In the world of cryptocurrency betting, the recent developments surrounding Polymarket Maduro Arrest Bets have gained significant attention. Recent reports indicate that a bettor who predicted Venezuelan President Nicolás Maduro’s arrest on the Polymarket platform has reaped a staggering profit of over $400,000. This curious case not only highlights the intriguing nature of Maduro arrest betting but also suggests potential financial ties to WLFI co-founder Steven Charles Witkoff. Utilizing on-chain data analysis, experts have traced connections that further entangle the cryptocurrency landscape with high-stakes political predictions. As these betting markets continue to evolve, they provide a fascinating lens through which to examine both political events and financial strategies in the digital currency arena.

The phenomenon of betting on the implications of political figures, such as the potential arrest of Maduro, has captivated the cryptocurrency market. In recent times, discussions around Maduro apprehension wagers have sparked interest among enthusiasts and analysts alike. These stakes not only shed light on the volatile nature of crypto investments but also reveal deeper associations with key financial players, particularly associated with WLFI’s co-founder. Harnessing innovative methods such as on-chain analysis, betting strategies are becoming more transparent, allowing us to trace connections and movements within the blockchain. This evolving trend in political forecasting through cryptocurrency betting presents a compelling intersection of finance, technology, and global events.

Understanding Polymarket Maduro Arrest Bets

Polymarket has emerged as a pivotal platform for speculative betting, especially with high-profile events like the anticipated arrest of Venezuelan President Nicolas Maduro. The recent surge in betting activity around this event has attracted significant attention due to the substantial financial implications. With bettors wagering upwards of $400,000 on Maduro’s arrest, the Polymarket platform has not only provided users a unique avenue for investment but has also highlighted the intersection of cryptocurrency and traditional betting mechanisms. The rise of such platforms indicates a compelling shift in how individuals perceive risk and opportunity in political events.

This trend of betting on political events, particularly through platforms like Polymarket, emphasizes a broader acceptance of cryptocurrency in the betting industry. Observers note the potential for ‘Maduro arrest betting’ to not only deliver profits for savvy investors but also to serve as valuable data points for analyzing political landscapes. The implications of these bets extend beyond quick transactions, suggesting a growing trend towards integrating on-chain data analysis to validate information before making predictions. Thus, Polymarket has become a significant case study for how cryptocurrencies can disrupt traditional betting markets.

The Financial Links to WLFI Co-Founder

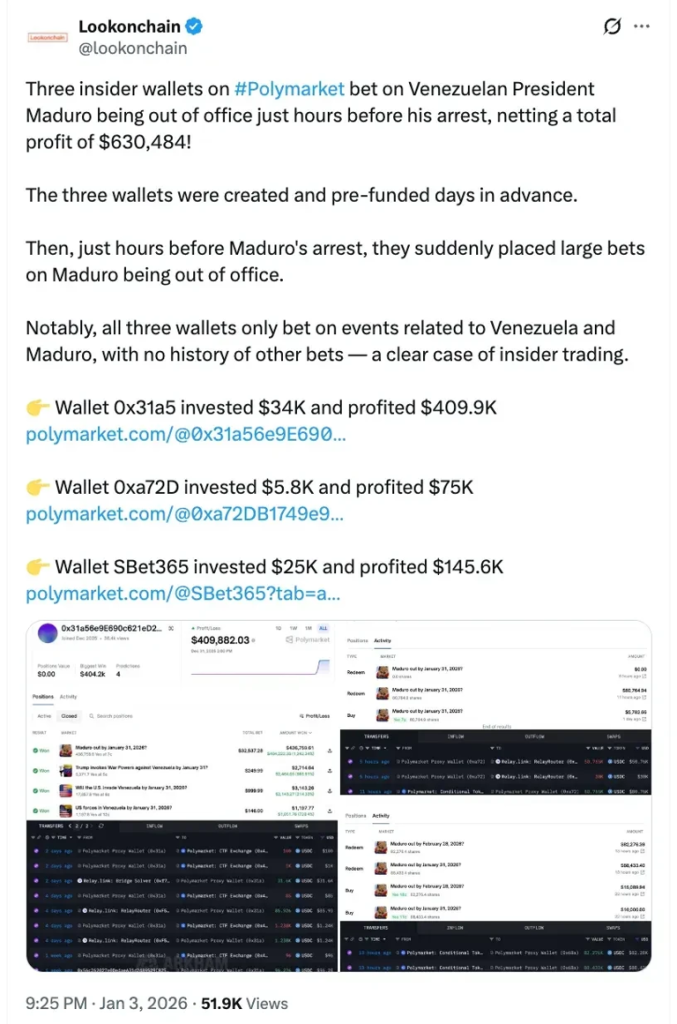

Recent investigations into the wallet addresses associated with profits from betting on Maduro’s arrest have unveiled connections to Steven Charles Witkoff, co-founder of World Liberty Finance (WLFI). These findings raise questions about the ethical dimensions of insider trading on platforms like Polymarket, where bettors can leverage financial information for profit. The analysis from on-chain data shows that these wallets not only transferred substantial amounts of SOL but also demonstrated patterns indicative of coordinated financial strategies, emphasizing the need for regulatory scrutiny in the cryptocurrency betting space.

Understanding these financial links, especially regarding WLFI and its co-founder, reinforces the notion of accountability and transparency in cryptocurrency transactions. With the amount transacted exceeding $400,000, the implications of this analysis extend to broader discussions on cryptocurrency regulation. As more individuals engage in cryptocurrency betting, recognizing the significance of on-chain data analysis will be crucial. This facilitates not only better investment decisions but also fosters a culture of responsible betting practices in a rapidly evolving market.

/n

Examining the legality of such bets on platforms like Polymarket can be incredibly complex. While some argue that these bets reflect personal opinions on political events, others express concerns regarding potential market manipulation and insider trading. As seen in the recent analysis, the detailed tracing of transactions showcases the need for clarity and regulatory oversight in a rapidly evolving landscape. These ethical considerations spotlight an urgent need for industry standards to dissect and understand the influence of cryptocurrency betting within broader financial systems.

Cryptocurrency Betting and On-Chain Data Analysis

As the popularity of cryptocurrency betting continues to surge, on-chain data analysis has emerged as a crucial tool for discerning patterns of betting behaviors. The recent focus on Polymarket’s betting activities surrounding Maduro’s arrest underscores the importance of this analytical approach. Bettors are increasingly utilizing on-chain metrics to guide their investments, allowing them to make informed decisions based on real-time data. This capability to track transaction histories lends itself to understanding investor sentiment in political events.

On-chain data analysis plays a critical role in distinguishing between regular bettors and potential insiders leveraging privileged information. With the significant profits derived from Maduro’s arrest betting, those engaged in cryptocurrency betting can assess risk more effectively. Additionally, by employing analytical tools, investors can identify correlations between wallet transactions and the broader market movements, thus facilitating smarter betting on platforms like Polymarket. It also raises questions about how data from these analyses can inform future regulatory frameworks surrounding cryptocurrency and betting industries.

The Role of Cryptocurrency Wallets in Betting Profits

The intricate web of cryptocurrency wallets plays a vital role in the profits derived from speculative betting on events such as Maduro’s arrest. As the investigation reveals, multiple wallets were involved in funding the Polymarket accounts which ultimately led to considerable earnings. The transfer of SOL between wallets indicates not just random movements of cryptocurrency, but also strategic positioning by informed bettors looking to capitalize on potential political upheavals.

Thus, understanding the dynamics of these wallets becomes pivotal for both participants and regulators in the cryptocurrency betting space. Each transaction leaves a digital trace that can inform future betting strategies, making it essential for bettors to engage in detailed wallet analysis. For instance, the profitability witnessed in the recent bets about Maduro’s potential arrest serves as an illustration of how critical wallet movements can be in the cryptocurrency betting narrative.

Potential Impact on Future Speculative Events

The implications of successful bets made on events like the suspected arrest of Nicolás Maduro could redefine the landscape of speculative betting. As more bettors engage in this space, interest in political prediction markets is likely to rise, spurred by potential profitability. The substantial payouts observed on the Polymarket platform signify a shift towards viewing politics through a financial lens, which could encourage more investors to participate in similar events.

However, this shift also brings potential risks and ethical considerations. As seen in the interplay between WLFI co-founder Steven Charles Witkoff and the betting outcomes, the risk of insider trading cannot be overlooked. Moving forward, establishing robust regulations will be crucial to ensure that bettors operate in a fair and transparent environment. This evolving dynamic demonstrates both the power and challenges of integrating cryptocurrency with traditional bet-making customs.

Betting Ethics and Transparency in Cryptocurrency Markets

The ethical ramifications of betting on political events raise significant discussions in today’s cryptocurrency markets. Observations from platforms like Polymarket show how investments in speculative bets, particularly regarding events such as Maduro’s arrest, can blur the lines between ethical betting and market manipulation. As the data from on-chain analysis suggests connections to WLFI, transparency in these betting practices becomes imperative to assess legitimacy.

As the industry matures, the call for regulatory reform becomes louder, with many advocating for clearer guidelines on how political betting should be conducted. Encouraging an open conversation around betting ethics, particularly in the realm of cryptocurrency, can foster a more responsible environment for all stakeholders involved. Implementing strict protocols for monitoring influencer behavior on such betting platforms is essential to maintain integrity, ensuring that bettors engage fairly in this new financial frontier.

The Future of Polymarket and Political Betting

Looking ahead, platforms like Polymarket will likely continue to influence the evolution of political betting. The success of bets surrounding events like Maduro’s arrest highlights a growing trend towards integrating cryptocurrency in these markets, opening new opportunities for investors. As the landscape evolves, the interest in speculative politics is anticipated to increase significantly, driven by both financial and social factors.

While the prospect of making informed bets fueled by on-chain data analysis is enticing, it comes with the responsibility of ensuring risk is managed and ethical standards are upheld. Polymarket’s future will depend heavily on how users navigate the balance of profit-making against potential ethical dilemmas. The dialog surrounding betting practices in the age of cryptocurrency is just beginning, and as public interest grows, so too will the scrutiny and expectations for responsible behavior.

Leveraging On-Chain Data for Informed Investments

The drive towards data-driven investment strategies is reshaping how bettors approach events like the Maduro arrest on platforms like Polymarket. On-chain data analysis serves as a vital resource for understanding market movements, allowing bettors to make more informed decisions. By examining wallet transactions and correlations, users can decipher trends that may influence betting outcomes, maximizing their profit potential.

In a rapidly changing environment like cryptocurrency betting, adaptability is key. Using sophisticated analytical tools to forecast potential shifts in political outcomes highlights the importance of being ahead of the curve. With the data indicating financial links to influential figures like WLFI’s co-founder, future bettors must prioritize analytics to demystify complex transactions, which can significantly enhance their investment strategies.

Navigating Risks in Cryptocurrency Betting

Engaging in cryptocurrency betting inherently comes with numerous risks, especially in speculative markets tied to unpredictable events. The instance of betting on Maduro’s arrest serves as a stark reminder of the volatility that characterizes this sector. Understanding the dynamics of risk management is essential for bettors aiming to navigate these treacherous waters successfully. Those who approach these markets without a solid foundation in on-chain data analysis may find themselves susceptible to unforeseen pitfalls.

Moreover, as the landscape of cryptocurrency betting evolves, it becomes paramount for participating investors to cultivate risk awareness and ensure they are prepared for potential losses. The knowledge gained from observing historical betting patterns and the activities of influential figures can inform strategies that mitigate risks while maximizing financial gains. In essence, bettors must continuously adapt and refine their approaches as they face an ever-changing crypto environment.

Frequently Asked Questions

What is Polymarket Maduro Arrest Bets and how does it work?

Polymarket Maduro Arrest Bets refers to betting markets on the Polymarket platform regarding the arrest of Venezuelan President Nicolas Maduro. Users can place bets on whether certain events, like an arrest, will occur. This betting model utilizes insights and predictions, often driven by financial analysis and cryptocurrency trends.

How did the Polymarket financial analysis reveal connections to WLFI co-founder?

The Polymarket financial analysis uncovered that an address linked to profitable bets on Maduro’s arrest has ties to Steven Charles Witkoff, co-founder of World Liberty Finance (WLFI). Through on-chain data, analysts tracked transactions that indicate financial relations between the betting address and WLFI.

What are the implications of the Maduro arrest betting for cryptocurrency investors?

Maduro arrest betting on Polymarket highlights how current events can create lucrative opportunities in the cryptocurrency betting landscape. Investors may leverage such events and on-chain data analysis to make informed bets, possibly leading to significant profits, as seen with the $400,000 yield.

Can on-chain data analysis impact betting strategies on Polymarket?

Yes, on-chain data analysis can significantly impact betting strategies on Polymarket by providing insights into transaction patterns and connections between wallets. This information allows bettors to make more informed decisions on events like the Maduro arrest, potentially leading to better odds and outcomes.

What role does WLFI co-founder Steven Charles Witkoff play in the Maduro arrest betting context?

Steven Charles Witkoff, the WLFI co-founder, is associated with the Polymarket Maduro Arrest Bets due to financial links revealed through on-chain data analysis. His involvement brings attention to the intersecting worlds of betting on political events and cryptocurrency finance.

How has the betting market on Polymarket regarding Maduro’s arrest evolved?

The betting market on Polymarket concerning Maduro’s arrest has evolved with increasing interest, especially after reports indicated substantial profits, like the $400,000 gain linked to informed bets. The market reflects how cryptocurrency betting can interact with real-time geopolitical events.

What risks are involved in Polymarket Maduro arrest betting?

Engaging in Polymarket Maduro arrest betting carries risks typical of speculative markets, including potential loss of funds and the unpredictability of political developments. Additionally, given the links to financial figures like WLFI’s co-founder, users should be cautious of insider information affecting betting outcomes.

How can bettors use Polymarket for cryptocurrency betting on political events?

Bettors can utilize Polymarket for cryptocurrency betting on political events by analyzing market trends, utilizing detailed financial analysis, and considering on-chain data for informed predictions. These strategies can enhance their ability to identify profitable betting opportunities, such as those surrounding the Maduro arrest.

| Key Point | Details |

|---|---|

| Polymarket Bets | Bets made on Venezuelan President Maduro’s arrest. |

| Profit Yielded | Over $400,000 in profit from successful bets. |

| Financial Links | Connections found between the bettor and WLFI co-founder Steven Charles Witkoff. |

| On-Chain Data Analysis | Wallets interacting with Polymarket account showed significant financial activity. |

| Fartcoin Transactions | Post-withdrawal of profits, $170,000 in Fartcoin was transferred to the STVLU.SOL wallet. |

Summary

The recent analysis of Polymarket Maduro Arrest Bets reveals significant insights into the betting activities surrounding Venezuelan President Maduro’s anticipated arrest. With profits exceeding $400,000 gained from these bets, the situation not only raises eyebrows regarding ethical trading practices but also highlights suspected financial ties between the bettor and WLFI co-founder Steven Charles Witkoff. Investigations into on-chain data point to substantial financial transactions that could suggest insider knowledge or coordination. As the story unfolds, the implications of such betting activities and their connections to significant financial figures will continue to garner attention.