Non-Farm Payroll Data serves as a crucial indicator of the health of the U.S. job market, reflecting the monthly changes in employment levels across various sectors, excluding farming. This invaluable employment report not only helps analysts gauge the overall labor market landscape but also influences U.S. Treasury yields, as investors react to shifts in economic trends. With the upcoming release of the non-farm payroll data, focus will intensify around the anticipated trends in the unemployment rate and insights derived from the preceding ADP report. As January unfolds, expectations suggest a potential decrease in unemployment, sparking discussions about hiring trends and economic recovery. Understanding these figures is essential for anyone keen on job market analysis, making the forthcoming data release a highly anticipated event.

The upcoming release of employment statistics, often referred to as payroll figures, marks a significant moment for analysts and investors alike. These metrics provide essential insights into workforce dynamics, revealing trends and shifts within the labor market that can impact economic policy and financial markets. The scheduled employment data, including vital insights from sources like the ADP report, is set against a backdrop of fluctuating U.S. Treasury yields, indicating a responsive economic environment. Observers are particularly keen on the expected variations in the unemployment rate, which could signal broader economic implications. As we approach this key report, the focus remains on deciphering how these labor statistics will shape future job market strategies and investor sentiment.

Impact of Non-Farm Payroll Data on Economic Predictions

The Non-Farm Payroll data is a crucial indicator of the health of the U.S. job market. With the expected release next Friday, both investors and analysts are keen to observe how the labor market has performed over the previous month. This release is particularly significant as it marks a return to the normal schedule from which it has deviated since September. Economic experts are looking at this data to gauge overall economic sentiment and employment stability, which can directly influence forecasting for the U.S. Treasury yields.

In conjunction with the Non-Farm Payroll report, the upcoming ADP employment report will provide preliminary insights into job creation within the economy. As these two data points are released, they are likely to offer a clearer picture of whether the anticipated changes, such as a slight decrease in the unemployment rate, hold true. These employment indicators create a strong narrative that drives market expectations, making the Non-Farm Payroll data a central focus for economic analysts and investors alike.

Understanding U.S. Treasury Yields in Relation to Employment Reports

U.S. Treasury yields are intricately linked to employment reports, including the Non-Farm Payroll data. When the job market shows improvement, indicated by rising employment numbers and a decreasing unemployment rate, Treasury yields typically reflect increased investor confidence. This relationship is crucial: the yields can influence borrowing costs and economic growth. Therefore, the readings from the Non-Farm Payroll data are eagerly awaited by both the federal reserve and market participants.

The fluctuations seen in U.S. Treasury yields as the New Year begins underscore the market’s sensitivity to labor market developments. Investors are acutely aware that stronger payroll numbers can lead to higher yields due to expectations of interest rate hikes from the Federal Reserve. Conversely, disappointing employment figures may signal a slowdown, leading to lower yields as investors seek safer assets. Hence, understanding the nuances of how employment reports affect Treasury yields can provide valuable insight into broader economic trends.

Job Market Analysis: Trends and Predictions

Analyzing the U.S. job market involves looking at various indicators, with the Non-Farm Payroll data being one of the most significant. As employers hire or lay off workers, these decisions directly shape the broader economic landscape. Recent trends suggest that the job market may be on a path to adoption of more flexible work arrangements, with companies focusing on retaining talent amid potential economic uncertainties. This analysis will be particularly pertinent when assessing the December employment figures next week.

Moreover, employment trends indicated by the ADP report will help set the stage for the expectations surrounding the Non-Farm Payroll announcement. Business sectors such as technology and healthcare are experiencing varying rates of job creation. By dissecting the data and related trends, analysts can better predict future movements in the job market, allowing investors to adjust their strategies and better prepare for the implications of upcoming employment data.

The Significance of the Unemployment Rate

The unemployment rate serves as a vital statistic for understanding economic health. With forecasts suggesting a potential decrease from 4.6% to 4.5%, observers are keen to determine if this prediction holds true against the backdrop of the upcoming Non-Farm Payroll data. A lower unemployment rate typically reflects a stronger job market and can lead to increased consumer spending as more individuals gain employment.

Conversely, if predictions like Citigroup’s, projecting a rise to 4.7%, come to pass, it would suggest that the job market is facing challenges. Understanding these unemployment rate dynamics is critical as they influence labor policy decisions and can affect overall economic growth. In anticipation of this, many investors are looking to how this crucial statistic will shift in relation to the employment data, making it a topic of significant discussion.

ADP Report: A Precursor to Non-Farm Payroll Data

The ADP report is often viewed as a precursor to the more comprehensive Non-Farm Payroll data and serves as an early indication of employment trends in the U.S. economy. Scheduled for release mid-week, it provides insights into private-sector job creation, giving markets a preliminary sense of labor market health. Analysts will look closely at the figures in the ADP report to gauge potential movements in the Non-Farm Payroll numbers, which will be released later in the week.

Expectations surrounding the ADP report often heighten the anticipation for the Non-Farm Payroll data as they can set the tone for market reactions. For instance, if the ADP report shows robust job growth, it may lead to increased confidence in the estimates of the broader employment data, possibly influencing U.S. Treasury yields shortly thereafter. Therefore, the relationship between the ADP report and Non-Farm Payroll shapes the narrative in financial markets and underscores the importance of employment reports in economic forecasting.

Market Reactions to Employment Data Releases

Market reactions to employment data releases, especially the Non-Farm Payroll data, are often dramatic. Traders and investors adjust their positions rapidly depending on the outcomes of these reports. Positive results, such as an increase in jobs and a decrease in the unemployment rate, can lead to a rapid rise in stock prices as confidence in economic recovery boosts investor sentiment.

On the other hand, disappointing employment figures can lead to bear reactions, as concerns over economic slowdown and reduced consumer spending may surface. The fluctuations in U.S. Treasury yields following these employment data releases highlight the importance of investor psychology and behavior concerning labor market indicators. Understanding these market dynamics is essential for navigating investment strategies during such announcements.

Investing Strategies Based on Job Market Trends

With the ever-evolving job market dynamics, investors must develop strategies that are responsive to employment trends highlighted in reports like the Non-Farm Payroll data. By analyzing job creation figures alongside the unemployment rate, investors can better position their portfolios for potential sectors poised for growth. This proactive approach helps in capitalizing on the rising demand for labor in specific industries while balancing risk.

Furthermore, utilizing LSI analytics in understanding related terms from employment reports, such as U.S. Treasury yields and employment indicators, allows investors to make informed decisions. By staying ahead of trends, particularly in relation to the upcoming employment releases, investors can mitigate risks while taking advantage of opportunities presented in a changing economic landscape.

The Role of Economic Indicators in Employment Analysis

Economic indicators, including the Non-Farm Payroll data and the unemployment rate, play a pivotal role in shaping our understanding of the labor market. These statistics not only inform policymakers but also empower businesses and investors to make strategic decisions. Economic indicators serve as benchmarks for evaluating the effectiveness of governmental policies aimed at job creation and labor market stability.

In particular, the interplay of various reports such as the ADP report and the timely release of Non-Farm Payroll data helps create a broader context for employment analysis. By understanding these economic indicators, stakeholders can develop a clearer picture of market conditions, enabling them to be better prepared for potential fluctuations in economic activity.

Frequently Asked Questions

What is non-farm payroll data and why is it important?

Non-farm payroll data refers to a monthly report that measures the number of jobs added or lost in the U.S. economy, excluding farm workers, government employees, and a few other classifications. This employment report is crucial because it provides insights into the job market analysis, influences U.S. Treasury yields, and helps gauge the overall economic health of the country.

How does the non-farm payroll data impact U.S. Treasury yields?

The non-farm payroll data can significantly impact U.S. Treasury yields. Strong job growth typically leads to higher yields, as it may signal inflation and prompt the Federal Reserve to adjust interest rates. Conversely, weak payroll numbers can result in lower yields, reflecting economic concerns and a potential slowdown.

What can we expect from the upcoming non-farm payroll data release?

The upcoming non-farm payroll data release, scheduled for next Friday, is expected to show important indicators about the job market. Analysts will compare it with the ADP report that precedes it, assessing trends in employment levels and potential changes in the unemployment rate.

How is the unemployment rate derived from non-farm payroll data?

The unemployment rate is derived from the non-farm payroll data along with other labor statistics. Changes in the payroll figures contribute to understanding job growth or loss, which in turn influences the unemployment rate for the period, providing a clear picture of overall labor market health.

What are the limitations of the non-farm payroll data?

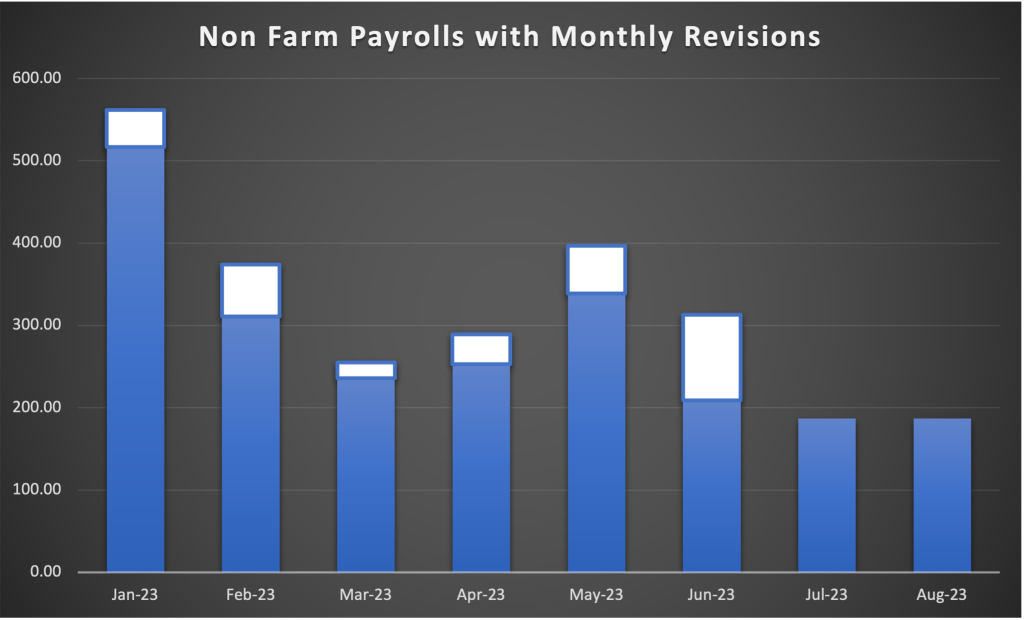

While the non-farm payroll data is a key economic indicator, it has limitations. It doesn’t include certain sectors like agriculture and self-employed individuals, which can lead to an incomplete view of employment trends. Additionally, revisions to previous data can alter interpretations of economic conditions.

How does the ADP report relate to the non-farm payroll data?

The ADP report is a precursor to the non-farm payroll data, providing an estimate of private sector job growth. Investors use the ADP report to gauge expectations for the upcoming non-farm payroll numbers, as it often serves as an early indicator of employment trends in the economy.

Why do analysts forecast a decrease in the unemployment rate alongside non-farm payroll data?

Analysts may forecast a decrease in the unemployment rate alongside non-farm payroll data based on indicators of job growth, economic expansion, and consumer confidence. For instance, if the payroll data shows significant job additions, it could signal positive economic momentum, possibly reducing the unemployment rate.

What trends have historically influenced non-farm payroll data?

Historically, non-farm payroll data has been influenced by various trends, including seasonal hiring patterns, economic cycles, policy changes, and global events that impact employment levels. Understanding these factors provides context for interpreting the monthly employment report.

How can investors use non-farm payroll data for decision making?

Investors can use non-farm payroll data to make informed decisions regarding their investment strategies. Data indicating strong employment growth may lead them to favor equities, while disappointing numbers might prompt them to consider defensive positions or lower-risk assets. Furthermore, payroll trends can impact expectations for interest rates.

What do rising U.S. Treasury yields indicate regarding non-farm payroll data?

Rising U.S. Treasury yields typically indicate that investors expect stronger economic growth, potentially driven by positive non-farm payroll data. When employment figures are robust, it can lead to expectations of inflation and subsequent rate hikes by the Federal Reserve, pushing yields upward.

| Date | Event | Commentary | Predictions |

|---|---|---|---|

| 2026-01-03 | Release of Non-Farm Payroll Data | U.S. Treasury yields have risen slightly as New Year begins; fluctuations expected. | Unemployment rate may decrease to 4.5% according to Capital Economics; Citigroup predicts an increase to 4.7%. |

Summary

Non-Farm Payroll Data is set to return to its regular release schedule next Friday, signaling an important moment for investors and economists. As the first significant employment data of the new year, it will provide insights into the labor market’s health. With mixed predictions regarding the unemployment rate, this data release will be crucial for understanding economic trends moving forward.

Related: More from Market Analysis | Earnings season is wrapping up with a mixed bag of results across | Polymarket Bet Fails to Catch Insider Traders