Whale liquidation WBTC has recently come to the forefront of cryptocurrency discussions as a significant player in the market begins to sell off their holdings. An on-chain analysis reveals that a notable whale deposited 378.11 WBTC, worth approximately $34.3 million, to Binance just hours ago, hinting at potential liquidation. This action comes after the whale initially purchased the tokens at an average price of $110,504, leading to nearly $7.5 million in trading losses over a three-month period. Such whale activity in crypto often sends ripples through the market, affecting WBTC price analysis and investor sentiment alike. As more traders examine the implications of this liquidation, the dynamics of WBTC trading and overall cryptocurrency liquidation strategies are worth exploring further.

In the ever-evolving cryptocurrency landscape, recent events regarding large-scale sell-offs, particularly involving Wrapped Bitcoin (WBTC), have captured significant attention. Notably, a prominent investor, often referred to as a ‘whale’, has been linked to extensive depositing activity that suggests a liquidation of assets. This particular case illustrates the broader trends of liquidity in the crypto market, where substantial financial movements can lead to substantial shifts in price dynamics. The fallout from such actions can inform traders and analysts alike, guiding future investment strategies and on-chain assessments. Understanding the nuances of these large transactions is crucial for anyone looking to navigate the complexities of the crypto trading environment.

Understanding Whale Liquidation: The Case of WBTC

Whale liquidation has become a prevalent topic in the cryptocurrency market, often causing significant price fluctuations and impacting market sentiment. Recently, a particular whale that invested $110,000 in Wrapped Bitcoin (WBTC) has come under scrutiny due to their massive liquidation activity. On-chain data indicates this whale deposited 378.11 WBTC, approximately valued at $34.3 million, to Binance, signaling a possible liquidation of their holdings. This action raises important questions about whale behavior in the current crypto landscape, especially given the significant on-chain losses accumulated over the past few months.

This whale’s predicament highlights the inherent risks of cryptocurrency investments, especially given the volatility in WBTC prices. Having purchased the asset during a period of price fluctuation, the current analysis suggests they are facing unrealized trading losses upwards of $7.5 million—a stark reminder of how quickly fortunes can change in crypto. Moreover, this situation exemplifies the broader implications of whale activity in the market, urging other investors to consider the potential effects of such large transactions on overall market stability.

Analyzing the Impact of Whale Activity on WBTC Trading

The recent activity surrounding WBTC has sparked discussions in trading circles about the implications of whale trades on market dynamics. Each major buy or sell order from a whale not only impacts the price of WBTC but also can trigger a chain reaction among smaller investors. The whale in question, who acquired their WBTC holdings at an average price of $110,504, now faces a pressing decision. Liquidating large amounts, particularly after incurring losses, signifies a shift in market sentiment and can encourage other investors to act similarly, fearing further declines.

On-chain analysis of whale transactions provides essential insights into market trends and indicators of future price movements. In this case, the whale’s liquidation signals potential bearish sentiment in the market. As traders monitor the WBTC price analysis, they can glean discernible patterns in whale activity, allowing them to make more informed decisions when trading. Furthermore, understanding such dynamics allows for the detection of broader trends such as market overreactions or corrections in response to sudden liquidations.

The Role of On-Chain Analysis in Understanding Liquidations

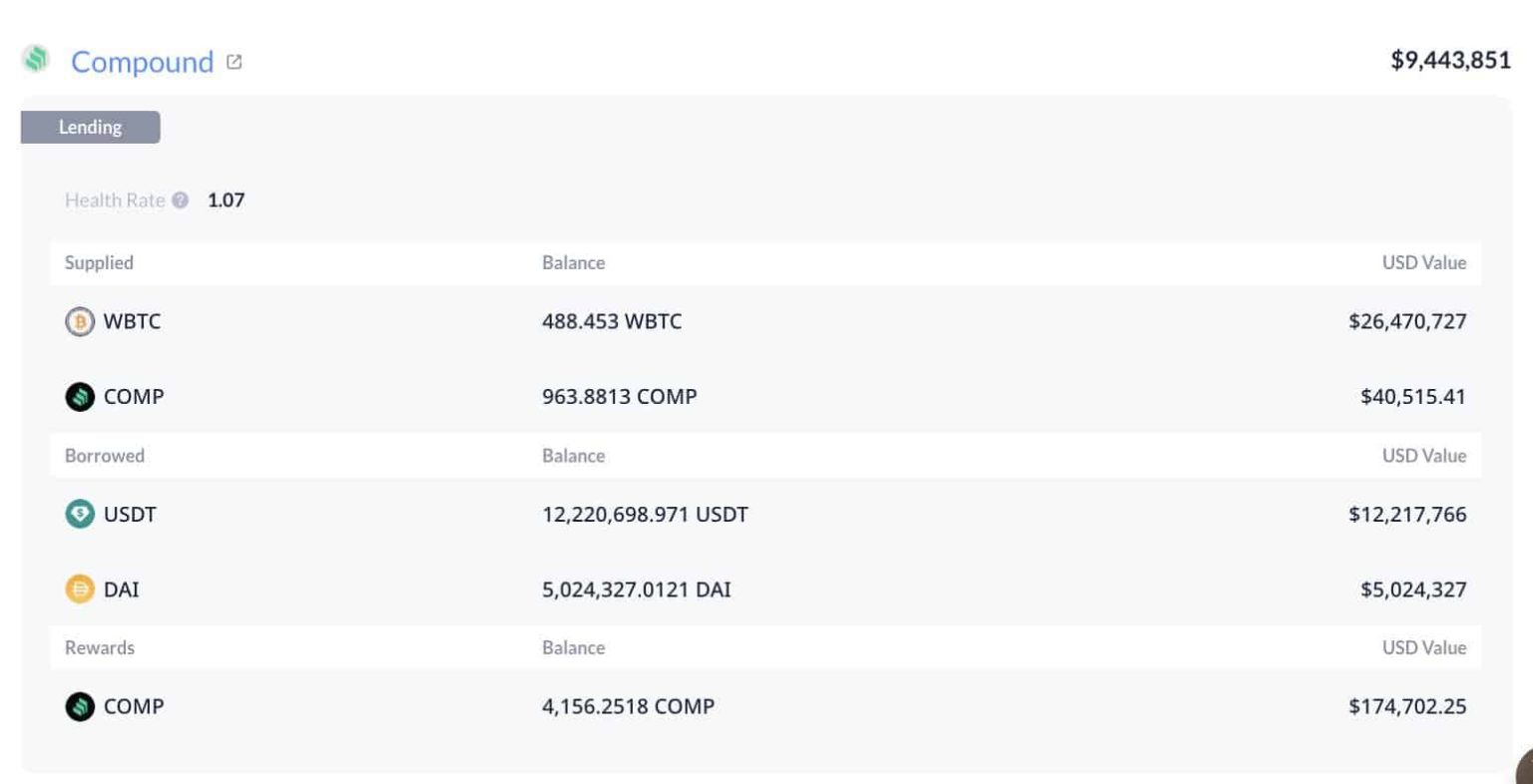

On-chain analysis is an invaluable tool for investors looking to understand the complexities of cryptocurrency liquidations. By examining transaction data on the blockchain, analysts can track whale movements and assess their potential impact on asset prices. In the case of the recent WBTC liquidation, observing the transaction of 378.11 WBTC to Binance can provide insights into the whale’s strategy and the current sentiment in the market. With decreasing prices and increasing selling pressure, such analysis helps investors navigate the turbulent waters of cryptocurrency trading.

Additionally, on-chain analysis reveals the behavior patterns of investors during different market phases. As more liquidity is drawn out from the market—evidenced by significant deposit movements towards exchanges like Binance—trade volumes often react accordingly, potentially leading to price drops. Thus, keeping an eye on whale movements offers specific trading strategies and risk management techniques that can help prevent substantial losses, especially in scenarios where significant WBTC trading losses are being reported.

Cryptocurrency Liquidation: A Risky Game for Investors

Liquidation in the cryptocurrency market represents one of the most significant risks for investors, particularly for those dealing with large positions. In the case of the whale who faced a loss of nearly $7.5 million, the question arises: how did they reach this point? The rapid decline in WBTC prices, coupled with the whale’s decision to liquidate, reflects not only personal trading failures but broader market volatility that can affect all participants. This situation serves as a cautionary tale about the importance of risk assessment and management strategies in trading.

Understanding the mechanisms behind cryptocurrency liquidation is essential for all traders, especially novices. Factors such as market sentiment, external economic conditions, and general liquidity contribute to the potential risk of liquidation. By prioritizing education and awareness, investors can strategically position themselves to mitigate risks associated with significant downturns in asset prices, especially when liquidations become a distinct possibility.

Minimizing Trading Losses in WBTC Transactions

Minimizing trading losses in WBTC transactions is crucial for investors, especially in an environment of high volatility. The whale’s experience illustrates the importance of not only timing the market but also understanding one’s own risk tolerance. Strategies like stop-loss orders and diversifying crypto portfolios can help hedge against unexpected market movements. By being proactive rather than reactive, traders can protect themselves from significant losses similar to those experienced by the aforementioned whale.

Furthermore, maintaining a close eye on market trends, including ongoing price analysis of WBTC and other cryptocurrencies, can empower investors to make sound decisions. As noted, significant movements by whales often prelude changes in market sentiment—staying informed allows traders to anticipate potential downturns and adjust their positions accordingly. This not only aids in safeguarding investments but also fosters a more robust trading strategy.

Current Trends in WBTC Price Analysis

Current trends in WBTC price analysis reveal a landscape marked by volatility and uncertainty. Following the disclosed liquidation action by the whale, market observers are reassessing price trajectories and potential support levels. With the cryptocurrency market being significantly influenced by large players, understanding these trends becomes pivotal for smaller investors looking to navigate through fluctuating prices safely. Given that the whale’s actions coincide with a notable shift in trading volumes, analyzing this data offers insights that could dictate future price movements.

Moreover, the integration of advanced analytics tools enables traders to maintain a sharp focus on price shifts and market responses. Monitoring not just the current price, but also the historical performance of WBTC allows for better strategic planning. As such, individuals who can accurately forecast price trends are more likely to capitalize on market openings while minimizing losses associated with sudden liquidation events.

The Importance of Whale Monitoring in Cryptocurrency Trading

The importance of whale monitoring in cryptocurrency trading cannot be overstated. Since whales hold significant portions of assets, their trading strategies can dramatically influence market movements. The recent liquidation of WBTC by a whale exemplifies how these large players can create ripples that affect all market participants. By adopting strategic whale monitoring practices, traders can gain valuable insights into potential market direction and execution timing, enhancing their chances of making profitable trades.

Analyzing whale activity also opens discussions about market psychology. Asset price increases or declines often correlate closely with the sentiment expressed by whales through their trades. Therefore, informed traders who recognize and understand whale patterns can better position themselves within the steeply competitive landscape of cryptocurrency trading. Fostering this awareness can lead to a more robust trading environment where risk is more effectively managed.

Future Implications of Whale Liquidation Activity

Looking to the future, the implications of whale liquidation activity in the cryptocurrency market will likely remain significant. The recent loss experienced by the whale in question should serve as a warning not only to them but to all traders about the potential risks involved in trading volatile assets like WBTC. As the cryptocurrency market increasingly matures, the behavior of whales and their impact on price movements will continue to be a focal point for analysts, investors, and regulators alike.

With advancements in technology and increased access to on-chain data, the ability to predict and track whale activities will improve, potentially leading to more informed trading decisions in the future. As more traders leverage data analytics to navigate market dynamics, awareness about whale liquidity and liquidation events will only grow, shaping the trading landscape in cryptos like WBTC and beyond.

Frequently Asked Questions

What is whale liquidation WBTC and how does it impact the cryptocurrency market?

Whale liquidation WBTC refers to significant sell-offs of Wrapped Bitcoin (WBTC) by large holders or ‘whales.’ Such liquidation can impact the cryptocurrency market by creating volatility, affecting WBTC price stability and increasing trading losses for smaller investors who may follow the sell-off trend.

How can on-chain analysis help in understanding whale liquidation WBTC events?

On-chain analysis provides insights into whale liquidations of WBTC by tracking large transactions, such as deposits to exchanges like Binance. Through on-chain data, investors can identify trends in whale activity in crypto, which can indicate potential price shifts and inform their trading strategies.

What are the implications of recent WBTC price analysis concerning whale activity in crypto?

Recent WBTC price analysis shows that notable whale activity, especially liquidations, can lead to significant price declines. When a whale liquidates a large position, it often results in increased selling pressure, further driving down the WBTC price and impacting overall market sentiment.

Can trading losses from whale liquidation WBTC influence retail investors in the crypto market?

Yes, trading losses from whale liquidation WBTC can greatly influence retail investors. As whale sell-offs become apparent, retail investors may panic and sell their holdings, fearing further declines, which can amplify market volatility and lead to collective trading losses.

What are the common causes for a whale to liquidate their position in WBTC?

Common causes for whale liquidation in WBTC include unfavorable market conditions, a strategy to cut losses after significant price drops, or liquidity needs. Whales often monitor WBTC price analysis closely to make informed decisions regarding their holdings.

How does whale liquidation WBTC relate to overall cryptocurrency liquidation?

Whale liquidation WBTC is a subset of overall cryptocurrency liquidation, as large holders in the entire market can impact liquidity and price stability. Monitoring whale liquidation events helps gauge market sentiment and potential shifts across various cryptocurrencies.

What should investors look at when analyzing the impact of whale liquidation WBTC?

Investors should consider on-chain analysis data, market sentiment, trading volumes, and the broader context of cryptocurrency liquidation. Understanding these factors can provide insights into the potential impact of whale activity on WBTC pricing and trading opportunities.

| Key Point | Details |

|---|---|

| Whale Acquisition | The whale purchased $110,000 worth of WBTC. |

| Current Liquidation Status | The whale is suspected to be liquidating their position. |

| Loss Incurred | The loss is estimated to be nearly $7.5 million over the past three months. |

| Recent Activity | The whale deposited 378.11 WBTC to Binance, valued at $34.3 million. |

| Average Purchase Price | The average purchase price was approximately $110,504. |

| Time Held | The position was held for three months, from October 21 to October 26, 2025. |

Summary

Whale liquidation WBTC has raised significant concerns among investors, as a notable whale has deposited 378.11 WBTC on Binance, indicating a potential liquidation of holdings. With this action, the whale is likely to face a substantial loss of approximately $7.5 million, emphasizing the volatility and risks associated with investing in WBTC. This situation highlights the need for thorough market analysis and risk management strategies for cryptocurrency investors.