Aave revenue sharing is set to reshape the landscape of decentralized finance as Aave Labs commits to distributing off-protocol revenue among AAVE token holders. In a recent announcement by founder Stani Kulechov, it was revealed that a formal governance proposal will outline the mechanisms for this innovative revenue model, fostering stronger alignments between the platform and its community. With the AAVE token price recently surpassing 160 USDT, the potential benefits of revenue sharing could enhance both investor confidence and overall platform engagement. The upcoming proposal promises to address key operational strategies that secure the interests of both the DAO and token holders. As the DeFi space continues to evolve, initiatives like Aave’s revenue sharing highlight the importance of collaboration and progress within blockchain ecosystems.

The concept of profit-sharing in decentralized finance, particularly through Aave’s initiative, introduces a new era where community participation is rewarded directly. Stani Kulechov’s recent discussions indicate a significant shift, aiming to integrate off-platform earnings into the incentives for AAVE token holders. This approach not only enhances the value proposition of the AAVE token but also strengthens the governance framework by encouraging active involvement from users. As the AAVE token price demonstrates impressive growth, the anticipation surrounding Aave’s forthcoming governance proposal underscores the potential for a more inclusive financial ecosystem. Engaging stakeholders in this manner not only ensures transparency but also paves the way for sustainable development in the rapidly changing DeFi market.

Aave Revenue Sharing: A New Era for Token Holders

In a groundbreaking announcement, Aave Labs has confirmed its commitment to distributing off-protocol revenue among AAVE token holders. This decision underscores the importance of aligning the interests of both the organization and its community. As AAVE’s value continues to climb, currently surpassing 160 USDT, token holders stand to benefit significantly from these revenue-sharing initiatives. Sharing revenue not only solidifies trust within the community but also enhances the long-term viability of the AAVE ecosystem.

Aave founder, Stani Kulechov, emphasized the importance of this initiative in promoting synergistic relationships among stakeholders. As more users engage with the AAVE platform, off-protocol revenue streams, potentially stemming from various partnerships and integrations, will be essential for sustaining growth. The upcoming governance proposal will outline a transparent operational mechanism aimed at ensuring that these benefits reach token holders, ultimately fostering a robust AAVE community.

Aave’s Market Performance: The Rise of AAVE Token Price

AAVE has recently surged in the cryptocurrency market, exceeding 160 USDT, reflecting a healthy growth trend. The token’s rise by 11.38% in just 24 hours highlights its resilience and the increasing investor confidence in the Aave platform. This upward momentum suggests a strong performance driven by strategic decisions made by Aave Labs and an enthusiastic response from the community. As the price rises, the implications of revenue sharing become even more pronounced for both investors and users.

The recent uptick in AAVE token price is also tied to broader market trends that favor decentralized finance (DeFi) projects. As platforms like Aave continue to innovate and provide value through their governance structures and revenue-sharing strategies, investors are likely to see AAVE as a prime asset in their portfolios. This increase not only showcases AAVE’s robust market positioning but also reinstates the importance of community-driven initiatives spearheaded by Aave Labs.

Stani Kulechov’s Vision for Aave and Its Governance

Stani Kulechov, the founder of Aave, has laid out a clear vision for the project’s governance and future growth. His involvement in the governance forum indicates a dedication to transparency and community engagement. As decisions regarding revenue sharing and operational mechanisms evolve, Kulechov’s insights will be pivotal in shaping the future of Aave. Understanding how off-protocol revenue will be utilized is crucial for both holders and users of the AAVE token.

Kulechov’s leadership emphasizes the need for a collective approach to governance within the Aave ecosystem. By involving community feedback in the proposal process, Aave Labs aims to ensure that the voices of token holders are heard and considered. This strategy not only enhances governance participation but also strengthens community bonds, ultimately leading to a more decentralized and resilient platform.

The Future of Off-Protocol Revenue in the Aave Ecosystem

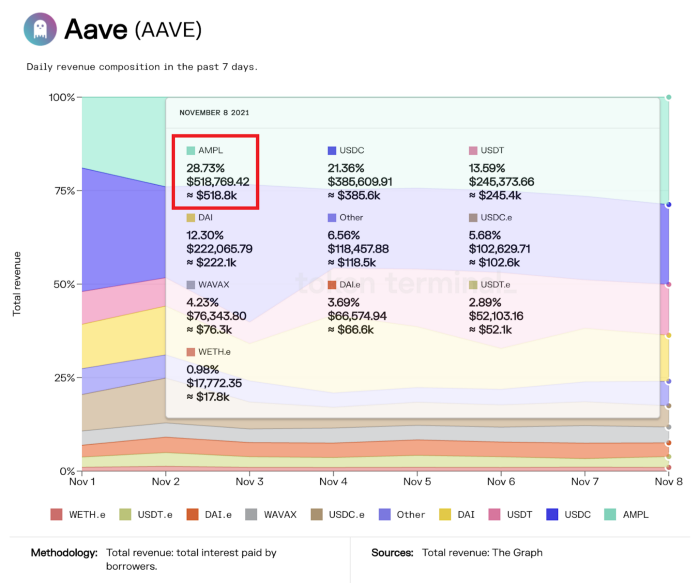

As Aave Labs prepares to unveil a formal revenue-sharing plan, the focus on off-protocol revenue sets the stage for substantial growth opportunities. Off-protocol revenue refers to income generated from sources outside the core lending and borrowing activities of the Aave platform. By tapping into these additional revenue streams, Aave Labs aims to enhance the overall profitability for its community.

The significance of off-protocol revenue cannot be understated, as it allows Aave to diversify its income sources, ultimately benefiting token holders through potential profit sharing. As the ecosystem matures, maintaining a focus on these innovative revenue strategies will be crucial for the longevity and success of the AAVE token, positioning it as a leader in the DeFi space.

Community Engagement and Aave Governance Proposals

Aave’s governance model encourages active community participation, exemplified by recent discussions around revenue distribution. Governance proposals serve as a mechanism for community members to express their views, enabling a collective approach to decision-making. This democratic model not only empowers holders but also ensures that decisions reflect the community’s values and interests.

As proposals are discussed, community input will play a crucial role in shaping the future of revenue sharing within Aave. Open dialogues led by Kulechov and the Aave Labs team are instrumental in fostering transparency, trust, and engagement among token holders. This emphasis on governance enhances the appeal of holding AAVE tokens, as participants are not just passive investors but active decision-makers in the platform’s evolution.

Strategic Innovations by Aave Labs

Aave Labs is committed to innovation, continually exploring new ways to enhance the platform’s offerings. Recent developments indicate a focus on creating additional revenue opportunities, not just for the company but for its community of token holders. This commitment to innovation demonstrates Aave’s proactive stance in a rapidly changing DeFi landscape, ensuring that the AAVE token remains competitive and valuable.

By integrating advanced technologies and refining operational strategies, Aave Labs aims to create a more comprehensive and user-friendly ecosystem. These strategic innovations are not only set to improve user experience but also ensure that off-protocol revenue can be maximized, providing greater financial incentives for AAVE holders.

The Role of LSI in Optimizing Aave’s Online Presence

Latent Semantic Indexing (LSI) plays a vital role in enhancing the online visibility of Aave and its offerings. By utilizing LSI keywords related to Aave, such as ‘Aave governance proposal’ and ‘AAVE token price’, the platform can effectively target relevant search queries. This optimization strategy ensures that potential investors and users can easily find information about Aave’s developments, market performance, and community initiatives.

Effective use of LSI not only boosts search engine rankings but also positions Aave as an authoritative source in the decentralized finance sector. As Aave Labs continues to communicate its vision and governance approaches, integrating LSI can further enhance community outreach and engagement, ultimately driving adoption of the AAVE token.

Understanding the Importance of DAO Protection for AAVE Holders

As Aave evolves, the protection of its Decentralized Autonomous Organization (DAO) becomes increasingly important. The proposed governance structure will aim to safeguard the interests of AAVE holders by establishing clear guidelines and mechanisms for revenue sharing. Ensuring that DAO operations are transparent and secure is fundamental for maintaining trust within the community.

The emphasis on protective measures within the DAO is essential for fostering a stable investment environment. By prioritizing DAO protection, Aave Labs seeks to reassure token holders that their investments are safeguarded against potential risks. This approach is expected to enhance confidence in the AAVE token, encouraging more investors to participate in the ecosystem.

Exploring Aave’s Competitive Edge in the DeFi Market

Aave’s strategic initiatives, such as revenue sharing and community governance, provide a competitive advantage in the decentralized finance market. As AAVE’s token price climbs, these features attract more users, creating a network effect that’s beneficial for the platform’s robustness. Other platforms are likely to look towards Aave as a template for success in engaging their communities and enhancing token value.

In a rapidly evolving landscape where many DeFi projects vie for attention, Aave’s commitment to its community and proactive governance measures set it apart. By continually refining its model and optimizing for user engagement, Aave positions itself as a leader, paving the way for other platforms to adopt similar strategies. As Aave Labs forges ahead, the direction taken will be closely watched by investors and industry analysts alike.

Frequently Asked Questions

What is Aave revenue sharing and how does it benefit AAVE token holders?

Aave revenue sharing refers to Aave Labs’ commitment to distribute off-protocol revenue to AAVE token holders. This initiative aims to align the interests of both the governance team and community members, providing financial benefits to those holding AAVE tokens through increased engagement and potential passive income.

Who announced the Aave revenue sharing plan and what are the next steps?

Stani Kulechov, the founder of Aave, announced the Aave revenue sharing plan on the official governance forum. Following community discussions, Aave Labs intends to propose a formal plan that outlines the operational mechanisms for sharing off-protocol revenue with AAVE holders.

How has the AAVE token price reacted to the news of revenue sharing?

Following the announcement of Aave revenue sharing, the AAVE token price has experienced significant growth, surpassing 160 USDT, indicating positive market sentiment and potential speculation on future benefits for token holders.

What role does the Aave governance proposal play in revenue sharing?

The Aave governance proposal will play a crucial role in defining the structure and implementation of the revenue sharing initiative. It is designed to ensure that the interests of AAVE token holders are prioritized while protecting the integrity of the DAO.

What are off-protocol revenues in the context of Aave revenue sharing?

Off-protocol revenue refers to the income generated by Aave Labs outside of its main lending and borrowing operations. This income will be shared with AAVE token holders as part of the revenue sharing initiative discussed by Stani Kulechov.

How does the commitment to share off-protocol revenue enhance Aave’s ecosystem?

The commitment to share off-protocol revenue strengthens Aave’s ecosystem by incentivizing AAVE holders to participate actively in governance and decision-making, which fosters community engagement and supports the long-term growth of the platform.

When can AAVE token holders expect more details on the revenue sharing proposal?

While no specific date has been given, Aave Labs is expected to soon release detailed information about the revenue sharing proposal. This information will clarify how the operational mechanism will work and the timeline for implementation.

What is the significance of Stani Kulechov’s involvement in the revenue sharing announcement?

Stani Kulechov’s involvement in the announcement of Aave revenue sharing underscores the importance of transparency and community involvement in decision-making within Aave. His leadership fosters trust and aligns the development team’s goals with those of the AAVE token holders.

| Key Point | Details |

|---|---|

| Aave Revenue Sharing Commitment | Aave Labs will share off-protocol revenue with AAVE token holders. |

| AAVE Price Surge | AAVE has surpassed 160 USDT, now trading at 164.63 USDT, marking an 11.38% increase in 24 hours. |

| Community Engagement | Aave founder Stani Kulechov highlighted the importance of community in the governance forum discussions. |

| Future Governance Proposal | A formal proposal detailing the revenue sharing operational mechanism will be made by Aave Labs. |

| Long-term Vision | The proposal will aim to support a long-term vision and provide protection for the DAO and AAVE holders. |

Summary

Aave revenue sharing marks a significant turning point for token holders, as Aave Labs commits to distributing off-protocol earnings. The recent surge in AAVE’s price reflects growing investor confidence, supported by the community’s active participation in governance discussions. With a formal proposal on the horizon, Aave aims to foster a constructive relationship with its token holders while ensuring the project’s sustained growth and security.