The altcoin market is poised for a remarkable resurgence, with expert insights from crypto trader Michaël van de Poppe shedding light on the potential upward movement ahead. Current technical market analysis indicates that altcoins are trading above essential support levels established in October, suggesting a bullish momentum. As it stands, the altcoin market boasts a valuation of over $879 billion, while Van de Poppe envisions a rally aimed at reclaiming its previous all-time high nearing $1.2 trillion. With the Total3 market cap maintaining significant support around $784 billion, enthusiasts are eagerly observing for indications of an impending altseason – a phase characterized by increased altcoin prices and vibrant cryptocurrency trends. This condition is critical for savvy investors looking to capitalize on market fluctuations and optimize their portfolios in a rapidly evolving crypto landscape.

The alternative cryptocurrency sphere, commonly referred to as the altcoin market, is seeing a renewed sense of optimism as traders and analysts monitor favorable shifts in market dynamics. Insights from prominent trading figures like Michaël van de Poppe highlight the strategic importance of current technical indicators, which reinforce the stability of altcoin valuations amidst shifting trends. With a substantial market cap that continues to grow, investors are more vigilant than ever, searching for signs of an altseason—a cycle where alternative digital assets thrive in value. The ever-evolving cryptocurrency market now features a diverse array of tokens, showcasing burgeoning opportunities for both seasoned traders and newcomers. As the market adjusts to factors such as trading volume and the potential influence of crypto ETFs, understanding these developments is paramount for anyone navigating this complex digital investment arena.

The Current State of the Altcoin Market

The altcoin market is positioned for a substantial upward surge, with many indicators supporting this forecast. As per the analysis by Michaël van de Poppe, current altcoin prices reflect strong technical setups, trading above previously established support levels. This trend suggests a healthy market foundation, which is integral for any future rallies. As of now, the altcoin market capitalization sits confidently above $879 billion, indicative of robust investor interest and potential forthcoming growth.

In looking at overall cryptocurrency trends, one cannot ignore the significance of the Total3 market cap, which omits the values of Bitcoin and Ether. This metric has recently maintained critical support near the $784 billion threshold, hinting at a bullish sentiment leading back toward the 365-day moving average. This level is crucial for maintaining a positive trading outlook, reinforcing the idea that the altcoin market is set for recovery and perhaps an eventual altseason.

Frequently Asked Questions

What can we expect from the altcoin market in 2023?

In 2023, the altcoin market is poised for significant growth, as analysts like Michaël van de Poppe anticipate a rally towards previous all-time highs near $1.2 trillion. Current market analyses indicate that altcoins are trading above critical support levels, suggesting a rebound in altcoin prices.

How does Michaël van de Poppe analyze altcoin prices?

Michaël van de Poppe utilizes technical analysis to evaluate altcoin prices, focusing on support levels established in October. His insights emphasize that the Total3 market cap, which excludes Bitcoin and Ether, remains around crucial support levels, indicating potential upward movement in the altcoin market.

What factors contribute to the next altseason in the altcoin market?

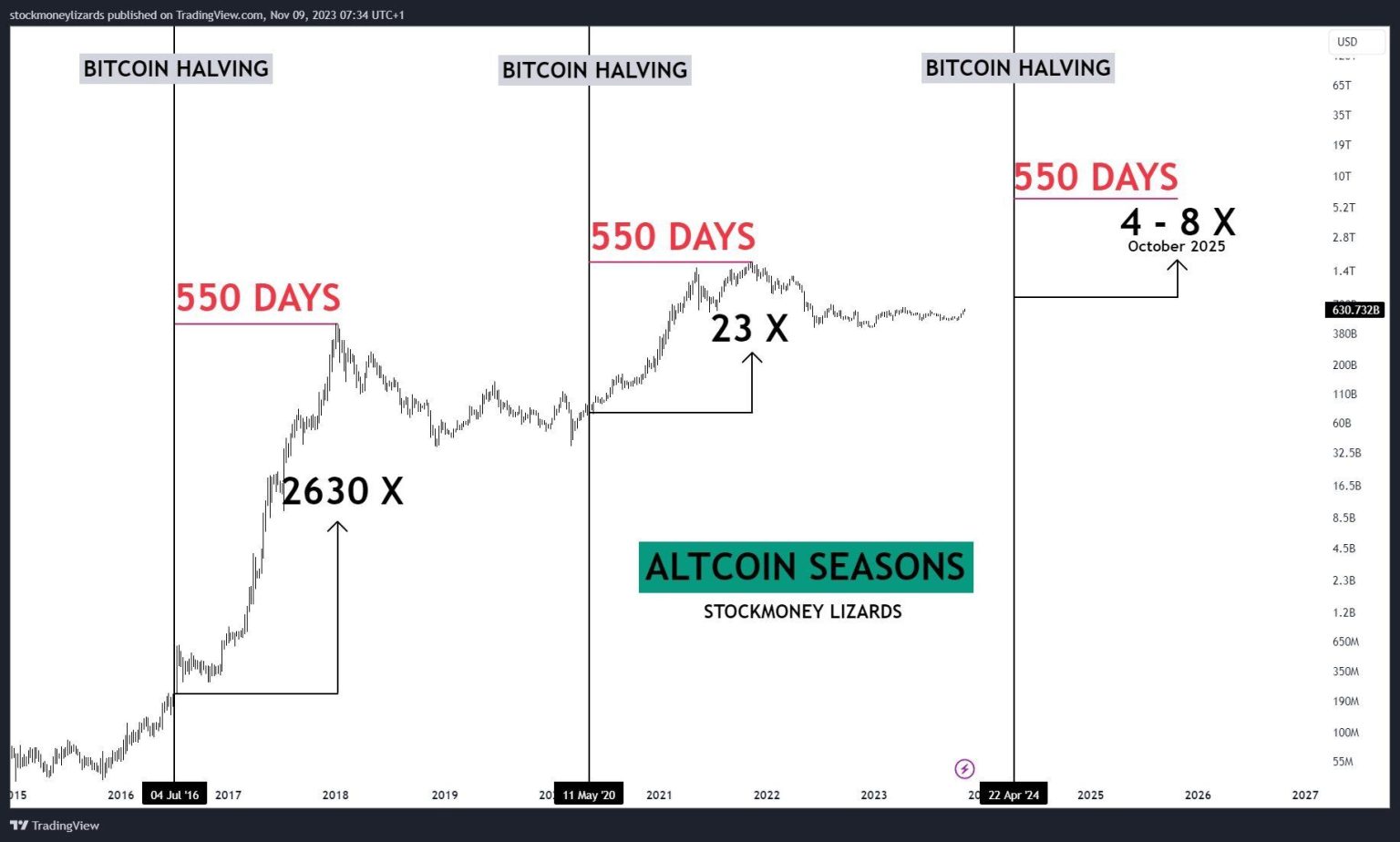

The next altseason in the altcoin market is influenced by various factors, including sustained increases in altcoin prices, key technical indicators, and the capital flow from Bitcoin into altcoins. With over 29 million coins listed, market dynamics are changing, and analysts are on the lookout for emerging trends.

How does the saturation of altcoins affect the altcoin market?

The saturation of the altcoin market, with millions of coins available, has hindered the emergence of an altseason. Increased competition for investor funds has discouraged significant capital rotation from Bitcoin into altcoins, slowing potential growth.

What impact do cryptocurrency ETFs have on the altcoin market?

Cryptocurrency exchange-traded funds (ETFs) have changed the altcoin market dynamics by creating liquidity silos that restrict the flow of capital. This has, in turn, impacted traditional cycles where profits from Bitcoin would rotate into altcoins, delaying the onset of altseason.

Are there any recent cryptocurrency trends impacting altcoin prices?

Yes, recent cryptocurrency trends indicate a growing anticipation for a resurgence in altcoin performance. Analysts point to shifts in market conditions and key technical thresholds being met as potential indicators for higher altcoin prices in the near future.

What is the Total3 market cap in the current altcoin market?

The Total3 market cap, which excludes Bitcoin and Ether, is currently valued at over $879 billion. It has held crucial support around $784 billion, making it an important indicator for traders and investors monitoring the altcoin market.

| Key Point | Details |

|---|---|

| Market Outlook | The altcoin market is projected to rise significantly, with a value currently exceeding $879 billion. |

| Technical Analysis | Altcoins are trading above essential support levels established in October, signaling potential for an upward movement. |

| Key Support Levels | The Total3 market cap, excluding BTC and ETH, has crucial support around $784 billion, with advancements towards the 365-day moving average. |

| Historical Context | Total3 reached an all-time high of about $1.2 trillion but retraced following a significant market decline. |

| Market Conditions | Expectations are building for an altseason as traders reassess strategies in light of mixed market performance. |

| Impact of ETFs | The introduction of crypto ETFs may be affecting capital flow in the market, possibly disrupting the typical cycle of profit rotation. |

Summary

The altcoin market is gearing up for a promising resurgence as analysts predict potential rallies based on current technical indicators and support levels. With the market value currently above $879 billion, investors are keenly observing for the next altseason, particularly following previous market volatility and the unprecedented dynamics introduced by cryptocurrency exchange-traded funds. As the landscape becomes increasingly competitive, understanding these shifts and adjusting investment strategies is crucial for those looking to thrive in the evolving altcoin market.

Related: More from Altcoin News | ETH, SOL, XRP Prices Drop Amid Nvidia Earnings Release | Solana ETF Gains, DEX Usage Up, Fees Higher: Is SOL Undervalued?