India cryptocurrency regulations have entered a new era with stringent guidelines aimed at combating money laundering and ensuring user verification. The Financial Intelligence Unit (FIU) has emphasized the importance of robust know-your-customer (KYC) procedures, introducing measures that require cryptocurrency users to submit live selfies along with their geographic location during the onboarding process. These regulations are designed to prevent identity fraud and enhance cryptocurrency exchange guidelines by mandating the collection of IP addresses and bank account verification. As a significant step toward AML compliance in India, these rules reflect urgent concerns regarding tax evasion facilitated by anonymous digital assets. With a heavy tax regime on cryptocurrency profits and classified exchanges facing mounting scrutiny, the landscape for crypto enthusiasts is becoming increasingly regulated and complex.

In the realm of digital finance, regulatory frameworks are evolving, particularly concerning cryptocurrency operations within India. Recent mandates aimed at ensuring compliance with anti-money laundering protocols and user identification have sparked a conversation about effective crypto user onboarding across various exchanges. With an increased focus on KYC requirements and the implementation of strict oversight by the FIU, the push for standardized practices has never been more urgent. These developments illustrate the government’s keen interest in managing the challenges posed by decentralized currencies, especially regarding tax implications and enforcement. As stakeholders navigate these shifting waters, the intersection of technology and regulation stands to redefine the cryptocurrency market landscape in India.

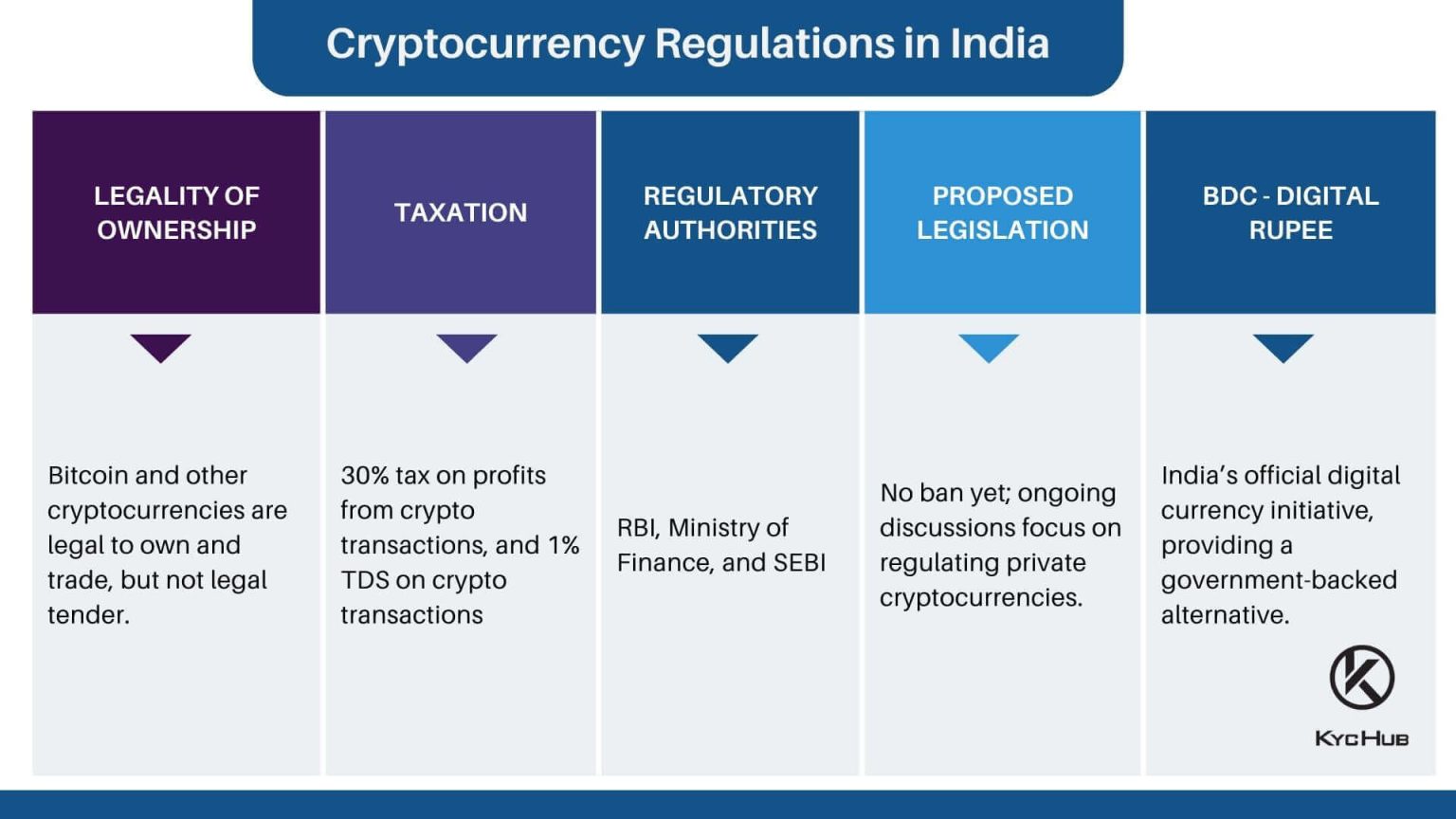

Understanding India’s Cryptocurrency Regulations

India’s evolving cryptocurrency regulations are a crucial aspect of the global financial landscape, particularly as digital currencies gain prominence. The Financial Intelligence Unit (FIU) has stepped up its efforts to enforce strict anti-money laundering (AML) and know-your-customer (KYC) protocols. These regulations mandate that cryptocurrency exchanges implement enhanced user verification processes to curb fraudulent activities while ensuring a transparent financial ecosystem. With the introduction of new guidelines that require live selfie verification and geolocation data from users, India aims to bolster its crypto regulatory framework.

As cryptocurrency continues to gain attention, the importance of robust compliance measures becomes evident. By implementing stringent KYC regulations, India is not only addressing concerns related to identity theft but also combating money laundering activities. Users now need to verify their identities through live selfies, which adds a layer of security that is increasingly necessary in the face of rising cyber threats. These measures reflect a commitment to developing a secure and compliant cryptocurrency market in India, aligning with similar trends observed globally.

Furthermore, the regulatory landscape in India introduces significant guidelines for cryptocurrency exchanges. These exchanges are responsible for collecting various user data, including geolocation and IP addresses, to enhance AML compliance. This requirement mandates that exchanges not only verify the users’ identities but also monitor their activities to prevent illegal transactions and ensure adherence to tax regulations. The incorporation of technology solutions to analyze live selfies for potential deep fakes showcases India’s innovative approach to maintaining the integrity of KYC processes.

As the country continues to navigate the complexities of taxation within the cryptocurrency framework, it remains essential for crypto exchanges to adapt promptly to these guidelines. By enhancing identity verification processes and maintaining detailed records of users’ transactional behavior, exchanges can contribute significantly to establishing compliance within the sector.

Implications of KYC Regulations on Crypto User Onboarding

The new KYC regulations introduced by India’s FIU have direct implications for cryptocurrency user onboarding processes. As new users look to enter the crypto market, they face heightened scrutiny when creating accounts on exchanges. The mandatory measures, which include submitting live selfies and identifying oneself through multiple government-issued IDs, ensure that exchanges can verify user identities effectively. This evolution in onboarding practices not only secures user data but also builds trust in the cryptocurrency ecosystem.

The introduction of these stringent KYC regulations seeks to enhance the credibility of digital asset transactions while minimizing the risks associated with unlawful activities. By aligning the onboarding processes with stringent financial regulatory standards, exchanges can mitigate risks posed by fraudsters and money launderers. Additionally, the reliance on technology to authenticate user identities counters the challenges of deep fake technologies, safeguarding the onboarding process further.

Moreover, compliance with these KYC guidelines lays the foundation for responsible cryptocurrency trading in India. It emphasizes the shared responsibilities of both users and exchanges to maintain transparency and adhere to regulations. Such adherence not only helps protect legitimate users but also fosters a more resilient marketplace that can withstand scrutiny from regulatory bodies.

By embracing these KYC protocols, exchanges can improve their operational integrity and align themselves with the broader international effort towards standardized global cryptocurrency guidelines. In doing so, they create a more attractive environment for potential investors who seek confidence in the legitimacy of their trading activities.

The Role of AML Compliance in Cryptocurrency Exchanges

AML compliance is a foundational aspect of cryptocurrency exchanges that has gained increased attention with the introduction of new regulations by India’s FIU. As concerns about the potential for cryptocurrencies to facilitate money laundering continue to grow, exchanges must establish robust processes for monitoring transactions. This includes not just KYC verifications but also the implementation of procedures to trace transactions and user backgrounds to detect suspicious activities effectively.

Exchanges face the dual challenge of balancing user privacy and regulatory obligations, making it essential for them to integrate advanced compliance systems. The requirement for exchanges to verify users’ bank accounts through small test transactions illustrates a proactive approach towards ensuring that cryptocurrency platforms do not become conduits for illicit financial activities. Adapting to these AML compliance guidelines is not just a regulatory necessity; it also safeguards the integrity of the entire cryptocurrency ecosystem.

Additionally, the implications of AML compliance extend beyond the immediate operations of exchanges, influencing user trust and confidence. The increased scrutiny and thorough verification processes help users feel secure in their trading activities. By demonstrating a commitment to preventing money laundering and financial crimes, exchanges can foster a more positive reputation within the industry, ultimately attracting a broader user base and legitimizing their operations.

Compliance with AML regulations also positions exchanges favorably in discussions about potential collaborations with financial institutions looking to partner with cryptocurrency platforms. As governments and regulatory bodies worldwide seek to address the challenges posed by digital assets, those exchanges that prioritize compliance will be better equipped to thrive and innovate in this dynamic space.

Navigating Tax Liabilities for Cryptocurrency Transactions

The taxation of cryptocurrency transactions in India introduces complex dynamics that users must navigate. Under the Income Tax Act, cryptocurrency profits are taxed at a flat rate of 30%. However, users can only deduct the cost basis from their gains, creating a strict taxation environment that emphasizes the need for accurate record-keeping. This lack of flexibility, such as not allowing crypto traders to offset losses, places considerable stress on traders who may engage in multiple transactions but face tax liabilities without avenues for relief.

Understanding these tax implications is vital for users in managing their cryptocurrency portfolios effectively. Each transaction carries potential tax consequences, and as India’s Income Tax Department grows more vigilant, traders must stay informed about their responsibilities. Embracing good practices such as proper transaction logging and regular consultation with tax professionals can help mitigate risks and ensure compliance with India’s tax laws.

In light of these regulations, it becomes crucial for cryptocurrency exchanges to support their users through educational resources and transparency about tax obligations. Providing clear guidance on tax liabilities can empower users to make informed decisions about their trades and investments. Ultimately, the interplay between cryptocurrency trading and taxation highlights the necessity of comprehensive education on the existing rules and regulations to ensure users can navigate this complex landscape proactively.

As regulators worldwide continue to refine tax frameworks for cryptocurrencies, the landscape remains dynamic. Engaging continuously with evolving regulations will be essential for users seeking to optimize their trading strategies while remaining compliant with tax obligations.

Future of Cryptocurrency in India amidst Regulatory Changes

The future of cryptocurrency in India is poised for transformation, especially given the heightened regulatory framework established by the FIU. With increasing scrutiny and formal regulations around AML and KYC, the cryptocurrency market must adapt to these constraints. While these changes may present challenges, they also offer opportunities to create a more structured and secure environment for digital asset trading.

As the Indian government grapples with the implications of cryptocurrency technology alongside traditional financial systems, the possibility of clearer regulatory guidance seems likely on the horizon. The evolving landscape will foster innovation as companies look to navigate compliance while remaining competitive in the global market. A properly regulated cryptocurrency space could lead to increased user participation and trust, ultimately fostering broader acceptance of digital currencies in everyday transactions.

On the other hand, the rapid changes in regulation may also provoke caution among potential users and investors. Uncertainty regarding future taxation policies and compliance requirements can deter new entrants from exploring the cryptocurrency market. For many, the complexity seen in the evolving regulatory landscape necessitates a wait-and-see approach.

Nevertheless, as regulations start to stabilize and clear guidelines emerge, the overall sentiment towards cryptocurrency could shift positively. The balance between innovation and regulation will determine the resilience and sustainability of the cryptocurrency market in India, ensuring its place in the future financial ecosystem.

Enhancing User Security through Cryptocurrency Exchange Guidelines

The implementation of enhanced guidelines for cryptocurrency exchanges is crucial in safeguarding users and ensuring a secure trading environment. The guidelines set forth by India’s FIU call for stringent KYC and user verification processes, mandating that exchanges collect and verify specific user information to enhance overall security. By adhering to these guidelines, exchanges create robust security frameworks that protect users from potential fraud and identity theft.

With the increase in sophisticated hacking techniques and fraudulent schemes targeting cryptocurrency users, the need for rigorous exchange guidelines is more critical than ever. By employing technology to examine selfies and utilizing geolocation data, exchanges are taking proactive measures to guard against illicit activities. These measures bolster user confidence, making them more likely to engage with cryptocurrency trading knowing that their information is well protected.

Moreover, the emphasis on user security through guidelines also promotes a culture of accountability within the exchange ecosystem. Compliance with regulations creates an environment where users feel safer to invest and engage in digital trading, ultimately contributing to the stability of the cryptocurrency market. The incorporation of best practices for user security positions exchanges as responsible entities in the financial ecosystem, encouraging the legitimate use of cryptocurrencies.

As regulations continue to evolve, cryptocurrency exchanges must remain at the forefront of implementing effective guidelines that prioritize user security. Strengthening the safety of digital transactions will not only help in protecting individual users but also fortify the overall integrity of the cryptocurrency market, preparing it for sustainable growth.

Frequently Asked Questions

What are the new regulations regarding cryptocurrency KYC in India?

India’s Financial Intelligence Unit (FIU) has issued stringent guidelines requiring cryptocurrency exchanges to enhance their know-your-customer (KYC) procedures. Users must now verify their identities using live selfie images and geographic location data. This aims to prevent fraud, including the use of AI-generated deep fakes, ensuring a more secure onboarding process.

How do FIU regulations India affect cryptocurrency exchanges?

FIU regulations India mandate that cryptocurrency exchanges implement stricter KYC and anti-money laundering (AML) compliance measures. Exchanges must collect users’ geolocation and IP addresses during signup, perform identity verification, and confirm bank account ownership through small transactions. These measures are in place to combat potential tax evasion and enhance security in the cryptocurrency market.

What steps must users take for crypto user onboarding under the new regulations?

Users must follow several steps for crypto user onboarding as per the latest regulations, including providing a government-issued photo ID, verifying their identity with a live selfie, confirming their email address and mobile number, and allowing exchanges to collect their geolocation and IP information. These measures are essential to meet KYC and AML compliance in India.

What are the AML compliance requirements for cryptocurrency exchanges in India?

Under India’s AML compliance requirements, cryptocurrency exchanges must implement robust KYC procedures, including identity verification and location tracking. They must validate users’ bank accounts through small transactions and ensure that they adhere to regulations set by India’s FIU, enhancing the safety and legitimacy of crypto transactions.

How do cryptocurrency exchange guidelines in India impact taxation?

Cryptocurrency exchange guidelines in India, which include enforcement of strong KYC and AML procedures, also intersect with taxation policies. Profits from cryptocurrency sales are taxed at 30% under the Income Tax Act, and taxpayers are limited to deducting their cost basis, with no loss offsetting allowed from trading activities. This regulatory landscape complicates tax compliance for crypto traders.

What concerns has India’s Income Tax Department raised about decentralized cryptocurrencies?

The Income Tax Department (ITD) of India has raised concerns about decentralized cryptocurrencies, highlighting that their anonymous nature can facilitate tax evasion. During discussions with lawmakers, ITD officials pointed out that decentralized exchanges and wallets pose significant challenges for tax enforcement, complicating the taxation process across varying jurisdictions.

What impact do the recent cryptocurrency regulations have on traders in India?

Recent cryptocurrency regulations in India impact traders by enforcing strict KYC and AML compliance, requiring extensive user verification that may prolong the onboarding process. Moreover, the stringent tax policies, including a 30% tax on profits and inability to offset losses, may significantly alter traders’ strategies and financial outcomes in the crypto market.

| Key Point | Details |

|---|---|

| New Identity Verification Requirements | Users must provide live selfie images and geographic location verification. |

| Software Analysis | Selfies will be analyzed for eye and head movements to prevent use of deep fakes. |

| Geolocation and IP Address Collection | Exchanges are now required to collect users’ geolocation and IP addresses. |

| AML Compliance | Users’ bank accounts must be verified through a small transaction sent to those accounts. |

| Additional ID Verification | Users need to provide a government-issued photo ID and confirm their email and mobile numbers. |

| Tax Implications | Profits from cryptocurrency sales are taxed at 30%, without allowance for offsetting losses. |

| Regulatory Crackdown | These changes reflect India’s tightening regulations on cryptocurrencies amid tax evasion concerns. |

Summary

India cryptocurrency regulations have evolved significantly in response to the challenges posed by decentralized finance and digital assets. The recent rulings by the Financial Intelligence Unit emphasize strict identity verification and compliance measures that cryptocurrency exchanges must follow to curb money laundering and improve tax enforcement. As these regulations become clearer, they represent a pivotal shift towards a more structured and secure environment for cryptocurrency transactions in India.

Related: More from Regulation & Policy | EU Crypto Taxes: Practical Implications Explained | UK FCA to Consider Cryptos for Gambling Payments