Binance leverage adjustment is a significant move that has caught the attention of traders across the crypto landscape. Effective January 16, 2026, Binance will modify the leverage and margin levels for various U-standard contracts, impacting popular trading pairs like SAHARAUSDT, ALLOUSDT, and BARDUSDT. This upcoming change is contingent on the latest crypto trading updates, aiming to enhance trading efficiency and manage risk better. Alongside these adjustments, Binance will also revise portfolio margin changes for assets such as VET, SC, and BTTC, set to take effect shortly before the leverage changes at 14:00 Beijing time. For those following Binance news January 2026, it’s crucial to stay informed about these updates as they can influence trading strategies and portfolio performance.

The impending adjustments to Binance’s leverage and margin configurations signal a pivotal evolution in the world of cryptocurrency trading. With alterations set to affect the U-standard perpetual contracts, traders will need to adapt their tactics and strategies accordingly. These revisions not only redefine margin levels but also revisit collateral rates for select cryptocurrencies, fostering an environment that can better support traders’ financial activities. As Binance initiates these vital changes, keeping abreast of the latest updates is essential for maintaining an agile trading portfolio. Such proactive measures taken by Binance reflect ongoing developments that aim to enhance user experience and mitigate trading risks in the competitive crypto market.

Understanding Binance Leverage Adjustments

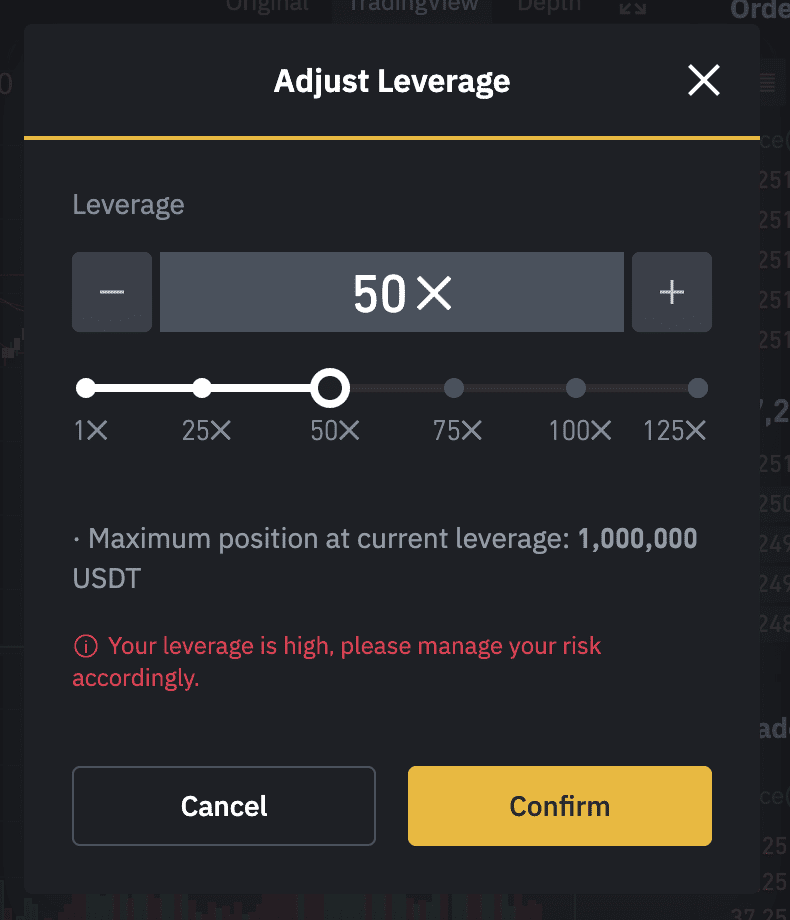

Binance’s decision to adjust leverage levels reflects the platform’s commitment to providing a safer trading environment for its users. Effective from January 16, 2026, the revised leverage limits for U-standard perpetual contracts aim to mitigate the risks associated with high volatility in crypto markets. Such adjustments help maintain market integrity while allowing traders to make informed decisions based on their risk tolerance.

Higher leverage allows traders to control larger positions with a smaller capital outlay, but it can also amplify potential losses. Therefore, these adjustments to Binance’s leverage levels can be seen as a proactive measure to encourage responsible trading. The changes will impact several major contracts, including SAHARAUSDT, ALLOUSDT, and BARDUSDT, indicating a broader shift in Binance’s trading strategy to better align with current market dynamics.

Impact of Margin Levels on Crypto Trading

Margin levels play a critical role in the trading strategies employed by crypto assets. Binance’s recent announcement regarding the adjustments to margin levels for various U-standard contracts symbolizes a shift to ensure that traders are adequately protected from the risks inherent in leveraged trading. Increased margin requirements can stabilize price movements, ensuring that traders are equipped to handle market fluctuations.

As crypto trading continues to evolve, understanding the impact of these changes is essential for traders. With companies like Binance leading the charge in updating portfolio margins and collateral rates for assets such as VET, SC, and BTTC, traders must stay informed about these developments to optimize their strategies. Keeping up with Binance news, particularly updates like these, is vital for making informed trading decisions.

The Role of U-Standard Contracts in Binance Trading

U-standard contracts have become an integral part of trading on Binance. They offer traders the opportunity to engage in perpetual swaps with potentially simpler terms compared to traditional futures contracts. As Binance adjusts leverage and margin levels for these contracts, it is essential to comprehend the implications of these changes in a rapidly evolving trading landscape.

The flexibility that U-standard contracts provide can be advantageous for both novice and seasoned traders looking to navigate the complexities of the crypto market. Despite the challenges associated with high leverage trading, these contracts allow for innovative trading strategies that can capitalize on market momentum. The upcoming adjustments planned by Binance will undoubtedly shape how traders utilize U-standard contracts moving forward.

Latest Developments in Binance Margin Trading

As of January 12, 2026, Binance has announced significant changes in its margin trading framework. These updates, effective on January 16, will recalibrate the collateral rates and portfolio margins associated with key digital assets. Traders must adapt to these new parameters to ensure their strategies align with Binance’s evolving policies, which prioritize user protection and market stability.

Staying updated on such developments is critical for effective trading. Binance’s commitment to communication through crypto trading updates reinforces the importance of transparency within the industry. As these adjustments take effect, traders should evaluate their current positions and consider how the revised margin levels might influence their overall risk management approaches.

Navigating Portfolio Margin Changes on Binance

The introduction of new portfolio margin changes illustrates Binance’s strategic approach in adapting to market realities. Starting January 16, the revised collateral rates for assets like VET, SC, and BTTC will impact how traders manage their margin accounts. Understanding these changes allows traders to refine their portfolio strategies and optimize for risk-adjusted returns.

With these modifications in portfolio margins, traders are encouraged to perform thorough analyses of their invested assets. It is vital to grasp how these adjustments can affect the overall margin requirements and potential liquidation risks. Utilizing Binance’s platform effectively amidst these transitions will require a focus on proactive measures to mitigate risks.

Binance News Update for January 2026

The latest Binance news from January 2026 not only highlights crucial changes in leverage and margin levels, but it also reflects broader trends within the crypto trading ecosystem. As exchanges adjust their operational frameworks, traders are called to remain agile and adaptable to these significant market shifts. Staying informed through reliable news channels can provide insights necessary for successful trading.

In addition to the leverage adjustments, Binance’s updates serve to remind traders of the increasingly dynamic nature of cryptocurrency markets. As policies evolve, comprehensive understanding of the underlying mechanics, such as portfolio margin changes and leverage usage, becomes a cornerstone of navigating the complex world of crypto trading successfully.

Strategies for Adjusting to New Leverage Limits

Traders aiming to adjust to new leverage limits must evaluate their trading strategies in light of the updated Binance policies. With the recent adjustments to leverage for U-standard contracts, it is essential for traders to conduct a thorough review of their risk management processes. Implementing stricter stop-loss orders and reassessing position sizes can help mitigate potential risks in a leveraged environment.

Moreover, traders should leverage tools and resources provided within the Binance platform to familiarize themselves with the adjusted limits. Participating in community discussions and seeking insights from experienced traders can also enhance understanding of how to navigate the new landscape effectively. Embracing adaptability will be key to thriving in this modified trading framework.

The Importance of Risk Management in Crypto Trading

With margins and leverage adjustments playing a critical role in crypto trading, risk management strategies become even more significant. Binance’s recent updates underscore the necessity for traders to assess their risk appetite and adjust their trading positions accordingly. By implementing comprehensive risk management plans, traders can protect themselves against the volatility often associated with cryptocurrency markets.

Educating oneself about various risk mitigation techniques, such as diversification and using risk-reward ratios, is essential in this new trading environment. As the crypto landscape evolves, maintaining a fortified risk management approach will not only secure investments but also enhance trading performance amidst changing market conditions.

Future Outlook for Binance and its Users

Looking ahead, the future of Binance appears promising as it continues to refine its trading framework to meet the needs of its users. The recent margin and leverage adjustments are likely to lead to a more stable and secure trading environment, fostering investor confidence in one of the leading exchanges in the crypto market. Users can expect more updates in the coming months as Binance responds to market oscillations.

These strategic adjustments highlight the importance of regulatory compliance and user protection within the cryptocurrency sector. As Binance prepares its platform for future challenges, traders should stay informed and ready to adapt, positioning themselves advantageously as new trends and trading opportunities emerge.

Frequently Asked Questions

What is the Binance leverage adjustment announced for January 2026?

The Binance leverage adjustment, effective January 16, 2026, involves changes to the leverage and margin levels for numerous U-standard perpetual contracts, including cryptocurrencies like SAHARAUSDT, ALLOUSDT, and BARDUSDT. Users should review these updates to understand how they may affect their trading strategies.

How will Binance margin levels change for U-standard contracts in January 2026?

From January 16, 2026, Binance will modify margin levels for various U-standard contracts. This adjustment aims to enhance risk management and provide traders with better trading experiences. It’s advisable to check the specific changes for each contract to plan accordingly.

What should I know about portfolio margin changes on Binance in January 2026?

On January 16, 2026, Binance will implement updates to portfolio margin and collateral rates, particularly for assets such as VET, SC, and BTTC, scheduled for 14:00 (Beijing time). Users utilizing Portfolio Margin Pro (PMPro) should familiarize themselves with these changes to effectively manage their crypto trading positions.

Will Binance provide crypto trading updates regarding the leverage adjustment?

Yes, Binance regularly shares crypto trading updates, including details about leverage adjustments and margin level changes for U-standard contracts. Traders can stay informed through Binance news and announcements to make better-informed decisions.

Why are adjustments to Binance leverage and margin levels important for traders?

Adjustments to Binance leverage and margin levels are crucial as they impact trading risk, profitability, and capital required to open positions. Understanding these changes allows traders to optimize their trading strategies, manage risk more effectively, and adapt to market conditions.

Where can I find more information about the Binance news for January 2026?

For the latest updates and announcements regarding leverage adjustments, margin levels, and other changes, visit the official Binance news section or keep an eye on their social channels, which will provide timely information about all developments in January 2026.

| Key Point | Details |

|---|---|

| Adjustment Announcement | Binance will adjust leverage and margin levels for multiple U-standard perpetual contracts. |

| Effective Date and Time | The adjustments will be effective from January 16, 2026, at 14:30 (Beijing time). |

| Contracts Affected | Contracts such as SAHARAUSDT, ALLOUSDT, and BARDUSDT will see leverage adjustments. |

| Portfolio Margin Update | In addition, portfolio margin and collateral rates for assets like VET, SC, and BTTC will be updated. |

| Timing for Portfolio Margin Update | This update will take place on the same day at 14:00 (Beijing time). |

Summary

Binance leverage adjustment is a significant move impacting multiple U-standard perpetual contracts. Starting January 16, 2026, Binance will change the leverage and margin levels for contracts such as SAHARAUSDT, ALLOUSDT, and BARDUSDT, ensuring their platform remains competitive and secure for traders. Additionally, the portfolio margin and collateral rates for various assets will also be updated at the same time, demonstrating Binance’s commitment to providing the best trading conditions for its users.

Related: More from Exchange News | Bybit Expands Stablecoin Income Products Amid Crypto Volatility | ARK Invest Coinbase Stock Sale: What This Means for Investors