The Bitcoin halving cycle is a pivotal event in the cryptocurrency ecosystem, occurring approximately every four years and fundamentally impacting Bitcoin’s supply and market dynamics. Historically, these halvings have led to significant price increases, capturing the attention of both retail and institutional investors, who recognize their potential to shape Bitcoin market trends. As institutional interest grows, especially with the introduction of Bitcoin ETFs, understanding the implications of this cycle becomes crucial for accurate Bitcoin price prediction and long-term investment strategies. However, recent discussions suggest that while the halving remains significant, it’s not the sole determinant of Bitcoin’s value. Thus, comprehensive cryptocurrency market analysis that considers diverse factors—such as regulatory changes and investor sentiment—is essential to navigate this evolving landscape effectively.

The Bitcoin halving event represents a critical milestone in the cryptocurrency landscape, indicative of reduced supply influxes that can significantly influence market behavior. These periods, marked by a halving of block rewards to miners, become essential focal points for traders and investors alike, heralding an opportunity for strategic positioning amid shifting dynamics. With a growing wave of institutional engagement and the burgeoning presence of exchange-traded funds (ETFs), there is an emerging narrative that these cycles are no longer the solitary compass guiding Bitcoin’s trajectory. Instead, they coexist with a myriad of factors affecting demand and liquidity, warranting a broader perspective for accurate Bitcoin valuation. As the ecosystem evolves, embracing a multifaceted analysis will empower market participants to decode the complexities shaping Bitcoin’s future.

The Evolution of the Bitcoin Halving Cycle

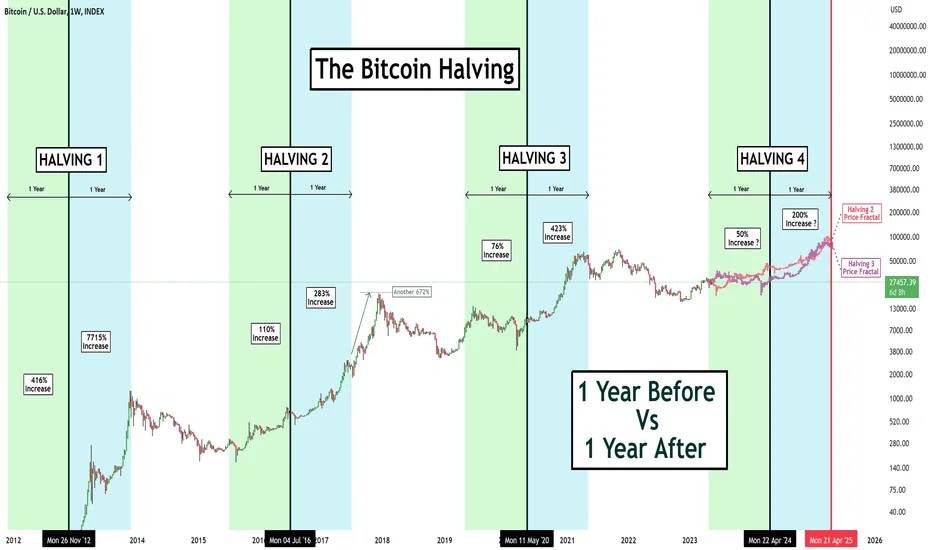

Bitcoin’s halving cycle has long been a central tenet of its market behavior and price dynamics. Traditionally, each halving event has been seen as a catalyst for exponential price increases due to the reduction in the rate at which new bitcoins are produced. This predictable rhythm of supply reduction has allowed traders to develop strategies around it, anticipating that whenever the supply decreases, demand would ultimately push prices upwards. However, recent discourse among market analysts has started to challenge this notion, suggesting that while the halving still plays a role, it is no longer the sole driving force behind Bitcoin’s price movements. Instead, the market is now influenced by a myriad of factors, including institutional participation and the evolving landscape of cryptocurrency regulations, which are reshaping how Bitcoin is perceived and valued in broader financial markets.

The shift from a singular focus on the halving cycle to a multifaceted understanding of Bitcoin’s market requires recognizing the implications of broader economic policies and market conditions. As institutional investors increasingly enter the fray, their trading behaviors and motivations diverge from those of retail investors, leading to a new narrative surrounding Bitcoin’s value. Understanding these dynamics necessitates examining not only the historical cycles but also the current market sentiment and liquidity conditions that interact with the halving. Thus, while the halving remains a significant event, it is now woven into a complex tapestry of market influences that alter its traditional impact.

Institutional Investors and Their Impact on Bitcoin Trends

The entry of institutional investors into the Bitcoin market represents a seismic shift in how this cryptocurrency is traded and valued. Unlike individual retail traders who might respond primarily to market sentiment and price trends, institutional investors approach Bitcoin with sophisticated strategies and risk management protocols. Their involvement has led to increased liquidity and a shift in the trading volume characteristics, creating a more stable floor for Bitcoin prices. As institutions leverage advanced methodologies for portfolio diversification, Bitcoin increasingly acts as a digital asset, compelling traditional financial structures to adapt to its presence in their investment strategies.

Moreover, the influence of institutional capital is also evident in the growing interest in Bitcoin ETFs (Exchange-Traded Funds). Institutional investors are now able to gain exposure to Bitcoin without directly trading it on exchanges, thereby lowering barriers to entry. The demand generated from Bitcoin ETFs is substantial, contributing to changes in supply and demand dynamics that exist beyond what traditional halving cycles might suggest. As a result, understanding how institutional forces shape Bitcoin market trends is essential for accurate price predictions and cryptocurrency market analysis.

The Bitcoin ETF Boom and Its Market Implications

Bitcoin ETFs have emerged as a pivotal development in the cryptocurrency landscape, significantly influencing how both retail and institutional investors approach Bitcoin. The introduction of these ETFs has not only broadened the accessibility of Bitcoin trading but has also provided a sense of legitimacy and stability to the market. As institutional investors capitalize on these vehicles, the demand for Bitcoin is now regulated and managed through conventional financial systems, creating a new level of scrutiny and governance that was previously absent. This shift enables more consistent inflows into Bitcoin, as ETFs attract investment from those who might have been previously hesitant due to the volatility associated with direct cryptocurrency trading.

Additionally, the mechanics of how Bitcoin ETFs operate have transformed the market’s supply-demand calculus. Buying pressure manifests through creation units of the ETF, while selling pressure is seen during redemptions. Such mechanisms allow for a more seamless integration of Bitcoin into traditional investment portfolios, fundamentally altering the price discovery process. As markets increasingly adapt to these structures, the traditional cycles surrounding Bitcoin’s supply, including the halving, must be reevaluated to incorporate these new dynamics accurately. Blockchain technology’s integration into mainstream finance sets a precedent for future cryptocurrency developments and market behaviors.

The Role of Liquidity in Bitcoin’s Market Dynamics

Liquidity is an essential component in understanding Bitcoin’s market dynamics and its interactions with institutional investment. As the liquidity factors fluctuate, they influence how Bitcoin trades in real-time, directly impacting price movements across all exchanges. During times of heightened liquidity, Bitcoin often witnesses price stability and enhanced trading volumes, while periods of low liquidity can lead to erratic price swings. This direct connection underscores the importance of monitoring market liquidity, especially as it relates to institutional order flows and trading strategies. Adjustments in liquidity not only impact Bitcoin prices but also dictate how institutional investors manage their risk and exposure.

Furthermore, the growing complexity of Bitcoin’s market has made liquidity an even more critical focus area for investors. The absorption of institutional funds and the rise of products like Bitcoin ETFs have increased the depth of liquidity, allowing for more nuanced trading strategies to emerge. Investors can now exploit these liquidity pools and dynamics to their advantage, potentially leading to innovations in risk management and trading strategies. Understanding these shifts is crucial for anyone looking to navigate the evolving Bitcoin landscape effectively.

Market Sentiment and Bitcoin Price Predictions

Market sentiment plays an intricate role in shaping Bitcoin’s price predictions, as it reflects the collective mood and perceptions of investors, both institutional and retail. Amid the fluctuations of the cryptocurrency market, sentiment can swing dramatically based on news, regulatory developments, and institutional adoption trends. For instance, positive news about Bitcoin ETFs or endorsements from major financial institutions can lead to increased optimism, driving retail investors back into the market and potentially fueling price surges. Conversely, negative sentiment, whether stemming from regulatory crackdowns or security breaches, can lead to significant sell-offs and price corrections.

To make accurate price predictions in such a volatile environment, analysts must delve into both technical indicators and broader market sentiment. Tools such as social media trends, investor surveys, and on-chain analysis offer indicators of prevailing sentiment, providing insights into potential market movements. As Bitcoin continues to evolve within a complex interplay of traditional finance and cutting-edge technology, being able to forecast price movements based on sentiment becomes increasingly important for effective cryptocurrency market analysis.

Understanding Price Volatility in the Bitcoin Market

Price volatility in the Bitcoin market is a well-documented phenomenon that poses a double-edged sword for investors. On one hand, the potential for high returns can attract speculative trading; on the other hand, the same volatility can deter more risk-averse institutional investors. Grasping the factors that contribute to Bitcoin’s price volatility is crucial for anyone participating in this market. Traders must account for not only the inherent attributes of Bitcoin itself—such as its limited supply and increasing demand—but also external factors like macroeconomic trends, regulatory announcements, and larger liquidity dynamics within the cryptocurrency sphere.

Furthermore, institutional involvement adds another layer of complexity to Bitcoin’s price volatility. As entities manage larger amounts of capital, their trades can have outsized effects on market movements. For instance, a significant buy order from an institutional player may send prices soaring, while large sell-offs can exacerbate downward trends. Consequently, understanding how institutional trading strategies align with Bitcoin’s price behavior is essential for investors aiming to navigate its volatility wisely. As Bitcoin’s market matures, balancing the risks and potential rewards tied to price fluctuations will remain a central challenge for both retail and institutional investors.

The Interplay Between Regulatory Changes and Bitcoin

Regulatory changes are one of the most significant external factors impacting Bitcoin’s market landscape. As governments and regulatory bodies establish frameworks to oversee cryptocurrency markets, the implications for investor behavior and market dynamics are profound. Regulatory clarity has become a critical driver for institutional investors looking to enter the Bitcoin market. The announcement of new regulations or the potential for future oversight can either instill confidence or induce fear among investors. This regulatory environment not only affects Bitcoin’s price volatility but also its market accessibility, influencing how and when institutional investors engage with this asset class.

Moreover, the effects of regulatory developments are not just confined to Bitcoin; they send ripples through the entire cryptocurrency market. As regulatory landscapes become more favorable or restrictive, market conditions can shift rapidly. The recent focus on Bitcoin ETFs and regulations around their launch has spurred institutional interest, indicating that adapted regulations can open up considerable funding channels for Bitcoin. Understanding how these regulatory changes interact with market trends is vital for making informed decisions in such a rapidly evolving landscape.

Future Outlook: Navigating Multiple Calendars in Bitcoin Investments

As the Bitcoin ecosystem continues to evolve, adapting to multiple calendars in terms of investment strategy is becoming increasingly imperative for traders and investors alike. No longer can participants focus exclusively on Bitcoin’s traditional halving cycles; the market now encompasses a broader set of influences—from institutional behaviors, ETF dynamics, to real-time liquidity conditions. This requires a paradigm shift in the way Bitcoin investments are approached. Those who can remain flexible and responsive to these evolving factors are likely to outperform those relying on outdated models centered solely on historical price movements.

Additionally, a nuanced understanding of the various cycles and rhythms that govern Bitcoin will allow investors to position themselves more effectively. The interplay between traditional market conditions, regulatory changes, and new investment vehicles like ETFs will set the stage for future price movements. As strategies evolve, investors must pay careful attention to the emerging trends and indicators that signal shifts in demand and investor sentiment. The winners in this new landscape will be those who master the holistic understanding of Bitcoin’s multi-faceted market dynamics, enabling them to make more informed and adaptive investment decisions.

Frequently Asked Questions

What is the significance of the Bitcoin halving cycle in the context of Bitcoin market trends?

The Bitcoin halving cycle is significant as it directly impacts Bitcoin’s supply by reducing the reward miners receive by half approximately every four years. This reduction in new supply can create a supply shock, historically leading to increased demand and higher prices following each halving. However, recent analysis suggests that other factors, such as institutional investor activity and the emergence of Bitcoin ETFs, are also influencing Bitcoin market trends and may alter the expected outcomes of the halving.

How do institutional investors impact the Bitcoin halving cycle?

Institutional investors play a crucial role in the Bitcoin halving cycle by providing significant liquidity and demand in the market. Their involvement has shifted the dynamics of Bitcoin trading and price movement, making the halving less dominant compared to previous cycles. As institutional players adopt Bitcoin into their portfolios, the effects of the halving cycle may be moderated by broader market conditions and investment strategies.

What effect do Bitcoin ETFs have on the halving cycle and price predictions?

Bitcoin ETFs can greatly impact the halving cycle by changing how demand is structured in the market. They create new pathways for investors to access Bitcoin, leading to more systematic buying and selling based on market conditions rather than purely on halving events. This shift alters price predictions, as the ETF flows (creations and redemptions) can influence Bitcoin prices independently of the halving cycle.

Can the Bitcoin halving cycle still influence price predictions amid changing market dynamics?

Yes, the Bitcoin halving cycle can still influence price predictions, but its impact may be less straightforward due to the changing landscape of Bitcoin market dynamics. Factors like institutional interest and ETF participation can overshadow the traditional response patterns associated with halving events. While the halving remains a key event, investors must also consider these new variables to make accurate predictions.

What are the broader implications of the transformation in Bitcoin’s market structure for the halving cycle?

The transformation of Bitcoin’s market structure, driven by institutional investment and product innovations like ETFs, suggests that the halving cycle is now just one of many factors influencing price movements. It implies that while the halving remains important, the actual trading dynamics are more complex, incorporating multiple ‘clocks’ or indicators that investors must watch rather than simply waiting for halving-related price surges.

How should investors approach Bitcoin price prediction strategies in light of the halving cycle?

Investors should adopt a multifaceted approach to Bitcoin price prediction strategies, recognizing that while the halving cycle still holds relevance, it is essential to also consider factors such as institutional investor behavior, ETF flows, and overall market conditions. Understanding how these elements interact will provide a more accurate framework for anticipating Bitcoin price movements beyond the traditional halving narrative.

Why is it important to analyze Bitcoin’s halving cycle alongside liquidity and risk management strategies?

Analyzing Bitcoin’s halving cycle alongside liquidity and risk management strategies is vital because it provides a complete picture of market activity. As the Bitcoin landscape evolves, shifts in liquidity and the accumulation of risk through derivatives and institutional trading can significantly affect price dynamics. Incorporating these factors helps investors adapt their strategies to the changing market and make informed decisions.

| Key Point | Details |

|---|---|

| Significance of Halving | The Bitcoin halving remains a major event, reducing new supply and influencing market dynamics. |

| Changing Market Dynamics | Institutional factors and the introduction of Bitcoin ETFs are reshaping the historical halving cycle. |

| Impact of Economic Conditions | Global financing conditions and interest rates influence buyer interest and market trends. |

| Broadened Investor Base | Increased access and familiarity with Bitcoin among institutional investors change trading dynamics. |

| Market Structure Evolution | The market now resembles mainstream markets, affecting how price discovery occurs. |

| Multiple Clocks Concept | Bitcoin’s cycles are no longer solely driven by halving events; multiple factors play a role. |

| Understanding the New Dynamics | Investors must look at cost of capital, ETF flows, and market positioning to navigate Bitcoin’s landscape. |

Summary

The Bitcoin halving cycle remains an essential component of cryptocurrency markets, but its influence has evolved amidst the introduction of institutional factors. The traditional narrative surrounding Bitcoin’s halving no longer solely dictates market movements, as institutional demand and economic conditions increasingly dictate buying behavior. Understanding these new dynamics is crucial for investors aiming to navigate the complexities of Bitcoin’s present and future.

Related: More from Bitcoin News | AI, BTC Miners Issue High | Bitcoin Above $69K? Glassnode Weighs In