The recent PEPE price increase is making waves in the cryptocurrency market, as it briefly surged past 0.0000063 USDT, marking a remarkable 24-hour increase of 20.4%. This surge can be attributed to the renewed investor enthusiasm at the start of 2026, sparking interest not only in PEPE but also in other digital currencies. Market analysts are closely monitoring PEPE cryptocurrency trends, as this momentum could signify a shift in trading behavior and market sentiment. In addition, the fluctuations in PEPE USDT value have drawn attention from traders seeking opportunities for profit. Stay tuned for more PEPE market news and trading analysis to navigate this ever-evolving landscape of cryptocurrency trends in 2026.

The notable rise in PEPE’s market value has captured the attention of both seasoned investors and new entrants alike, highlighting the ongoing excitement within the realm of digital currencies. As PEPE crypto recently clocked a significant peak, surpassing 0.0000063 USDT, many are analyzing what this means for future trading strategies and potential investments. The keen interest in assets like PEPE within the larger ecosystem of cryptocurrencies reflects broader market dynamics and highlights the importance of vigilance in trading analysis. Investors are eager to grasp how shifts in PEPE’s valuation correlate with general cryptocurrency trends for 2026. Ultimately, the discourse surrounding this market surge illustrates the evolving nature of virtual asset trading in today’s economy.

PEPE Cryptocurrency Market Surge

In recent news, PEPE cryptocurrency has shown remarkable growth, briefly spiking above 0.0000063 USDT before settling at 0.0000061 USDT. This sudden surge can be attributed to an enthusiastic investor sentiment as the new year begins. Over a 24-hour period, the coin experienced a notable increase of 20.4%, highlighting the potential for significant returns in the rapidly evolving cryptocurrency market.

The uptick in PEPE’s price reflects not just local trading activity but also broader trends affecting digital assets today. Many traders are analyzing the dynamics of PEPE’s recent performance against other cryptocurrencies, utilizing specialized trading analysis tools and market data to gain insights. As more investors enter the PEPE market, there are growing expectations about its future, reinforcing PEPE’s position in digital asset discussions.

Understanding PEPE’s Price Movements

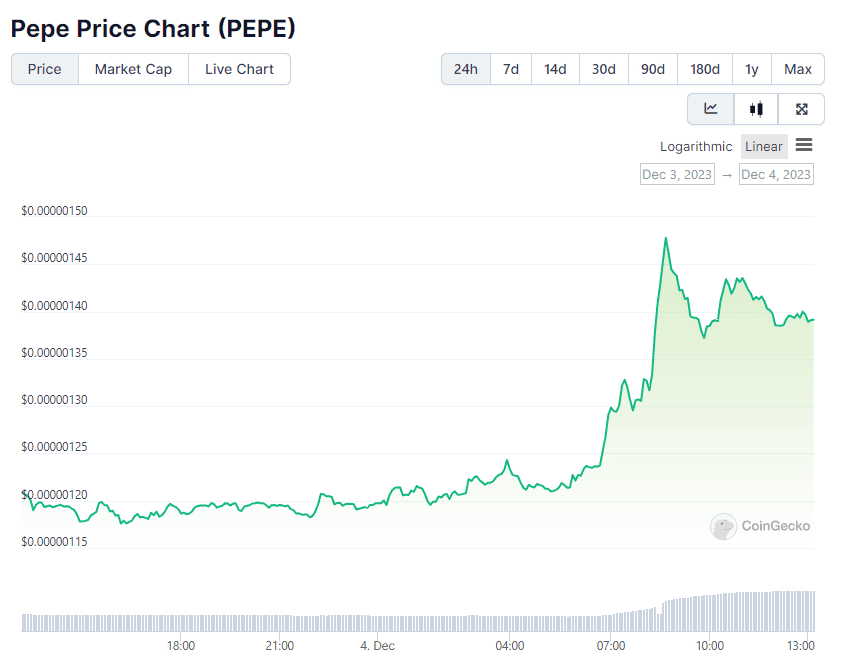

The fluctuations in PEPE’s USDT value provide a fascinating case study for traders and investors alike. The recent spike over the 0.0000063 USDT mark has triggered debates about potential resistance levels and support zones. Given the fast pace of cryptocurrency trends, even small price changes can indicate larger shifts in market sentiment, often reflected in trading charts. Traders are closely watching these movements as they assess how external factors, such as regulatory news or market speculation, could affect PEPE’s trajectory.

Traders need to stay updated on PEPE market news and developments to make informed decisions. As PEPE continues to gain traction, insights into its trading patterns can reveal broader cryptocurrency trends for 2026. Monitoring social media chatter, news stories, and expert analysis will help traders anticipate future price movements and make better investment choices.

PEPE Trading Analysis for New Investors

For new investors looking to dive into PEPE cryptocurrency, understanding the nuances of trading analysis is essential. By leveraging tools that analyze trading volume, price history, and market sentiment, investors can grasp the volatility inherent in digital currencies like PEPE. This analysis may help newcomers identify optimal entry and exit points, allowing for strategic trades driven by current market conditions.

Additionally, engaging with the latest PEPE market news can provide insights into potential triggers for price shifts. Whether it’s technological updates in the realm of cryptocurrencies or macroeconomic factors affecting the digital economy, staying informed will enhance investors’ ability to navigate the sometimes unpredictable waters of PEPE trading. A comprehensive analysis not only strengthens individual trading strategies but also contributes to a better understanding of the PEPE landscape as a whole.

Future of PEPE in Cryptocurrency Trends

As we head into 2026, PEPE cryptocurrency is poised to be a significant player in upcoming trends within the blockchain landscape. With the increasing adoption of digital assets and the potential for various technological advancements, the future holds promising opportunities for PEPE. It may attract further investment, especially if it aligns with evolving cryptocurrency trends, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), drawing attention from both individual investors and institutional players.

The evolving narrative around PEPE and similar cryptocurrencies will likely shape their trajectory in the marketplace. Understanding how PEPE can integrate within the broader ecosystem of cryptocurrencies could provide a competitive advantage over time. Investors should monitor how PEPE adapts to these trends, as this adaptability could prove pivotal in determining PEPE’s value and relevance in a dynamic and ever-changing digital currency market.

Impact of Market Sentiment on PEPE

Market sentiment plays a crucial role in the valuation of cryptocurrencies, including PEPE. The recent uptick above 0.0000063 USDT signifies a renewed confidence among traders and investors, which can have a ripple effect. Positive sentiment often leads to increased trading volume and interest, pushing the price higher, while negative sentiment can have an opposite effect. Understanding these dynamics is essential for anyone looking to invest in PEPE.

Moreover, the correlation between social media trends and price movements cannot be overlooked. Topics trending on platforms can drastically impact PEPE’s market perception, leading to speculative trading behaviors. Investors who utilize this knowledge and tap into social sentiments surrounding PEPE will be better equipped to navigate market fluctuations and make informed decisions about their investments.

Analyzing PEPE vs Established Cryptocurrencies

In the context of a rapidly evolving cryptocurrency market, PEPE’s growth trajectory can be compared to established cryptocurrencies like Bitcoin and Ethereum. While Bitcoin remains the market leader and Ethereum drives innovation through decentralized applications, PEPE is finding its niche by appealing to a specific investing demographic. As PEPE continues to capture attention due to its recent price increase, investors may begin to analyze its potential for long-term growth against the backdrop of traditional cryptocurrencies.

To effectively assess PEPE, investors might consider its use case, market strategy, and community support compared to larger cryptocurrencies. Examining how emerging trends in 2026 could impact PEPE’s future and its role in the broader market landscape will be critical for investors looking to diversify their portfolios. The comparative analysis will shed light on how PEPE can hold its own or perhaps even outperform established players in the competitive cryptocurrency ecosystem.

PEPE Investment Strategies for 2026

As we move deeper into 2026, formulating effective investment strategies for PEPE is crucial for both new and seasoned investors. A common approach is dollar-cost averaging, which involves consistently investing a set amount of money into PEPE at regular intervals, mitigating the risk associated with volatility. This strategy allows investors to benefit from lower prices during market dips while capturing gains during upward movements.

Additionally, understanding the significance of trend analysis in PEPE’s trading patterns is vital. Investors who remain diligent in tracking market performance and consulting reliable trading analysis resources can position themselves advantageously within the market. As PEPE’s value fluctuates, having a clear investment strategy tailored to market conditions will make a significant difference in achieving financial goals.

PEPE Community Engagement and Influence

The importance of community in the cryptocurrency space cannot be understated, and for PEPE, engaging with its community is vital for sustained growth. As the community rallies around promotions, events, and discussions related to PEPE, it fosters a sense of belonging and loyalty among investors. This collective engagement often leads to increased trading volumes and investor confidence, which are crucial for maintaining PEPE’s value in a competitive marketplace.

Furthermore, community-driven projects can lend additional credibility to PEPE. When investors see active participation in events or initiatives, it signals robust support for the cryptocurrency. Monitoring community engagement through social media platforms and forums will provide insights into how PEPE is perceived, potentially influencing trading behaviors and investment decisions in the long run.

Potential Risks of Investing in PEPE

Investing in any cryptocurrency, including PEPE, comes with its share of risks that potential investors must consider. The high volatility of the cryptocurrency market can lead to rapid price fluctuations, making it essential for investors to be prepared for potential losses. Understanding these risks requires thorough research and a keen awareness of market trends, especially as PEPE’s trading patterns become more defined in 2026.

Additionally, external factors such as regulatory challenges and market sentiment shifts can impact PEPE’s valuation. Critical analysis of all potential risks is key for investors. By balancing these risks against possible rewards, investors can make informed decisions and navigate the complexities of PEPE and the broader cryptocurrency landscape.

Frequently Asked Questions

What factors contributed to the recent PEPE price increase?

The recent PEPE price increase can be attributed to a rejuvenated investment sentiment at the beginning of the year, which has significantly influenced the PEPE cryptocurrency market. As of now, PEPE briefly broke through 0.0000063 USDT with a 24-hour increase of 20.4%, reflecting strong market interest and bullish trading activity.

How does the PEPE USDT value compare to other cryptocurrencies?

The PEPE USDT value, recently peaking at 0.0000063 USDT, shows a notable increase compared to other cryptocurrencies in the market. Its recent 20.4% rise in 24 hours indicates a robust performance, especially in light of the overall cryptocurrency trends in 2026, highlighting growing interest and investment in niche tokens like PEPE.

What does the current PEPE market news indicate for future price movements?

Current PEPE market news, including a recent spike to 0.0000063 USDT, suggests that bullish momentum may continue if investment sentiment remains strong. The cryptocurrency trends for 2026 indicate a potential for further price appreciation, particularly if similar market dynamics persist.

What insights can be gathered from PEPE trading analysis after its recent price surge?

PEPE trading analysis after its recent price surge reveals that the cryptocurrency reached a brief high of 0.0000063 USDT due to heightened trading activity. The 20.4% increase in just 24 hours may indicate a significant shift in market sentiment, suggesting that traders are optimistic about PEPE’s future performance, particularly within the broader context of cryptocurrency trends in 2026.

How might upcoming cryptocurrency trends in 2026 impact the PEPE price increase?

Upcoming cryptocurrency trends in 2026 could significantly impact the PEPE price increase by fostering a more favorable trading environment. If market sentiment remains nuanced and investment in cryptocurrencies, including PEPE, continues to rise, we could see further price growth beyond the recent peak of 0.0000063 USDT.

| Key Points | Details |

|---|---|

| PEPE Price Movement | Briefly broke through 0.0000063 USDT. |

| Current Price | Currently at 0.0000061 USDT after retreating. |

| 24-Hour Price Increase | 20.4% increase recorded within 24 hours. |

| Market Influence | Driven by rejuvenated investment sentiment at the start of the year. |

Summary

The recent PEPE price increase signifies a substantial market movement, with the cryptocurrency briefly breaking through the 0.0000063 USDT mark before settling at 0.0000061 USDT. This notable 24-hour increase of 20.4% reflects a positive shift in investor sentiment and market dynamics as we enter the new year.