Ethereum holdings have become a focal point for investors, especially with substantial movements in the cryptocurrency market. Recently, a notable institution known as 7 Siblings has been actively engaged in ETH accumulation, strategically amassing 252,000 ETH, which currently exceeds an impressive total ETH value of 800 million USD. Their strategic investments, including the recent acquisition of 48,588.72 ETH since October 2024, underline the growing trend of institutional Ethereum investments. Additionally, surpassing the Ethereum Foundation’s holdings places 7 Siblings in a prominent position within the cryptocurrency landscape. As Ethereum continues to evolve, understanding such significant holdings is crucial for both current and prospective investors.

In the realm of digital currencies, the concept of Ethereum asset ownership is gaining traction among various entities and individuals. The recent activities of 7 Siblings illustrate a focused effort in acquiring large quantities of ETH, reflecting a trend toward substantial cryptocurrency investments by institutions. With total Ethereum assets amounting to over 800 million USD, this particular accumulation showcases the growing relevance and intrigue surrounding digital currencies. Furthermore, the strategic maneuvers made by 7 Siblings not only highlight their investment aspirations but also signal the rising interest in Ethereum among prominent investors. As the market matures, tracking such notable Ethereum asset acquisitions becomes increasingly vital for understanding future developments in the blockchain ecosystem.

A Deep Dive into 7 Siblings’ Ethereum Holdings

The 7 Siblings investment group has emerged as a formidable player in the Ethereum ecosystem, currently boasting an impressive total of 252,000 ETH on-chain. This substantial accumulation of Ethereum signifies not only a strategic approach to cryptocurrency investment but also highlights their foresight amid market fluctuations. With a total value exceeding 800 million USD, their Ethereum holdings position them as one of the top institutional investors. This rise in ETH accumulation reflects a strong belief in the future of decentralized applications and the blockchain technology that underpins Ethereum.

In recent months, 7 Siblings has significantly ramped up its investments, purchasing approximately 48,588.72 ETH since October 2024 at an average price of $3,479. This calculated strategy underscores a collective confidence among institutional Ethereum investors, as they foresee the potential for price appreciation as the ecosystem expands. As the Ethereum network continues to evolve and adapt with improvements like Ethereum 2.0, institutions like 7 Siblings are likely to remain at the forefront of ETH accumulation.

Understanding Ethereum’s Market Dynamics Through Institutional Investments

The landscape of Ethereum investments is marked not only by individual investors but also by large institutions that are increasingly placing their bets on this leading cryptocurrency. The significant holdings by groups like 7 Siblings, which have surpassed institutions such as the Ethereum Foundation, signal a shift in market confidence. With ETH accumulation trends soaring, many investment firms are recognizing the utility of Ethereum beyond speculation, exploring its potential for decentralized finance (DeFi) and NFTs.

Generally, institutional Ethereum investments have surged over the past couple of years as organizations begin to diversify their portfolios to include digital assets. Key players like 7 Siblings have leveraged strategic market analysis and on-chain metrics to amplify their investments. As a result, total ETH value is expected to appreciate as institutional capital flows into the market, fostering increased liquidity and potentially leading to greater market stability for Ethereum.

The Role of the Ethereum Foundation in Market Stability

The Ethereum Foundation plays a pivotal role in supporting the ecosystem of Ethereum, providing resources and guiding developments aimed at enhancing the network’s capabilities. By overseeing updates and improvements, the foundation adds a layer of credibility and stability, which is vital for institutional investors like 7 Siblings. Their substantial ETH holdings of 252,000 also highlight the importance of established institutions alongside community-driven foundations.

As the Ethereum Foundation maintains its own significant holdings, it becomes increasingly essential for developers and communities to adapt to the evolving requirements of the blockchain. This nurtures an environment where institutional Ethereum investments can thrive. The interplay between the Ethereum Foundation and investment groups like 7 Siblings could yield innovative projects and applications, further boosting the total ETH value in the long term.

Ethereum Accumulation Trends Among Institutional Investors

Observing the trend of Ethereum accumulation among institutions reveals a growing interest in digital assets as a viable investment strategy. Notably, 7 Siblings has exemplified this trend with their remarkable acquisition of ETH since late 2024. Their approach mirrors a broader pattern in the cryptocurrency market, where institutions are transitioning from cautious observation to active participation, reflecting a maturing market outlook.

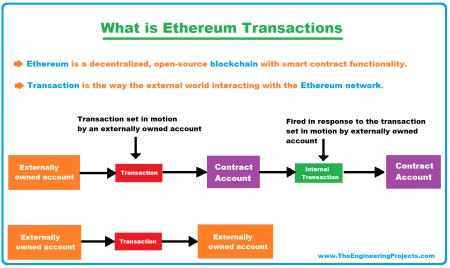

The reasons for this surge in institutional interest are multifaceted, including the desire to hedge against inflation, diversify portfolios, and tap into the innovation that Ethereum fosters. Institutions view Ethereum not merely as a currency, but as a platform with vast possibilities due to its smart contract functionality. This shift has led to increased ETH accumulation, stressing the need for robust risk management frameworks as they navigate the complexities of the crypto market.

The Implications of 7 Siblings’ Investment Strategy

7 Siblings’ strategy for accumulating ETH is indicative of their confidence in the cryptocurrency’s long-term viability. By investing over 169 million USD into Ethereum, they are betting on both the technology and its potential for adoption across various sectors. Their actions serve as a beacon for other institutional investors, demonstrating that substantial investment in Ethereum can yield significant returns as the digital economy continues to expand.

The implications of their investment strategy extend beyond mere financial gain; they also contribute to the overall legitimacy of Ethereum as an asset class. As more institutions follow suit, confidence in Ethereum’s stability and performance is likely to grow, which can, in turn, contribute to a more resilient and mature crypto market landscape.

Analyzing the Future of Ethereum Holdings

The future of Ethereum holdings looks promising, especially with institutions like 7 Siblings leading the charge. Their massive acquisition spree indicates a strong belief in Ethereum’s capacity to adapt and thrive in the competitive landscape of digital assets. As Ethereum continues to evolve with enhancements that address scalability and efficiency, such as the movement towards ETH 2.0, the foundation for growth and further investment will be fortified.

Furthermore, as institutional investments proliferate, the potential for ETH’s price to appreciate grows. This influx of capital may encourage other potential investors to enter the market, creating a positive feedback loop that can drive demand and elevate the total ETH value. Monitoring these developments will be critical for understanding how Ethereum can solidify its position within the broader context of digital currencies.

The Impact of Ethereum on the Cryptocurrency Ecosystem

Ethereum has significantly impacted the broader cryptocurrency ecosystem, catalyzing innovations and paving the way for decentralized finance (DeFi) and non-fungible tokens (NFTs). Through its unique smart contract functionality, Ethereum has become a foundational layer for countless applications, attracting substantial investments from entities like 7 Siblings and others. Their large-scale acquisition underscores the belief in Ethereum’s longevity and its central role in the future of decentralized digital systems.

As Ethereum evolves, the repercussions of these advancements can profoundly affect the entire cryptocurrency market. With institutions increasingly recognizing the value of Ethereum, it is poised to emerge as a leading blockchain platform. The ongoing development and research supported by the Ethereum Foundation add to this positive trajectory, reinforcing the ecosystem’s adaptability and sustainability, which can ultimately benefit ethic investors and drive further ETH accumulation.

Navigating Institutional Risks in Ethereum Investments

While institutional investments in Ethereum present significant opportunities, they also come with inherent risks. Entities like 7 Siblings are keenly aware of the volatility associated with cryptocurrency markets and have developed strategies to mitigate potential pitfalls. This risk management is crucial for ensuring that their substantial holdings remain protected against market fluctuations while still benefiting from potential upside growth.

Moreover, regulatory scrutiny surrounding cryptocurrencies can create additional challenges for institutional investors. As the landscape of digital assets evolves, adhering to frameworks established by government entities will become increasingly important. 7 Siblings’ approach to navigating these risks could serve as a blueprint for other institutions looking to engage with Ethereum cautiously yet effectively.

The Future of Ethereum Accumulation Strategies

As Ethereum continues to mature, the strategies for accumulation by institutions will likely evolve as well. Investors like 7 Siblings are setting precedents with their large-scale treasury management focused on crypto assets. The diversification within Ethereum holdings will become crucial, as institutions explore various methods like staking and yield farming to generate returns on their accumulated ETH.

Looking ahead, the integration of advanced analytics and on-chain data will play a pivotal role in shaping institutional strategies. By harnessing these insights, institutions can better navigate the complexities of the Ethereum market and optimize their accumulation methods. The proactive approach taken by groups like 7 Siblings could inspire a new wave of investment tactics, ultimately benefiting their portfolios while contributing to Ethereum’s overall ecosystem.

Frequently Asked Questions

What is the total value of the 7 Siblings Ethereum holdings?

The total value of the 7 Siblings Ethereum holdings exceeds 800 million USD, with the institution currently holding 252,000 ETH.

How much ETH has 7 Siblings accumulated on-chain since October 2024?

Since October 2024, 7 Siblings has accumulated 48,588.72 ETH on-chain at an average price of $3,479.

How do the 7 Siblings Ethereum holdings compare to the Ethereum Foundation?

The 7 Siblings Ethereum holdings of 252,000 ETH rank fifth among institutions, surpassing the Ethereum Foundation’s holdings.

What are institutional investments in Ethereum holdings?

Institutional investments in Ethereum holdings refer to significant purchases of ETH by organizations or funds, such as the 7 Siblings, which has amassed a total of 252,000 ETH.

Why is ETH accumulation important for institutions like 7 Siblings?

ETH accumulation is crucial for institutions like 7 Siblings as it allows them to build substantial portfolios in Ethereum, reflecting their confidence in the cryptocurrency’s future value.

How does the total ETH value impact institutional Ethereum investments?

The total ETH value directly influences institutional Ethereum investments, as a higher market valuation, such as the over 800 million USD value of the 7 Siblings holdings, can encourage more investments from other institutions.

| Key Point | Details |

|---|---|

| Institution | 7 Siblings |

| Total ETH Held | 252,000 ETH |

| Total Value | Over 800 million USD |

| ETH Accumulation Since | October 2024 |

| ETH Accumulated Amount | 48,588.72 ETH |

| Average Purchase Price | $3,479 |

| Ranking Among Institutions | 5th (above Ethereum Foundation) |

Summary

Ethereum holdings have gained significant attention with 7 Siblings amassing an impressive portfolio of 252,000 ETH, translating to a market value exceeding 800 million USD. This substantial accumulation, which began in October 2024, showcases the increasing institutional interest in Ethereum as a valuable asset. With such an extensive holding, 7 Siblings ranks fifth among all institutions, underscoring the competitive landscape within cryptocurrency investments.