The December non-farm data revealed a complex landscape for the U.S. employment market, showcasing mixed results that could influence economic policies. As the overall job market exhibits signs of a mild downward trend, the marginal decrease in the unemployment rate offers a glimmer of hope for stability. This nuanced situation provides the Federal Reserve with critical insights as they prepare for January’s decisions. Additionally, the potential Supreme Court ruling on IEEPA tariffs may temporarily favor U.S. stocks and strengthen the dollar, while simultaneously putting pressure on U.S. Treasury bonds. All these factors contribute to a cautious optimism surrounding the labor market, with expectations set for minimal rate cuts in the near future, leading to a cautiously optimistic outlook for investors and policymakers alike.

The employment statistics for December indicate pivotal shifts within the workforce landscape. With job creation figures suggesting a tepid pace and the unemployment metrics reflecting slight improvements, the broader economic environment remains uncertain. Analysts are closely monitoring how decisions from the Federal Reserve could be influenced by these indicators, particularly amidst discussions of potential adjustments to tariffs under IEEPA. Furthermore, the interplay between market expectations and the performance of government bonds adds another layer of complexity to the financial outlook. As we delve deeper into these employment trends, it’s essential to assess their implications for growth and investment in the coming months.

December Non-Farm Data: Analyzing Employment Trends

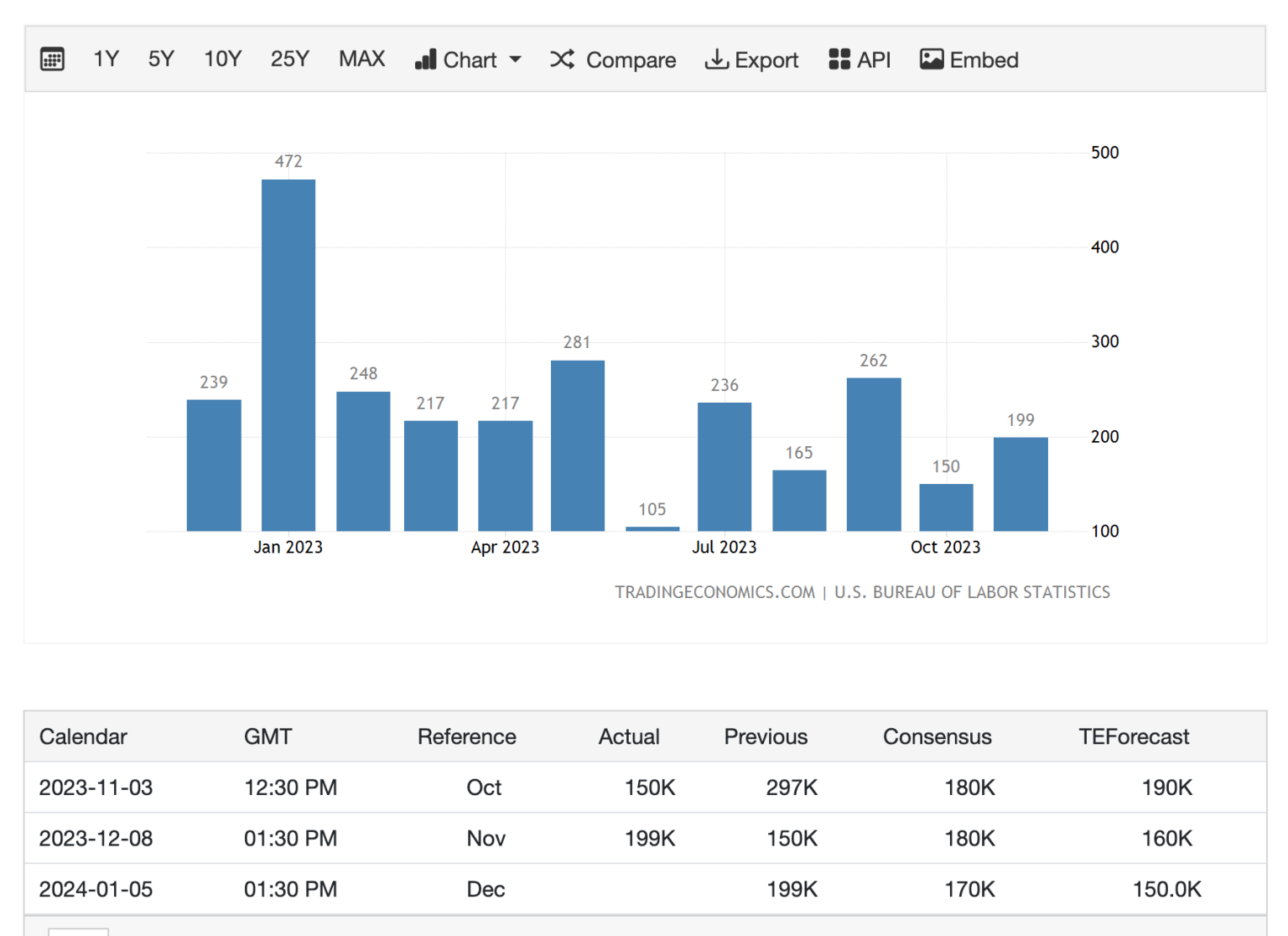

The December non-farm data has yielded a mixed bag of results, indicating that the U.S. employment market is experiencing a mild downward trend. While new job growth remains sluggish, a marginal improvement in the unemployment rate serves as a glimmer of hope amidst this softness. Employment figures reported show that job growth was less robust than anticipated, which may raise concerns about overall economic vitality and the health of various sectors in the labor market.

This mixed output leads the Federal Reserve to approach their monetary policy strategies with heightened caution as they prepare for their January decisions. Analysts believe that the improvement in the unemployment rate, while slight, might lend credibility to the notion of economic stability, thus justifying a pause in aggressive rate hikes. As the market digests these indicators, the challenge for policymakers remains balancing growth against inflation, particularly in an environment where job vacancies still reflect underlying supply and demand discrepancies.

Implications of Unemployment Rate on Federal Reserve Actions

The marginal decrease in the unemployment rate adds complexity to the Federal Reserve’s decision-making process. With the U.S. employment market exhibiting signs of weakness through limited job creation and stagnant wage growth, the Fed is likely to remain cautious in its approach to interest rates. As they prepare for a critical January meeting, these factors could play pivotal roles in determining if any rate cuts will be introduced or if the current rates will hold steady until more conclusive data is revealed.

This situation aligns closely with the Fed’s dual mandate of achieving stable prices and maximum sustainable employment. Despite signs of a cooling labor market, potential shifts in the unemployment rate could influence monetary policy. Notably, if these trends continue, the Fed may have to recalibrate its fiscal strategies to react effectively to any further deviations in economic expectations, which could have downstream effects on financial markets and consumer confidence.

Legal Challenges and Their Impact on Tariffs and Markets

The possibility that the Supreme Court might rule on the unconstitutionality of IEEPA tariffs introduces additional layers of uncertainty in the market. Should such a ruling come to fruition, it could offer temporary relief to U.S. stocks and the dollar by alleviating some trade pressures. However, the flip side of this coin is the potential for increased ongoing fiscal deficits that might result from the consideration of tariffs as a revenue source for federal income.

Market participants are closely monitoring these legal developments, as they could affect not just tariffs but broader economic expectations. Reduced tariffs may lead to lower inflationary pressures, which could positively influence consumer spending and investment. However, the associated challenges of defending against a burgeoning fiscal deficit warrant careful consideration, especially as sectors such as industrials and consumer staples navigate this evolving landscape.

U.S. Treasury Bonds: Navigating Market Signals Amid Economic Change

In light of the December non-farm data showing mixed employment results, interest rate futures and U.S. Treasury bond markets are reacting cautiously. Data revealing no expected interest rate cuts by the Federal Reserve in January suggests a more stable environment for Treasury bond investors, at least in the short term. This perception is vital as those investing in government securities seek guidance on potential returns amidst the fluctuating economic indicators.

The short-term outlook for U.S. Treasury bonds appears less favorable due to the interplay of limited rate cuts and ongoing fiscal concerns. Investors may need to adapt their strategies to a more challenging environment where the risks of rising interest rates could outpace the yields offered by these securities. As the Federal Reserve holds steady at current rates while negotiating the complexities surrounding tariffs and fiscal deficits, those in the bond market must remain vigilant for further policy adjustments.

The Impact of AI Activity on U.S. Stocks

In a rapidly evolving economic landscape, increased artificial intelligence (AI) activity has emerged as a potential boon for U.S. stocks, particularly in sectors like consumer staples and industrials. These industries are positioned to benefit from enhanced efficiencies, reduced costs, and improved productivity, setting them apart from others that may be adversely impacted by ongoing tariff disputes. As companies leverage AI technologies, we can expect a ripple effect enhancing overall market performance.

Consequently, stocks in these sectors may enjoy an uplift, countering some of the negative pressures from a softening employment market and uncertainties surrounding IEEPA tariffs. This upturn may signal renewed investor interest and confidence, depending on how effectively organizations can integrate AI into their operational frameworks. As U.S. stock dynamics shift, keeping an eye on how AI influences productivity and profitability will be essential for stakeholders.

Exploring Job Vacancy Rates and Economic Resilience

The job vacancy rates as reflected in December’s non-farm data illuminate the underlying challenges faced by the U.S. employment market. Despite demonstrating a degree of resilience, the lower vacancy rates indicate a mismatch in the supply and demand for labor, which contributes further to economic uncertainty. With fewer new job postings, it’s crucial for market analysts to dissect these patterns to understand the implications for broader economic activity.

This stagnation in job creation signals potential challenges for workers seeking stability in employment, while simultaneously presenting hurdles for the Federal Reserve as they consider the overall economic trajectory. Policymakers must carefully analyze these indicators and their potential impacts on consumer spending and confidence, which are essential drivers of economic growth in the long run.

Understanding Wage Growth Trends in a Weak Labor Market

Wage growth trends play a significant role in evaluating the health of the labor market, especially in light of the December non-farm data’s mixed findings. Limited growth in wages amid rising inflation raises concerns for consumer purchasing power and overall economic growth. A stagnant wage environment might deter consumer spending, which is vital for economic recovery following adverse shocks in the employment sector.

The Federal Reserve will likely be influenced by these wage growth trends as they assess monetary policy moving forward. If wage growth remains stagnant while inflation rises, this could lead to tensions as it complicates the Fed’s objectives of fostering maximum employment while ensuring price stability. Understanding these dynamics will be crucial for stakeholders as they navigate the uncertain economic waters ahead.

Federal Reserve Policies and Uncertain Economic Prospects

The upcoming Federal Reserve meeting in January will be pivotal, reflecting the uncertain economic prospects following December’s non-farm data. With a stoic labor market and modest shifts in the unemployment rate, the Fed finds itself at a crossroads, evaluating the necessity of cutting rates or maintaining them until more definitive trends emerge. Their policies will directly impact financial markets and consumer confidence, indicating the need for careful deliberation.

As economic signals continue to shift, the implications of Federal Reserve policies become increasingly critical. The interplay of these policies with ongoing economic challenges, such as global trade tensions and domestic wage stagnation, underscores the delicate balance the central bank must strike to foster a resilient economic environment. Observers should closely monitor upcoming decisions to gauge their potential influence on the U.S. employment market and broader economic trends.

Evaluating Consumer Confidence Amid Economic Fluctuations

Consumer confidence is crucial in gauging the overall health of the U.S. economy, particularly in light of December’s mixed employment data. With signs of market fragility reflected in job creation and wage growth, consumer sentiment could be influenced negatively, leading to decreased spending and investment. Understanding these dynamics is essential for businesses and policymakers as they navigate the unpredictability inherent in current economic conditions.

In addition, the potential implications of recent job vacancy rates and a stagnating wage environment could serve as further deterrents to consumer confidence. As individuals seek more stable employment opportunities, the extent to which these factors influence spending behavior remains to be seen. Continuous monitoring of consumer sentiment will be vital as we approach key economic indicators and observe their interactions with Federal Reserve policies.

Frequently Asked Questions

What does the December non-farm data say about the U.S. employment market?

The December non-farm data indicates that the U.S. employment market is experiencing a mild downward trend, showing mixed results overall. While job creation remains weak, the unemployment rate has seen a slight improvement, which adds a cautious note for the Federal Reserve’s actions in January.

How does the unemployment rate relate to the December non-farm data?

The December non-farm data reflects a marginal decrease in the unemployment rate, a rare positive indicator amidst otherwise weak job market conditions. This decrease may influence the Federal Reserve’s approach to interest rate adjustments in the coming months.

What impact might the December non-farm data have on the Federal Reserve’s decisions?

The December non-farm data suggests that, despite mixed signals from the U.S. employment market, the Federal Reserve is likely to remain cautious due to the minor improvement in the unemployment rate, as they weigh potential interest rate cuts in the upcoming months.

How could IEEPA tariffs affect the December non-farm data implications?

The possibility of the Supreme Court declaring the IEEPA tariffs unconstitutional could temporarily boost U.S. stocks and the dollar while negatively impacting U.S. Treasury bonds, creating a complex interplay with the signals from December non-farm data.

What does the December non-farm data indicate for U.S. Treasury bonds?

After the release of the December non-farm data, market trends suggest a higher likelihood of unfavorable conditions for U.S. Treasury bonds due to the Federal Reserve’s cautious stance and the anticipated impact of cooling tariffs.

Will the U.S. employment market improve based on December non-farm data?

While the December non-farm data shows signs of weakness in job creation and wage growth, the slight improvement in the unemployment rate offers a glimmer of hope, although significant overall improvement in the U.S. employment market is not expected in the short term.

What sectors could benefit from the implications of the December non-farm data?

Following trends hinted at by the December non-farm data, sectors like consumer staples and industrials could see benefits from increased AI activity and reduced tariff disruptions, enhancing resilience amid current employment market challenges.

What does the December non-farm data mean for future economic expectations?

The December non-farm data suggests marginally improved economic expectations, leading to reduced inflationary pressures but could contribute to a rising fiscal deficit, thereby impacting overall economic stability.

| Key Point | Details |

|---|---|

| Overall Employment Market | Mild downward trend observed. |

| Unemployment Rate | Despite mixed results, there was a marginal improvement. |

| Impact of Supreme Court Ruling | Possible declaration of IEEPA tariffs unconstitutional could benefit stocks and dollar. |

| Job Market Indicators | New jobs, vacancy rates, and wage growth indicate relative weakness. |

| Interest Rate Futures | Market indicates no rate cut from Fed in January, cuts not expected until June. |

| Economic Expectations | Marginal improvement expected, inflationary pressures reduced. |

| Fiscal Deficit | An increasing fiscal deficit expected. |

| Implications for U.S. Treasury Bonds | Negative factors present, high operating probability more likely. |

| U.S. Stock Market | Potential benefits from AI growth and reduced tariff impacts. |

Summary

The December non-farm data depicts a complex scenario for the U.S. job market, revealing a mild downward trend in overall employment alongside a slight improvement in the unemployment rate. Although the economic indicators suggest persistent weaknesses, the potential Supreme Court ruling on IEEPA tariffs may offer some positive momentum for U.S. stocks and the dollar. With no immediate interest rate cuts anticipated by the Federal Reserve, the landscape poses challenges for U.S. Treasury bonds while highlighting certain growth opportunities in sectors resilient to tariff fluctuations. Overall, the December non-farm data paints a cautious but hopeful image for policymakers and investors.

Related: More from Regulation & Policy | EU Crypto Taxes: Practical Implications Explained | UK FCA to Consider Cryptos for Gambling Payments