital for recognizing trends in crypto ETF performances and making informed investment decisions.

In particular, the impact of institutional investors can lead to rapid changes in the crypto ETF market, as their large transactions can result in heightened volatility and significant price movements. The ongoing net outflow trend for Bitcoin ETF coupled with inflows in the Solana ETF highlights that institutions are not afraid to pivot when they believe opportunities arise elsewhere. It emphasizes the need for retail investors to stay informed about institutional trends to align their own investment strategies effectively.

Regulatory Challenges Affecting Bitcoin and Ethereum ETFs

The regulatory landscape surrounding cryptocurrencies is complex and continually evolving, impacting the behavior of Bitcoin and Ethereum ETFs significantly. Regulatory challenges can deter potential investors, evidenced by recent net outflows from the Bitcoin ETF, driven partly by uncertainty regarding future regulations. Keeping abreast of regulatory shifts is crucial for investors evaluating the long-term viability of their ETF investments.

Additionally, with the ongoing discussions around cryptocurrency regulations, the ability of ETFs to attract and retain investors could be fundamentally affected. As the market responds to regulatory clarity or ambiguity, asset flows within Bitcoin and Ethereum ETFs might reflect broader market uncertainties. This scenario underlines the necessity for comprehensive regulation to foster a more stable environment for cryptocurrency investments, thereby influencing asset performance significantly.

Comparative Analysis of Crypto Asset Performance

Conducting a comparative analysis of the performance of Bitcoin, Ethereum, and Solana as represented by their ETFs provides valuable insights into market trends. The distinct patterns of net inflows and outflows reveal how investors are prioritizing their strategies. With Bitcoin and Ethereum ETFs exhibiting net outflows, it becomes essential to explore which specific attributes of Solana are appealing to investors, evidenced by consistent inflows.

Moreover, this comparative study emphasizes that market conditions favor diversification across various cryptocurrencies. By analyzing the performance metrics of these assets, investors can better understand the volatility landscape and make informed choices. This analysis serves as a reminder that while Bitcoin remains the flagship cryptocurrency, emerging assets like Solana may redefine investment criteria in an ever-evolving market.

Investing Strategies in Light of Recent Crypto Flows

The recent flows in the crypto ETF markets underscore the necessity for investors to reevaluate their investment strategies. With the marked net outflow from the Bitcoin ETF and the rising interest in Solana, it’s vital for investors to remain adaptive. Strategies that once prioritized Bitcoin may need to consider the relative performance of emerging cryptocurrencies like Solana and Ethereum, reflecting the shifting preferences within the market.

Furthermore, diversification appears to be the key strategy amidst precarious market trends. Investors should not solely focus on Bitcoin, particularly given its current performance metrics. Instead, the opportunities associated with Ethereum and Solana should be considered as potential areas for growth. In doing so, investors can maintain resilience and adaptability, securing their positions in the shifting landscape of cryptocurrency investments.

Frequently Asked Questions

What caused the Bitcoin ETF net outflow of 3,734 BTC today?

The recent Bitcoin ETF net outflow of 3,734 BTC may be attributed to various factors including market volatility, investor sentiment, and a shift in capital towards alternative cryptocurrencies. Investors often reassess their portfolios in reaction to market trends, which can lead to significant outflows.

How does the Bitcoin ETF net outflow compare to other crypto ETFs?

Today, the Bitcoin ETF net outflow of 3,734 BTC contrasts with the Ethereum ETF’s substantial outflow of 42,299 ETH. Meanwhile, the Solana ETF experienced an inflow of 36,370 SOL, highlighting diverging trends within the crypto ETF market.

What are the implications of Bitcoin ETF net outflow trends on the market?

Sustained Bitcoin ETF net outflow trends can signal weakening investor confidence, potentially impacting Bitcoin’s price negatively. However, fluctuations in the crypto ETF market, including inflows to other assets like Solana, illustrate the dynamic nature of investor behavior.

What does the 7-day net outflow for Bitcoin ETFs indicate?

The 7-day net outflow of 7,706 BTC from Bitcoin ETFs indicates a longer-term trend of capital leaving this asset class, which may reflect broader market concerns or a strategic pivot by investors towards other opportunities, including Ethereum and Solana.

How do market trends affect Bitcoin ETF net outflows?

Market trends directly influence Bitcoin ETF net outflows; bearish market conditions often lead to higher outflows as investors sell off holdings. Conversely, positive market news can result in inflows, as seen with rising interest in Ethereum and Solana ETFs amidst Bitcoin’s current net outflow.

| Cryptocurrency | Today Net Outflow | 7-Day Net Flow |

|---|---|---|

| Bitcoin ETF | 3,734 BTC | 7,706 BTC (Outflow) |

Summary

Bitcoin ETF net outflow took place today, with the fund experiencing a notable loss of 3,734 BTC. This trend is alarming, as it also reflects an overall outflow of 7,706 BTC over the past week, indicating potential bearish sentiment among investors in the Bitcoin market. Meanwhile, contrasting data shows the Ethereum ETF had an outflow of 42,299 ETH today, while maintaining a net inflow of 8,466 ETH over the week. The Solana ETF presents a more positive scenario as it had a net inflow of 36,370 SOL today. Investors should closely monitor these trends as they reveal significant shifts in market sentiments.

Related: More from Bitcoin News | AI, BTC Miners Issue High | Bitcoin Above $69K? Glassnode Weighs In