Publicly listed companies Bitcoin holdings have been making waves in the investment community as a testament to the growing acceptance of cryptocurrency in traditional finance. As of January 4, 2026, the top 100 publicly traded firms collectively own a staggering 1,090,949 BTC, showcasing a significant footprint in the digital asset landscape. Recently, just five of these major firms Bitcoin ownership has increased, highlighting ongoing strategic investments in Bitcoin. Companies like @Strategy and @Metaplanet_JP are leading the charge, with notable additions to their Bitcoin holdings. Such trends signal a shift in how Bitcoin investment companies view cryptocurrency as a viable asset class, thereby underscoring the importance of tracking Bitcoin holdings companies in the current market.

The landscape of Bitcoin in corporate portfolios is increasingly pertinent, particularly among publicly traded entities. These leading firms that are integrating blockchain technology and digital currency into their balance sheets represent a new era of financial strategy. As investments in Bitcoin become more prevalent, the discussion around major firms Bitcoin ownership is heating up. The commitment of these companies to hold Bitcoin reflects growing confidence in its potential as a stable long-term investment. This trend emphasizes the rise of corporate cryptocurrency adoption, where the continuing surge of Bitcoin investment companies hints at a robust future for digital assets.

Overview of Publicly Listed Companies Bitcoin Holdings

As of January 2026, the data highlights an impressive total of 1,090,949 BTC held collectively by the top 100 publicly listed companies. This substantial amount denotes a significant interest in the cryptocurrency space among major corporations, highlighting Bitcoin’s growing acceptance as a legitimate asset class. These entities include a diverse group of firms ranging from tech giants to financial corporations, demonstrating that Bitcoin investment is not limited to any single industry. Moreover, it reflects the trend of companies diversifying their portfolios with alternative assets, including cryptocurrencies.

The impressive figure of over a million Bitcoin underscores the strategic importance of digital currencies in today’s market. Public companies Bitcoin involvement signifies a shift in investment philosophy, wherein firms are increasingly looking to hedge against inflation and economic uncertainty through crypto assets. Furthermore, with only 5 out of these 100 companies increasing their BTC holdings recently, it raises questions about the investment strategies of the remaining firms, considering the current volatility and potential of the cryptocurrency market.

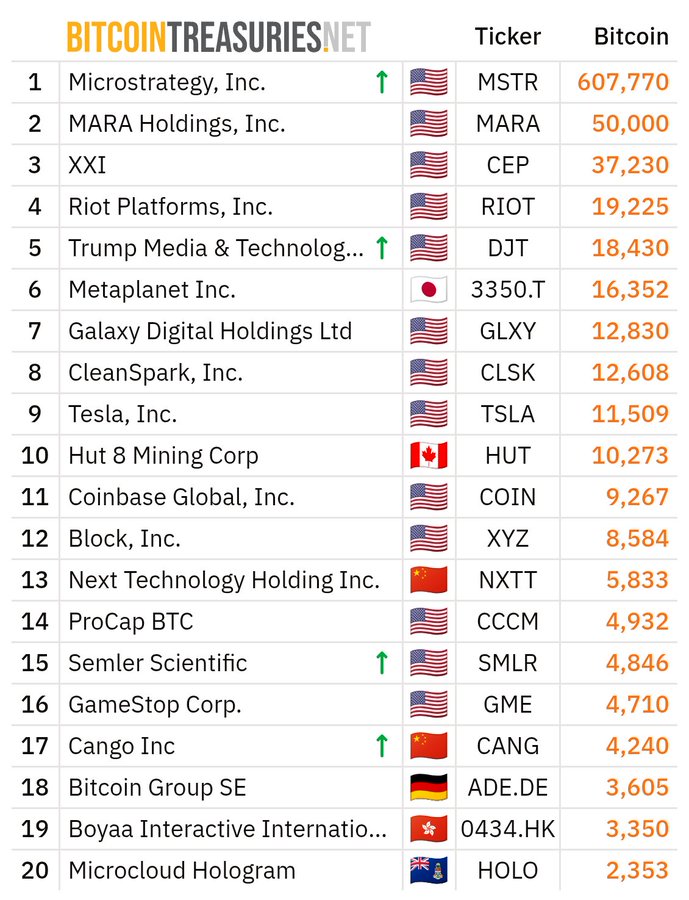

Top BTC Holders Among Publicly Listed Companies

Among the largest public companies holding Bitcoin, a few notable names stand out. Notably, companies such as Tesla and MicroStrategy have garnered attention for their substantial Bitcoin investments, leading the charge among reported Bitcoin holdings companies. These major firms have transformed their digital asset strategies, opting to allocate significant portions of their treasury reserves into Bitcoin, immediately boosting their credibility in the crypto community and attracting further investment.

This increased engagement from top BTC holders exemplifies a broader acceptance of Bitcoin as a store of value and a viable treasury reserve asset. Companies like MicroStrategy, which have consistently updated their BTC investment plans, have influenced other public entities to consider Bitcoin ownership as a strategy to enhance their financial stability and potential for growth. The trend showcases a maturing market where major corporations are prepared to leverage Bitcoin for competitive advantage.

Recent Increases in Bitcoin Holdings by Major Firms

In a recent report by BitcoinTreasuries.NET, it has been highlighted that only 5 companies among the top 100 saw an increase in their Bitcoin holdings in the previous week. Noteworthy mentions include @Strategy with an addition of 1,229 BTC and @Metaplanet_JP with a remarkable +4,279 BTC. This selective expansion in holdings could indicate strategic moves by these companies to capitalize on favorable market conditions or anticipate future volatility in Bitcoin pricing, underlining their commitment to the cryptocurrency investment sphere.

The recent uptick in holdings, albeit among a small group of firms, indicates a cautious yet optimistic approach to Bitcoin investments. These companies seem to recognize the potential of holding digital assets as an integral part of their overall financial strategy. Such actions highlight divergent views among public companies regarding Bitcoin; while many are holding back, a few are making determined strides to enhance their asset portfolios with Bitcoin investment.

Impact of Bitcoin Investment Companies on the Market

As the popularity of Bitcoin continues to rise, Bitcoin investment companies are playing a pivotal role in shaping market trends and influencing corporate strategies. These firms, which specialize in managing Bitcoin and other cryptocurrencies, provide critical insights and liquidity to the market, enhancing overall stability. Their strategic investments often drive demand, impacting market sentiment positively, and encouraging more publicly listed companies to consider Bitcoin as a serious investment option.

The presence of Bitcoin investment companies is also serving as a bridge between traditional finance and the burgeoning crypto economy. Through their involvement, they help demystify Bitcoin while also providing the necessary frameworks for large-scale investments, thereby mitigating the risks associated with cryptocurrency ownership. This evolution from niche asset to mainstream consideration underlines the critical role played by dedicated Bitcoin investment firms.

Future Trends in Public Companies Bitcoin Ownership

Looking ahead, the landscape of publicly listed companies Bitcoin ownership is set to evolve significantly. As institutions continue to educate themselves on blockchain technology and digital currencies, it’s likely that more major firms will reassess their asset allocation strategies. The existence of a growing network of secure and regulatory-compliant Bitcoin investment companies is expected to facilitate this transition, making it easier for public companies to enter the Bitcoin market.

Moreover, as digital currencies become increasingly accepted as part of the financial ecosystem, the potential for new investment opportunities expands. Trends suggest that more firms will follow the lead of top BTC holders who have already reaped the benefits of early adoption. The combination of enhancing technological infrastructure to support BTC transactions and an increasingly favorable regulatory environment could usher in a new era of corporate Bitcoin engagement.

Public Perception and Market Sentiment Towards Bitcoin Holdings

Public perception of corporations holding Bitcoin is increasingly positive, reflecting growing trust in cryptocurrencies as a legitimate asset class. With many top BTC holders publicly announcing their Bitcoin strategies, the narrative has shifted from skepticism to acceptance. Investors are not only viewing Bitcoin as a speculative asset but as a cornerstone for building financial resilience in an ever-evolving economic landscape.

The sentiment surrounding major firms’ Bitcoin ownership is also influenced by their associated messaging and actions. Companies that openly engage with the cryptocurrency community, whether through transparency or educational initiatives, are likely to gain favorable investor sentiment. This trend shows that as more public companies enter the Bitcoin space, their engagement can enhance overall trust and credibility within the market.

Risks and Challenges Faced by Companies Holding Bitcoin

While the potential gains from Bitcoin holdings can be significant, companies must also navigate various risks associated with cryptocurrency investments. Price volatility remains a primary concern; the fluctuations in Bitcoin’s value can impact financial statements and, subsequently, investor confidence. Companies that maintain substantial BTC investments must develop strategies to mitigate these risks, including employing advanced risk management techniques and diversifying their cryptocurrencies.

Moreover, regulatory challenges pose another layer of complexity for public companies Bitcoin investments. As governments around the world continue to formulate crypto regulations, companies must stay updated and compliant. Failure to do so not only invites legal repercussions but could also affect their market standing and investor loyalty, making it essential for firms to integrate compliance into their Bitcoin strategies.

The Role of Blockchain Technology in Bitcoin Holdings

Blockchain technology serves as the backbone for Bitcoin and has transformed how publicly listed companies approach their cryptocurrency holdings. The decentralized nature of blockchain enhances transparency and security in transactions, fostering greater trust among corporate investors. By utilizing this technology, companies can also streamline their operations, reduce costs, and improve transaction efficiency when managing their Bitcoin assets.

As organizations integrate blockchain into their business models, they stand to benefit from innovative solutions that accompany Bitcoin investments. Companies that embrace this technology will not only strengthen their Bitcoin holdings but may also unlock new revenue streams by leveraging blockchain functionalities. The synergy between Bitcoin and blockchain could very well pave the way for a future where digital assets play a central role in corporate finance.

Investment Strategies Adopted by Public Companies

Public companies are adopting a variety of investment strategies when it comes to holding Bitcoin, with each approach customized to their unique risk profiles and market views. Some firms have embraced a long-term hold strategy, recognizing Bitcoin as a store of value, akin to how one would manage traditional treasury assets. This conservative strategy reflects an understanding of Bitcoin’s potential to protect against inflation and economic instability.

Conversely, other companies may adopt a more aggressive trading approach, capitalizing on Bitcoin’s price volatility for short-term gains. These firms may utilize sophisticated trading algorithms or hedge their positions with derivatives to manage risk. The variety of strategies highlights the flexible approaches companies are taking as they navigate through the complex landscape of cryptocurrency investments.

Frequently Asked Questions

What are publicly listed companies Bitcoin holdings?

Publicly listed companies Bitcoin holdings refer to the quantity of Bitcoin that publicly traded firms report owning as part of their asset portfolio. As of January 4, 2026, the top 100 publicly listed companies collectively hold a total of 1,090,949 BTC.

Which companies are the top BTC holders in 2026?

The top BTC holders among publicly listed companies include firms actively identified for their substantial Bitcoin investments. Notably, recent reports indicate that five companies increased their BTC holdings in the last week, highlighting ongoing interest in Bitcoin among major firms.

How many Bitcoin do major firms own?

As per the latest data, major firms collectively own approximately 1,090,949 BTC. Many of these firms are recognized as significant players in the Bitcoin investment landscape.

Why are public companies investing in Bitcoin?

Public companies are investing in Bitcoin to diversify their asset holdings, hedge against inflation, and tap into the growing acceptance of cryptocurrencies. The interest in Bitcoin from public companies has also surged due to its potential as a long-term store of value.

What percentage of total Bitcoin is held by Bitcoin investment companies?

Publicly listed Bitcoin investment companies are part of the larger group of BTC holders, contributing to the overall percentage of outstanding Bitcoin owned by firms. The top 100 publicly listed companies currently hold a significant portion, amounting to a total of 1,090,949 BTC.

Which publicly traded firms have increased their Bitcoin holdings recently?

In the past week, five publicly traded firms have increased their Bitcoin holdings. These include @Strategy (+1,229 BTC), @Metaplanet_JP (+4,279 BTC), @BitdeerOfficial (+1.6 BTC), @bitcoinhodlco (+1 BTC), and @BTCS_SA (+0.988 BTC).

How can you track Bitcoin holdings of public companies?

You can track the Bitcoin holdings of public companies through various financial reporting platforms and cryptocurrency analytics websites like BitcoinTreasuries.NET, which provide up-to-date figures on the investments made by publicly listed firms in Bitcoin.

What impact do Bitcoin investment companies have on the market?

Bitcoin investment companies play a pivotal role in shaping market dynamics by increasing liquidity, promoting wider adoption among institutional investors, and influencing public perception of Bitcoin as a legitimate asset class.

Are there risks associated with public companies Bitcoin holdings?

Yes, there are risks associated with public companies holding Bitcoin. Price volatility, regulatory changes, and market sentiment fluctuation can significantly impact the value of their Bitcoin holdings, affecting overall financial health.

What are the benefits of being a public company Bitcoin holder?

Public companies that hold Bitcoin can benefit from brand recognition, attracting investment, and leveraging cryptocurrency’s appreciation potential. They also position themselves as innovators within their respective industries.

| Company Name | BTC Holdings Increase |

|---|---|

| @Strategy | +1,229 BTC |

| @Metaplanet_JP | +4,279 BTC |

| @BitdeerOfficial | +1.6 BTC |

| @bitcoinhodlco | +1 BTC |

| @BTCS_SA | +0.988 BTC |

Summary

Publicly listed companies Bitcoin holdings have reached significant levels, with the top 100 companies collectively owning 1,090,949 BTC as of January 4, 2026. However, the activity in the market shows that during the past week, only 5 companies have increased their holdings, indicating a cautious approach among these firms towards Bitcoin investments.