Stablecoins and criminal activities have emerged as a concerning trend in the evolving landscape of digital finance. As these cryptocurrencies gain traction for their reliability and ease of use, they are increasingly being adopted by illicit networks operating on the dark web. Recent reports indicate that stablecoins accounted for an astounding 84% of the $154 billion in unlawful transactions, outpacing Bitcoin and highlighting a shift towards a programmable dollar economy used for money laundering and other illegal ventures. This dramatic rise in the use of stablecoins poses unique challenges for authorities attempting to regulate the cryptocurrency environment and combat cryptocurrency crime. With their low volatility and pegged values, stablecoins facilitate smooth, anonymous exchanges that make them a preferred option for those engaged in nefarious activities.

When discussing digital currencies tied to stable assets, particularly in the context of unlawful dealings, alternative terms such as ‘pegged coins’ or ‘digital fiat’ come into play. These currency forms are increasingly favored in illicit transactions, providing criminals with the stability and anonymity needed to operate away from the watchful eyes of regulators. The sophisticated infrastructure being built around these cryptocurrencies not only supports money laundering but also enables the efficient execution of dark web currency trades. Hence, the intersection of stable currencies and criminal endeavors has transformed the landscape of financial crime, posing significant risks and raising questions about the oversight of digital finance. As this shadow economy flourishes, understanding the implications for both cybersecurity and national security becomes critical.

The Rise of Stablecoins in Cryptocurrency Crime

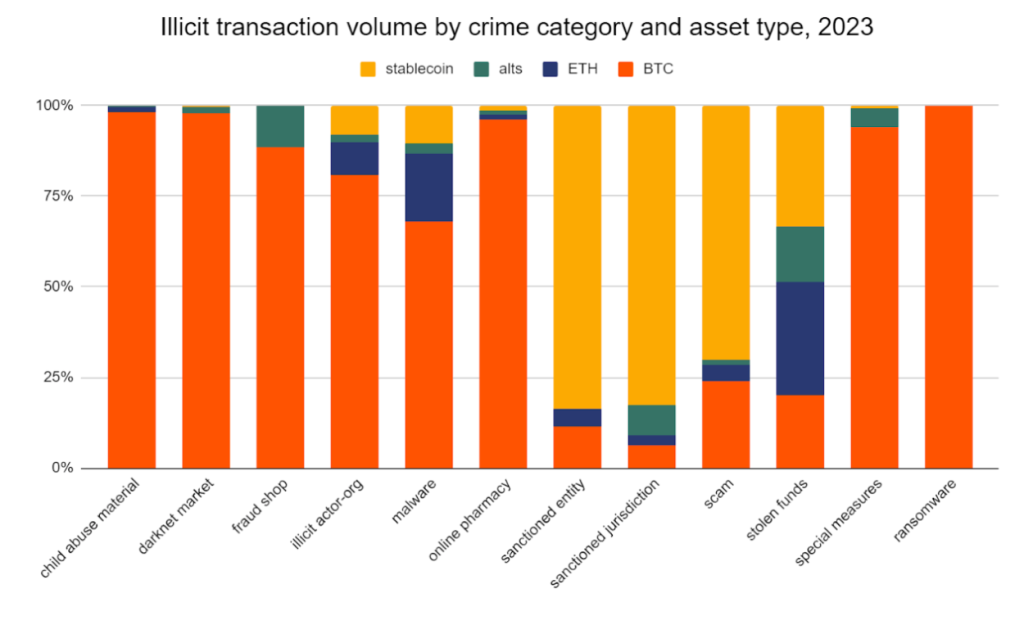

In recent years, the landscape of cryptocurrency crime has shifted dramatically, with stablecoins at the forefront of this change. As highlighted by recent reports, stablecoins now account for a staggering 84% of the illicit transaction volume within the cryptocurrency ecosystem. This shift underscores a growing trend where criminals are opting for the stability and reliability offered by stablecoins compared to the volatility of Bitcoin. The allure of a dollar-pegged asset has rendered stablecoins the currency of choice, particularly on the dark web, where ease of transaction and price predictability are paramount for illegal activities.

The transition from Bitcoin to stablecoins not only reflects individual criminal preferences but also a broader normalization of stablecoin usage in illicit activities. With the ability to conduct substantial transactions without the fear of wild price swings, criminal enterprises are utilizing stablecoins to efficiently facilitate money laundering and other related activities. Moreover, the interoperability of stablecoins with decentralized finance (DeFi) platforms has further cemented their role as the dominant digital currency used for illicit transactions.

Frequently Asked Questions

How are stablecoins being used in criminal activities such as money laundering?

Stablecoins have become a preferred method for money laundering due to their low volatility and ease of cross-border transactions. Criminals leverage stablecoins for illicit transactions, using them as a shadow financial system to operate outside traditional banking regulations.

What role do stablecoins play in facilitating illicit transactions on the dark web?

Stablecoins account for a significant portion of transactions on the dark web, representing 84% of the $154 billion in illicit transaction volume last year, as they offer a more stable and reliable currency than Bitcoin, making them ideal for criminal networks.

Why have criminals shifted from Bitcoin to stablecoins for their illegal activities?

Criminals have shifted to stablecoins as they offer enhanced stability and are tied to the US dollar. This makes stablecoins less susceptible to the price volatility of traditional cryptocurrencies like Bitcoin, enabling smoother and more predictable operations for illicit transactions.

What impact does the rise of stablecoins have on cryptocurrency crime?

The rise of stablecoins in cryptocurrency crime has resulted in a surge of sophisticated criminal activities, including state-sponsored money laundering and sanctions evasion. This trend highlights the growing intersection of legitimate digital finance and illicit operations.

How do stablecoins facilitate the operations of sophisticated criminal networks?

Stablecoins facilitate operations of sophisticated criminal networks by enabling fast, low-cost transactions that can bypass traditional financial institutions. These networks utilize ‘laundering-as-a-service’ models powered by stablecoins, enhancing their efficiency and reach.

What measures are being taken to combat the use of stablecoins in illegal activities?

Regulatory bodies and law enforcement agencies are increasing their scrutiny of stablecoin transactions, aiming to disrupt networks that use these digital currencies for criminal activities. Collaboration between regulators, cryptocurrency businesses, and law enforcement is essential to maintain ecosystem integrity.

Are most cryptocurrency transactions criminal in nature, particularly involving stablecoins?

Despite the concerning trends associated with stablecoins and criminal activities, illicit transactions in the cryptocurrency market represent less than 1% of the overall crypto economy. However, the involvement of stablecoins signifies a more professionalized and organized approach to cybercrime.

How do geopolitical factors influence the use of stablecoins in illicit transactions?

Geopolitical factors greatly influence the use of stablecoins, as state actors utilize them to evade sanctions and fund illegal activities. Countries like Russia and North Korea have demonstrated how stablecoins can be weaponized to bypass international banking restrictions.

| Key Points | Description |

|---|---|

| Stablecoins vs Bitcoin | Stablecoins have overtaken Bitcoin as the preferred currency for criminal activities, particularly on the dark web. |

| Illicit Transactions Data | Stablecoins accounted for 84% of the $154 billion in illicit transaction volume in the previous year. |

| Reasons for Shift | Criminal networks now prefer stablecoins due to lower volatility and ease of use in transactions. |

| Nation-State Involvement | Governments like Russia and Iran have leveraged blockchain technology for sanction evasion. |

| Emergence of Money Laundering Networks | Chinese money laundering networks have become more sophisticated, offering ‘laundering-as-a-service’. |

| Intersection with Violent Crime | There is a concerning connection between crypto crime and physical violence, especially in human trafficking. |

| Overall Market Context | Despite the rise in illegal transactions, they still represent less than 1% of the overall cryptocurrency economy. |

Summary

Stablecoins and criminal activities have become integral to illicit operations on the dark web, overtaking Bitcoin as the primary currency of choice. As stablecoins rise in popularity among criminal elements, they pose a significant challenge to regulators and law enforcement agencies tasked with maintaining global security. Understanding the dynamics at play within this evolving shadow economy is crucial for addressing the broader implications on national and international security.