In 2025, Bitcoin performance highlighted the volatile nature of the cryptocurrency market as it experienced a decline of approximately 7%. This downturn mirrored the struggles faced by many companies within the sector, where stock prices cryptocurrency were adversely affected. Yet, in the midst of this decline, Cathie Wood’s blockchain-focused ARKF ETF thrived, boasting a remarkable return of 29%. This growth can be attributed to a strategic pivot towards technology companies heavily intertwined with fintech and artificial intelligence, a move that clearly distinguished ARKF in the turbulent environment of cryptocurrency market trends. Such contrasts underscore the challenges and opportunities that arise within the evolving fintech landscape, making the analysis of Bitcoin performance in 2025 particularly critical for investors and enthusiasts alike.

Exploring the financial climate of 2025, the performance of Bitcoin offers essential insights into the dynamics of the cryptocurrency sector. Despite facing a notable dip, the broader trends in fintech investments reveal a mixed landscape that suggests potential growth avenues. This period saw the rise of significant funds, particularly those associated with Cathie Wood, whose ARKF ETF capitalized on innovations within the blockchain space. Moreover, different fintech asset performances varied, reflecting a spectrum of investor sentiment towards emerging technologies and digital finance solutions. Understanding these developments is crucial for those looking to navigate the intricate tapestry of finance in the digital age.

Bitcoin Performance in 2025: An Overview

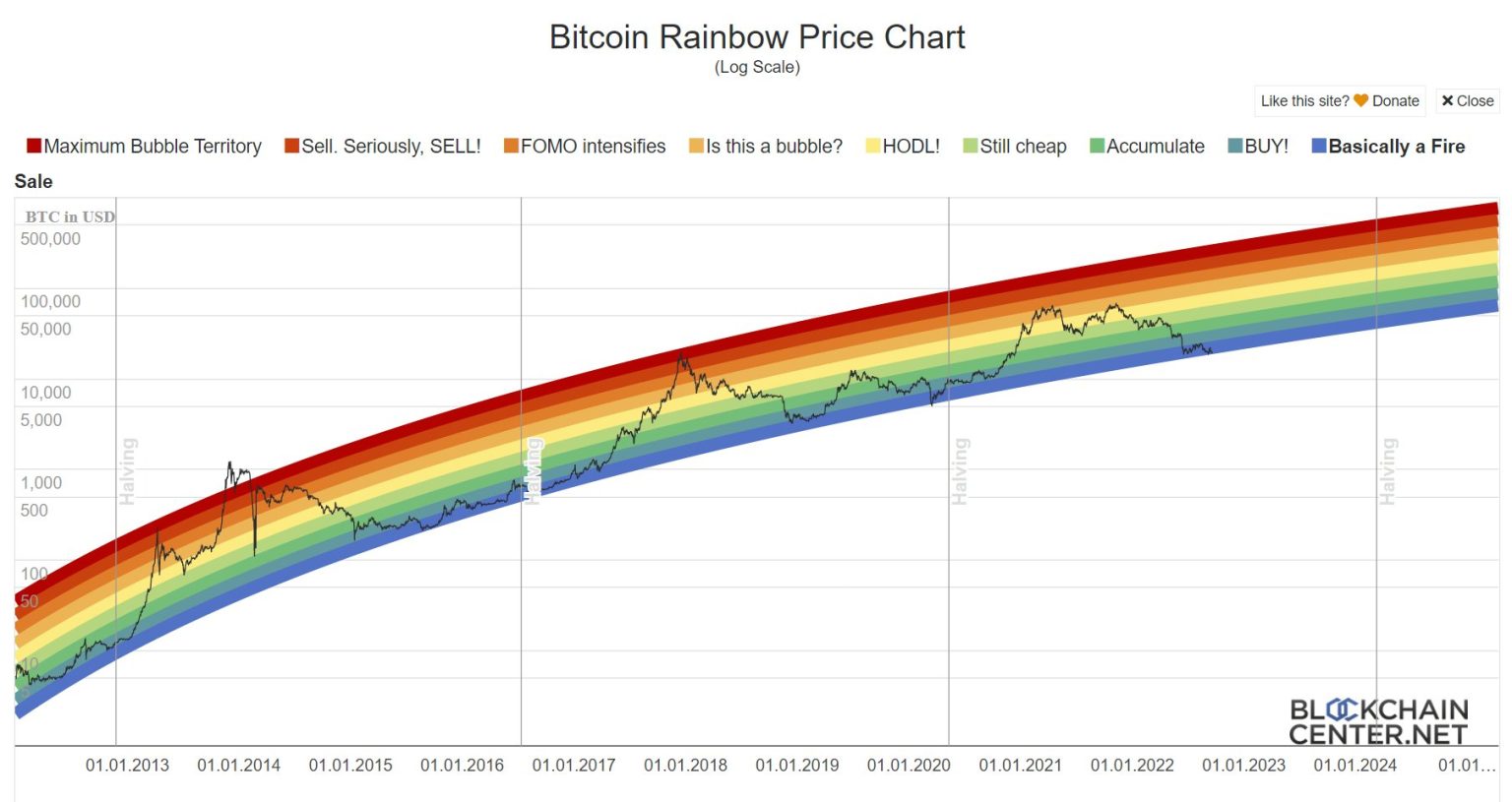

In 2025, Bitcoin faced a notable decline of approximately 7%. This downturn was reflective of broader trends in the cryptocurrency market, which saw many digital assets struggle as investors reacted to fluctuating market conditions. The performance of Bitcoin during this year raises significant questions about its future trajectory and the overall health of the cryptocurrency ecosystem. Despite this setback, advocates continue to promote Bitcoin as a long-term investment, emphasizing its potential for recovery and growth.

The decline in Bitcoin’s valuation also impacted the stock prices of several companies entrenched in the cryptocurrency space. The downturn signaled increased caution among investors who previously showed enthusiasm for cryptocurrencies. However, the ripple effect on traditional financial markets, particularly on fintech and blockchain sectors, indicates resilience in sectors closely tied to technological advances, suggesting a potential recalibration in investor strategies moving forward.

The Impact of ARKF ETF on Cryptocurrency Investments

Cathie Wood’s ARKF ETF has surged ahead in 2025, achieving an impressive return of 29%, despite the overall negative trends in the cryptocurrency market. By adjusting the focus of the fund to include a broader range of technology companies, especially those innovating in artificial intelligence and blockchain, ARKF has successfully capitalized on emerging trends. This strategic pivot exemplifies how fintech innovations can offer substantial returns, even when some core crypto assets falter.

ARKF’s performance is indicative of a larger shift in how investors perceive the intersection of blockchain technologies and traditional finance. The fund’s significant holdings in companies like PayPal, Adyen, and Toast reflect a growing recognition of the importance of fintech in the changing landscape of financial services. Such investments demonstrate that while cryptocurrencies like Bitcoin may be facing challenges, the underlying technologies driving the crypto revolution are still poised for substantial growth.

Trends in Fintech ETFs: Navigating Market Volatility

The performance landscape of fintech ETFs in 2025 has been notably mixed. While some funds such as the Global X FinTech ETF and Siren NexGen Economy ETF recorded slight declines, others like the Fidelity Crypto Industry and Digital Payments ETF have experienced double-digit gains amid the turmoil. This disparity underscores the importance of strategic investment choices in navigating the rollercoaster of market volatility inherent in both cryptocurrency and fintech sectors.

Investors are increasingly drawn to funds that offer diversified exposure to blockchain technology and digital financial services, recognizing that certain segments of the fintech market remain resilient even when cryptocurrencies may be struggling. The VanEck Digital Transformation ETF and iShares Blockchain and Tech ETF stand out as examples of investment vehicles that have successfully harnessed the growth potential of fintech innovations amidst challenging market conditions.

Stock Prices and Cryptocurrency: A Symbiotic Relationship

The relationship between stock prices and the cryptocurrency market has never been more pronounced than in 2025, as evidenced by the correlation between Bitcoin’s decline and the performance of related stocks. Many cryptocurrency firms saw their stock prices plummet alongside Bitcoin’s drop, suggesting that investor sentiment in the digital asset realm significantly influences traditional equities tied to blockchain and fintech.

Understanding this relationship is crucial for investors looking to navigate both markets effectively. While Bitcoin and other cryptocurrencies may face cyclical downturns, the ongoing evolution within the fintech sector shows promise. This interplay indicates that while cryptocurrencies can be highly volatile, the broader financial technology landscape presents opportunities for growth and innovation, particularly in well-managed ETFs that adapt to changing economic environments.

The Role of Technology in Fintech and Blockchain Growth

Technology continues to play a pivotal role in reshaping the fintech and blockchain industries. In 2025, companies leveraging cutting-edge innovations in artificial intelligence and machine learning have outperformed their traditional counterparts, highlighting the potential of these technologies to enhance operational efficiency and customer engagement in financial services. Firms that prioritize technological integration are likely to thrive, even amid market downturns.

As the fintech sector evolves, the emphasis on technology is becoming more pronounced. Innovations such as blockchain, which underpin many cryptocurrencies, are increasingly being harnessed for real-world applications, from payment processing to supply chain management. This trend reinforces the idea that the future of finance is not solely tied to the success of Bitcoin or other cryptocurrencies but is also dependent on the broader technological advancements that drive the industry forward.

The Future of Bitcoin: What Investors Should Expect

Looking ahead, the future of Bitcoin remains uncertain yet promising, as many analysts project that strategic investments in the cryptocurrency could yield favorable returns in the long term. Despite the setback in 2025, factors such as increasing adoption by institutional investors and developments in regulatory frameworks may play crucial roles in Bitcoin’s revival. Investors are advised to stay informed and consider the potential cyclical nature of cryptocurrency trends as they weigh their options.

Moreover, Bitcoin’s performance will likely be influenced by broader market behaviors and technological advancements within the fintech ecosystem. The resilience displayed by some fintech-focused ETFs indicates that there are alternative investment opportunities that can complement Bitcoin holdings. As the cryptocurrency market continues to mature, investors who diversify their portfolios to include both Bitcoin and promising fintech stocks may find themselves better positioned for future growth.

The Resilience of Fintech: Investing for the Long Term

The fintech realm demonstrates remarkable resilience in 2025, as evidenced by the strong performances of certain ETFs, even when other segments, like Bitcoin, struggle. Institutional and retail investors are recognizing the importance of diversifying their portfolios to include a broad spectrum of fintech-focused investment vehicles, which can mitigate risks associated with cryptocurrency volatility. Funds such as ARKF stand as a testament to the potential for strong long-term gains in this sector.

Investors should approach fintech investments with an eye on innovation, especially with firms that prioritize technological integration and disruptive advancements. With the continual evolution of consumer needs and regulatory shifts, the fintech industry appears positioned for sustained growth, making it a compelling area for investment. As ETF strategies evolve to focus on the most promising sectors within fintech and blockchain, informed investors can position themselves advantageously for the future.

Evaluating the Performance of Cryptocurrency Investment Funds

Evaluating the performance of cryptocurrency investment funds requires a comprehensive understanding of both market trends and individual fund strategies. In 2025, the variance among funds reflects their differing approaches to risk management and asset allocation. For instance, while the ARKF ETF outperformed significantly, other funds may have faced challenges tied to the cryptocurrency market’s overall performance. Investors must analyze these factors to better understand which funds align with their investment goals.

Moreover, tracking the performance of specific holdings within these funds can provide additional insights. As the cryptocurrency landscape changes, fund managers who adapt their strategies to include high-growth industries such as artificial intelligence and blockchain technology are likely to fare better. Consequently, evaluating investment funds through the lens of innovation and market adaptability is essential to making informed investment choices in the evolving financial landscape.

Conclusion: Navigating the Future of Fintech and Cryptocurrency

As the financial landscape continues to diversify, navigating the future of both fintech and cryptocurrency calls for a balanced approach. Investors must remain vigilant, analyzing emerging trends and adapting their strategies accordingly. With Bitcoin’s fluctuating performance in 2025 and the strong returns generated by focused fintech investments, there are lessons to be learned about risk and opportunity in this dynamic market.

Ultimately, staying informed about both cryptocurrency movements and innovations in fintech will empower investors to make strategic decisions. Whether through direct investment in cryptocurrencies or by supporting progressive fintech ETFs that capitalize on technology advancements, the future for savvy investors in this field remains bright, proving that understanding and adaptability are key.

Frequently Asked Questions

What was Bitcoin’s performance in 2025 compared to previous years?

In 2025, Bitcoin experienced a decline of about 7%, which marked a notable deviation from its historical performance trends. This downturn in Bitcoin’s value reflected broader challenges within the cryptocurrency market, affecting the stock prices of most cryptocurrency companies as well.

How did the performance of fintech ETFs like ARKF impact Bitcoin’s performance in 2025?

Despite Bitcoin’s decline in 2025, the ARKF ETF, managed by Cathie Wood, recorded impressive returns of 29%. By focusing on fintech and technology companies associated with AI, ARKF managed to outperform the overall cryptocurrency market, showcasing the potential of innovative sectors amidst the struggles in Bitcoin’s performance.

What are the key factors that influenced Bitcoin’s performance in 2025?

Several factors influenced Bitcoin’s performance in 2025, including regulatory developments affecting the cryptocurrency market, technological advancements, and investor sentiment. The overall downturn was compounded by setbacks in stock prices of cryptocurrency companies, while fintech innovation ETFs like ARKF performed well due to their strategic focus on technology.

How did ARKF ETF’s returns relate to Bitcoin’s performance in 2025?

While Bitcoin’s performance in 2025 was marked by a 7% decline, the ARKF ETF delivered a strong return of 29%. This contrasting performance highlights how sectors within fintech that are associated with technological innovation can thrive even when the broader cryptocurrency market faces challenges.

What trends can be observed in the cryptocurrency market in 2025 with respect to Bitcoin?

In 2025, the cryptocurrency market displayed mixed trends, with Bitcoin declining while many fintech ETFs, particularly ARKF, achieved significant gains. This indicates a divergence between Bitcoin’s market performance and the success of innovation-focused investment strategies targeting technology companies.

Which fintech ETFs outperformed Bitcoin in 2025?

In 2025, while Bitcoin declined, several fintech ETFs outperformed it, notably ARKF, which had a striking 29% return. Other fintech-related funds such as the Fidelity Crypto Industry ETF and iShares Blockchain and Tech ETF also reported double-digit gains, underscoring the potential for growth in tech-driven sectors in contrast to Bitcoin’s struggles.

Did Bitcoin experience any significant competition from fintech ETFs in 2025?

Yes, in 2025, Bitcoin faced significant competition from fintech ETFs like ARKF, which not only outperformed Bitcoin with a 29% return but also attracted investment away from traditional cryptocurrencies. This trend suggests that investors are increasingly diversifying into innovation-driven fintech sectors even amid volatility in Bitcoin’s performance.

What implications does Bitcoin’s performance in 2025 have for future cryptocurrency investments?

Bitcoin’s performance in 2025, marked by a decline, raises important implications for future cryptocurrency investments. Investors may need to consider broader market trends, such as the rise of fintech innovation ETFs and their ability to generate returns, when evaluating their strategies in the evolving cryptocurrency landscape.

| Key Points |

|---|

| In 2025, Bitcoin experienced a decline of about 7%. |

| The stock prices of most cryptocurrency companies faced severe setbacks. |

| Cathie Wood’s ARKF ETF achieved a return of 29%. |

| ARKF focused on technology companies related to AI, reversing the downturn. |

| ARKF holds shares in PayPal, Adyen, Toast, Circle, and Robinhood. |

| Other fintech funds saw varied performances; some experienced slight declines. |

| Fidelity and VanEck ETFs achieved double-digit gains in the crypto space. |

Summary

Bitcoin performance in 2025 saw a notable decline of about 7%, reflecting the challenging landscape of the cryptocurrency market. Despite this setback, innovative financial products like Cathie Wood’s ARKF ETF demonstrated resilience, achieving a remarkable 29% return by pivoting towards technology-driven investments. While many cryptocurrency companies struggled, ARKF’s strategic focus on AI and fintech stocks highlights the potential for recovery in the broader market. The year 2025 exemplifies the dichotomy in cryptocurrency performance, where established assets like Bitcoin faced challenges, but innovative investment strategies found success.