Digital asset investment outflow has recently made headlines as CoinShares reports a staggering net outflow of $454 million last week alone. This substantial withdrawal reflects a broader trend in the crypto market as investors respond to shifting interest rate expectations and diminished optimism surrounding digital asset investment products. Over just four days, the total outflow skyrocketed to $1.3 billion, nearly cancelling out the earlier $1.5 billion net inflow seen at the start of the year. Notably, the U.S. market faced a significant net outflow of $569 million, signaling caution among local investors amid changing economic landscapes. As Bitcoin and Ethereum saw steep drops in investment, trends indicate a potential recalibration in strategies among cryptocurrency enthusiasts and traditional investors alike.

In the realm of cryptocurrency, the recent trend of capital withdrawal from digital assets highlights a pivotal shift in investor sentiment. Following the latest findings from industry analysts, such as CoinShares, the emergence of net outflows in investment products suggests a reevaluation of investment strategies across the sector. Factors such as fluctuating interest rate predictions and market instability have prompted many to reconsider their positions within this volatile ecosystem. As investment in major cryptocurrencies like Bitcoin and Ethereum dwindles, alternative digital currencies are beginning to attract attention, reflecting evolving market dynamics. The implications of these trends are profound, signaling a potential restructuring within digital asset portfolios.

Understanding Digital Asset Investment Outflows

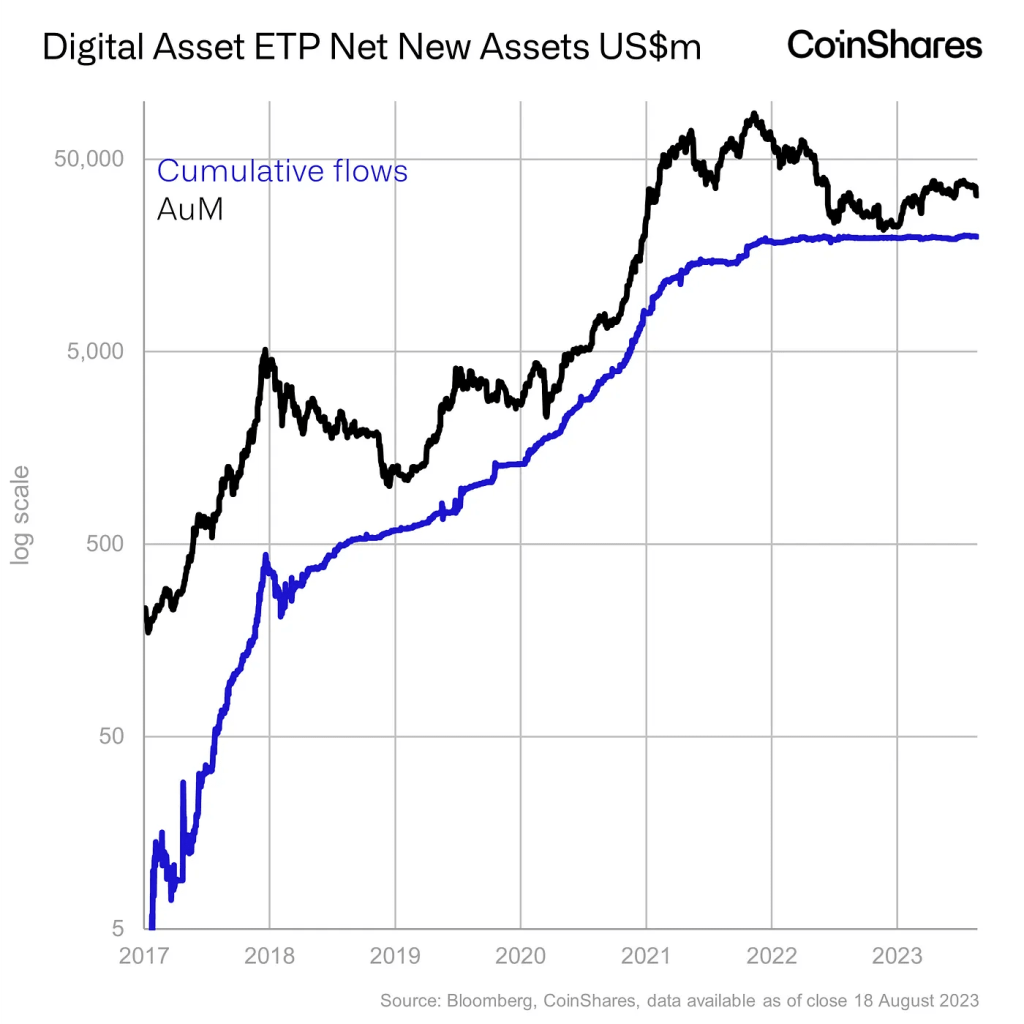

Digital asset investment outflows represent the withdrawal of funds from various digital assets and investment products. In the past week, CoinShares reported a significant net outflow of $454 million, indicating a shifting sentiment among investors. This kind of outflow can have ripple effects on market dynamics, as reduced capital inflows can lead to lower asset prices, increased volatility, and an overall bearish outlook on the crypto market. Investors should pay close attention to these patterns, as they often correlate with macroeconomic factors and investor sentiment.

The recent net outflow signals a cautious approach from many digital asset investors, influenced largely by external economic pressures. For instance, uncertainties surrounding interest rate expectations have contributed to this trend, with many investors opting for safer investment avenues rather than higher-risk digital assets. As the Federal Reserve’s anticipated moves become clearer, the flow of investment into or out of digital assets may also stabilize, reflecting more favorable or detrimental market conditions based on prevailing interest rates.

Frequently Asked Questions

What does the recent CoinShares report say about digital asset investment outflow?

The latest CoinShares report indicates that digital asset investment products experienced a significant net outflow of $454 million in the last week, contributing to a total outflow of $1.3 billion over four days. This trend closely follows a $1.5 billion net inflow earlier this year, primarily influenced by shifting interest rate expectations from the Federal Reserve.

How do interest rate expectations impact digital asset investment outflow?

Interest rate expectations can significantly affect digital asset investment outflow. For example, the recent net outflow was largely attributed to weakened expectations for an interest rate cut by the Federal Reserve in March. When investors anticipate rising interest rates, they may withdraw investments from digital asset products in favor of more stable returns.

Which regions experienced the highest digital asset investment outflow according to CoinShares?

According to CoinShares, the U.S. market faced the highest digital asset investment outflow, totaling $569 million last week. In contrast, other regions like Germany, Canada, and Switzerland recorded positive inflows, showing a contrasting trend in digital asset investments.

What cryptocurrencies saw the most outflow in digital asset investments recently?

Despite the overall digital asset investment outflow, Bitcoin and Ethereum experienced the most significant withdrawals, with outflows of $405 million and $116 million, respectively. These trends reflect changing investor sentiment within the crypto market amidst evolving economic conditions.

Are there opportunities for inflow despite the current digital asset investment outflow?

Yes, within the context of the current digital asset investment outflow, certain cryptocurrencies like Solana, XRP, and Sui showcased inflows of $32.8 million, $45.8 million, and $7.6 million respectively. This suggests that while overall outflows are occurring, specific assets still attract investor interest amid prevailing market trends.

| Key Points | Details |

|---|---|

| Net Outflow | $454 million last week, totaling $1.3 billion over the past four days. |

| Previous Inflow | $1.5 billion net inflow at the beginning of the year. |

| Reason for Outflows | Weakened expectations of an interest rate cut by the Federal Reserve in March. |

| Geographical Flow Summary | U.S. saw $569 million outflow; Germany ($58.9 million), Canada ($24.5 million), and Switzerland ($21 million) had inflows. |

| Specific Asset Outflows | Bitcoin outflow: $405 million; Ethereum outflow: $116 million. |

| Specific Asset Inflows | Solana inflow: $32.8 million; XRP inflow: $45.8 million; Sui inflow: $7.6 million. |

Summary

Digital asset investment outflow has become a significant trend recently, as highlighted by CoinShares’ latest report detailing a staggering net outflow of $454 million last week. This trend, driven by factors such as altered expectations around interest rate decisions by the Federal Reserve, signals a cautious market sentiment. Investors should remain vigilant in these changing conditions, as the outflow figures are substantial enough to cause ripples across various cryptocurrency sectors.

Related: More from Ethereum News | Google Cloud, MoneyGram Join New Privacy Network Bank Initiative | Ethereum Network Transactions Hit New Record: What It Means for You