Illicit cryptocurrency activity has witnessed a significant uptick, driven predominantly by sanctioned entities seeking alternative avenues for financial transactions. According to Chainalysis, a staggering $154 billion flowed into underground crypto addresses in 2025, marking an alarming trend as nations and organizations navigate increasingly stringent cryptocurrency sanctions. Notably, the rise of Russia’s A7A5 token, a ruble-backed digital currency, exemplifies how blockchain and sanctions intersect, facilitating over $93.3 billion in transactions within just one year. Additionally, stablecoins emerged as powerful instruments for illicit transactions, effectively blurring the lines between legal and illegal financial movements. As the landscape evolves, these developments pose significant challenges for regulators striving to combat illicit crypto flows while adapting to the dynamic capabilities of blockchain technology.

The surge of underground digital currency transactions has become a pressing issue in recent years, as various entities attempt to circumvent international financial regulations. Terms like unlawful blockchain exchanges and underground crypto dealings have come to the forefront of discussions surrounding global financial stability. With nations implementing strict sanctions, actors are increasingly relying on decentralized networks to facilitate illicit transfers, thereby enhancing their financial autonomy. Reports indicate a marked increase in cross-border transactions utilizing various digital assets, reflecting a shift in how entities navigate restricted environments. This transformation poses a challenge for authorities aiming to understand and monitor the burgeoning ecosystem of underground cryptocurrency operations.

The Impact of Global Sanctions on Illicit Cryptocurrency Activity

In recent years, the landscape of illicit cryptocurrency activity has been significantly shaped by global sanctions, which have forced sanctioned entities to explore alternative financial routes. The growth in illicit inflows, which reached a staggering $154 billion in 2025, highlights how these entities leverage blockchain networks for cross-border money transfers, circumventing traditional banking systems. This shift represents an adaptation to increased financial restrictions, demonstrating how sanctions influence the methods and motivations behind illicit crypto transactions.

Global sanctions have not only heightened the volume of illicit crypto activity but have also evolved the participants within this ecosystem. As a response to such pressures, entities that once relied on conventional forms of finance are now turning to the blockchain as a means of maintaining connectivity and executing transactions. This transition signifies a crucial pivot, amplifying the need for monitoring and compliance mechanisms as the intersection of sanctions and cryptocurrency continues to develop.

Elaborating on the global scale, the rising number of sanctioned individuals and organizations, now approximating 80,000, serves as a backdrop for the surge in illicit cryptocurrency flows. The ability of these entities to exploit the relatively anonymous nature of blockchain transactions complicates efforts to enforce financial regulations effectively. As sanctions proliferate, we may not only see an increase in illicit transactions but also a fundamental shift in the global economic paradigm as leaders opt for decentralized currencies to bypass financial restrictions.

As the illicit cryptocurrency landscape evolves due to global sanctions, the implications stretch beyond just financial crime. Regulators worldwide are now faced with the looming challenge of developing frameworks that can keep pace with these rapid changes. Whether it’s through the implementation of stricter compliance mandates or the utilization of advanced blockchain monitoring technologies, the implications of this shifting dynamic will resonate across economic and political arenas for years to come.

Russia’s Role in Illicit Cryptocurrency Flows

The geopolitical landscape has dramatically shifted following Russia’s invasion of Ukraine, significantly influencing illicit cryptocurrency flows. Following the implementation of extensive sanctions against Russia, the introduction of the ruble-backed A7A5 token catalyzed a new chapter in how sanctioned states maneuver funds in the digital realm. With $93.3 billion processed in under a year, this blockchain instrument exemplifies how nations under duress are innovating ways to maintain economic activity in the face of international isolation.

This new digital asset architecture allows sanctioned nations to operate on an expansive scale, reflecting a growing trend of state-backed activities in the crypto space. Unlike organic illicit use cases associated with the dark web or cybercrime, Russia’s approach marks a deliberate shift towards the utilization of blockchain technology as a state mechanism. By adopting such technologies, Russia is not only mitigating traditional financial constraints but is also essentially redefining its trade and financial strategies on the global stage.

Additionally, this evolving scenario compels further examination of how state-sponsored tokens will influence the broader cryptocurrency market. As President Putin’s administration navigates these challenging waters, the precedent set by the A7A5 token raises questions about the future of sanctions and their effectiveness in curbing state-level financial misconduct. With an increasing number of nations potentially following similar paths, the international community must prepare for a more complex and nuanced battlefield in the realm of illicit cryptocurrency activities.

Moreover, the implications of state-linked crypto tokens extend beyond borders, as Russia’s actions may inspire other sanctioned nations to pursue similar initiatives. Consequently, regulatory bodies around the world must bolster their frameworks to effectively combat such developments while ensuring legitimate uses of blockchain technology are not stifled. This makes it imperative for regulators to remain vigilant as they adapt to these unavoidable shifts in the illicit crypto landscape driven by state actions.

The Rise of Stablecoins in Illicit Transactions

Stablecoins have come to the forefront of illicit cryptocurrency activities, primarily due to their inherent price stability and liquidity. Accounting for 84% of all illegal transactions recorded in 2025, stablecoins offer a unique advantage for sanctioned entities seeking reliable financial instruments. This notable trend exemplifies how stablecoins transcend their original purpose as merely a method for facilitating legitimate economic transactions and instead become tools for navigating around financial constraints imposed by sanctions.

The increasing adoption of stablecoins in the illicit realm is primarily driven by their unique characteristics that allow for efficiency and reliability in high-stakes transactions. As entities look for predictable settlements in a volatile market, the ability of stablecoins to offer such stability has made them an essential component of the illicit cryptocurrency ecosystem. This burgeoning trend raises serious questions about the implications regulators must consider regarding the oversight of these digital assets.

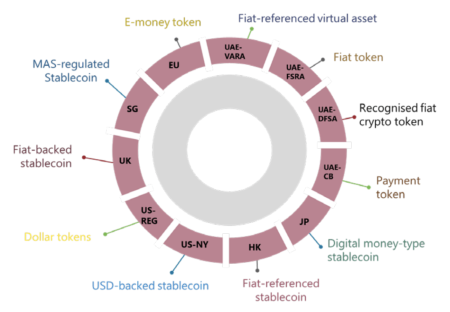

With the rising reliance on stablecoins, there is an urgent need for more stringent regulatory frameworks that address the potential misuse of these assets. As their popularity grows within the realm of sanctioned entities, the pressure mounts on regulatory agencies to create policies that can distinguish between legitimate transactions and those driven by illicit purposes. This delicate balance is crucial as the line between legal and illegal usage of cryptocurrencies continues to blur.

Ultimately, while stablecoins can promote financial inclusion and efficiency, their increasing association with illicit transactions poses significant challenges. The cryptocurrency ecosystem’s ongoing evolution necessitates a robust response from governments and regulatory agencies to combat illicit cryptocurrency activity effectively while fostering an environment conducive to innovation and legitimate financial practices.

Understanding the Motivation behind Illicit Crypto Flows

The motivations driving illicit cryptocurrency activities are multifaceted, often rooted in a mix of economic necessity and strategic evasion of regulatory frameworks. As global sanctions continue to tighten, particularly against nations like Russia, entities facing oppressive financial limitations increasingly resort to digital currencies as a means of protecting their economic assets. The quest for financial autonomy amidst strict sanctions becomes a primary motivator for many, leading them to adopt stealthier methods of conducting transactions.

Moreover, the allure of low transaction costs and the anonymity associated with blockchain networks further entices illicit actors to embrace cryptocurrencies. The digital nature of these assets allows for swift transfers that can easily bypass traditional financial scrutiny. As global financial systems tighten their regulations, individuals and organizations motivated by illicit goals seem to gravitate towards these decentralized solutions that offer them a way to operate outside conventional economic constraints.

Another dimension to consider is how these motivations relate to broader geopolitical strategies. For certain nations under sanctions, utilizing cryptocurrencies can also serve as a form of resistance against perceived economic aggression from global powers. This dynamic complicates the relationship between international financial policies and cryptocurrency markets, as sanctioned entities leverage innovative solutions to pursue their interests.

Understanding these motivations is not only critical for practitioners working within the compliance and regulatory space but also for policymakers striving to address the evolving threats posed by illicit crypto flows. By recognizing what drives these activities, we can aspire to develop more effective approaches to mitigate the risks associated with sanction evasion while simultaneously preserving the rights to financial innovation globally.

Compliance Challenges in a World of Increased Illicit Crypto Activity

The rapid increase in illicit cryptocurrency activity poses significant challenges for compliance and regulatory frameworks worldwide. As more entities turn to blockchain networks to facilitate transactions and navigate around traditional sanctions, regulators are finding it increasingly difficult to monitor these movements effectively. The complexity of on-chain transactions and the anonymity offered by cryptocurrencies make it challenging for enforcement agencies to maintain compliance standards and track illicit flows.

To effectively tackle these challenges, regulators must invest in advanced technologies and collaborative efforts with blockchain analytics firms to gain visibility into these new transaction trends. Additionally, enhanced cooperation among international regulatory bodies becomes vital to ensure that actions taken by one nation do not inadvertently drive illicit actors to seek refuge in more lenient jurisdictions. This collaborative approach will enable governments to create comprehensive frameworks that can adapt to the evolving nature of blockchain transactions.

Furthermore, the need for continuous education and training for compliance officers and law enforcement personnel cannot be understated. As illicit cryptocurrency activities evolve, so too must the skill set required to address these crimes. This involves not only understanding the technical aspects of blockchain technology but also comprehending the broader implications of sanctions and how they shape financial behaviors in the digital economy.

In conclusion, remaining ahead of illicit cryptocurrency activity necessitates a proactive and adaptive approach from compliance professionals and regulators. By embracing innovation and fostering collaboration, we can create a financial landscape resilient against illicit flows while ensuring the legitimate use of blockchain technology continues to thrive.

The Future of Blockchain with Sanctions and Illicit Activity

The future of blockchain technology and its interaction with sanctions and illicit activities is an unfolding narrative that will significantly impact global economies. As blockchain becomes increasingly integrated into the fabric of financial systems, its utilization by sanctioned states poses new challenges for traditional financial authorities. The capacity for decentralized networks to operate outside conventional frameworks raises critical questions about the effectiveness of existing sanctions and how they will need to evolve to address emerging threats.

Additionally, the rapid pace of technological advancements in blockchain raises concerns about how quickly illicit actors can adapt to new opportunities. This adaptive capability presents an ongoing challenge for regulators who must anticipate and counter emerging patterns of misuse while also promoting innovation within the cryptocurrency space. As restrictions become tighter and sanctioned entities turn to blockchain solutions, the interplay between technology and compliance will shape the future landscape of both illicit and legitimate cryptocurrencies.

The investments made in compliance and regulatory frameworks today will inform the ongoing struggle against illicit activity on the blockchain. Creating dynamic, responsive policies that can keep up with the innovations in this field will be crucial for preventing the misuse of crypto-assets. As we look to the future, it is essential for industry stakeholders and regulators alike to advocate for comprehensive regulatory strategies that protect the integrity of the financial system while allowing blockchain technology to flourish.

Ultimately, the rise of illicit cryptocurrency activity in response to sanctions underscores the urgent need for collaborative responses that bring together regulators, technologists, and policymakers. Only through cooperative efforts can we expect to navigate the complexities stemming from the interplay of sanctions, illicit flows, and the transformative potential of blockchain technology. The future will require a balance between securing the financial ecosystem from abuse and embracing the revolutionary advantages that blockchain can offer.

Frequently Asked Questions

What are the recent trends in illicit cryptocurrency activity related to cryptocurrency sanctions?

In recent years, illicit cryptocurrency activity has significantly increased due to growing cryptocurrency sanctions. For example, in 2025, illicit inflows reached $154 billion, primarily driven by sanctioned entities finding alternative ways to transfer funds via blockchain networks.

How has Russia’s A7A5 token influenced illicit crypto flows in 2025?

Russia’s A7A5 token, launched in early 2025, processed over $93.3 billion in transactions within its first year, highlighting how sanctioned nations are using state-backed digital tokens to engage in illicit cryptocurrency activity despite global sanctions.

Why are stablecoins increasingly used in illicit transactions involving cryptocurrency?

Stablecoins represent 84% of the total illegal transaction volume in cryptocurrency due to their price stability, high liquidity, and ease of cross-border transfers, making them attractive to sanctioned entities seeking reliable transfer methods in illicit cryptocurrency activity.

What impact do blockchain and sanctions have on the growth of illicit cryptocurrency activity?

Blockchain technology has become an alternative financial channel for sanctioned states, as it allows for harder-to-monitor cross-border transfers. The surge in global sanctions has reshaped the illicit cryptocurrency ecosystem, encouraging a shift towards on-chain activities for moving funds among sanctioned actors.

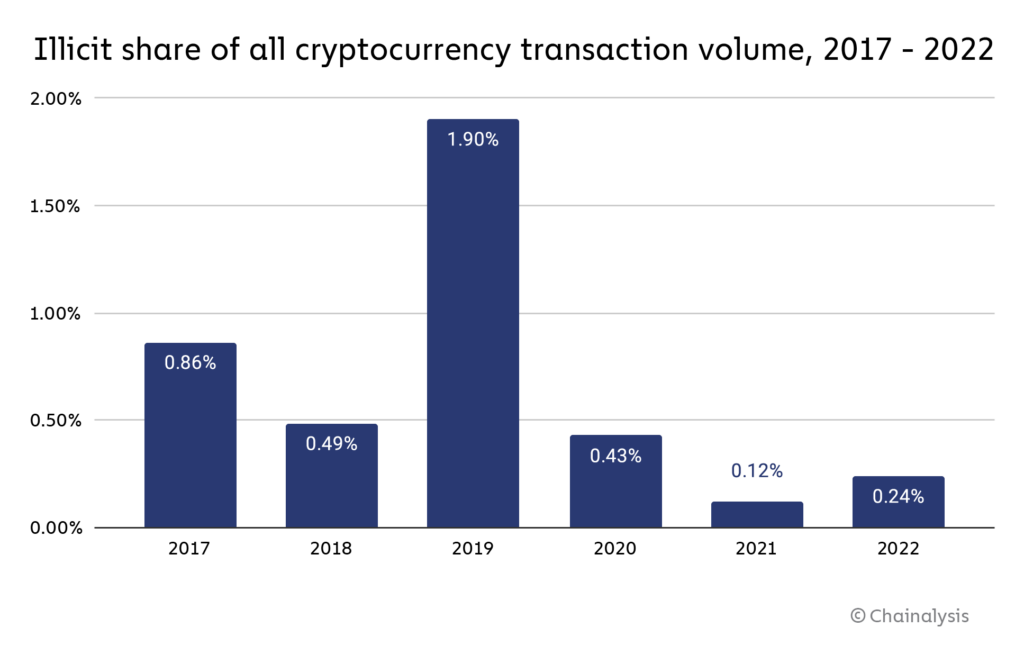

How does the scale of illicit crypto activity relate to overall cryptocurrency transactions?

Despite the record growth in illicit cryptocurrency activity, it still accounts for less than 1% of total on-chain transactions. The rise in value reflects how sanctions influence certain actors, but the broader crypto economy continues to expand independently.

What are the implications of growing illicit crypto flows for regulatory frameworks?

The increase in illicit cryptocurrency activity related to sanctions suggests a need for more robust regulatory frameworks to address the technical sophistication and coordination among sanctioned entities using blockchain for illicit transactions.

Can illicit cryptocurrency activity be linked to broader patterns of global sanctions?

Yes, the surge in illicit cryptocurrency activity is closely linked to the expansion of global sanctions and the increased number of individuals and entities under sanctions, as these actors seek alternative methods for cross-border transactions.

What role do illicit cryptocurrency activities play in the context of international relations?

Illicit cryptocurrency activities can serve as a mechanism for sanctioned states to circumvent international pressures and maintain economic operations, thus complicating the landscape of international relations.

How do hackers and scams relate to rising illicit cryptocurrency activity?

While hacking and scams remain conventional forms of illicit activity, the rise of sophisticated, state-linked operations has shifted focus towards higher levels of coordination in illicit cryptocurrency transactions, especially among sanctioned players.

What preventative measures can be taken to combat illicit cryptocurrency activity?

To combat illicit activity linked to cryptocurrencies, authorities can enhance regulatory measures, implement stricter monitoring on blockchain transactions, increase collaboration among international financial regulators, and promote awareness of cryptocurrency sanctions compliance.

| Key Point | Details |

|---|---|

| Illicit Inflows | $154 billion recorded by Chainalysis, driven by sanctioned entities. |

| Rise of A7A5 Token | Russia’s ruble-backed A7A5 token processed over $93.3 billion in transactions in less than a year. |

| Growth Rate | Illicit cryptocurrency activity grew 162% from $59 billion in 2024 to $154 billion in 2025. |

| Shifts in Criminal Activity | Increase in coordinated, sophisticated activities among sanctioned states compared to past hacks and scams. |

| Sanctions Impact | Worldwide sanctions have surged; 80,000 individuals/entities under sanctions as of May 2025. |

| Role of Stablecoins | Stablecoins accounted for 84% of illicit transaction volume, favored for their stability and liquidity. |

| Crime Volume | Illicit transactions still constitute less than 1% of total crypto economy despite significant growth. |

Summary

Illicit cryptocurrency activity has been reshaped by global sanctions that have forced sanctioned entities to adapt to new financial landscapes. With record-high illicit inflows, particularly from state actors like Russia utilizing digital tokens like A7A5, the landscape of crypto crime is evolving. The increasing use of stablecoins for predictable settlements indicates a strategic shift in this illicit space, all while criminal activities remain a minor fraction of the overall crypto economy.