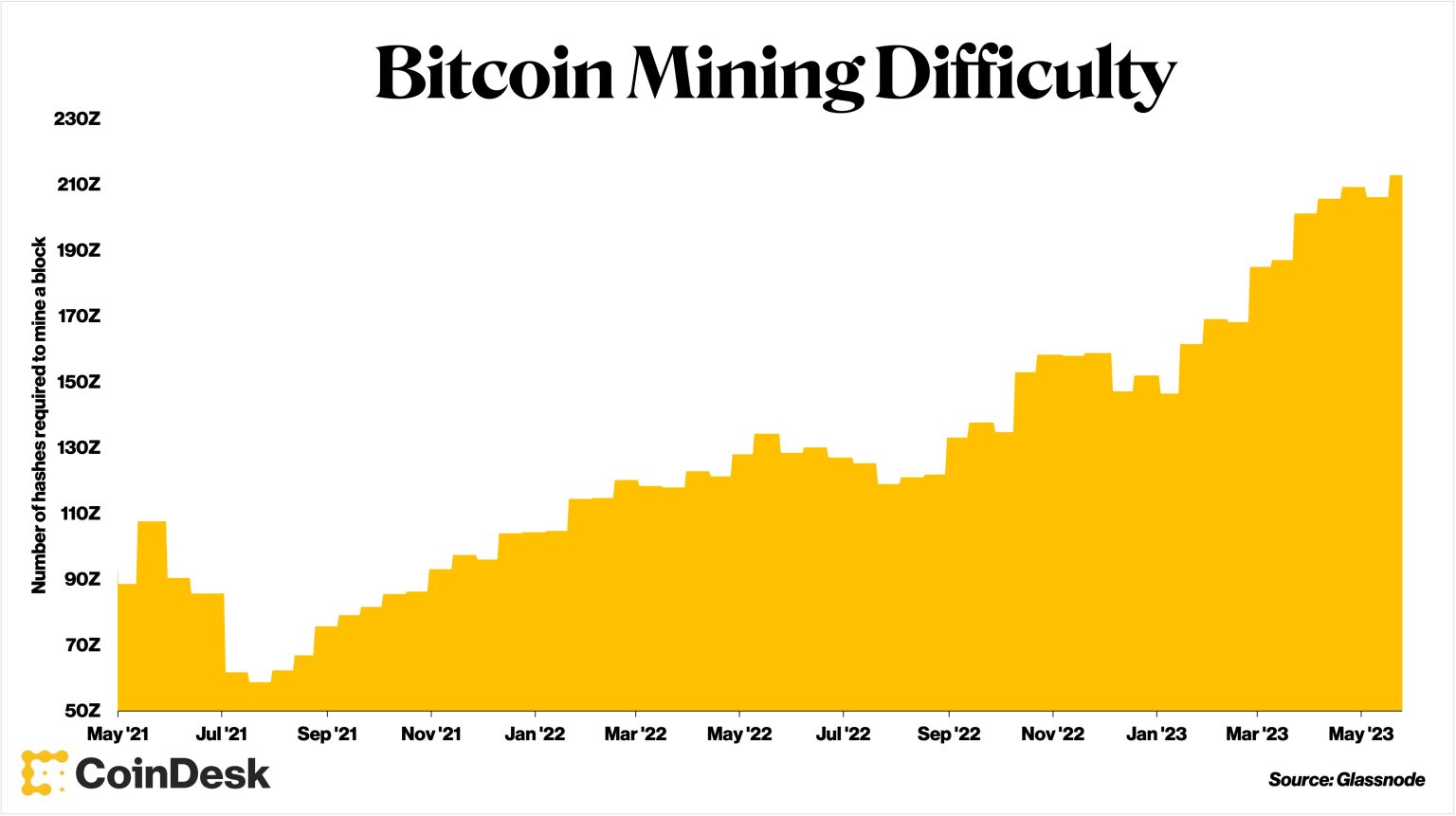

Bitcoin mining difficulty, a crucial metric for evaluating the competitiveness of the mining landscape, saw a notable decline during its first adjustment of 2026. This adjustment brought the difficulty down to 146.4 trillion, providing a brief respite for miners amid a year characterized by unprecedented challenges and volatility in the crypto sector. As miners grapple with the impacts of dwindling profitability and shifting market dynamics, understanding Bitcoin mining difficulty becomes essential for navigating the evolving landscape of Bitcoin mining in 2026. Current crypto mining trends indicate that while the network adapts to rapid changes, maintaining an optimal block time remains critical. This fluctuation in Bitcoin mining difficulty also reflects broader Bitcoin network changes that could influence miner strategies and economic viability as competition intensifies.

The challenge of Bitcoin mining, often referred to as the computational hurdle faced by miners, plays a pivotal role in determining the efficiency and feasibility of extracting new Bitcoin blocks. As mining operations respond to the complexities of fluctuating difficulty levels and market conditions, this aspect of cryptocurrency technology underscores the importance of staying informed about upcoming Bitcoin block time adjustments. In 2026, miners will need to consider various elements affecting mining profitability, including recent trends in crypto mining and the pressures posed by regulatory frameworks. The rise and fall of these difficulty levels not only impact individual mining rigs but also signify the broader state of the Bitcoin ecosystem. Therefore, grasping the nuances of this ever-changing environment is crucial for miners looking to thrive in an increasingly competitive market.

Understanding Bitcoin Mining Difficulty Trends in 2026

As of January 2026, Bitcoin mining difficulty has undergone a significant adjustment, dropping to 146.4 trillion. This first adjustment of the year sets the stage for an evolution in the crypto mining landscape, emphasizing the ongoing shifts in network dynamics. The Bitcoin network adjusts its difficulty approximately every two weeks, ensuring that block generation time remains close to the target of 10 minutes. Such adjustments are critical in maintaining the balance of supply and demand within the cryptographic ecosystem. The rising and falling patterns of mining difficulty reflect broader trends in the sector, including competition and technological advancements.

These fluctuations in Bitcoin mining difficulty are not merely about the computational challenges faced by miners; they also signal changes in that industry’s economic viability. As miners compete to secure Bitcoin rewards, the profitability of their operations can dramatically shift. With the backdrop of 2025 showcasing unprecedented high difficulty levels, the slight drop in early 2026 might offer a glimmer of hope for miners grappling with tight margins. Understanding these trends becomes essential for stakeholders, providing insight into potential profitability and the future trajectory of Bitcoin’s economic landscape.

Impact of Block Time Adjustments on Mining Profitability

The average Bitcoin block time is currently clocking in at approximately 9.88 minutes, slightly below the 10-minute benchmark that miners aim for. This timing is crucial because it affects the mining rewards received when a new block is successfully mined. If the block time consistently falls short of the target, it leads to an increase in mining difficulty to slow down the pace of block generation, aimed at preserving Bitcoin’s scarcity. Conversely, longer block times may signal a decrease in network activity or miner inefficiencies, which can affect profitability across the board.

Shiifting dynamics in block times not only influence the immediate operations of miners but also reflect broader changes within the Bitcoin ecosystem. As the community adapts, so too must miners reassess their strategies, potentially investing in more efficient hardware or exploring alternative energy sources to lower costs. These adjustments are necessary to enhance financial sustainability, especially in a landscape where mining profitability has been under pressure due to increased competition and regulatory challenges. With eyes set on 2026, miners need to remain agile to navigate these complex shifts.

The Future of Bitcoin Mining Amid Network Changes

As the Bitcoin mining community moves deeper into 2026, the network is expected to undergo further changes that could impact the mining landscape drastically. The recent drop in difficulty might suggest a more favorable environment for existing miners, but this could be short-lived if more participants enter the mining arena. Mining farms and individual miners alike must keep a close watch on network changes and market trends, especially as adjustments will continue to occur based on hash rate fluctuations and global energy availability.

Additionally, the implications of Bitcoin’s evolving infrastructure cannot be overstated. Developing technologies, like AI optimization for mining processes and renewable energy innovations, might reshape how mining profitability is assessed. Staying ahead of crypto mining trends, coupled with prudent operational changes, can provide miners with competitive advantages in the face of ongoing network developments.

Key Factors Influencing Bitcoin Miners in 2026

Several critical factors will shape the future of Bitcoin mining in 2026, from the anticipated adjustments in mining difficulty to broader economic influences. The first adjustment of the year has highlighted the delicate balance of profitability in the mining sector, where operational costs must be continually juxtaposed against potential rewards. Regulatory pressures and global energy prices further complicate these calculations, as miners weigh their options for sustainability and efficiency against rising operational costs.

Moreover, macroeconomic conditions, including interest rates and inflation, will also play a crucial role in influencing miners’ decisions. With Bitcoin’s price remaining volatile, miners are faced with the challenge of not only maintaining their equipment but also managing their financial strategies in an ever-changing environment. Therefore, understanding these key factors becomes paramount for miners seeking to thrive in 2026 and beyond.

Approaching Mining Profitability in a Competitive Market

In the world of Bitcoin mining, maintaining profitability has become increasingly challenging amid heightened competition. The miner hash price—a critical metric indicating expected revenue per unit of computational power—has experienced serious fluctuations, dropping below breakeven levels in late 2025. With prices hitting record lows, miners are caught in a precarious position where every operational decision is crucial. As the first adjustment of 2026 signifies a slight easing in mining difficulty, many hope for a corresponding uptick in profitability.

Looking forward, Bitcoin miners must strategize carefully to enhance their profitability. This may involve upgrading to more efficient mining hardware, diversifying into alternative cryptocurrencies, or leveraging cheaper energy sources. The pressure to innovate and adapt will define the success of mining operations in 2026, forcing miners to stay aligned with the latest technological advancements and market trends. By responding effectively to these challenges, miners can ensure their sustainability and long-term success in the competitive landscape.

Navigating Regulatory Challenges in Bitcoin Mining

Just as the Bitcoin mining industry has adapted to changes in network difficulty and profitability, regulatory frameworks surrounding the sector are also evolving. The geopolitical landscape in 2026 has introduced new challenges for miners, including taxation policies and energy consumption regulations that could significantly affect operational costs. As laws and guidelines shift, miners must remain vigilant and adaptable to ensure compliance while safeguarding their profit margins.

Furthermore, understanding regional regulations can provide miners with a competitive advantage. For instance, jurisdictions with favorable tax rates or subsidies for renewable energy might attract miners seeking to improve their bottom line. As Bitcoin mining continues to mature, navigating these regulatory landscapes will be crucial for ensuring not just legality but also operational stability.

Technological Innovations Shaping Bitcoin Mining

As the Bitcoin mining sector moves through 2026, technological innovations will play a pivotal role in shaping its future. From ASIC miners evolving to become more efficient to advancements in cooling technologies, miners are continuously seeking ways to optimize their operations. With the pressure mounting from mining difficulty and economic conditions, embracing new technologies could very well mean the difference between reaching profitability or exiting the market.

Furthermore, integrating AI and machine learning into mining operations is becoming increasingly prevalent. These technologies can aid in predictive analysis, allowing miners to anticipate market dynamics and adjust their strategies accordingly. Investing in such innovations positions miners not just to survive the volatility of 2026 but potentially to thrive in an era where efficiency and adaptability will define success.

The Role of Energy Consumption in Bitcoin Mining

Energy consumption remains one of the most contentious topics within the Bitcoin mining debate. As concerns about the environmental impact of mining activities grow, 2026 will likely see increased scrutiny over the energy sources used in Bitcoin mining. Miners must continually evaluate their energy consumption, seeking out greener alternatives and more sustainable practices while also navigating the economic implications of their choices.

The transition to renewable energy sources not only addresses environmental concerns but can also provide cost-saving advantages in the long run. As countries look to implement stricter regulations on energy use, those Bitcoin miners who invest in renewable infrastructure may position themselves more favorably in the industry. Thus, the relationship between energy consumption and mining practices will be critical in shaping the future of Bitcoin mining as it progresses through 2026.

Market Analysis: The Future of Bitcoin Prices

Understanding future trends in Bitcoin pricing is crucial for miners as they adapt their operations in 2026. After experiencing a severe downturn in November 2025, Bitcoin prices struggled to regain momentum, a situation compounded by the overall uncertainty in the crypto markets. Falling prices can quickly affect mining profitability, compelling operators to reconsider their exit strategies or adjust their mining methods.

Analysts predict a fluctuating but potentially stabilizing Bitcoin market in 2026, providing a glimmer of hope for miners who desperately need a rebound in prices to enhance sustainability. By keeping a pulse on market movements and adapting strategies accordingly, miners may find pathways to profitability even in challenging economic conditions. Proactive decision-making in this realm could significantly determine their success amidst the ever-evolving landscape.

Frequently Asked Questions

What is Bitcoin mining difficulty and how is it determined?

Bitcoin mining difficulty refers to the computational challenge miners face when trying to add a new block to the blockchain. It adjusts approximately every two weeks based on the average time it takes to mine blocks, ensuring that new blocks continue to be added roughly every 10 minutes. This adjustment helps maintain the stability of the Bitcoin network.

How does Bitcoin mining difficulty affect mining profitability in 2026?

As Bitcoin mining difficulty rises, it typically reduces the profitability of mining. In 2026, Bitcoin mining difficulty is projected to increase due to rising competition, which could lead miners to evaluate the cost-effectiveness of their operations in a challenging market, especially given the backdrop of the 2024 halving and declining miner hash prices.

What trends in Bitcoin mining difficulty should we expect as we move through 2026?

In 2026, we can expect Bitcoin mining difficulty to remain influenced by factors such as changes in miner participation, network security, and market conditions. The ongoing competition among miners and adjustments triggered by the average block times will play a crucial role in how these trends evolve throughout the year.

How do Bitcoin block time adjustments relate to mining difficulty?

Bitcoin block time adjustments are directly tied to mining difficulty. When block times are faster than the target of 10 minutes, it indicates that miners are successfully solving blocks too quickly, prompting an increase in mining difficulty. Conversely, slower block times can lead to a decrease in difficulty, helping balance the system.

What impact do Bitcoin network changes have on mining difficulty?

Changes to the Bitcoin network can significantly impact mining difficulty. For instance, policy changes, technological advancements, or shifts in miner behavior can lead to fluctuations in the network’s total hashing power, thereby influencing difficulty adjustments based on the rate at which blocks are mined.

Will Bitcoin mining difficulty ever return to the all-time highs seen in 2025?

While it is difficult to predict the future with certainty, Bitcoin mining difficulty could potentially return to or exceed the all-time highs of 155.9 trillion seen in 2025. Factors such as increased miner investment, advancements in mining technology, and shifts in market conditions will influence whether this occurs.

What is the correlation between miner hash price and Bitcoin mining difficulty?

Miner hash price is a critical metric for assessing profitability, and it tends to correlate with Bitcoin mining difficulty. As difficulty increases, miners require more computational power, which can lead to higher operating costs and lower profit margins, particularly if the hash price remains below breakeven levels.

How will Bitcoin mining difficulty be affected by macroeconomic factors in 2026?

Macroeconomic factors, such as inflation, energy prices, and regulatory developments, will play a significant role in determining Bitcoin mining difficulty in 2026. Economic pressures can impact miner profitability, which in turn affects their participation in the network and ultimately influences mining difficulty adjustments.

| Key Point | Details |

|---|---|

| Bitcoin Mining Difficulty Adjustment | The Bitcoin mining difficulty dropped slightly to 146.4 trillion, marking the first adjustment of 2026. |

| Next Difficulty Adjustment | The next adjustment is predicted for January 22, 2026, increasing the difficulty from 146.47 T to 148.20 T. |

| 2025 Mining Conditions | Mining faced significant challenges with the harshest margin environment leading to declining profit margins due to the April 2024 halving and market downturns. |

| All-Time Highs | Despite a slight recent decrease, the mining difficulty in 2025 reached highs of 155.9 trillion. |

| Miner Hash Price | The miner hash price fell below breakeven at $35 per petahash-second, pressuring miners financially. |

| Impact of Inflation and Regulations | U.S. tariffs and inflation concerns have exacerbated the challenges for miners, raising fears of supply chain shortages. |

| Market Price Decline | BTC prices fell over 30% in November due to a flash crash, impacting miner profitability. |

Summary

Bitcoin Mining Difficulty has seen a notable change with a recent drop at the beginning of 2026, reflecting the ongoing challenges in the mining sector. The Bitcoin network’s mining difficulty fluctuates based on various factors, including market conditions and miner profitability. As miners continue to navigate a tumultuous landscape, the impending difficulty adjustment in January is likely to introduce further changes, forcing miners to adapt to the pressures of increased competition and fluctuating crypto prices.

Related: More from Bitcoin News | Bitcoin Analysts: BTC Market Bottoming in Q4 2026 | BTC Below $70K, JPN Inflation Under 2%: Monthly Charts