Bitcoin ETF outflows have surfaced, marking a notable shift following an explosive start to 2026. After drawing in more than $1.16 billion in net inflows during the first two trading days of the year, the latest data reveals a sudden exit of $243 million from Bitcoin exchange-traded funds. This change highlights the dynamic nature of the Bitcoin investment landscape, especially as investors react to market fluctuations. The contrast is sharp, with other crypto ETFs like Ethereum and XRP continuing to attract fresh capital amidst these outflows. As the cryptocurrency market evolves, monitoring Bitcoin ETF outflows becomes crucial for understanding broader investment trends and portfolio strategies.

The recent trend of withdrawals from Bitcoin-related exchange-traded products suggests a potential recalibration within the cryptocurrency sector. Following a robust influx of capital at the beginning of the year, the outflow of significant sums raises questions about the future of Bitcoin-focused investment vehicles. While Bitcoin ETFs face challenges, altcoin ETFs are still engaging investors, attracting funds and showcasing an expanding interest in the wider crypto market. The subtle shift in focus towards Ethereum ETFs and other alternatives underscores the importance of diversification in investment strategies. As the market reacts to these developments, the ebb and flow of ETF outflows and inflows will likely paint a complex picture of investor sentiment in the months ahead.

Overview of Bitcoin ETF Outflows in 2026

As 2026 opened with high expectations, Bitcoin ETFs initially flourished, accumulating over $1.16 billion in inflows within just the first two trading days. However, this momentum quickly reversed with a notable outflow of $243 million on January 6, marking the first day of negative flows for Bitcoin exchange-traded funds this year. This sharp decline underscores the volatile nature of crypto investments, where market sentiment can shift dramatically in response to external factors or investor behavior.

Notably, this decline was not uniform across all Bitcoin ETFs. Funds such as BlackRock’s iShares Bitcoin Trust still attracted substantial investments despite the overall negative outflows. This situation illustrates differing performance among Bitcoin ETFs, with some funds sustaining investor confidence while others struggled, reflecting the dynamic landscape of crypto assets and the varying attraction of different investment vehicles.

Key Players Behind ETF Outflows

The recent outflows from Bitcoin ETFs can largely be attributed to prominent players like Fidelity and Grayscale. Fidelity’s Wise Origin Bitcoin Fund experienced significant withdrawals, totaling over $312 million on the reported day, while Grayscale’s flagship Bitcoin Trust recorded outflows of $83 million. These trends demonstrate how institutional clients’ decisions can significantly impact the flows of Bitcoin ETFs, contributing to the overall market sentiment.

Additionally, the performance of various funds also illustrates a competitive environment where some ETFs manage to retain their investor base better than others. BlackRock’s iShares Bitcoin Trust has seen inflows even amidst the broader trend of outflows, hinting at its growing reputation and the strength of its investment strategy compared to its competitors. The relationship between institutional confidence and ETF performance is critical in understanding the current landscape of the crypto investment space.

Ethereum and Altcoin ETFs: A Contrasting Narrative

While Bitcoin ETFs struggled with outflows, Ethereum and altcoin ETFs demonstrated resilience, attracting significant investments. Ethereum ETFs, for instance, saw a net inflow of $114.7 million on the same day Bitcoin faced redemptions. This divergence in performance highlights growing investor interest in Ethereum and other altocurrencies, suggesting a broader acceptance and diversification beyond Bitcoin investment.

Moreover, altcoin-focused ETFs, including those for XRP and Solana, added $19 million and $9 million respectively, indicating ongoing enthusiasm in the crypto market. These developments suggest that while Bitcoin remains a critical player, there is a significant appetite for alternative digital assets, strengthening the overall market and demonstrating the potential for ongoing innovation within the crypto ETF space.

Investor Sentiment and Bitcoin ETF Flows

The dramatic shifts in Bitcoin ETF inflows and outflows reflect the complex nature of investor sentiment in the crypto market. Following an explosive start to 2026, the subsequent outflows indicate a potential cooling of enthusiasm as investors reassess their positions. Such volatility is not uncommon in crypto investments, where market dynamics can change swiftly due to macroeconomic factors or regulatory news.

This sentiment is further exacerbated by the unpredictable nature of Bitcoin’s price movements, which are known to influence ETF performance significantly. As prices fluctuate, investors often reevaluate their strategies, leading to rapid shifts in capital flows. Understanding these sentiment-driven changes is crucial for investors looking to navigate the turbulent waters of Bitcoin and crypto asset investments.

Future Implications for Bitcoin ETFs

The recent trends in Bitcoin ETF outflows raise important questions about the future of Bitcoin investments. As institutional players like Morgan Stanley announce plans for new Bitcoin and Solana ETFs, it hints at a potential resurgence in Bitcoin’s popularity. If market conditions stabilize and investor confidence returns, these new products could reinvigorate the sector.

Moreover, the strong inflows earlier in 2026 suggest that, despite recent outflows, the appetite for Bitcoin remains considerable. Should favorable market conditions emerge, the potential for Bitcoin ETFs to reclaim their growth trajectory is promising. This cyclical nature of investment flows emphasizes the necessity for investors to stay alert and adapt to evolving market conditions.

Understanding Bitcoin ETF Market Dynamics

The dynamics of the Bitcoin ETF market are shaped by multiple factors, including institutional participation, regulatory developments, and broader market trends. The interplay between these elements can create significant fluctuations in investor flows, as witnessed in the sharp transition from inflows to outflows earlier in 2026. It is essential for investors to understand these dynamics, as they directly influence overall market performance and investment strategies.

Furthermore, the competition among ETFs can lead to variations in performance as they vie for investor attention. The resilience shown by funds like BlackRock’s IBIT amidst outflows exemplifies how some ETFs can capitalize on market conditions effectively. Monitoring these trends is vital for any investor looking to assess the overall landscape of crypto ETFs and optimize their investment portfolio.

The Role of Institutional Investors in Crypto ETFs

Institutional investors play a pivotal role in shaping the landscape of Bitcoin and crypto ETFs. Their substantial capital commitment can lead to significant inflows, as seen during the strong start to 2026. However, institutional sentiment can also lead to abrupt outflows, highlighting the volatility in the market. Understanding how these large players react to market signals is crucial for anticipating future ETF performance.

As institutions grow more comfortable with crypto investments, their strategies can have lasting implications for the broader market. New ETF products introduced by companies like Morgan Stanley are indicative of this growing confidence, potentially transforming how retail and institutional investors participate in the cryptocurrency space. As more institutional funds enter the market, they could create stability and continued growth for Bitcoin ETFs overall.

Monitoring Bitcoin Price Trends and ETF Flows

The relationship between Bitcoin price movements and ETF flows is a crucial factor for investors. Fluctuations in Bitcoin prices often correlate with changes in ETF inflows and outflows, as investor sentiment is heavily influenced by market performance. Understanding these correlations can provide valuable insights into future investment opportunities in the Bitcoin ETF space.

For instance, the recent dip in Bitcoin prices contributed to the outflows observed in ETFs, demonstrating a direct link between asset performance and investor behavior. Analyzing these trends allows investors to make informed decisions by anticipating potential shifts in capital flows based on Bitcoin’s trading activity. A strategic approach to monitoring these patterns can ultimately enhance investment outcomes in the volatile crypto market.

Comparing Bitcoin and Ethereum ETFs: Performance Insights

When assessing the performance of Bitcoin versus Ethereum ETFs, distinct trends emerge. Bitcoin ETFs experienced substantial inflows at the beginning of 2026, followed closely by outflows, while Ethereum ETFs maintained positive performance, attracting consistent investment. This divergence indicates varying levels of investor confidence and may reflect broader market perceptions towards each cryptocurrency.

The stability of Ethereum ETFs amidst Bitcoin’s volatility suggests that investors are increasingly viewing Ethereum and altcoins as viable alternatives. This trend could reshape the investment landscape, encouraging greater diversification in crypto portfolios. For investors, understanding these dynamics will be essential for making sound decisions in the evolving cryptocurrency market.

Emerging Trends in the Crypto ETF Market in 2026

As we move further into 2026, emerging trends in the crypto ETF market are beginning to take shape. The initial explosive inflows into Bitcoin ETFs may serve as a harbinger for a record-setting year, yet the recent outflows also highlight the need for caution. The market’s ability to stabilize will be pivotal in determining the future trajectory of Bitcoin and alternative crypto ETFs.

Moreover, the ongoing interest in Ethereum and other altcoins suggests that investors are diversifying their strategies and exploring beyond Bitcoin-focused investment options. This shift could lead to a more balanced cryptocurrency market, presenting an opportunity for growth across various asset classes. Keeping an eye on these emerging trends is vital for investors looking to capitalize on the opportunities presented by crypto ETFs.

Frequently Asked Questions

What are the recent trends in Bitcoin ETF outflows?

Recent data shows that Bitcoin ETF outflows have returned, with U.S. spot Bitcoin ETFs experiencing a net outflow of $243 million, marking a reversal after a strong start to 2026 where they gathered over $1.16 billion in inflows.

Which factors have contributed to the negative Bitcoin ETF flows?

The primary factors contributing to the recent Bitcoin ETF outflows include significant withdrawals from Fidelity’s Wise Origin Bitcoin Fund and Grayscale’s Bitcoin Trust, which saw $312 million and $83 million exit, respectively.

How do Ethereum ETFs compare to Bitcoin ETF outflows?

While Bitcoin ETFs experienced outflows, Ethereum ETFs attracted $114.7 million in net inflows, showcasing strong investor interest in crypto ETFs beyond Bitcoin amidst the volatile market conditions.

What impact did Bitcoin price movements have on ETF outflows?

The fluctuation in Bitcoin prices, particularly the recent recovery above the $90,000 mark, has influenced investor sentiment, contributing to both significant inflows early in the year and subsequent outflows as profit-taking occurred.

Are altcoin ETFs affected by Bitcoin ETF outflows?

No, altcoin ETFs, such as XRP and Solana ETFs, continue to show positive trends, with net inflows of $19 million and $9 million, indicating investor interest remains robust despite the outflows in Bitcoin ETFs.

What does the recent reversal in Bitcoin ETF flows mean for future investments?

The recent reversal in Bitcoin ETF flows suggests a potential shift in investor sentiment, possibly impacting the overall market stability for Bitcoin investments, as seen with both outflows and continued interest in other crypto ETFs.

How did Bitcoin ETFs perform in the initial phase of 2026 compared to 2025?

Bitcoin ETFs performed exceptionally well in the early days of 2026, garnering over $1.2 billion in inflows, a significant increase compared to the overall $21.4 billion attracted in all of 2025.

Could the recent Bitcoin ETF outflows be a temporary trend?

Yes, the recent outflows could be temporary, especially considering the strong inflows recorded at the start of 2026, which indicates potential ongoing interest in Bitcoin investment if market conditions stabilize.

What is the significance of BlackRock’s iShares Bitcoin Trust in the context of ETF outflows?

BlackRock’s iShares Bitcoin Trust (IBIT) remains a leading performer, with $228 million in net inflows, highlighting its significance in countering the overall trend of outflows seen in other Bitcoin ETFs.

How do projected Bitcoin ETF inflows in 2026 compare to past years?

If the current inflow momentum continues, projections suggest that Bitcoin ETFs could reach annual inflows of approximately $150 billion in 2026, substantially more than the $21.4 billion recorded in 2025.

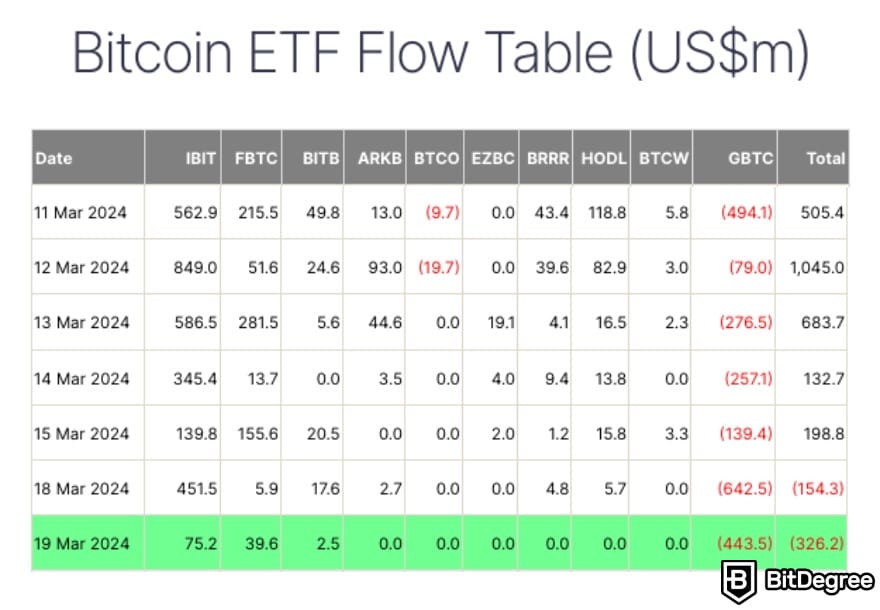

| Date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | BTC | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 06 Jan 2026 | 228.7 | -312.2 | 0.0 | -29.5 | 0.0 | 0.0 | 0.0 | -14.4 | 0.0 | -83.1 | -32.7 | -243.2 |

| 05 Jan 2026 | 372.5 | 191.2 | 38.5 | 36.0 | 15.0 | 13.6 | 7.2 | 5.3 | 0.0 | 0.0 | 17.9 | 697.2 |

| 02 Jan 2026 | 287.4 | 88.1 | 41.5 | 6.7 | 4.5 | 13.0 | 0.0 | 8.3 | 0.0 | 15.4 | 6.4 | 471.3 |

| 31 Dec 2025 | -99.0 | -66.6 | -13.8 | -76.5 | 0.0 | -5.1 | 0.0 | -6.8 | 0.0 | -69.1 | -11.2 | -348.1 |

| 30 Dec 2025 | 143.7 | 78.6 | 13.9 | 109.6 | 0.0 | 0.0 | 0.0 | 5.0 | 0.0 | 0.0 | 4.3 | 355.1 |

Summary

Bitcoin ETF outflows have gained attention due to their significant fluctuations in early 2026. After an explosive start, where Bitcoin ETFs attracted over $1.16 billion in inflows, the trend shifted with recorded outflows of $243 million within days. The major players, such as Fidelity and Grayscale, contributed to these outflows, highlighting the volatility in the market. Despite this, some funds like BlackRock’s IBIT remained strong, signaling differing dynamics in the cryptocurrency ETF space. As the year progresses, these trends will be crucial for understanding Bitcoin’s position in the investment landscape.

Related: More from Bitcoin News | Gold, AI, Tech Stocks Lead as Bitcoin Fades | UBS Slides on US Stocks: Bitcoin’s Fate?