The Nikkei 225 Index has recently reached an impressive milestone, soaring to 52,000 points, marking its highest level since early November of the previous year. This notable surge captures the attention of investors and analysts alike, as the Japanese stock market showcases significant momentum amid fluctuating global financial conditions. With the latest Nikkei updates, market participants are eager to delve into the implications of this index performance on Japan’s economic landscape. As investors seek the latest Nikkei 225 news, understanding the factors driving this growth becomes crucial for effective financial market analysis. Stay tuned for insights that could shape your investment strategies in this vibrant market.

The Japanese stock market, represented by the Nikkei 225 Index, has achieved remarkable highs, sparking interest in its current performance and future trends. As we explore the dynamics within this economic hub, discussions surrounding market indices become essential for grasping the broader financial context. This surge in the Nikkei is indicative of shifting sentiments among investors, influencing trade activities and investment decisions across the region. Analysts are closely monitoring the latest developments and updates related to Japan’s premier stock index, which may carry substantial implications for those engaged in financial market analysis. Understanding these factors is ever more vital as the landscape evolves.

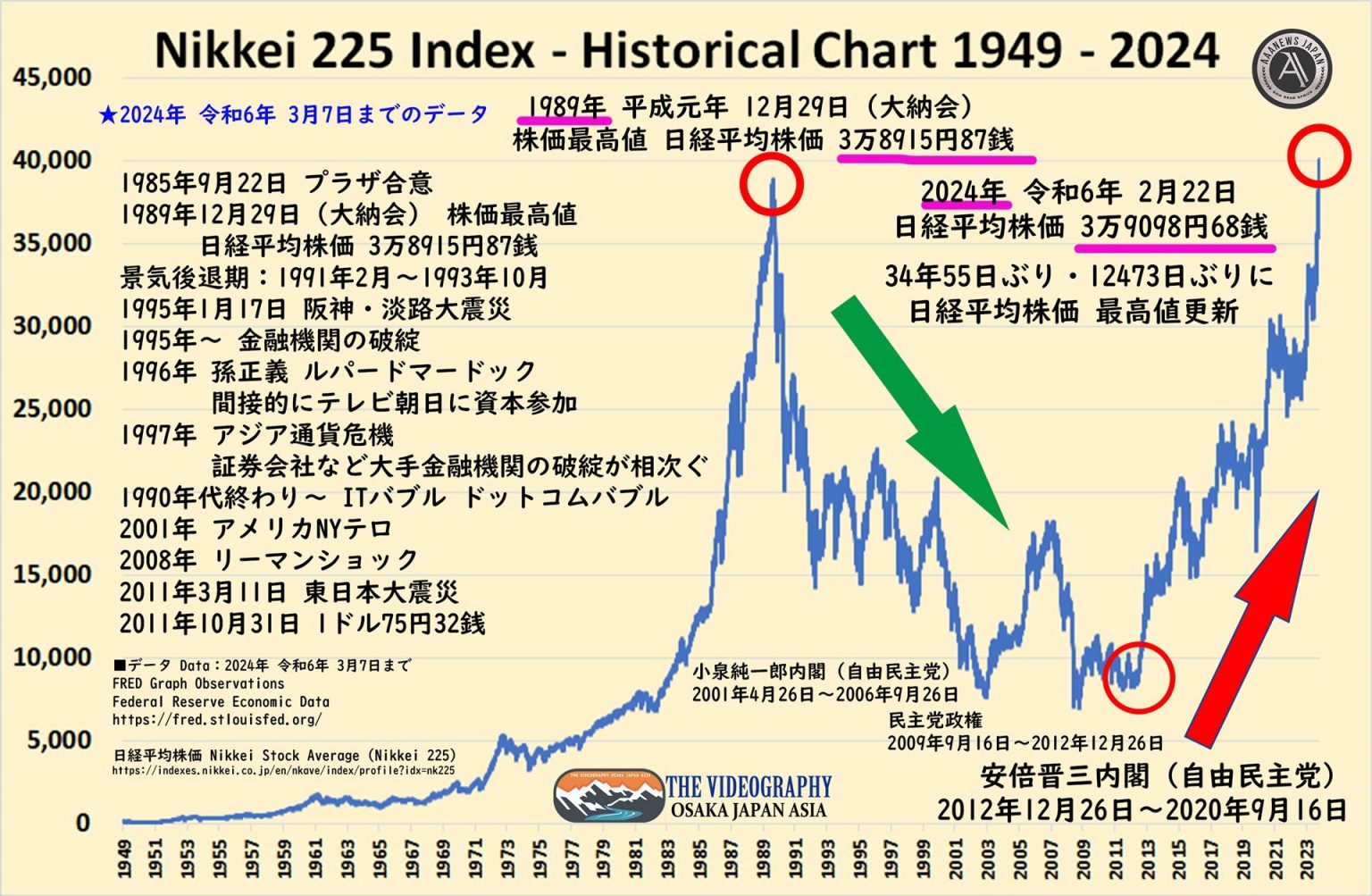

Nikkei 225 Index Hits New Highs: A Market Overview

The Nikkei 225 Index recently surged to an impressive 52,000 points, marking its highest level since November 4 of the previous year. This surge reflects a robust recovery in the Japanese stock market, bolstered by strong economic indicators and investor confidence. Analysts suggest that the index’s performance signals a potential shift in market dynamics, with increasing investment inflows and optimism around corporate earnings forecasting.

As we delve deeper into the financial market analysis, the rise of the Nikkei 225 can be attributed to several factors, including favorable government policies and a revival in consumer spending. This momentum has sparked renewed interest among global investors looking to capitalize on Japan’s economic recovery. Continuous updates on the index indicate a trend that could further influence global market sentiments.

Financial Market Analysis: Understanding the Nikkei 225

Conducting a comprehensive financial market analysis reveals underlying trends driving the Nikkei 225 Index’s recent highs. The Japanese stock market has historically been influenced by both domestic economic policies and global financial events. Factors such as Japan’s monetary easing strategy and recovery from economic downturns play a pivotal role in shaping investor sentiment and stock evaluations.

Economic data suggesting lower unemployment rates and increasing manufacturing output have enhanced market outlook in Japan. As investors digest these developments, the implications for the Nikkei 225’s trajectory appear promising. Keeping in touch with Nikkei updates can provide valuable insights into future market movements and potential investment opportunities.

Impact of Global Events on Nikkei 225 Index Performance

The Nikkei 225 Index does not operate in a vacuum; its performance is intricately tied to global economic events. For instance, fluctuations in the US markets, geopolitical tensions, and trade negotiations significantly influence investor decisions in Japan. Understanding these correlations is essential for investors looking to navigate the complexities of the financial markets.

Recent global developments, including monetary policies adopted by major economies, have reverberated through the Japanese market. Global financial instability often leads to increased volatility in the Nikkei 225 Index, indicating a reactive relationship. Investors should remain vigilant, monitoring both domestic indicators and international news to anticipate shifts in the index.

The Role of Domestic Policies in Shaping the Nikkei 225

Domestic policies in Japan play a crucial role in shaping the Nikkei 225 Index. The government’s approach to fiscal stimulation and regulatory reforms can directly impact market trends and investor confidence. As Japan continues to navigate economic recovery from the impacts of past global crises, proactive measures from policymakers become essential for sustaining growth in the index.

Furthermore, monitoring legislative changes and economic strategies will be key to understanding the future trajectory of the Nikkei 225. Investors looking for stable opportunities in the Japanese stock market must keep track of government initiatives aimed at enhancing economic stability and growth prospects.

Investor Sentiment and its Influence on Nikkei 225

Investor sentiment significantly influences the performance of the Nikkei 225 Index. As the index reaches new highs like the current 52,000 points benchmark, gauge investor mood can predict market sustainability. Positive sentiment often leads to increased trading activity, while any negative news can trigger rapid sell-offs.

Surveys and indicators tracking investor confidence provide valuable insights into market direction. Market analysts emphasize the need for potential investors to observe these sentiments closely, as they can serve as indicators for entry and exit points within the Japanese stock market.

Upcoming Challenges and Opportunities for the Nikkei 225

Despite the current bullish trend, the Nikkei 225 Index is not without its challenges. Economic uncertainties, driven by international market conditions and geopolitical issues, could pose risks to its continued growth. Investors must remain cautious and aware of potential market corrections as they strategize their investments.

However, opportunities abound within this dynamic landscape. With ongoing innovations in various sectors, including technology and manufacturing, the Nikkei 225 may experience further upward momentum. Close monitoring of market developments and corporate earnings can aid in identifying promising investment prospects.

Understanding Technical Indicators for the Nikkei 225

Technical analysis plays a pivotal role in understanding the Nikkei 225’s performance. Investors often utilize charting tools and indicators such as moving averages and RSI (Relative Strength Index) to gauge market trends and make informed decisions. A well-rounded understanding of these technical indicators will significantly enhance investment strategies in the Japanese stock market.

As the index approaches new highs, technical analysis may reveal crucial patterns that can assist investors in identifying potential entry points. Educating oneself on these tools allows investors to respond proactively to market movements, ultimately leading to better investment outcomes.

The Future of the Nikkei 225 Index: Predictions and Trends

Looking to the future, analysts are making predictions about the trajectory of the Nikkei 225 Index. Many experts project that with favorable economic conditions and continued investor interest, the index could sustain its upward trend. Monitoring fiscal developments and corporate success stories will be essential as investors look for indicators of stability in the market.

Trends in technology innovation and sustainability initiatives are expected to play significant roles in shaping the future of the Japanese stock market. Investors who align their portfolios with these growing sectors may find lucrative opportunities as companies positioned for growth begin to thrive within the Nikkei 225.

Nikkei 225 Updates: Staying Informed on Market Movements

To capitalize on the movements of the Nikkei 225 Index, staying informed through regular updates is critical. Financial news sources, market analyses, and industry reports offer valuable information that can guide investment strategies. Investors can leverage this information to make well-informed decisions that reflect the current market landscape.

Utilizing online platforms and financial news outlets dedicated to the Nikkei 225 allows investors to track real-time developments and adjustments in the index. This proactive approach to staying updated can bolster confidence and enhance investment outcomes in the Japanese stock market.

Frequently Asked Questions

What is the current status of the Nikkei 225 Index as of January 2026?

As of January 5, 2026, the Nikkei 225 Index has reached 52,000 points, marking its highest level since November 2025. This performance reflects a significant rebound in the Japanese stock market, garnering considerable interest from investors looking for the latest Nikkei updates.

How does the Nikkei 225 Index impact financial market analysis in Japan?

The Nikkei 225 Index serves as a vital barometer for financial market analysis in Japan, as it reflects the performance of 225 large, publicly-owned companies on the Tokyo Stock Exchange. Analysts monitor its movements to gauge economic trends and stock market health.

Where can I find the latest Nikkei 225 news?

The latest Nikkei 225 news can be found on financial news platforms and market analysis websites. Keeping abreast of these updates is important for investors, as they provide insights into the index’s performance and trends in the Japanese stock market.

What factors influence the performance of the Nikkei 225 Index?

The performance of the Nikkei 225 Index is influenced by various factors, including economic data releases, corporate earnings reports, global market trends, and geopolitical events. Investors often conduct financial market analysis to understand how these aspects impact index performance.

What does a rise in the Nikkei 225 Index indicate about the Japanese stock market?

A rise in the Nikkei 225 Index typically indicates bullish sentiment in the Japanese stock market, suggesting that investors are optimistic about the economic prospects of the companies listed. This trend often leads to increased investments and positive market movements.

How can I track the performance of the Nikkei 225 Index?

To track the performance of the Nikkei 225 Index, investors can utilize financial news websites, stock market apps, or trading platforms that provide real-time updates and charts. Regularly checking these sources can help you stay informed about significant changes in the index’s value.

What historical significance does the current level of 52,000 points on the Nikkei 225 Index hold?

Reaching 52,000 points, the Nikkei 225 Index has attained its highest level since November 2025, which could signify a recovery phase or renewed investor confidence in the Japanese economy, making it a noteworthy milestone in its historical performance.

How do Nikkei updates affect international investors?

Nikkei updates can significantly affect international investors by influencing their perceptions of the Japanese economy and stock market. Positive trends in the Nikkei 225 Index can attract foreign investments, while negative movements can deter participation from international markets.

| Key Points | Details |

|---|---|

| Nikkei 225 Index | Reached 52,000 points, a new high since November 4 of the previous year. |

| Source | Odaily Planet Daily |

| Date and Time | 2026-01-05 05:52 |

| Market Reactions | Japanese and South Korean stock indices increased by 3% during the day. |

| Related Articles | – 2025 Annual Archive: Selected Articles from the Odaily Editorial Team – BTC returns to $93,000, is the Fed’s $16 billion bailout saving the market? – The first wave of the 2026 market is actually Meme coins: Prelude to recovery? Bull market trap? – New capital reward path under the new system: The true landscape of cryptocurrency investment and financing in 2025 |

Summary

The Nikkei 225 Index has notably reached 52,000 points, marking its highest level since November 4 of the prior year. This surge highlights the momentum in the Japanese market, influenced by positive market trends evident in both Japanese and South Korean stock indices, which saw an increase of 3% on the same day. Such positive movements in the Nikkei 225 Index indicate a potential recovery phase, drawing attention to the evolving dynamics in the financial landscape, particularly within the context of evolving economic conditions and investor sentiment.

Related: More from Market Analysis | Kaspa KAS Price Forecast: Why $0.03 Crucial for Bulls | Barclays Looks at Blockchain for Payments, Deposits